- Okay, so Bitcoin’s cruising over $98K—amazing, right? You’d think everyone would be popping champagne, but no! People are still pessimistic. Disbelief everywhere. Maybe it’s the *perfect* time to buy? Or maybe you’re just a sucker. Who knows?

- ETFs are pumping Bitcoin like it’s on life support, big money’s rolling in, but hey, remember 2022? Yeah—boom, rug pulled. It can happen again. Don’t get cocky.

Let’s talk about Bitcoin. It’s above $98K, flexing for everyone and their grandmother. But investors? They’re nervous. Really nervous. The kind of nervous you get before a colonoscopy. Shouldn’t everyone be ecstatic in a bull market? Guess not.

So, what’s happening? Is everyone gearing up for one of those “told ya so” euphoric moments when Bitcoin skyrockets and your cousin turns into Warren Buffett overnight? Or maybe it’s déjà vu—the bear market is around the corner, ready to mug you while you’re counting your imaginary profits. 🙄

Either way, there’s almost as much psychology here as there is finance. Maybe more. Frankly, I trust psychology about as much as anyone who still uses Hotmail.

A bull run, but don’t get too excited

You want divergence? I’ll give you divergence. Bitcoin’s price looks like it stole someone’s Ferrari, but sentiment on X (which by the way, is still Twitter no matter how desperately Elon wants it not to be) is stuck in “who cares?” territory.

BTC up, everyone still grumpy. That’s a new one. Usually when something sets a record, there’s at least one aunt at Thanksgiving asking if she should cash out her retirement for it. But now, the 7-day average sentiment is basically “meh” with a side of doom. That’s the kind of gloom you get before great reversals—or before someone hands you a free lunch and you wonder what’s wrong with it.

People just don’t trust it. The price goes up, their pessimism refuses to budge. Could be the setup for a rocket to $120K. Or a crater. We’ve seen how “can’t lose” turns out—see: 2022, FTX, your friend who forgot his Ledger password.

Institutional money: the big kids are playing

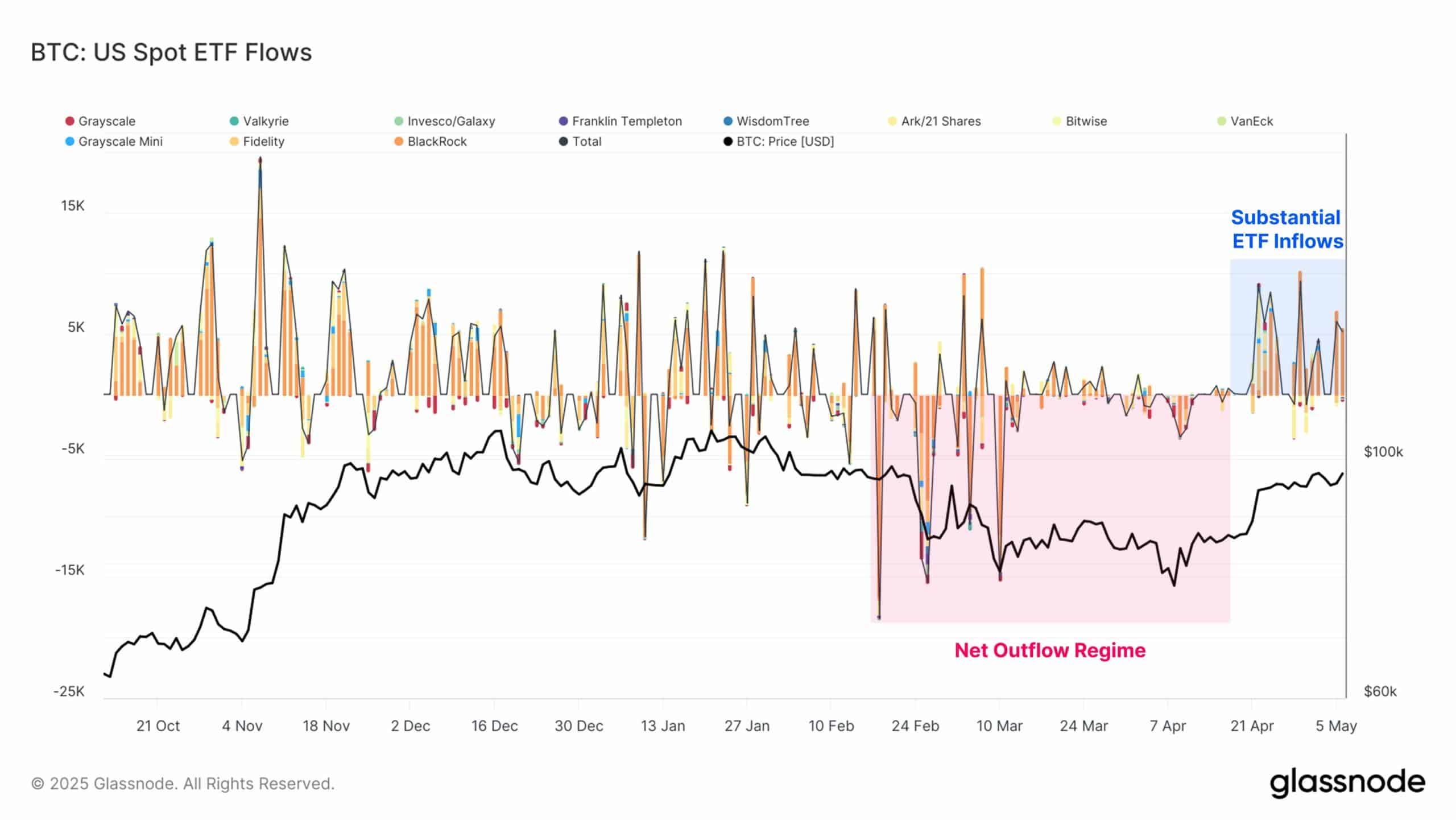

Now, let’s peek at the big end of town: ETF inflows. For weeks, it was bone dry. Then April comes and—bam!—ETFs are pouring in. BlackRock and Fidelity? Love ’em or hate ’em, they’re flipping the switch. Suddenly Bitcoin goes from shaky to running laps.

This isn’t your uncle’s “HODL”-and-pray anymore. The money’s big, the flows are (allegedly) steady, the “long-term conviction” people are sniffing glue over. They’re convinced. Retail investors, meanwhile, are still perched on the fence with binoculars and a crash helmet.

Are the institutions right? Maybe. Or maybe they just like the smell of their own strategies.

So… what’s gonna screw this up? 😬

ETF inflows? Great. But history has the memory of an elephant who never forgives. 2022 was a mess—remember that? Everyone hyped up, and then… disaster. Liquidity vanished faster than your waiter when you ask for split checks.

It only takes one spooked banker or a crypto regulation thrown like a bagel from the sky, and poof: outflows, price nosedives, panic tweets galore. Don’t think ETFs make it all sunshine and rainbows; if the inflow tap shuts off, Bitcoin could tumble so fast you’ll get whiplash.

Moral of the story? Don’t get too comfortable. Bitcoin’s only guarantee: it’ll find a way to make you anxious, rich, or both—and never for the reasons you expect. 🚀🤷♂️

Read More

- PI PREDICTION. PI cryptocurrency

- WCT PREDICTION. WCT cryptocurrency

- Gold Rate Forecast

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- LPT PREDICTION. LPT cryptocurrency

- SOL PREDICTION. SOL cryptocurrency

- Playmates’ Power Rangers Toyline Teaser Reveals First Lineup of Figures

- FANTASY LIFE i: The Girl Who Steals Time digital pre-orders now available for PS5, PS4, Xbox Series, and PC

- Shrek Fans Have Mixed Feelings About New Shrek 5 Character Designs (And There’s A Good Reason)

- Solo Leveling Arise Tawata Kanae Guide

2025-05-08 13:35