Hold onto your hats, folks! Bitcoin has just broken through the $122,000 barrier, setting a new all-time high and leaving us all wondering if $200,000 is closer than we think. 🚀💸

Market Overview: Bitcoin Breaks Out as Technicals Stay Strong

After weeks of teasing us with its $118,000 hovercraft, Bitcoin has finally decided to show us what it’s made of. The price surged to a high of $122,533, according to CoinMarketCap, following a clean bullish setup across several indicators. 📈

The 4-hour EMA cluster (20/50/100/200) remains stacked below the price, indicating a strong uptrend, while the RSI has cooled to 68.3 after briefly entering overbought territory. MACD continues to show positive momentum, and Bollinger Bands have expanded, signaling that volatility is increasing in favor of the bulls. 🐂

Short-term resistance now sits at $125,500, followed by a major psychological barrier near $130,000. On the downside, support remains firm around $118,200, with deeper fallback levels at $114,000. These levels suggest Bitcoin is preparing for further upside as the current structure shows no immediate threat of reversal. 📉

ETF Inflows and Geopolitics: The Hidden Drivers Behind the Rally

The recent breakout is not just technical. According to Bitcoin ETF news, the last 24 hours saw $309 million in net inflows into BTC-linked funds. This comes after Thursday’s historic $1.18 billion ETF inflow—setting a 2025 record. Bitwise’s IBIT fund has now surpassed $53 billion in gross inflows, with Fidelity’s FBTC following at over $12 billion. 💸

“The sheer scale of institutional demand is unlike anything we’ve seen before,” said Matt Hougan, CIO of Bitwise. “There’s relentless appetite from corporate treasuries and asset managers, and it’s colliding with Bitcoin’s fixed supply.” 🏦

Simultaneously, President Trump’s recent 30% tariffs on the EU and Mexico have sparked global market jitters, prompting some investors to rotate into Bitcoin as a macro hedge. Combined with crypto-friendly legislation under debate in Congress, these developments are lifting sentiment and encouraging large capital flows into BTC. 🏛️

Expert Insights: $200K Forecasts Gaining Legitimacy

With institutional demand rising and technicals aligning, analysts are becoming more confident in Bitcoin price predictions, calling for a move to $160,000 to $200,000 within the next 6–12 months. 🔮

“This shift signals a maturing perspective on Bitcoin—not merely as a speculative asset, but as a structurally scarce store of value,” said George Mandres, senior trader at XBTO Trading. 💡

Technical projections based on Fibonacci extensions show $136,000 and $160,000 as upcoming targets, while market sentiment indicators like the Fear & Greed Index hover around 68, suggesting more room for growth. 📊

Rachael Lucas, a crypto analyst at BTC Markets, commented: “Bitcoin’s cleared $120,000, but the real test is $125,000. ETF demand is strong, and dips to $112,000 will likely be bought aggressively. We’re not in reversal territory yet.” 📈

Even more bullish is James Lavish, a hedge fund manager who noted, “Bitcoin may have no ultimate limit—this is a once-in-a-cycle opportunity.” 🌀

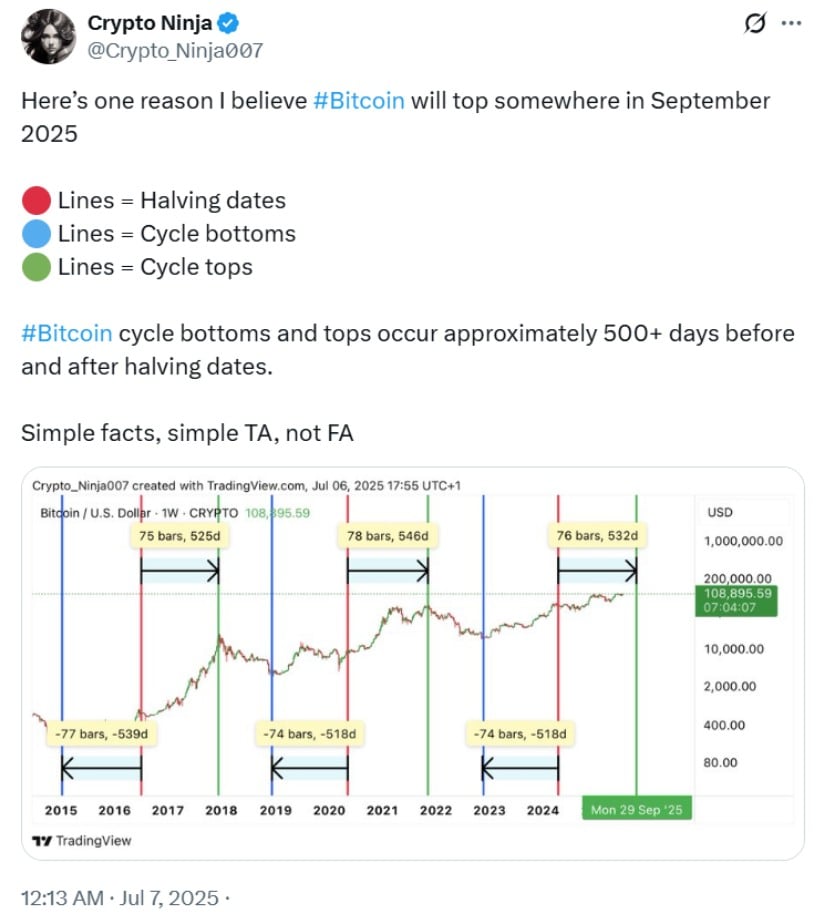

Bitcoin Halving 2025 and the Bigger Picture

Another influential variable in shaping long-term predictions is the upcoming Bitcoin halving in 2025, forecasted in April. Previously, Bitcoin rallies during the time leading up to and after a halving occurrence due to reduced miner supply. Now, the shortage of supply is even higher, with daily ETF demand exceeding daily mining output by 20x on some days. ⛏️

Meanwhile, revenues for Bitcoin miners continue to grow as network usage increases, resulting in earned transaction fees. Improvements to the Bitcoin Lightning Network and the Taproot update are also boosting confidence in Bitcoin’s scalability and long-term adoption. ⚡️

Looking Ahead: What’s Next for Bitcoin’s Price?

Today’s bitcoin story is a textbook case of bullish technicals, macroeconomic volatility, ETF-driven demand, and political tailwinds. Bitcoin is no longer a specialized asset but increasingly an anchor component of institutional portfolios, and its scarcity is pushing price discovery to all-time highs. 📈

Though a near-term retreat to $110,000 is still conceivable, the long-term picture continues to be exceptionally bullish. With support in place, ETF inflows pouring in, and the halving in 2025 on the horizon, Bitcoin could be moving towards $200,000 sooner than most were expecting. 🚀

As always, volatility should be expected, but for now, the Bitcoin price forecast remains one of historic upside potential. 📈

Read More

- Where Winds Meet: How To Defeat Shadow Puppeteer (Boss Guide)

- Gold Rate Forecast

- Best Thanos Comics (September 2025)

- Best Shazam Comics (Updated: September 2025)

- PlayStation Plus Game Catalog and Classics Catalog lineup for July 2025 announced

- Did Churchill really commission wartime pornography to motivate troops? The facts behind the salacious rumour

- Resident Evil Requiem cast: Full list of voice actors

- 4 TV Shows To Watch While You Wait for Wednesday Season 3

- Netflix is Bringing KPop: Demon Hunters Back to Theaters (And At the Perfect Time)

- Harnessing Superconductivity for Quantum Computing

2025-07-14 19:24