- Bitcoin retained momentum, despite dropping below $70,000

- Insights using the MVRV indicator hinted at a possible surge

As a seasoned analyst with years of experience navigating the tumultuous waters of the cryptocurrency market, I find myself intrigued by Bitcoin’s recent performance. While its dip below $70,000 may have sent shivers down some investors’ spines, the MVRV indicator suggests we might be in for a potential surge.

Following multiple efforts to surpass $70,000, Bitcoin has dipped back under that resistant mark once more. This indicates some difficulties in maintaining a positive trend as suggested by the graphs.

Currently, the cryptocurrency is being sold for approximately $68,581, having experienced a slight increase of 0.3% over the past day. This suggests that the market might need more strength to firmly push the price beyond $70,000 in the long term.

Based on the latest fluctuations in cryptocurrency prices, CryptoQuant’s analyst, CoinLupin, offered insights about Bitcoin’s Market Value to Realized Value (MVRV) pattern. The analyst posited this observation.

Approaching significant events in November, the MVRV (Mempool Value to Realized Value) ratio provides a classic method for evaluating Bitcoin’s worth, taking into account broader market influences.

The MVRV ratio (around 2 at the present moment) indicates that Bitcoin’s market value is approximately double its estimated on-chain value. However, instead of merely looking at the current MVRV value, CoinLupin suggests paying attention to the trend by employing tools like the 365-day Bollinger Band for MVRV and the four-year average to gain a deeper understanding of Bitcoin’s market cycles.

Source; CryptoQuant

Currently, when I’m composing this text, the MVRM (Market Value Realized to Value) ratio has climbed beyond its yearly mean – Indicating that although Bitcoin’s trajectory remains upward, it still holds the possibility for reaching a higher cycle top.

Long-Term price indicators and future targets

Based on the expert’s analysis, the current MVRV value indicates a prolonged climb, however, it hasn’t surpassed previous record highs yet. Normally, this value ranges from 3 to 3.6 on the MVRV ratio.

If we presume the current Realized Value remains constant, an analyst projects that Bitcoin might need to surge by 43% to 77% to possibly reach prices ranging from $95,000 to $120,000.

Additionally, he pointed out that increasing market interest and purchasing power might cause the Realized Value to climb even further – Indicating that potential future highs could surpass these existing levels, according to past trends.

Apart from the MVRV ratio, CoinLupin pointed out that Bitcoin experienced a significant increase in value over the last twelve months. Interestingly, Bitcoin’s price has just begun to hover around the typical MVRV line without losing its upward trajectory.

Examining key Bitcoin metrics and market interest

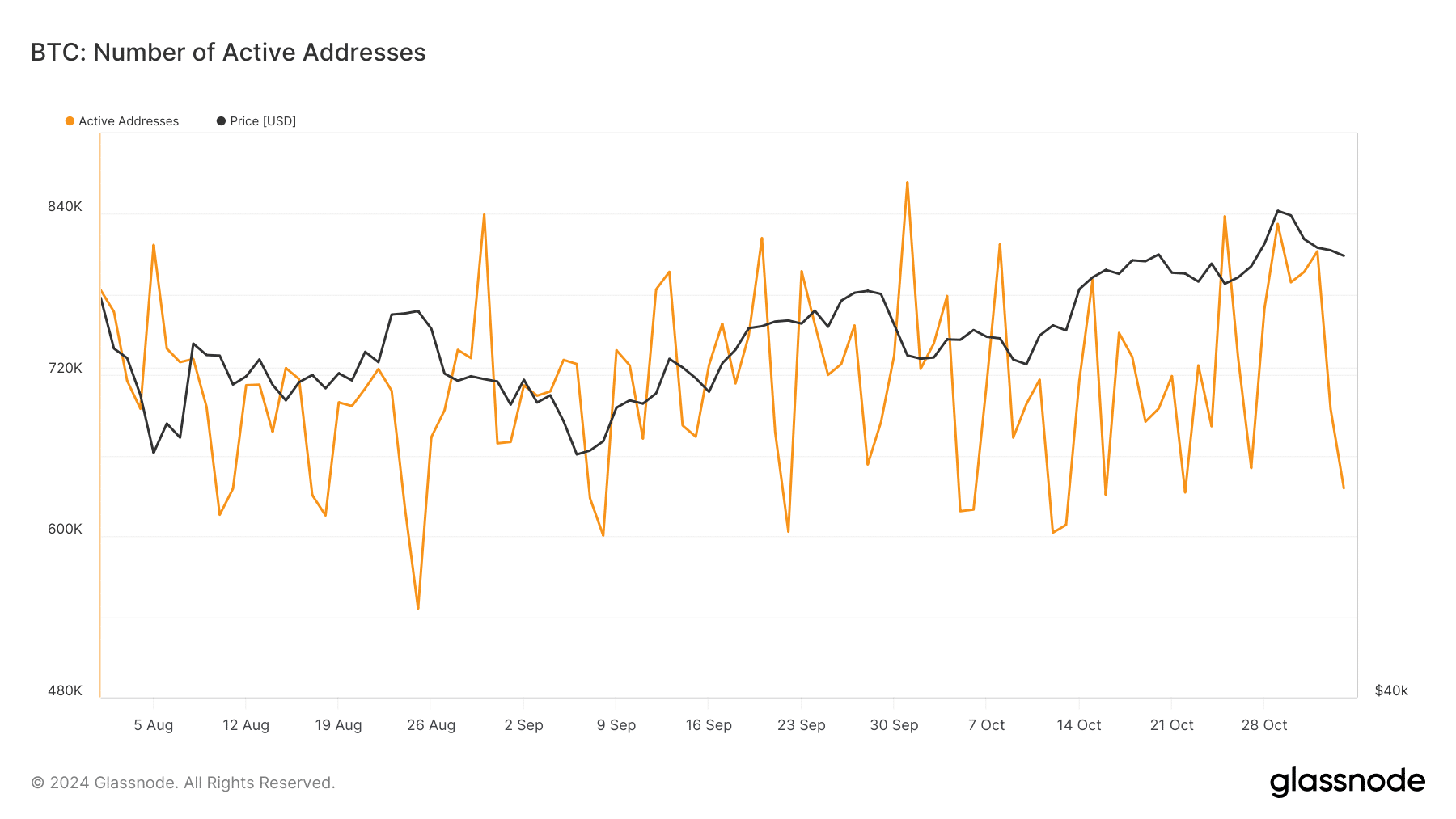

The continuing behavior of Bitcoin can be better grasped by examining its on-chain statistics more closely. For instance, retail involvement, signified by the number of active addresses according to Glassnode, has remained fairly consistent since August.

Regardless of Bitcoin’s current price swings, the number of actively used addresses has consistently stayed within a specific range. Lately, this figure has varied from approximately 870,000 to 546,000 active addresses.

It seems like the consistent activity around Bitcoin (BTC) suggests that there’s some level of interest, but it might mean that new retail involvement is still relatively limited. The absence of clear directional movement in active addresses might suggest that existing users are sticking around, but a substantial wave of fresh participants hasn’t shown up yet. This could be crucial for BTC to set a more robust path towards an upward trend.

Furthermore, analyzing transactions involving whales (major Bitcoin holders) offers an alternative viewpoint regarding Bitcoin’s possible future trends.

On October 29th, the number of significant Bitcoin transactions (whale transactions) reached a high of 24,070, but then dropped down to 13,300 by November 3rd.

A significant decrease in big transactions hints at a temporary lull in the activity of “whales,” which might influence Bitcoin’s immediate pace. A decrease in whale transactions could imply that major investors are temporarily halting their buying or selling actions, potentially causing Bitcoin’s price movement to slow down or cool off.

As I analyze market trends, I notice that an increase in whale activity might reinvigorate Bitcoin’s price. This could pave the way for surpassing crucial resistance levels, a development that could be beneficial to the asset’s growth trajectory.

Read More

- Jujutsu Kaisen Reveals New Gojo and Geto Image That Will Break Your Heart Before the Movie!

- We Ranked All of Gilmore Girls Couples: From Worst to Best

- Gaming News: Why Kingdom Come Deliverance II is Winning Hearts – A Reader’s Review

- PI PREDICTION. PI cryptocurrency

- How to Get to Frostcrag Spire in Oblivion Remastered

- Why Tina Fey’s Netflix Show The Four Seasons Is a Must-Watch Remake of a Classic Romcom

- Disney Cuts Rachel Zegler’s Screentime Amid Snow White Backlash: What’s Going On?

- First U.S. Born Pope: Meet Pope Leo XIV Robert Prevost

- How Michael Saylor Plans to Create a Bitcoin Empire Bigger Than Your Wildest Dreams

- Kylie & Timothée’s Red Carpet Debut: You Won’t BELIEVE What Happened After!

2024-11-05 08:24