-

Bitcoin’s aSOPR was at 1.03 at press time.

As it approaches 1.08, the coin is at risk of a price decline.

As a seasoned crypto investor with a keen interest in on-chain metrics and technical analysis, I’ve closely monitored Bitcoin’s (BTC) recent price action and the associated indicators. The latest findings from CryptoQuant analyst Woo Minkyu have caught my attention, as they suggest that BTC’s Adjusted Spent Output Profit Ratio (aSOPR) is approaching a historically “dangerous” level.

According to a recent analysis by CryptoQuant’s Minkyu Woo, Bitcoin’s [BTC] price could experience a correction as the value of a crucial on-chain indicator approaches warning signs from the past.

I closely monitored Bitcoin’s Adjusted Spent Output Profit Ratio (aSOPR) by applying a 200-day moving average. Noting that this key indicator approached the threshold of 1.08, I became concerned about the possibility of a correction for the leading cryptocurrency.

The Average Spent Output Price (aSOPR) of Bitcoin indicates whether its holders are currently making a profit or incurring a loss when they spend their coins. A value greater than 1 suggests that, on average, Bitcoin is being sold for more than what was originally paid for it.

Conversely, a value below 1 suggests that investors are selling at a loss.

At present, the coin’s realized price to spend ratio (sASOPR) stands at 1.03. This indicates that Bitcoin sellers have made profits on their transactions.

As a crypto investor, I’ve come across an interesting piece of information from AMBCrypto. Despite encountering strong resistance at the $71,000 mark, approximately 87% of Bitcoin’s total supply is currently in profit for its owners.

Based on Minkyu’s analysis, a rising Bitcoins’ realized price to realize value ratio (sOPR) approaching 1.08 may indicate an impending price drop.

Based on historical analysis, I’ve found that when this specific indicator reaches around 1.08, Bitcoin prices have historically entered a corrective phase. Given my examination of past trends where comparable patterns emerged, it’s plausible that the current situation could follow suit.

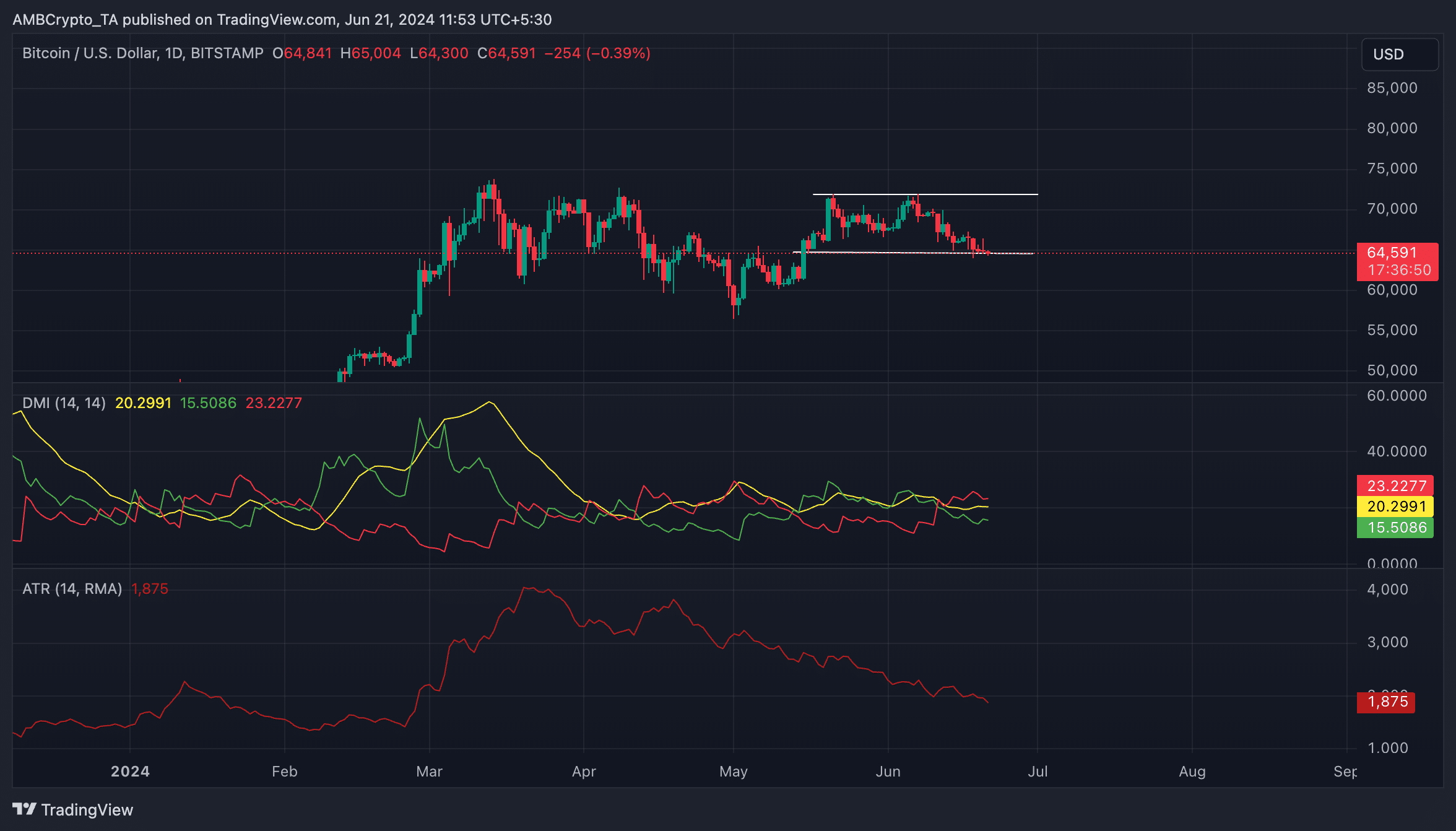

Bitcoin continues to trend within a range

As of the current moment, Bitcoin was trading at $64,584. Over the past few days, its price has moved within a flat range, oscillating between the resistance level of $71,926 and the support level of $64,529, which it had touched since May 20th.

When an asset’s price stays confined to a specific band for an extended duration, it creates a horizontal pricing pattern. This price stability results from a delicate equilibrium between demand and supply forces that inhibits the price from exhibiting significant upward or downward trends.

As a crypto investor, I’ve noticed that Bitcoin’s (BTC) Average True Range (ATR) has been on a downward trend lately, confirming the current consolidation phase. Based on my research using AMBCrypto, this volatility indicator has dropped by a significant 28% since May 20th.

As an analyst, I would explain that this metric quantifies market turbulence by computing the typical difference between the highest and lowest prices over a designated time frame.

As an analyst, I would interpret a price drop as indicating reduced market volatility and implying that the asset’s value is moving within a particular range.

Despite BTC presently moving within a range, the bearish sentiment in the market remains quite strong according to the Directional Movement Index (DMI) analysis.

Read Bitcoin’s [BTC] Price Prediction 2024-25

At present, the red indicator for the coin’s reversal (representing a negative direction) was higher than the green indicator (signifying a positive direction).

The DMI (Directional Movement Index) of an asset quantifies the power and the prevailing direction of its price movement. Configured thus, it signifies that the downward trend holds more influence than the upward trend, implying a greater probability of a declining trend over an ascending one.

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Masters Toronto 2025: Everything You Need to Know

- WCT PREDICTION. WCT cryptocurrency

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- LPT PREDICTION. LPT cryptocurrency

- Elden Ring Nightreign Recluse guide and abilities explained

- Solo Leveling Arise Tawata Kanae Guide

- Despite Bitcoin’s $64K surprise, some major concerns persist

2024-06-21 23:03