-

The increase in realized losses on-chain indicates that another BTC rally was close.

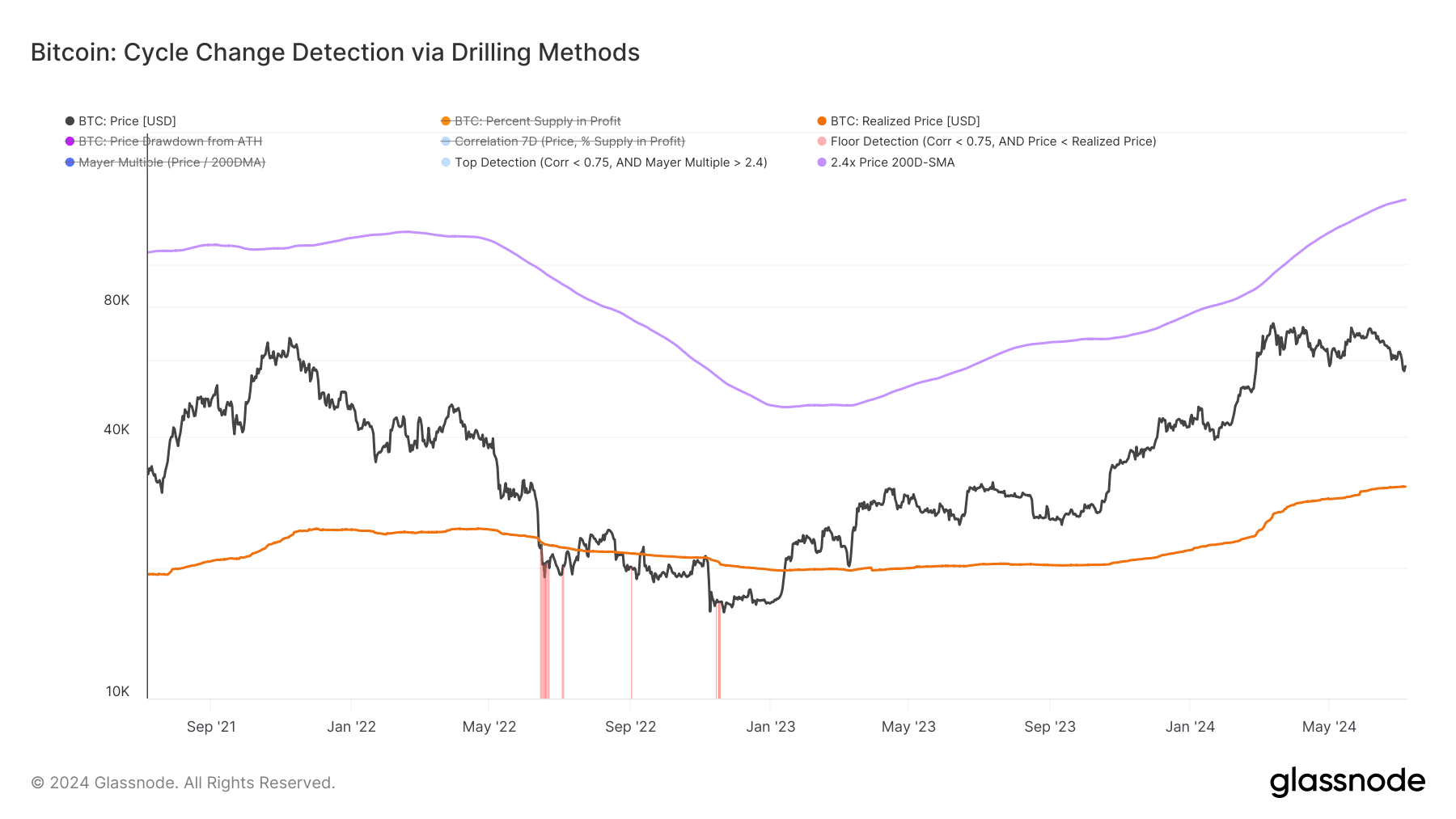

Historical data presented by the cycle detector shows the coin is not in a bear phase.

As an experienced analyst, I believe that the current trend in Bitcoin’s realized losses on-chain is a strong indicator of an upcoming rally. The STH-SOPR metric, which has dropped below 1, suggests that prices sold are higher than the weighted buying value, indicating realized losses on-chart. Historically, this pattern has been a reliable signal that Bitcoin has hit its bottom or is close to it.

If the ongoing Bitcoin (BTC) market cycle remains bullish, then based on the Short-Term Holder SOPR (Spend Output Profit Ratio) analysis by AMBCrypto, we can infer that Bitcoin’s price might be near its lowest point during this current uptrend.

As a researcher studying on-chain transactions, I’m delving into the concept of SOPR, or Spent Output Profit Ratio. This particular indicator sheds light on the short-term realized profits accrued from all coins transacted on the blockchain.

Are losses great for Bitcoin’s price?

As an analyst, I would interpret an STH-SOPR (Spent Output Proportion Ratio) greater than 1 as follows: The cost basis of the Bitcoin coins being spent is lower than their current market value at the time of transaction. This suggests that sellers have realized substantial profits from their previous purchases before making these transactions on-chain.

When the STH-SOPR metric falls below 1, such as in Bitcoin’s case with a value of 0.98 according to CryptoQuant, it signifies that the prices at which coins were sold are greater than their weighted average buying price. Essentially, this situation suggests on-chain realizations of losses.

Based on historical trends, when Bitcoin experiences such a significant price drop as depicted in the graph above, it often signals that the cryptocurrency has reached its lowest point or is very close to doing so. A comparable event transpired in September 2023.

Approximately during that period, Bitcoin’s value was sitting at around $26,253. Simultaneously, the Spent Output Probability Ratio (SOPR) dipped to a comparable level. However, by November of the same year, Bitcoin surged up to hit $35,441.

Similar to the market trends in 2021 and 2018, there are indications that Bitcoin’s price may follow a pattern and experience a surge of around 35% within a brief span of time.

Based on current prices, Bitcoin’s value may reach approximately $77,100 by September.

Should this become reality, it means that BTC could reach a new all-time high this quarter.

As an analyst, I would emphasize the necessity of examining whether the current market cycle remains in its bullish phase despite the optimistic perspective.

Bears, it’s not yet your time yet!

In the past, when Bitcoin’s price dipped to $54,274, some voices predicted a revisit to the bear market. However, such opinions don’t materialize things. To gain factual insights into the matter, AMBCrypto turned to Glassnode for up-to-date intelligence.

We analyzed the Bitcoin Cycle Change Detector in order to identify shifts between bull and bear markets. This tool is capable of signaling when a bull market transforms into a bear one, as well as when the reverse happens.

If the market shifts to a bearish trend, the color on the chart changes to red as a reflection of this condition. However, at present, such a shift wasn’t observed in the market situation of November 2022. But it’s important to note that market conditions can change rapidly.

If the total Bitcoins in circulation haven’t realized almost 100% in gains, it’s unlikely that a bear market will set in. In such a scenario, Bitcoin’s price may have already reached its lowest point.

Read Bitcoin’s [BTC] Price Prediction 2024-2025

Based on current trends, the value of the coin could significantly increase by the end of the quarter, potentially ranging from $76,000 to an optimistic price point above $80,000.

As a researcher, I’ve made a prediction based on current market trends. However, if selling pressure were to suddenly intensify, similar to what we’ve seen lately, my prediction could be rendered inaccurate.

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Masters Toronto 2025: Everything You Need to Know

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

- LPT PREDICTION. LPT cryptocurrency

- WCT PREDICTION. WCT cryptocurrency

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Elden Ring Nightreign Recluse guide and abilities explained

2024-07-07 21:11