- Bitcoin experienced a notable surge at press time compared to previous day’s close.

- Are traders capitalizing on the recent pullback or awaiting a further price drop?

After years of observing and analyzing the cryptocurrency market, I must admit that it continues to surprise me with its unpredictable nature. While Bitcoin [BTC] has shown a notable surge today, it remains below the critical $60K mark, hinting at a lingering correction.

In the last day, Bitcoin (BTC) saw a significant increase, but it hasn’t fully corrected its price as it still hovers beneath the crucial $60,000 threshold.

Furthermore, monitoring the fluctuations of stablecoins can serve as an important indicator of general investor attitudes towards Bitcoin (BTC).

Considering that, AMBCrypto examined a recent post from CryptoQuant, suggesting a drop in the flow of stablecoins.

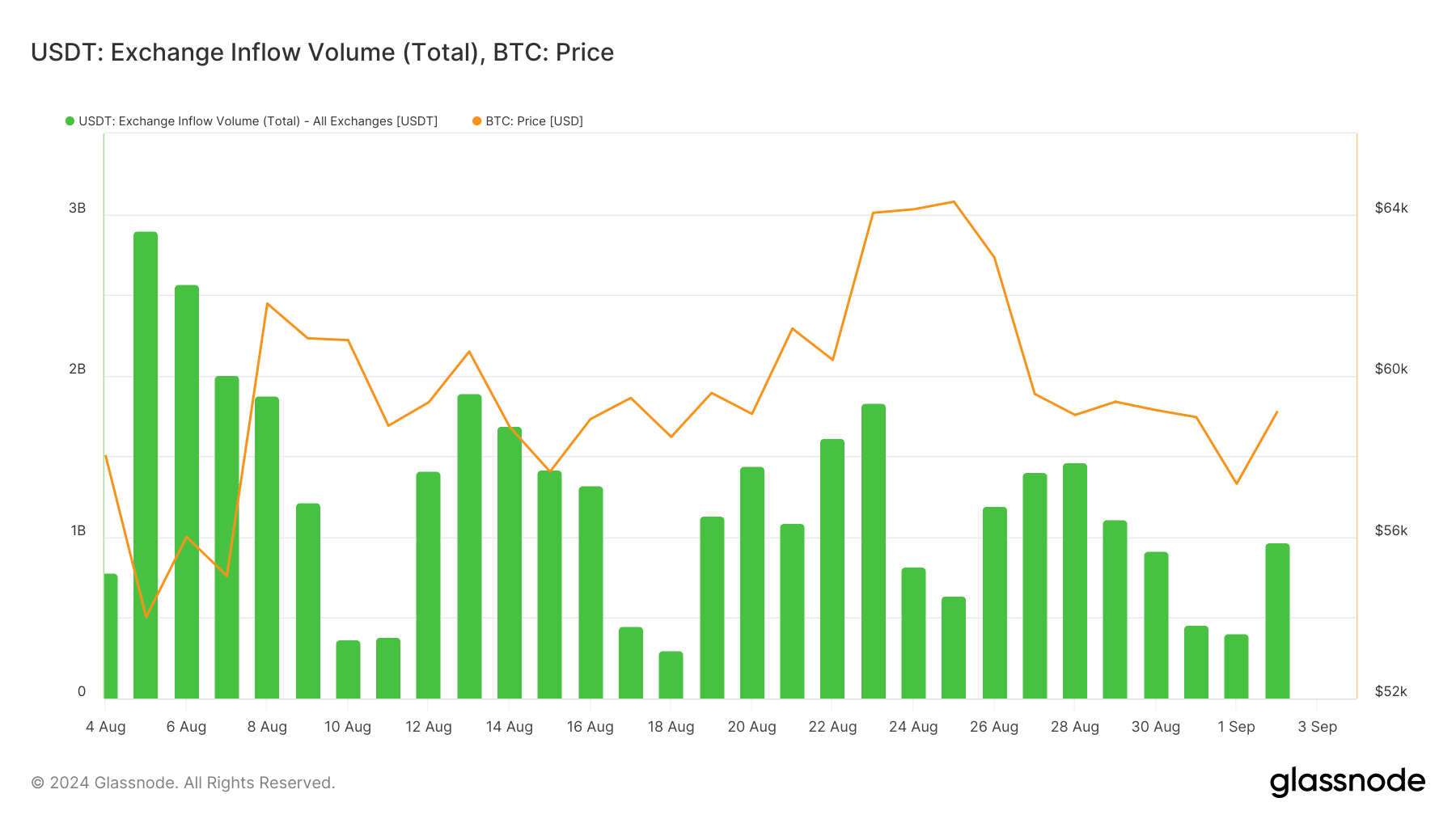

USDT influx in contrast with BTC’s muted rise

It’s not surprising that USDT commands a 70% share of the stablecoin market. As a result, AMBCrypto has scrutinized recent investment trends surrounding this particular token.

Source : Glassnode

Initially in September, Bitcoin showed a downward trend on the daily price chart, dropping approximately 3% to reach $57,300 compared to the previous day. Yet, an impressive surge the day after brought Bitcoin close to the $60,000 mark.

It’s worth noting that the increase in value occurred around the same time as USDT inflows nearly doubled, rising from $402 million to $970 million.

Based on AMBCrypto’s assessment, the increase in USDT deposits into exchanges points towards a revived enthusiasm among stakeholders.

Additionally, this surge could be responsible for the recent upward trend, enticing day traders to take advantage of the price drop.

Generally viewed as a positive indicator, this information stands in stark contrast to the previous post.

As a result, AMBCrypto took a closer look, observing that although USDT saw a significant rise, Bitcoin was only slightly up by 0.21%, standing at $59,130 at the current reporting.

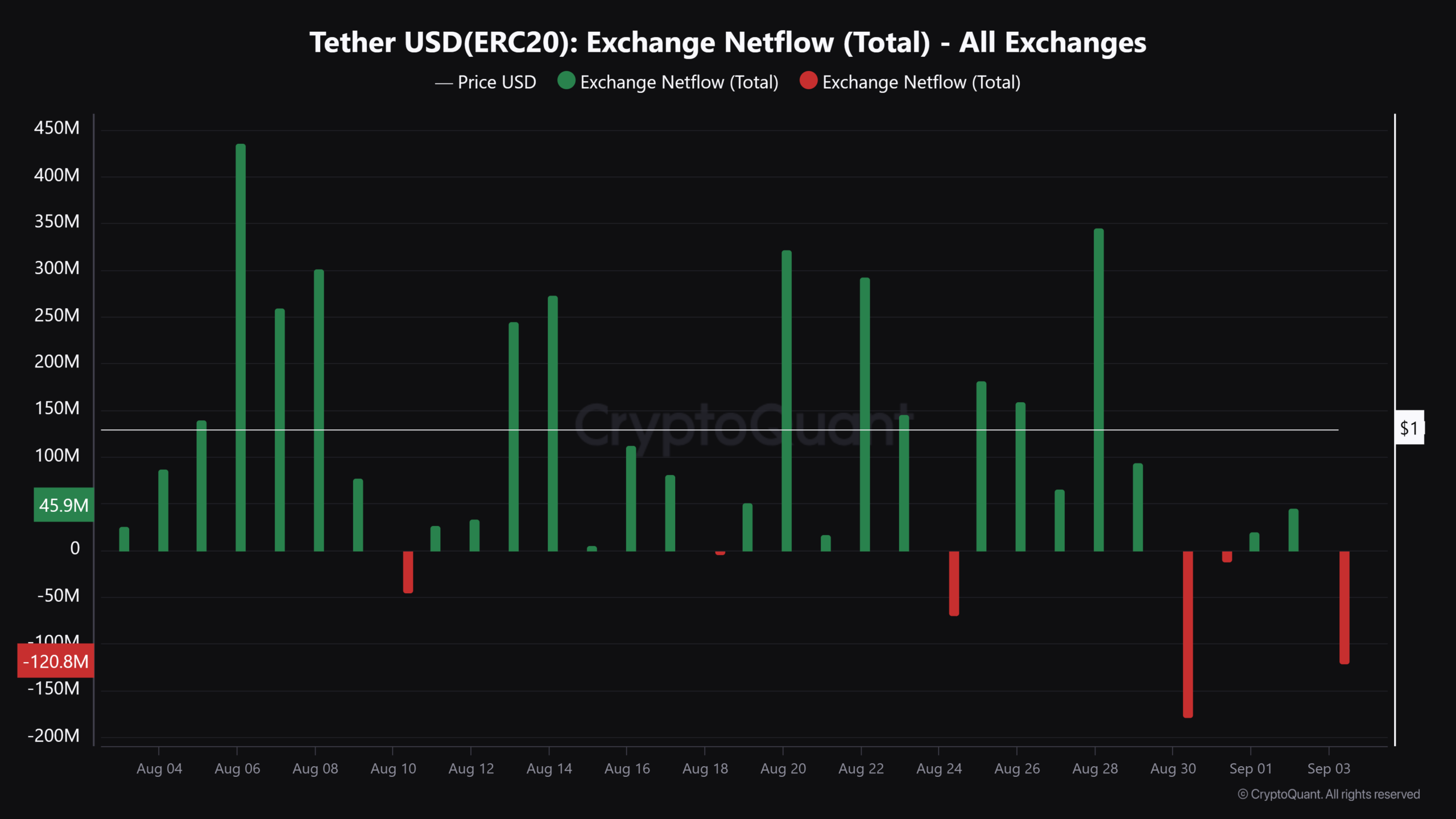

Market caution evident in net flows

As I delve into the analysis, focusing on net flows provides a clearer perspective. At the moment, USDT’s net flow stands at a deficit of approximately $120.8 million, and the trading day is far from over, suggesting potential shifts in this trend.

Certainly, this significant net outflow suggested growing caution among stakeholders.

Source : CryptoQuant

Four days ago, as analyzed by AMBCrypto, there was a significant withdrawal of approximately $180 million worth of Tether from cryptocurrency exchanges.

After that point, Bitcoin saw a significant drop in value, ending the day at $57,700 – its lowest point for the day.

As a crypto investor, I find myself contemplating the recent decrease in Bitcoin transactions using Tether (USDT). It’s not clear-cut whether this points toward sellers unloading their Bitcoin or traders being cautious, perhaps taking profits or waiting for a price drop to make new purchases. In either case, it’s crucial to keep a watchful eye on market movements and adapt strategies accordingly.

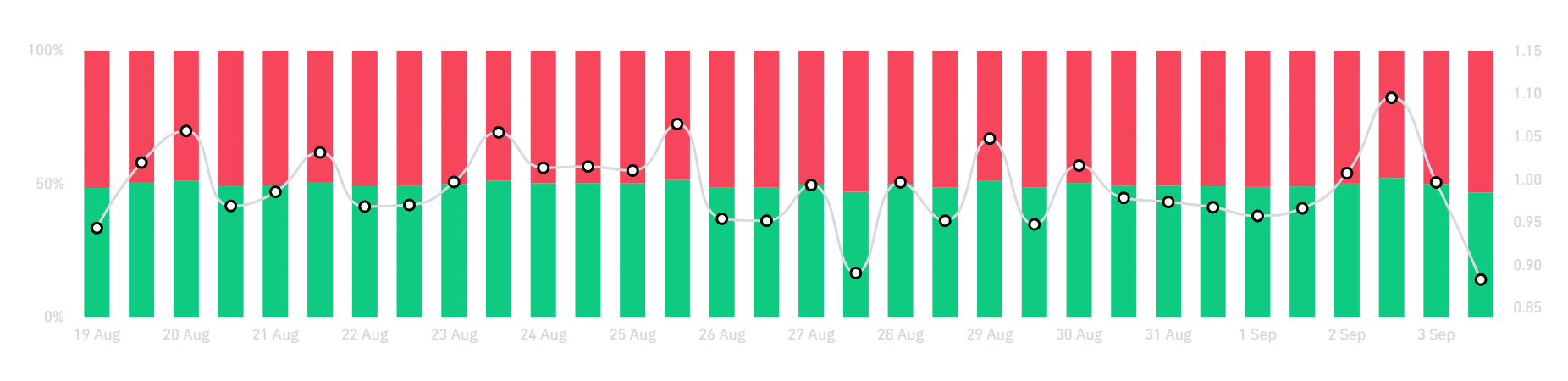

Traders brace for a deeper drop amid rising BTC caution

AMBCrypto examined the following chart to ascertain whether traders are predominantly preparing for a possible price drop or waiting for further gains.

Source : Coinglass

On the 12-hour chart, a sharp plunge shows 46% long versus 54% short positions.

Essentially, the prevalence of short positions suggests that traders are expecting a further decrease in price before they consider entering new long (buy) positions.

Read Bitcoin’s [BTC] Price Prediction 2024-25

If bulls don’t step in, it’s possible for Bitcoin’s price to drop again towards the previous support level of about $57K, at which point we might see a price adjustment occur.

Should the market show greater resilience or receive unanticipated bullish updates, it may trigger short squeezes. During such events, short sellers might be compelled to repurchase their holdings, which could propel Bitcoin beyond the $60K threshold.

Read More

- WCT PREDICTION. WCT cryptocurrency

- The Bachelor’s Ben Higgins and Jessica Clarke Welcome Baby Girl with Heartfelt Instagram Post

- AMD’s RDNA 4 GPUs Reinvigorate the Mid-Range Market

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- PI PREDICTION. PI cryptocurrency

- Chrishell Stause’s Dig at Ex-Husband Justin Hartley Sparks Backlash

- Royal Baby Alert: Princess Beatrice Welcomes Second Child!

- Studio Ghibli Creates Live-Action Anime Adaptation For Theme Park’s Anniversary: Watch

- SOL PREDICTION. SOL cryptocurrency

- Bitcoin’s Golden Cross: A Recipe for Disaster or Just Another Day in Crypto Paradise?

2024-09-04 12:14