- Bitcoin surged to $94,000 and hit a new ATH, following Donald Trump’s presidential election victory.

- As both short- and long-term drivers converge, Bitcoin’s rally faces questions of sustainability.

As a seasoned crypto investor with over a decade of experience under my belt, witnessing the rise and fall of multiple bull and bear markets, I must admit that Bitcoin’s latest surge to $94,000 has left me both awestruck and cautiously optimistic. The short-term catalysts behind this ATH are undeniably compelling – from renewed media attention to increased institutional demand, the convergence of these factors has certainly fueled market enthusiasm.

On November 19th, Bitcoin (BTC) set a record-breaking peak, soaring beyond $94,000. This impressive climb in value started following the victory of Donald Trump in the 2016 U.S. Presidential election, marking an extended bullish trend for the digital currency.

The king coin has surged nearly 35% from around $70,000 on election night.

Short-term catalysts behind the Bitcoin ATH

As a crypto investor, I’ve witnessed an incredible surge in Bitcoin’s value, reaching an all-time high (ATH) of $94,000. At the moment of writing this, the price dipped slightly to around $92,000. This dramatic increase is largely attributed to a combination of short-term factors that have come together in a powerful way.

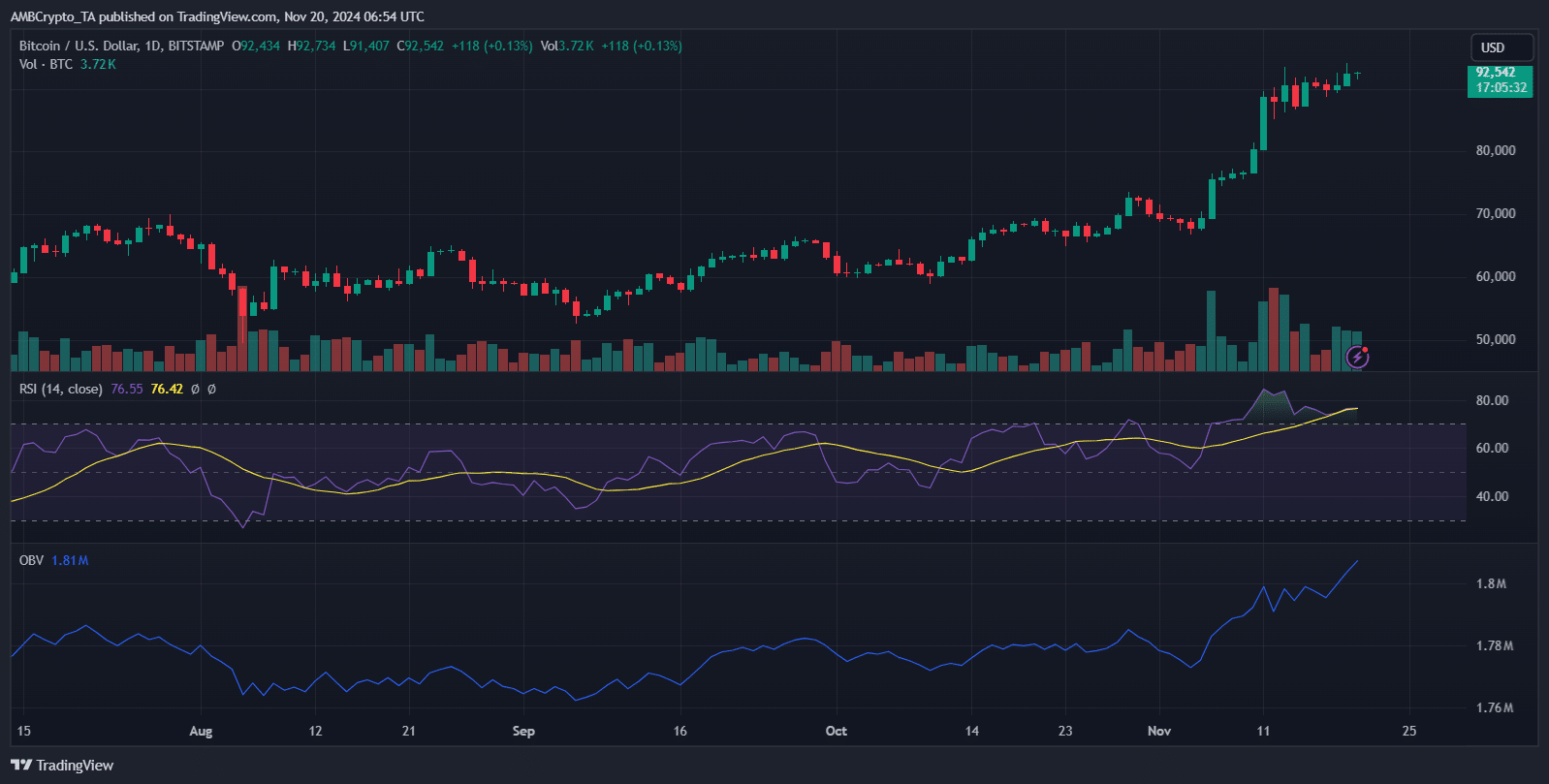

The RSI climbed to 76.74, signaling strong bullish momentum yet entering overbought territory, suggesting potential caution for traders.

The price of OBV is significantly increasing, indicating continued buying from major investors, and trade volume stays high, underscoring heightened market engagement.

The presidential election has rekindled significant media focus on cryptocurrencies, positioning them as intriguing investment possibilities.

The rising popularity and interest from institutions has ignited excitement within the market due to growing exposure in the mainstream.

Discussion about Bitcoin serving as a safeguard against economic instability during Trump’s administration has contributed to its growing popularity.

Moreover, there have been significant signs of whale involvement in the market recently, as substantial purchase orders have underpinned the recent uptrend.

But as Relative Strength Index (RSI) nears overbought territory, it’s advisable for traders to be vigilant for potential periods of sideways movement or brief price reversals.

Long-term drivers of Bitcoin’s growth

In simpler terms, the temporary reasons behind Bitcoin’s recent rise are well-known, but it is the long-term elements that have been consistently contributing to its ongoing increase.

Over the last two months, there’s been a significant rise in institutional investments, particularly in Bitcoin-linked Exchange Traded Funds (ETFs). Firms such as BlackRock have increased their involvement, which indicates a broader mainstream approval and recognition of this digital currency.

As an analyst, I’ve noticed a significant increase in corporate treasury investments, such as Tesla’s, in Bitcoin. This trend suggests that Bitcoin is increasingly perceived as a reliable digital form of value storage.

The use of Bitcoin in retail transactions has grown significantly as well, with prominent payment systems incorporating it into their services.

During the presidential election, people became curious about Donald Trump’s views on cryptocurrency regulations once again.

Furthermore, rumors that Trump Media & Technology Group is considering purchasing the Bakkt platform have boosted market enthusiasm.

As a researcher, I perceive this potential acquisition as an attempt to merge Bitcoin with the conventional financial and media landscapes, thereby bolstering its credibility on a global scale and maintaining a positive outlook for future price trends.

What’s next for BTC?

In the midst of Bitcoin’s remarkable surge, I find myself pondering about the hurdles that may arise down the line. The spotlight will undoubtedly shift towards regulatory actions, as world administrators are poised to closely examine this meteoric rise in the cryptocurrency realm.

The way the Trump administration handles cryptocurrency regulations might encourage wider use or create a less favorable atmosphere, depending on their actions.

As a crypto investor, I’m keeping an eye on potential market corrections. The Relative Strength Index (RSI) is indicating that we may have overbought, suggesting a possible short-term dip could be on the horizon. Moreover, the momentum seems to be driven by whales, and there’s a risk it might cool down soon. So, I’m bracing myself for potential pullbacks in my investment portfolio.

Read Bitcoin’s [BTC] Price Prediction 2024–2025

Several experts believe that the price of $90,000 might act as a significant floor, although breaking this level could potentially trigger a more substantial drop.

Nevertheless, Bitcoin’s underlying strength stays solid, offering a firm base for ongoing expansion, despite fluctuations in the short term.

Read More

- Hut 8 ‘self-mining plans’ make it competitive post-halving: Benchmark

- Jujutsu Kaisen Reveals New Gojo and Geto Image That Will Break Your Heart Before the Movie!

- Gaming News: Why Kingdom Come Deliverance II is Winning Hearts – A Reader’s Review

- The Elder Scrolls IV: Oblivion Remastered – How to Complete Canvas the Castle Quest

- We Ranked All of Gilmore Girls Couples: From Worst to Best

- Shundos in Pokemon Go Explained (And Why Players Want Them)

- Kylie & Timothée’s Red Carpet Debut: You Won’t BELIEVE What Happened After!

- S.T.A.L.K.E.R. 2 Major Patch 1.2 offer 1700 improvements

- Why Tina Fey’s Netflix Show The Four Seasons Is a Must-Watch Remake of a Classic Romcom

- How to Get to Frostcrag Spire in Oblivion Remastered

2024-11-20 10:32