So, here we are again, folks. Bitcoin (BTC) is caught in a whirlwind, and no, it’s not the usual crypto circus. It’s like everyone woke up with a bad hangover after an all-night crypto party. U.S. markets? They’re stumbling around, feeling the pain after yesterday’s wild rally. All that optimism about a 90-day tariff hike pause went poof, vanished like your last slice of pizza at a party. 🍕

Now investors are suddenly interested in the bigger picture. You know, the one that involves a little thing called ‘growing friction with China.’ It’s like a sitcom no one wants to watch, but here we are, tuning in anyway. Is it supposed to have a happy ending? Who knows!

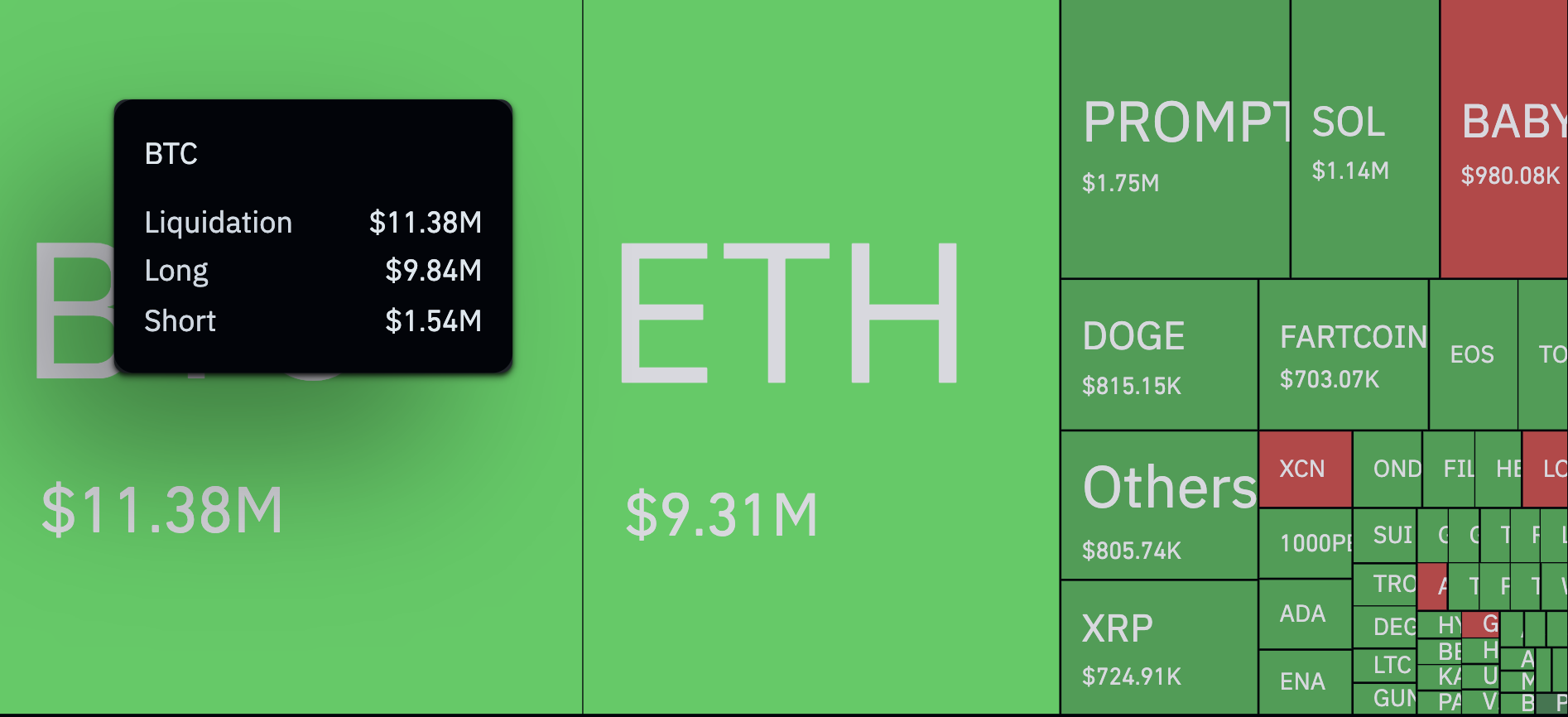

And guess what happened next? The crypto space decided to throw a reality check party—everyone’s invited, and they brought their leveraged positions. Bitcoin took the spotlight, leading the charge with a staggering liquidation of $11.38 million. Can you believe it? $9.84 million from longs and just $1.54 million from shorts. Someone really overdid it on the bullishness. It’s like preparing a five-course meal for one person. 🍽️

It wasn’t a dramatic collapse or anything; no one burst into tears. But deep down? It’s a classic case of traders over-extending themselves after a fleeting moment of joy, then getting caught with their pants down—literally, folks. Like being offside in soccer. Who designed these rules anyway?

And this wasn’t just a little hiccup; it was a full-on faceplant. In just one hour, $26.1 million went bye-bye. Shocking? Yes! Most of it from longs, because of course. In the last four hours, we’re counting a whopping $68.7 million in liquidations, and in a full day? Hold onto your hats: $465.5 million across 134,811 traders. Are these people allergic to caution or something? 🧐

The biggest single liquidation was a mighty $3.33 million BTC/USDT position on Bybit. Talk about putting all your eggs in one basket—what was this trader thinking, using a basket made of spaghetti?

And while altcoins like XRP, DOGE, and SOL took some hits, it’s clear Bitcoin’s wearing the volatility crown. All this right after a CPI report that dropped 0.1%? Traders are already stressing about a potential recession if the trade war escalates. It’s like trying to predict the weather in a storm—good luck with that! 🌩️

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- Masters Toronto 2025: Everything You Need to Know

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- WCT PREDICTION. WCT cryptocurrency

- LPT PREDICTION. LPT cryptocurrency

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- Elden Ring Nightreign Recluse guide and abilities explained

2025-04-10 18:47