- It appears that our dear Mr. Bitcoin has assumed an accumulation pattern not unlike a bachelor’s disposition before a whirlwind of romantic attentions—an air, my dear, last observable ere 2024’s most dramatic rallies.

- The long-term holders—those steadfast, undemonstrative creatures—have managed to amass 150,000 BTC in April, whilst the U.S. dollar, once faint, has sensibly revived her spirits.

It is a truth universally acknowledged, that a cryptocurrency in possession of a handsome price, must be in want of a rally. Bitcoin, the ever-elusive Mr. Darcy of digital coinage, flirted tantalisingly with $97,000—a sum not seen objected to since February, and rendering it a mere 3.5% distance from the hallowed $100,000. On-chain metrics, which I daresay are less romantic than fortune tellers but more fashionable than suitors, have insisted this sum is not so unattainable as it first appears.

Pray, observe CryptoQuant’s pronouncements: the short-term holders (with more fleeting affections—mere days or a week) in Q2 2025 exhibit tendencies curiously familiar from those wild, positively improper price rallies of early and late 2024. A prodigious coincidence, or a sign of fortune’s favour?

Upon inspecting the fashionable charts, one spies that the short-term holders, whenever they accumulate with greater enthusiasm, precipitate a price surge reminiscent of prior seasons’ engagements. CryptoQuant, ever the hopeful matchmaker, whispers:

“Should this tendency persist, Bitcoin may soon surpass $100,000 and enter a most advantageous upward phase—something quite like an eligible heir settling into his estate.”

Rally or Rivalry? The Barque of Bitcoin Sails Onwards

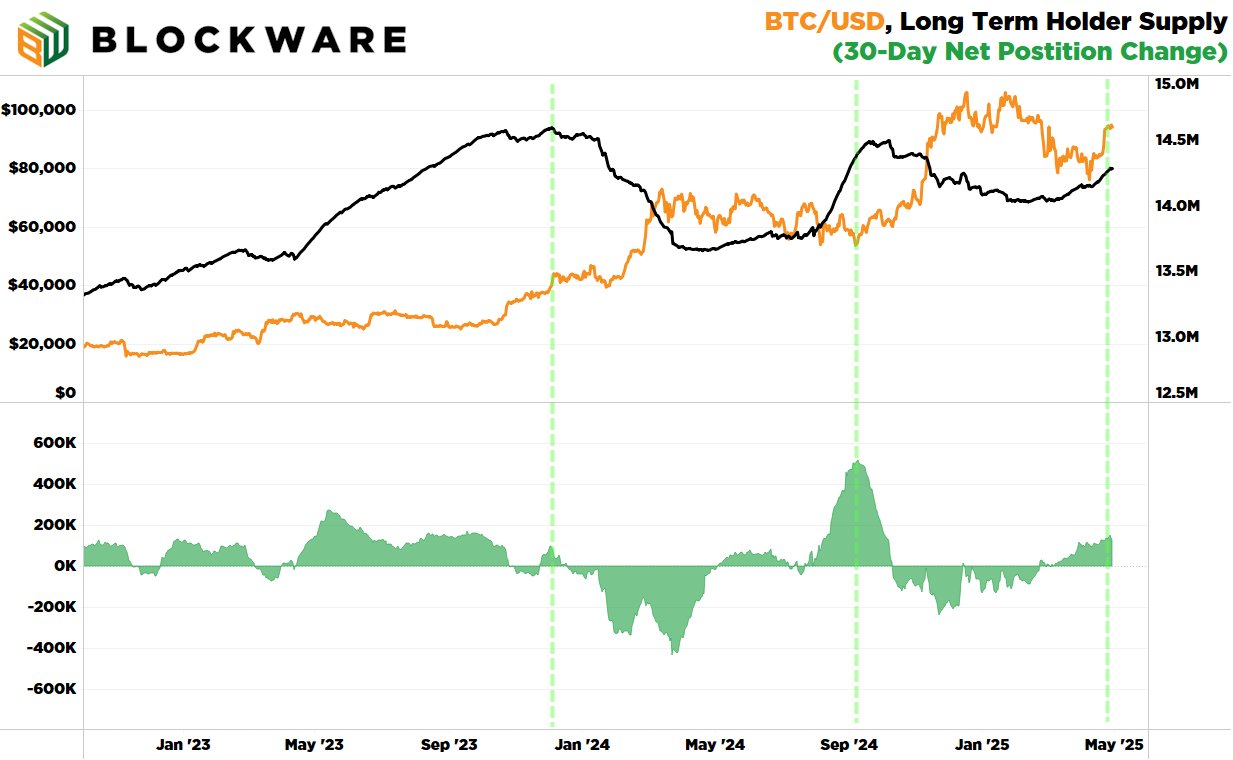

Blockware, that reputable mining entrepreneur—no less steady than the town’s most eligible landowner—echoes this optimistic outlook. Responding with all the composure of a Regency dowager, they reveal that long-term holders’ supply has increased, thus removing much of the pressure that once caused indiscriminate selling. It appears, for once, the balls are well-attended, but the fortune-hunters have retired early.

Indeed, the analyst Mr. Robert Breedlove opines,

“In the previous thirty days, the long-term holders have secured an additional ~150,000 BTC. The sellers in the $80k to $100k range appear to have absconded—perhaps to Bath?”

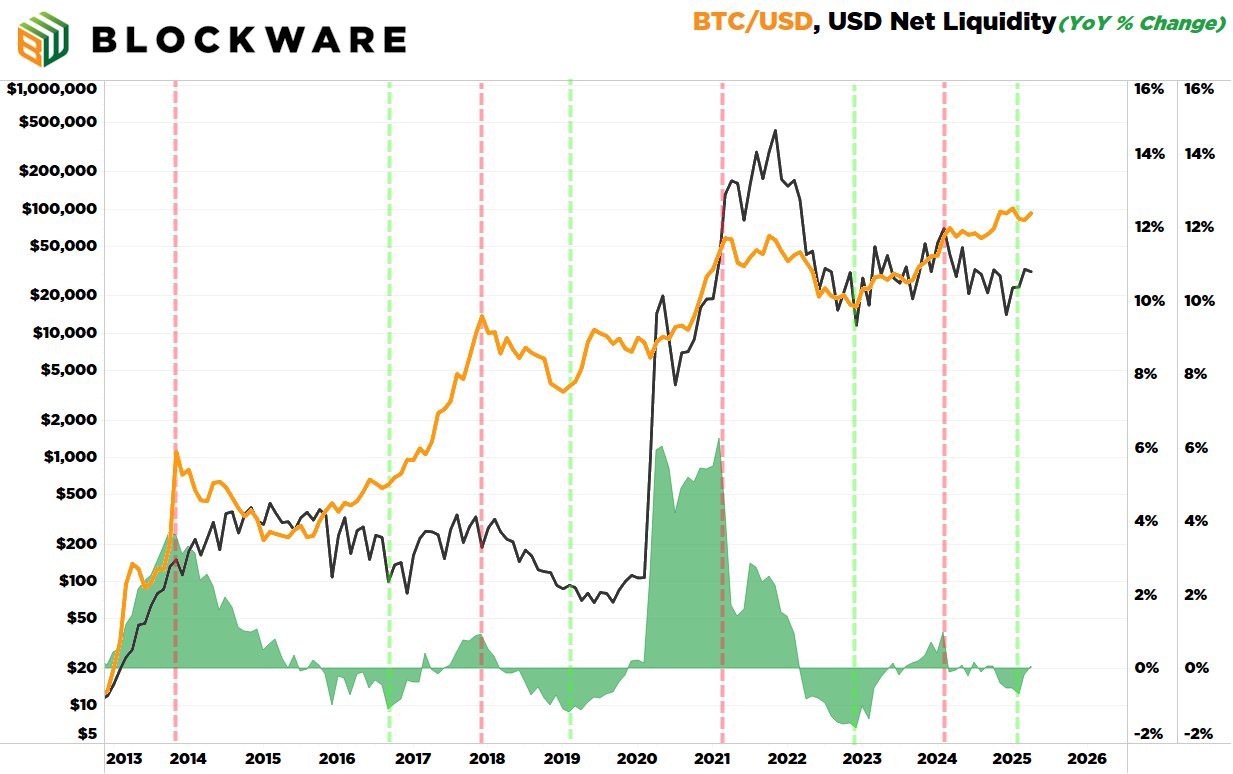

Yet, the most tantalising factor is the resuscitation of U.S. dollar liquidity—regarded by many as the most eligible debutante in the room. Witness, if you will, the rapid increase in dollar liquidity during the festive season of 2020-2021, which saw Bitcoin ascend from $3,500 to a princely $69,000—almost enough to make Lady Catherine faint.

This liquidity, after a most disagreeable contraction in late 2024 and early 2025, appears once again to be improved in Q2 2025. If the pattern persists, Bitcoin may be beset with so many suitors (bids), its price could be nudged higher out of social obligation alone.

One must not exclude the technical indicators, which for the present appear as agreeable as an invitation to a Netherfield ball. The 4-hour Super Trend, in particular, currently issues a most persuasive ‘buy’—and the price, above the key moving averages, could make even Mrs. Bennet hopeful.

The evidence aligns on the side of the bulls, my dear reader. In short, Bitcoin seems quite prepared to sweep $100,000 off its feet—though, as in all matters of the heart (and finance), a little suspense remains for the second act. 🍸💃

Read More

- PI PREDICTION. PI cryptocurrency

- WCT PREDICTION. WCT cryptocurrency

- The Battle Royale That Started It All Has Never Been More Profitable

- Michael Saylor’s Bitcoin Wisdom: A Tale of Uncertainty and Potential 🤷♂️📉🚀

- Everything Jax Taylor & Brittany Cartwright Said About Their Breakup

- New PS5 Console Bundle Leaks Prior to Reveal

- Jason Ritter Joins DC’s Lanterns (and May Be Tied to a Major Villain)

- EastEnders’ Balvinder Sopal hopes for Suki and Ash reconciliation: ‘Needs to happen’

- Taylor Swift and Travis Kelce: A Love Story Unfolds at Chiefs’ AFC Celebration!

- Zendaya’s Friends Hilariously Call Tom Holland by His Spider-Man Nickname!

2025-05-03 09:17