-

Bitcoin hovering in a critical zone eliciting history repetition.

BTC likely to go below $60K before a rally.

As a seasoned researcher with over two decades of experience in financial markets, I have seen cycles come and go, bull markets turn bearish, and market sentiment swing from exuberance to despair. With Bitcoin [BTC] at its current critical juncture, I find myself looking back at the history books for guidance.

In the realm of digital assets, Bitcoin (BTC) continues to be the dominant player, presenting potential avenues for traders and investors seeking substantial returns over a prolonged period.

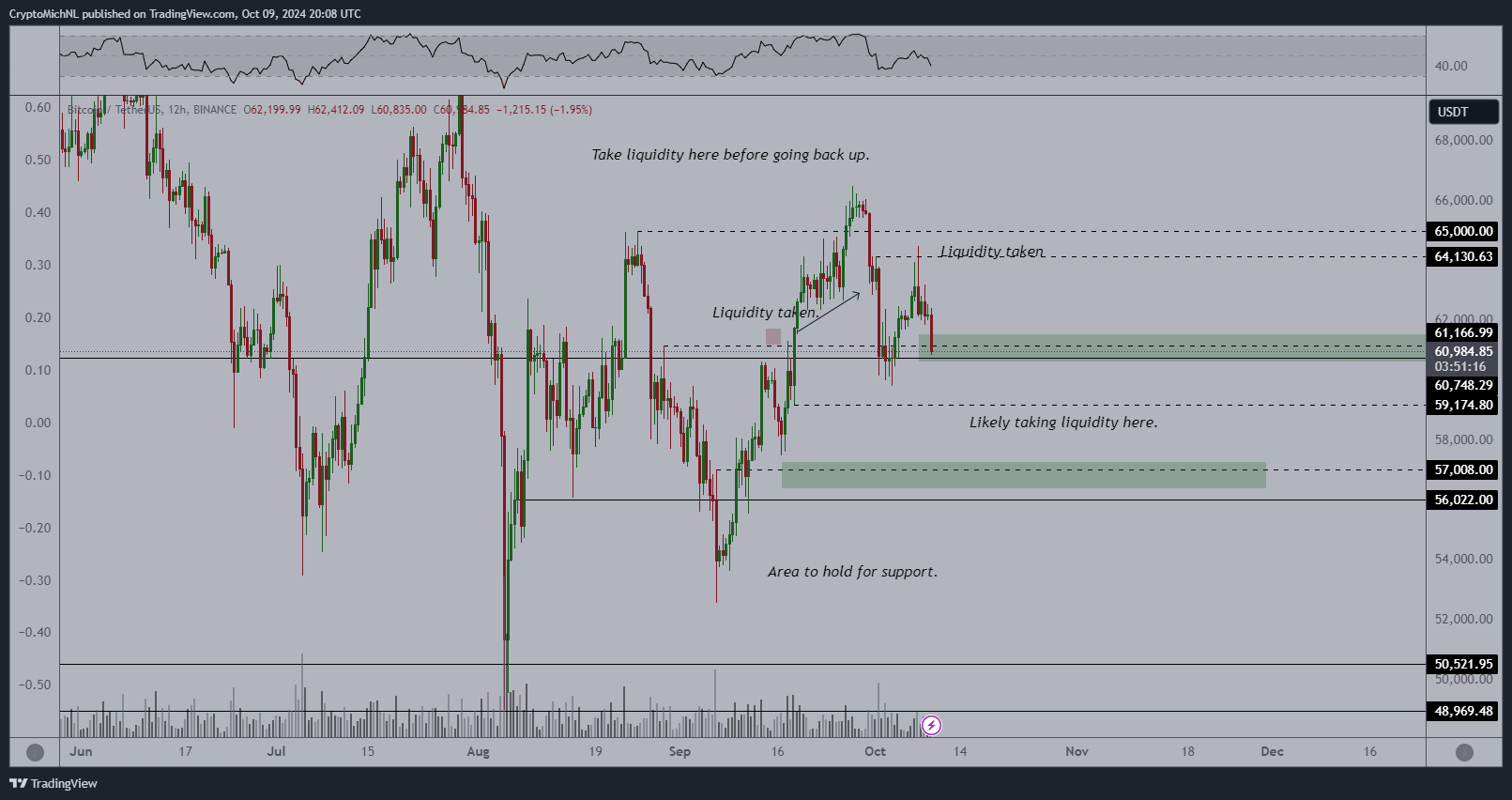

Currently, the value of Bitcoin appears to be at a crucial psychological juncture, a significant level influenced by past trends in CryptoQuant’s data. This vital price area has historically served as a platform for trader sentiment, with optimism or pessimism becoming evident based on profitability factors.

At present, the market seems to be climbing, but falling below this level might cause people’s feelings about it to change significantly.

Historical data suggests that when Bitcoin’s price remains within a certain range, as it currently does, it tends to continue an uptrend, lending credence to the notion of a price hike.

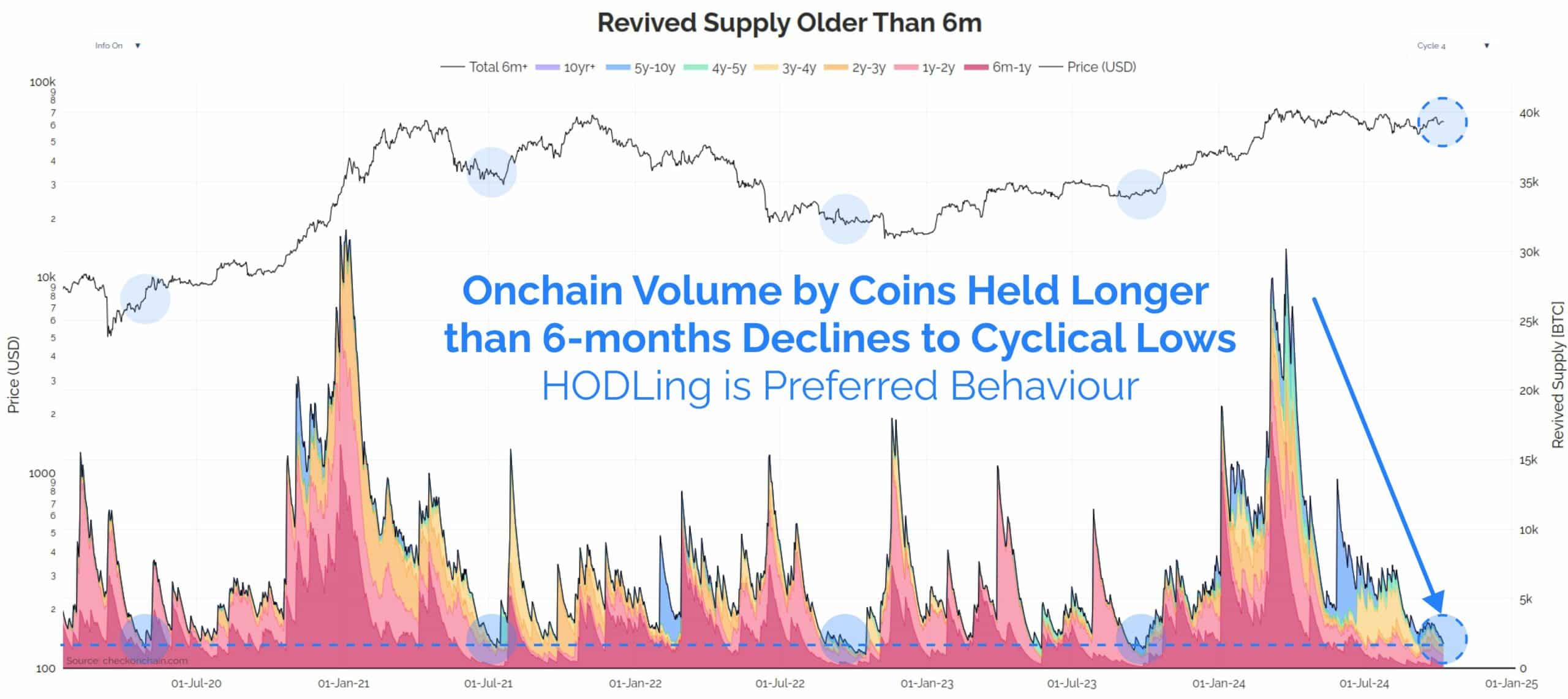

HODL mode despite price decline

Examining the market more closely, it appears that most Bitcoin owners are adopting a ‘HODL’ strategy, demonstrating their faith in the currency, even amidst its volatile fluctuations.

There could be an instance where a large number of Bitcoin might be sold, leading to a short-term decline followed by a strong rebound as traders resume their buying activities. Interestingly, long-time Bitcoin holders, particularly those who have owned coins for over six months, seem to be maintaining their positions, suggesting they are optimistic about an upcoming price surge.

Nevertheless, a slight drop might propel Bitcoin down to around $60K, potentially marking the lowest point before a rebound, hinting at an impending uptrend. The recent price movement indicates that Bitcoin is exploring lower boundaries within its ongoing downtrend.

The price of Bitcoin might maintain its current level, but if there’s a downward correction due to unfavorable market feelings, it could potentially drop below $60K. However, it should then recover again.

With technical indicators factored in, the forecast for an uptrend stays optimistic since Bitcoin is holding steady within its protective boundaries, hinting at a possible spike ahead.

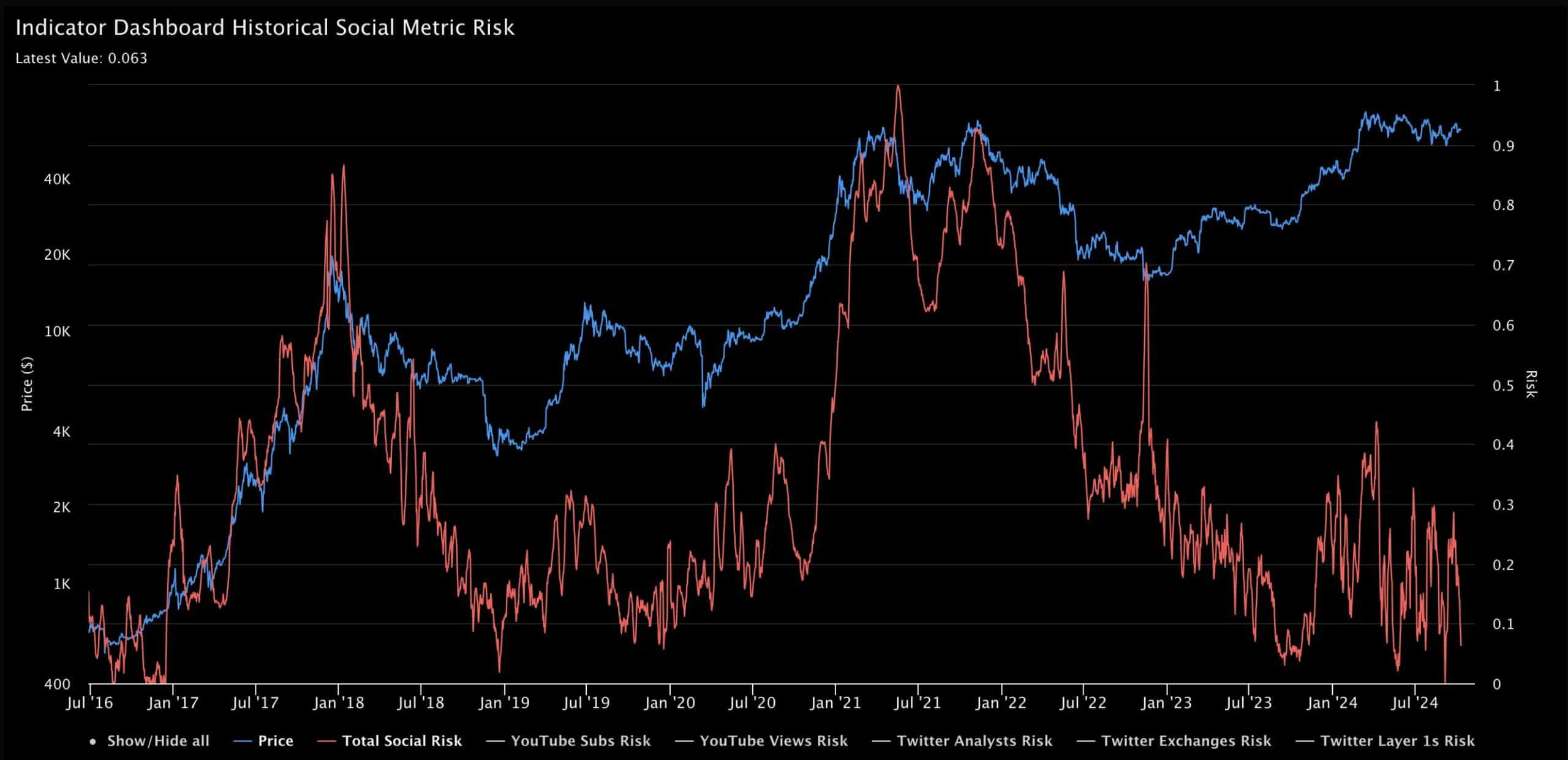

BTC social risk

Ultimately, the public’s feelings towards Bitcoin significantly impact its price fluctuations. The collective opinion and involvement of the community shape market behavior, and Bitcoin’s current social sentiment has reached a peak not seen since the approval of Bitcoin Exchange Traded Funds (ETFs).

This surge might stem from the current buzz surrounding Bitcoin’s originator, adding more excitement among the public. The favorable community opinion and minimal risk at present prices hint at an impending substantial rise in Bitcoin’s value.

Read Bitcoin’s [BTC] Price Prediction 2024–2025

Investors are expecting this possible burst, signaling the start of a potentially new upward trend in the market.

At its current value, Bitcoin seems primed for an increase based on past trends, technical signals, and public opinion. This could be a good moment for investors to keep tabs on the market, ready for a potential price surge.

Read More

2024-10-11 04:07