- Bitcoin’s rally to $60,000 was short-lived as fear and uncertainty continued to grip the market.

- Profit-taking by short-term holders and miner selling behavior suggested a lack of confidence in a bullish reversal.

As a seasoned researcher who has weathered numerous market cycles, I find myself closely monitoring Bitcoin’s current price movements with a mix of intrigue and caution. The recent rally to $60,000 was undoubtedly exciting, but the subsequent drop and shift in sentiment to “fear” is concerning.

As I analyze the current state of Bitcoin (BTC), I observe a series of volatile price fluctuations following a 2.3% drop, with the coin trading at $58,740 at this moment. This downward trend has also led to a shift in market sentiment from neutral to fear.

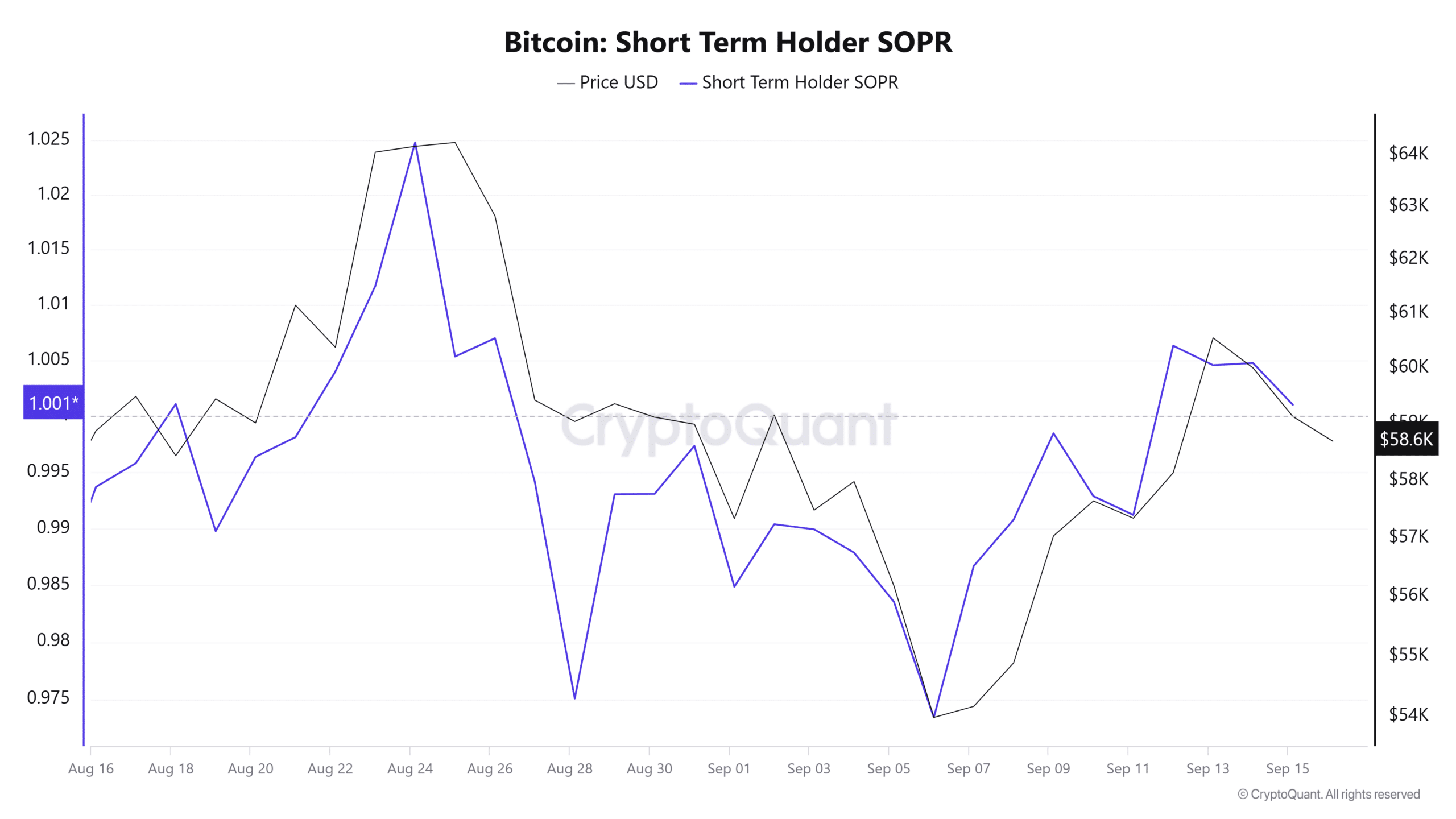

The spike in Bitcoin’s price surpassing $60,000 has renewed market trust, as the Short-Term Holder Spent Output Profit Ratio (SPOR), reported by CryptoQuant, exceeded 1, indicating that short-term investors are making a profit.

Yet, this confidence didn’t last long, as the ratio subsequently plummeted close to the breakeven level. This suggests thinning profitability margins and potentially increased selling force.

Could the price of Bitcoin continue to fall or level off due to investors cashing in their profits and feelings of apprehension?

Downside risk remains elevated

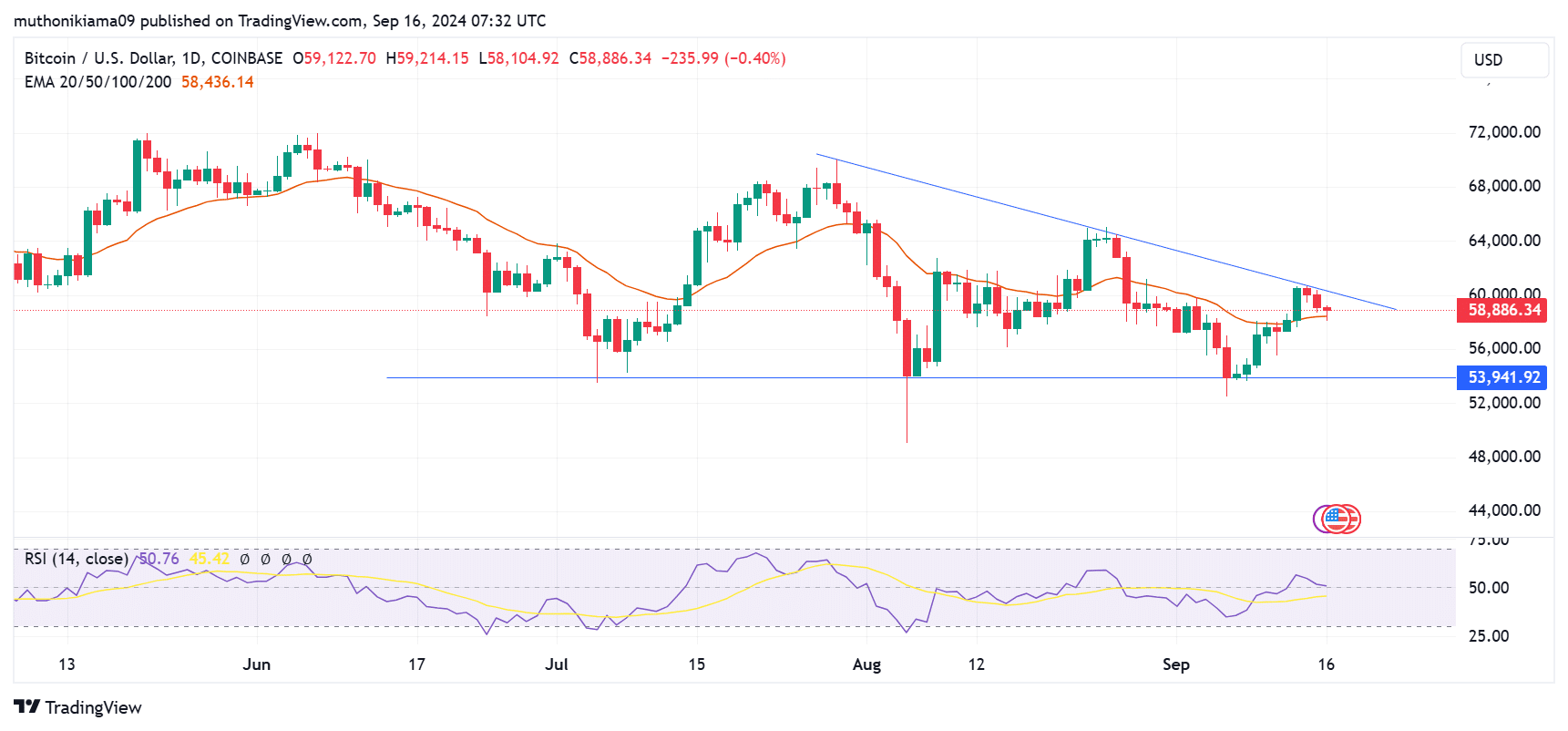

According to a recent study by 10x Research, for Bitcoin to reduce its potential downside, it must surpass an existing downtrend pattern on its charts.

On the daily chart, Bitcoin seems to be encountering resistance whenever it tries to break through, suggesting a persistent downward trend.

The failed breakout stems from the lack of buying activity in the market, as seen in the Relative Strength Index (RSI) at 50. This metric showed a neutral sentiment.

If shoppers come back into the market, it is possible that Bitcoin (BTC) could once again reach the level of $60,656, as this would be an indication pointed out by 10x Research, suggesting a robust upward trend.

Nevertheless, traders should watch out for the 20-day Exponential Moving Average (EMA). Bitcoin was at risk of falling below this critical point, which could spur further losses.

Miners are capitulating

Bitcoin miners are hesitant to act due to the unpredictable market conditions, as evidenced by the decreasing rate of mining activity (hash rate).

According to data from BitInfoCharts, the hash rate of the Bitcoin network peaked at a new all-time high of over 700 quintillion hashes per second earlier in the month, but had since dipped to approximately 665 EH/s as of press time.

As someone who has closely followed the cryptocurrency market for several years now, I have witnessed firsthand how volatile and unpredictable its prices can be. Miners are no exception to this rule. In my personal experience, when Bitcoin prices began to drop, I noticed a significant reduction in mining activity among miners. This is because mining requires a substantial investment in specialized hardware, electricity costs, and maintenance fees, all of which add up quickly. When the profitability of mining decreases due to falling BTC prices, it simply becomes unsustainable for many miners to continue operations. This is why I always stress the importance of carefully monitoring market trends and adjusting one’s strategy accordingly in this fast-paced and ever-changing industry.

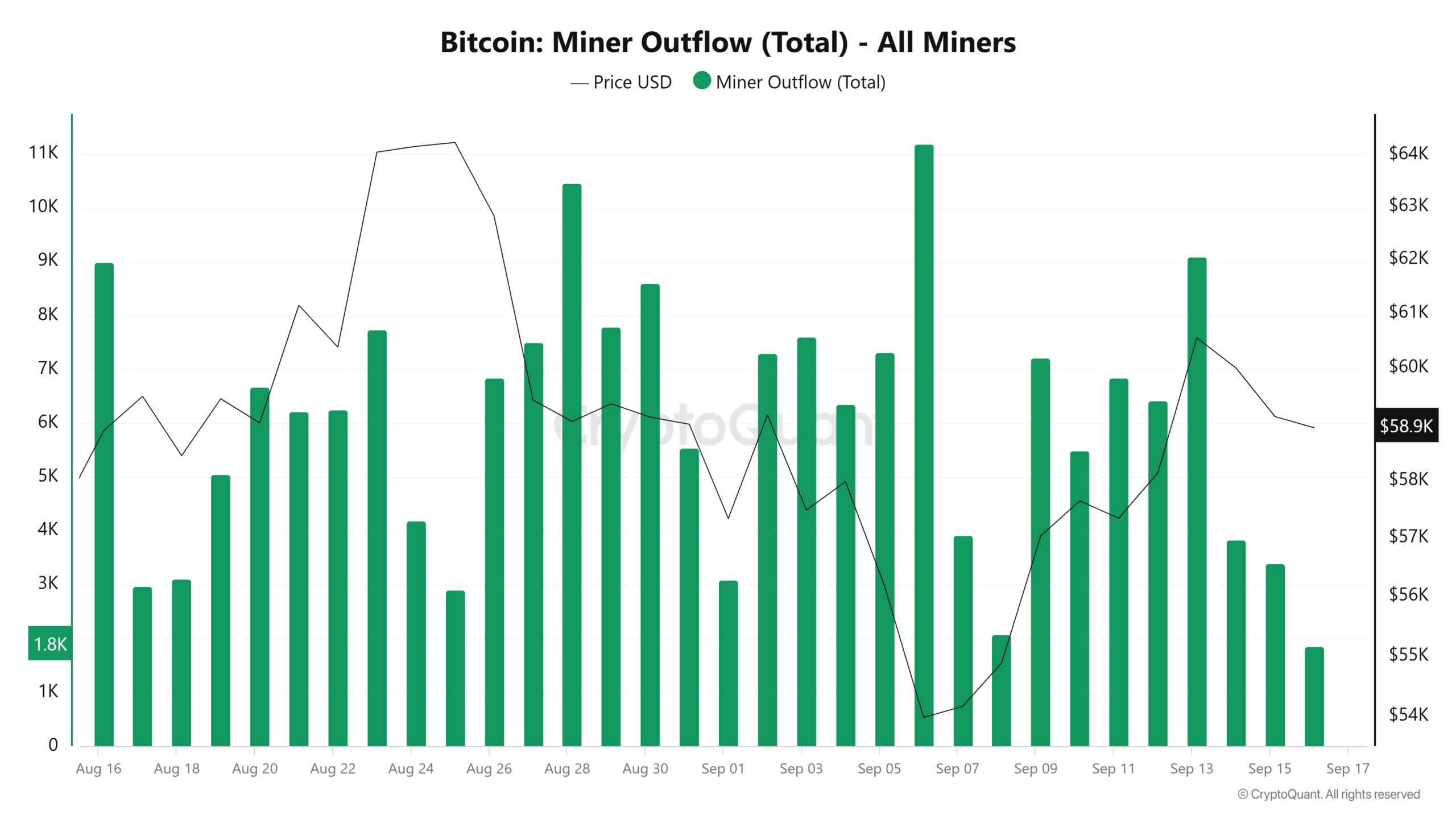

According to information from CryptoQuant, during the weekend when Bitcoin was trading near $60,000, miners moved approximately 7,230 Bitcoins worth more than $400 million to cryptocurrency exchanges.

This data suggested miner capitulation, which also elevated the downside risk for BTC.

Do positive narratives suggest tailwinds?

As an analyst, I anticipate sharing news with you about a potential change in interest rates by the Federal Open Market Committee (FOMC) in the days ahead.

A rate cut is expected to fuel gains for risk assets like Bitcoin.

In other words, since the market seems to have already factored in the Federal Reserve’s potential shift in policy, the actual announcement might not cause significant fluctuations in prices due to this pre-existing expectation.

Read Bitcoin’s [BTC] Price Prediction 2024–2025

Moreover, 59% of investors anticipate a steeper cut of 50 basis points per the CME FedWatch Tool.

A significant wound in the economy might spark worries about its deterioration in the United States, leading investors to shift away from high-risk investments like stocks and instead opt for more secure options such as gold.

Read More

- WCT PREDICTION. WCT cryptocurrency

- Chrishell Stause’s Dig at Ex-Husband Justin Hartley Sparks Backlash

- LPT PREDICTION. LPT cryptocurrency

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- The Bachelor’s Ben Higgins and Jessica Clarke Welcome Baby Girl with Heartfelt Instagram Post

- PI PREDICTION. PI cryptocurrency

- SOL PREDICTION. SOL cryptocurrency

- Grammys Pay Emotional Tribute to Liam Payne in First Honorary Performance

- Lucy Hale’s Sizzling Romance with Harry Jowsey: The Un serious, Fun-Filled Love Story!

- Playmates’ Power Rangers Toyline Teaser Reveals First Lineup of Figures

2024-09-16 16:08