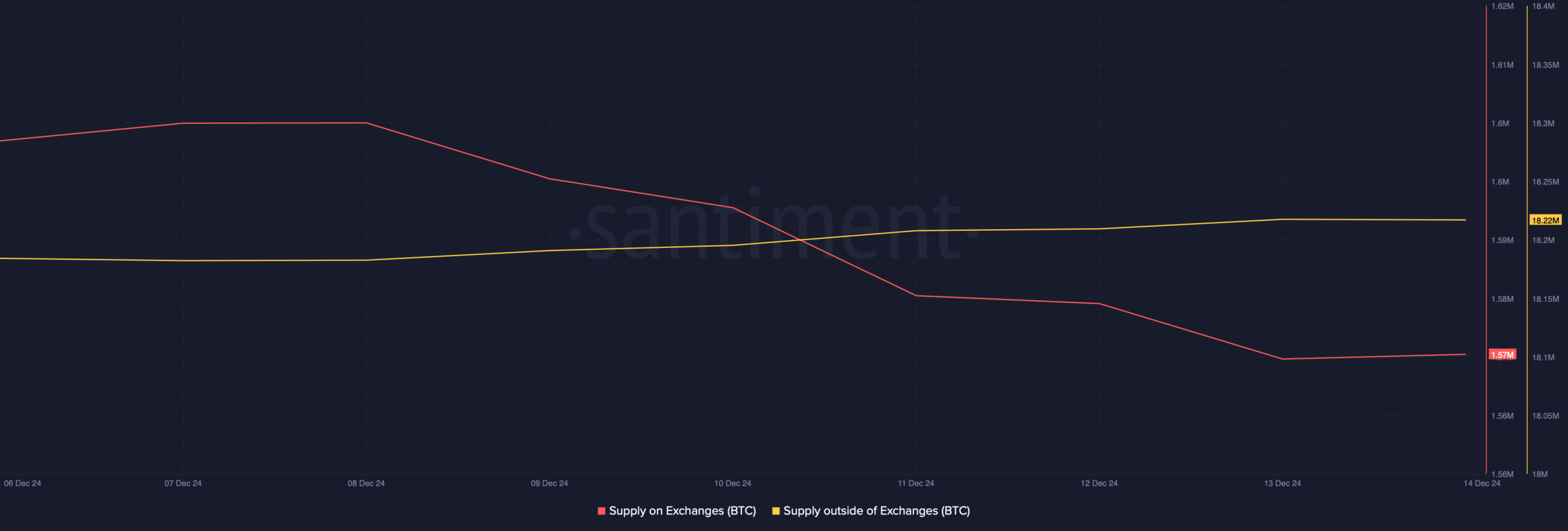

- Bitcoin’s supply on exchanges dropped over the last few days

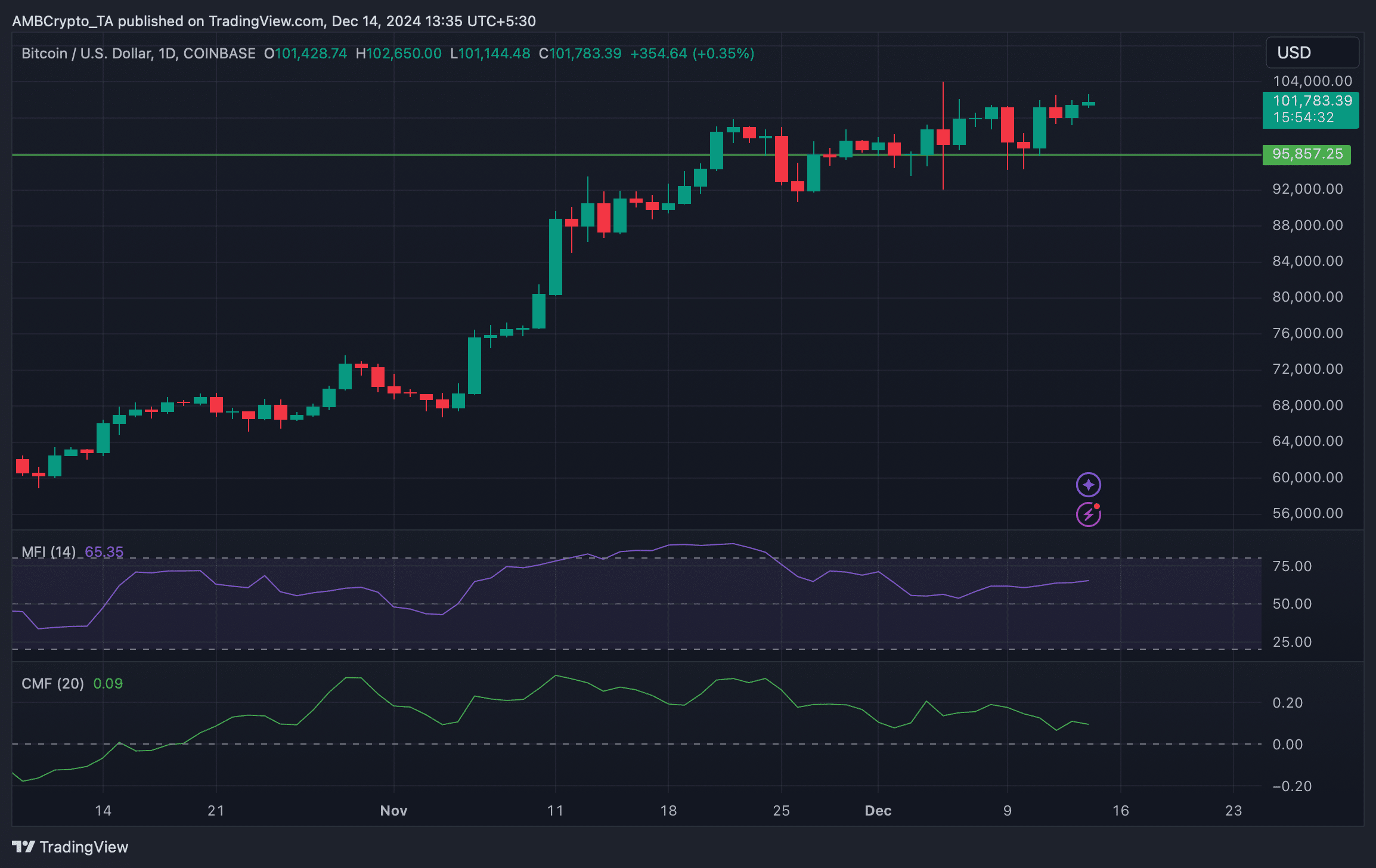

- The Money Flow Index (MF) repealed an uptick in buying pressure on the charts

As a seasoned analyst with years of experience in navigating the cryptocurrency market, I find myself intrigued by Bitcoin’s recent behavior. The drop in Bitcoin’s supply on exchanges and the rise in exchange reserves, as indicated by Santiment and CryptoQuant respectively, suggest a growing buying pressure. However, the uptick in the Money Flow Index (MFI) is countered by a southward movement of the Chaikin Money Flow (CMF), which could potentially halt Bitcoin’s upward momentum.

Currently, Bitcoin (BTC) has surpassed the $100,000 mark, yet there might be potential challenges in the near future. Interestingly, even after breaching a significant resistance point, purchasing activity has stayed relatively subdued.

Hence, the question – Will this low buying pressure cause BTC’s price to drop in the coming days?

What’s up with Bitcoin?

As I’m typing this analysis, Bitcoin (the King Coin) is currently exchanging hands at approximately $101.9k. With a market capitalization surpassing the $2 trillion mark, it has experienced a dip in the past 48 hours, falling briefly below $97.5k.

In the following period, Santiment – a widely-used data analytics tool – indicated that by week’s end, there was relatively little chatter about buying Bitcoin on social media. This chart could prove incredibly valuable for predicting Bitcoin’s next significant price movement, specifically identifying when to buy (during periods of panic) and sell (when the market exhibits excessive greed).

According to AMBCrypto’s recent findings, the amount of Bitcoin held on exchanges has decreased noticeably over the past few days. This trend suggests an increase in demand or buying pressure for Bitcoin. Interestingly, the supply of Bitcoin held outside of exchanges also declined during this period, indicating a possible decrease in selling pressure as well.

What to expect from BTC

Additionally, according to CryptoQuant’s data, Bitcoin’s stored reserves on exchanges are decreasing, suggesting a strong demand or buying pressure in the market.

Moreover, the Rainbow chart for Bitcoin indicates another favorable sign. Based on this data, Bitcoin continues to follow an accumulation pattern. This implies that there could potentially be a rise in its value in the near future.

Contrary to what one might expect, the fear and greed index indicated a “greed” period during the past 24 hours. In other words, it suggested that a potential price adjustment could occur.

Based on our examination of Bitcoin’s daily price chart, we observed an increase in the Money Flow Index (MFI). This upward trend suggests a growing interest in purchasing Bitcoin. If this buying pressure continues, there is potential for Bitcoin to surpass the $102k mark in the near future.

Read Bitcoin’s [BTC] Price Prediction 2024-25

It’s worth noting that the Chaikin Money Flow (CMF) has shifted downwards, which might impede Bitcoin’s attempt to rise.

Read More

2024-12-14 17:11