-

Bitcoin rose to $70,000 in the previous trading session.

Miner reserve has continued to decrease, but BTC’s price has slowed it down.

As a seasoned researcher who has closely followed Bitcoin’s (BTC) market trends for several years, I find myself intrigued by recent developments. The surge to $70,000 in the previous trading session was a notable event, but it was quickly tempered by a slight increase in miner outflows and a subsequent drop in price.

Lately, Bitcoin [BTC] miners have seen a modest uptick in their output. However, other market signals don’t necessarily indicate an impending major sell-off based on this increase alone.

Bitcoin miner reserve declines

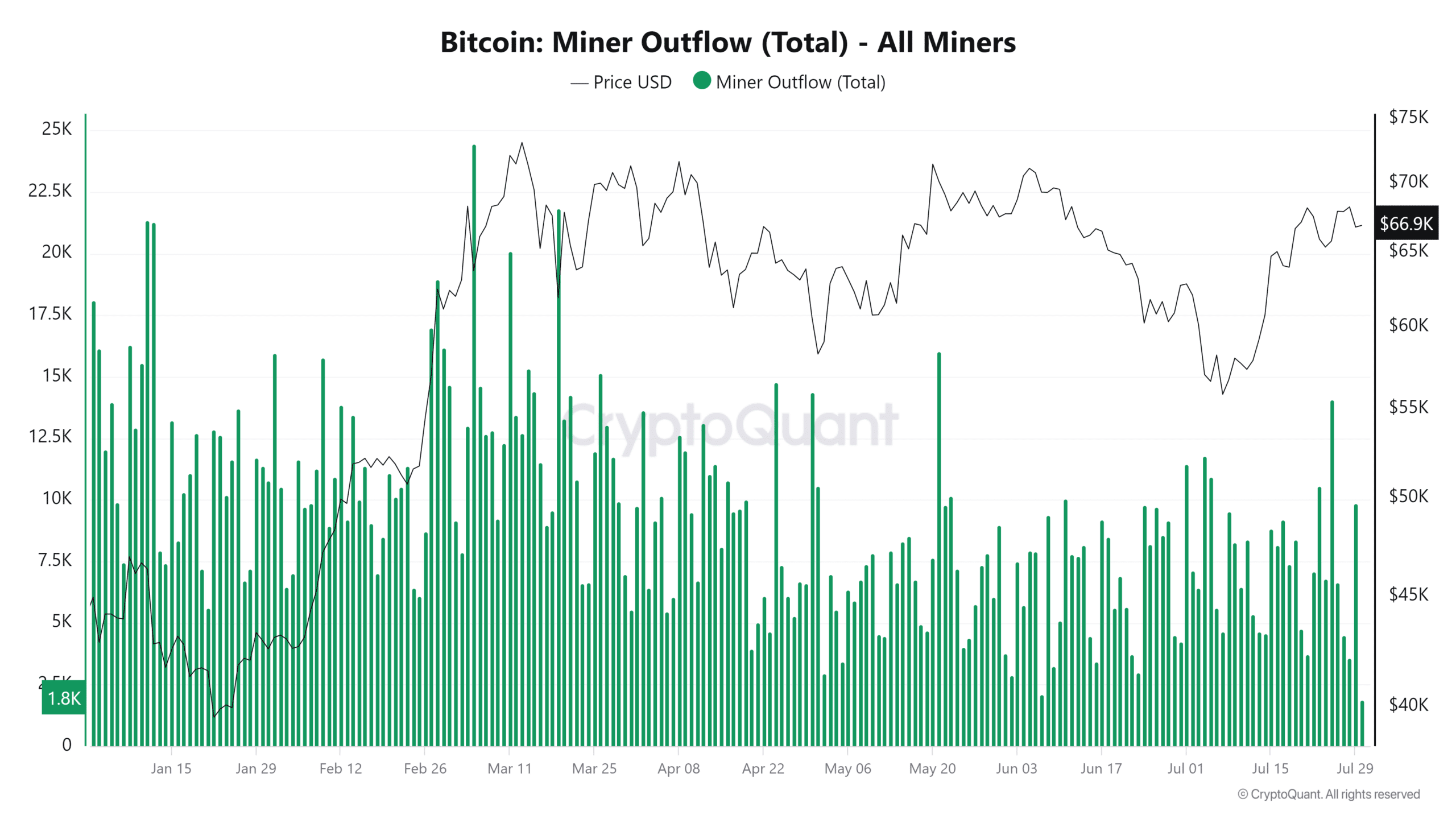

A current analysis by CryptoQuant reveals a substantial uptick in the transfer of Bitcoin from miners’ wallets, as indicated by an upward trend in miner outflows.

1. On July 25th, the miner outflow indicator saw a significant surge, exceeding 14,000 BTC – a figure not seen since nearly a month prior and marking the first such high in the month of July.

29th of July witnessed a remarkable surge in my Bitcoin holdings, as outflows soared beyond 9,800 BTC, following a dip that ensued after the peak I had previously experienced.

The data from Bitcoins mined and held in reserve showed a growing pattern of withdrawals. As of early July, this reserve amounted to roughly 1.814 million BTC.

As of the latest data, this reserve has slightly decreased to around 1.813 million BTC.

Selling spree in check

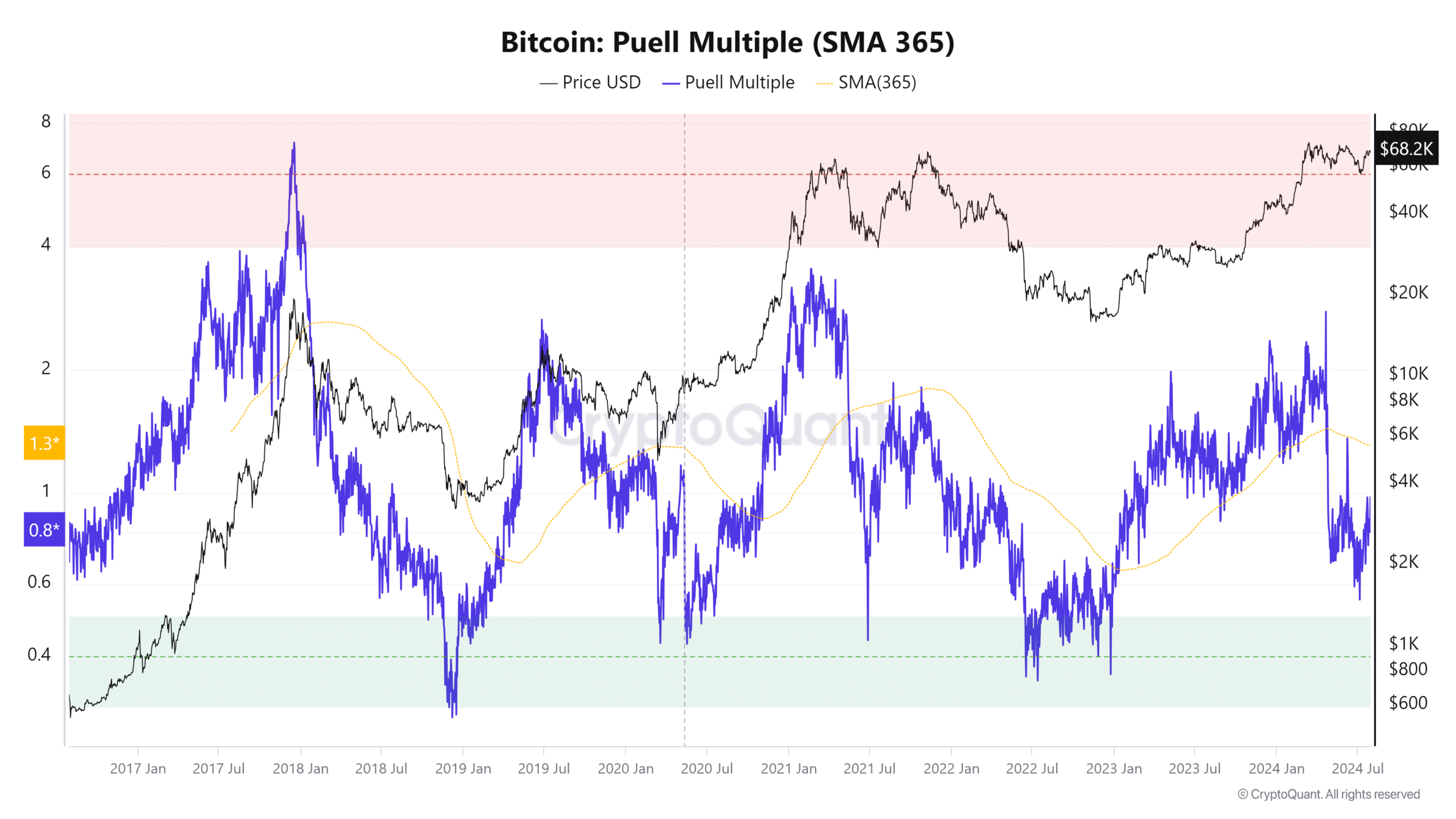

After the Bitcoin halving, miner income experienced a significant decrease. The reason being, the halving event cut down the reward given to miners for each block they mined.

1. Additionally, there occurred a change in the Puell Multiple, a tool employed to evaluate the well-being and future tendencies of the mining sector.

This method determines how much the current daily value of Bitcoin in US dollars (issuance rate) varies from its average over the past year (365 days).

1. A decreased Puell Multiple implies that miners are earning less than usual, on average. When the Puell value hovers near 0.5, it often signifies a substantial drop in miner earnings, potentially indicating a possible market low point.

Currently, the Puell Multiple stands at 0.9. This figure represents a rise, yet it signifies that miners’ earnings remain comparatively lower than the typical average.

In these circumstances, miners could be reluctant to offload their Bitcoin as the selling price might not cover their mining expenses adequately.

BTC fails to hit $69K

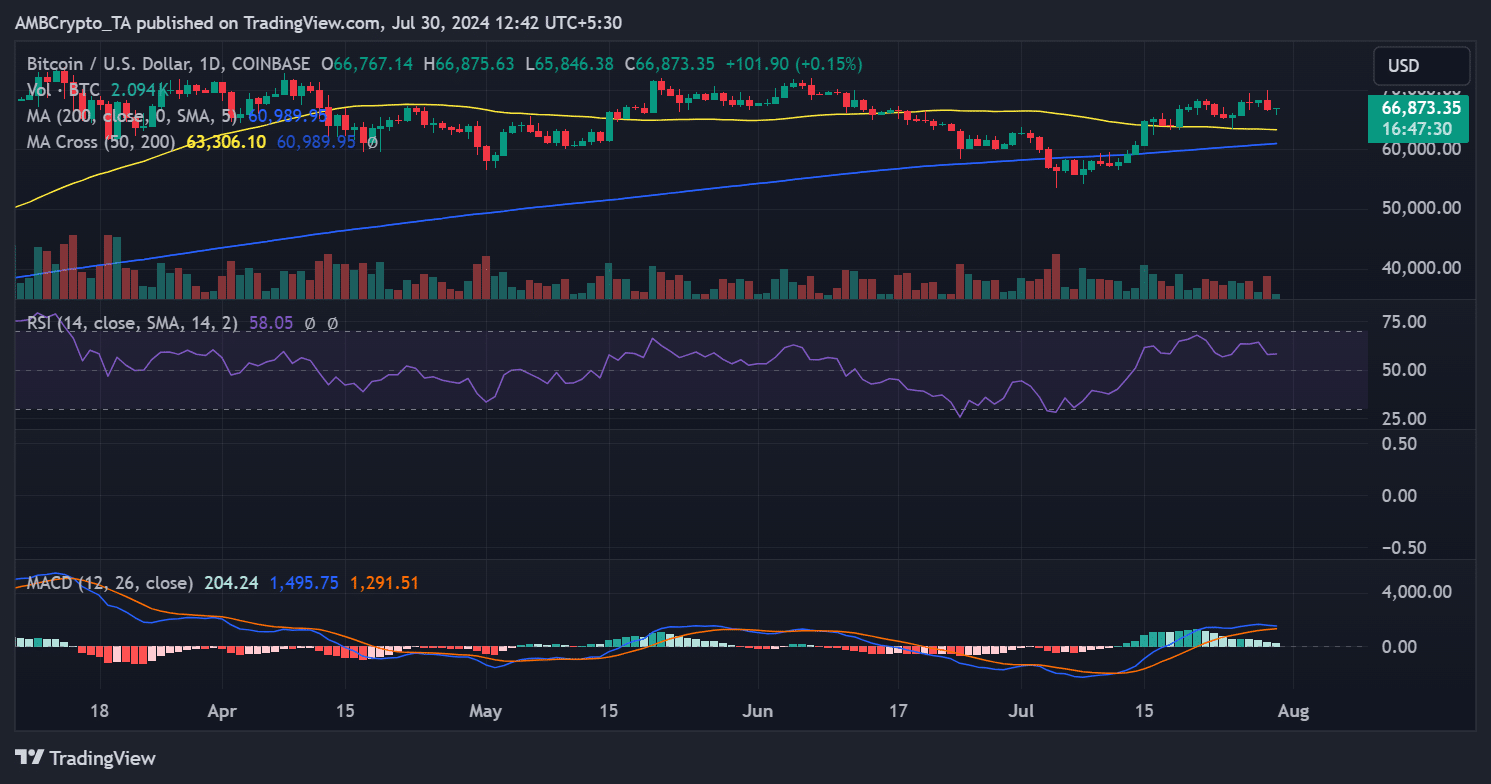

On July 29th, Bitcoin started the trading day with a robust performance, momentarily touching the $70,000 price bracket. Yet, as the day progressed, its value dipped, experiencing a decline of approximately 2%, and ending the day at roughly $66,771.

Read Bitcoin’s [BTC] Price Prediction 2024-25

1. In a down economy, the worth of cryptocurrency miners’ assets could be impacted, which might sway their choices regarding increased withdrawals.

Based on AMBCrypto’s examination, the value of Bitcoin stood around $66,800 as of the latest update, demonstrating a small rebound with an increment of almost 1%.

Read More

- The Lowdown on Labubu: What to Know About the Viral Toy

- Street Fighter 6 Game-Key Card on Switch 2 is Considered to be a Digital Copy by Capcom

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Masters Toronto 2025: Everything You Need to Know

- Mario Kart World Sold More Than 780,000 Physical Copies in Japan in First Three Days

- ‘The budget card to beat right now’ — Radeon RX 9060 XT reviews are in, and it looks like a win for AMD

- Karate Kid: Legends Hits Important Global Box Office Milestone, Showing Promise Despite 59% RT Score

- Valorant Champions 2025: Paris Set to Host Esports’ Premier Event Across Two Iconic Venues

- Microsoft Has Essentially Cancelled Development of its Own Xbox Handheld – Rumour

- There is no Forza Horizon 6 this year, but Phil Spencer did tease it for the Xbox 25th anniversary in 2026

2024-07-30 17:12