- Last week’s crypto market rally led to a flow of funds into crypto-backed investment products.

- Last week, Ethereum recorded its highest weekly inflows since March.

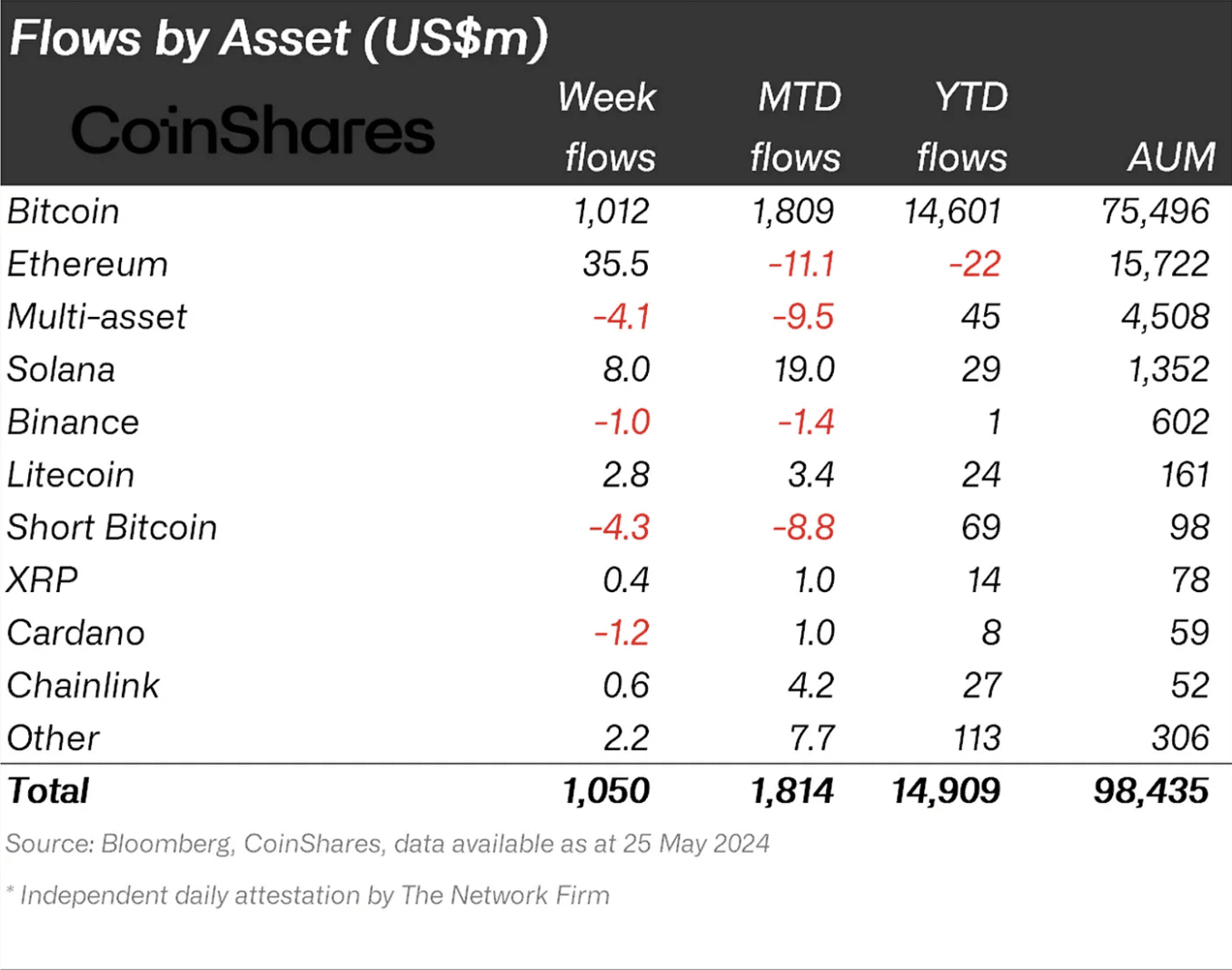

As a researcher with a background in digital asset investment and market analysis, I’ve been closely monitoring the crypto market trends over the past few weeks. Last week’s rally brought about a significant surge in funds flowing into crypto-backed investment products, particularly Ethereum. According to CoinShares’ latest report, digital asset investment products recorded inflows totaling $1.05 billion last week, marking the third consecutive week of inflows and bringing year-to-date inflows to a record-breaking $14.9 billion.

Last week, there was an inflow of $1.05 billion into digital asset investment products, according to a recent report by CoinShares, making it the third successive week with such investments attracting substantial funds.

Last week’s investments in cryptocurrency funds pushed the total amount poured in this year to an all-time high of $14.9 billion, as indicated by the report.

Last week’s cryptocurrency market growth led to an increase in trading volume for Exchange-Traded Products (ETPs) at the digital asset investment firm.

During that period, weekly ETP trading volume climbed by 28% to $13 billion.

As a crypto investor looking back at the data from CoinShares, I’m thrilled to note that the combined value of assets invested in crypto-focused financial products had surpassed $98 billion by the end of the observed period.

This marked a 7% growth from the $91 billion recorded the previous week.

Last week, a significant portion of investments into crypto funds were sourced from the United States, Germany, and Switzerland. The United States contributed the largest share with $1.03 billion, followed by Germany with $48 million, and Switzerland with $30 million in inflows.

Interestingly, Hong Kong saw outflows during the week in review. According to CoinShares,

Unfortunately, after an encouraging start with over $300 million in investments during the first week of Hong Kong’s Bitcoin spot-based ETF launch, there was a withdrawal of approximately $29 million last week.

Bitcoin’s YTD inflows topple $14 billion

Last week, there were investments totaling $1.03 billion in products backed by Bitcoin, which accounted for an impressive 98% of the total inflows during that timeframe.

As a crypto investor, I’ve noticed that the inflows into the top-ranked digital asset have surged this week, reaching a total of $14.60 billion year-to-date (YTD). This represents an impressive 8% increase from the previous week’s YTD inflow of $13.58 billion.

Last week, there were withdrawals of approximately $4.3 million from Bitcoin short positions. This adds up to a total of around $8.8 million in outflows for the current month.

CoinShares said this might be due to changing sentiments around Bitcoin from negative to positive.

“This is likely due to investors interpreting the FOMC minutes and recent macro data as mildly dovish, it added.”

Ethereum reaches new milestone

Last week, Ethereum (ETH), the top altcoin, experienced a significant influx of approximately $38 million into its associated digital asset offerings – marking its largest intake since March.

CoinShares said this was,

“Likely an early reaction to the approval of ETH ETFs in the United States.”

Due to the recent trend of outflows from Ethereum-linked financial instruments, the net amount flowing into these products during the current month was a negative $11.1 million as of last week.

Read More

- Jellyrolls Exits Disney’s Boardwalk: Another Icon Bites the Dust?

- Carmen Baldwin: My Parents? Just Folks in Z and Y

- Jelly Roll’s 120-Lb. Weight Loss Leads to Unexpected Body Changes

- OM PREDICTION. OM cryptocurrency

- Moo Deng’s Adorable Encounter with White Lotus Stars Will Melt Your Heart!

- 1923 Sets Up MASSIVE Yellowstone Crossover

- Lisa Rinna’s RHOBH Return: What She Really Said About Coming Back

- Leslie Bibb Reveals Shocking Truth About Sam Rockwell’s White Lotus Role!

- Despite Strong Criticism, Days Gone PS5 Is Climbing Up the PS Store Pre-Order Charts

- Netflix’s Dungeons & Dragons Series: A Journey into the Forgotten Realms!

2024-05-29 13:11