Right then, what ho! Seems even a temporary cessation of the Trump chap’s tariff shenanigans hasn’t quite sent the markets into a joyous jig. The blighters are still a bit hesitant to go the whole hog with these so-called “risk assets,” what?

The crypto markets, you see, are in a bit of a pickle – caught between a spot of cautious optimism and a positively beastly amount of uncertainty. Bitfinex’s eggheads (jolly good fellows, I’m sure) have informed crypto.news that while this tariff pause has stopped things from completely going to pot, chaps are still wary of diving headfirst into the deep end with assets of the risky persuasion. Bitcoin (BTC), as a result, has been behaving rather like a bored houseguest – trading sideways, you know, and generally not pulling its weight. And the Bitcoin ETF flows? Utterly subdued, old boy, utterly subdued. 😴

According to these Bitfinex chaps, this 90-day tariff pause, courtesy of the aforementioned Trump, is not the long-term ticket. Rather, it’s a temporary stay of execution, failing entirely to sort out the larger trade kerfuffle. This has kept investors as jumpy as a cat on a hot tin roof when it comes to Bitcoin and its ilk, suggesting that the general feeling is one of “steady on, old bean.” 🤔

“Trump’s 90-day tariff pause is not a resolution, only a delay. Investors understand that tariff threats remain on the table, and as such, positioning is unlikely to shift aggressively toward risk-on just yet,” Bitfinex analysts

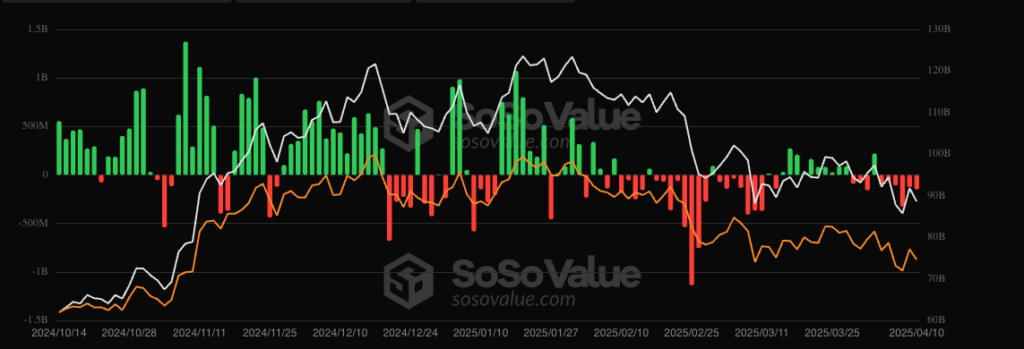

And the Bitcoin ETF flows? Don’t even mention them! As of April 10, these ETFs have been recording negative flows for six days running, with a daily outflow that would make a bookie weep – a cool $149 million. The absolute nadir, I’m told, occurred on April 8, when a whopping $326 million decided to beetle off from Bitcoin ETFs. Good heavens! 😲

In the current climate, it appears crypto assets are likely to be less impressive than those terribly dull equities, until some new, exciting thing happens. Bitfinex suggests possible drivers could be a slightly softer approach from the U.S. Federal Reserve or perhaps a fresh wave of dosh flooding into the crypto market. One can only hope! 🙏

“Bitcoin may also benefit from a slight reduction in macro pressure, but the market will likely wait for more concrete signals—such as a shift in Fed tone or improving liquidity conditions—before aggressively rotating back into crypto. We believe that crypto could underperform equities in relative terms until this happens.”

Relief, of sorts, might arrive due to Trump badgering the Fed Chair, Jerome Powell, to reduce interest rates. However, what with all this rising inflation, the Fed will likely continue doing what it’s doing, unless there’s a change at the top. It’s worth noting that a recent Supreme Court decision means Trump can now temporarily give the boot to officials of independent agencies, leading some to suggest that Powell might be next for the chop. The plot thickens! 😈

(BTC)

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- Masters Toronto 2025: Everything You Need to Know

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- WCT PREDICTION. WCT cryptocurrency

- LPT PREDICTION. LPT cryptocurrency

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- Elden Ring Nightreign Recluse guide and abilities explained

2025-04-11 18:05