As a seasoned financial analyst with extensive experience in cryptocurrency markets, I have closely monitored Bitcoin’s recent price behavior and liquidation trends. The data from Coinglass regarding Bitcoin’s price spike above $66,000 on 19th July has piqued my interest.

Recently, Bitcoin’s price surged dramatically, touching the $66,000 mark. This sudden rise led to a chain reaction of market sell-offs or liquidations. However, the number of these sell-offs was surprisingly small given the significant price shift.

Bitcoin experiences lower liquidation volume

An intriguing examination of the Bitcoin liquidation data from Coinglass following the price surge surpassing $66,000 on the 19th of July uncovered several noteworthy aspects.

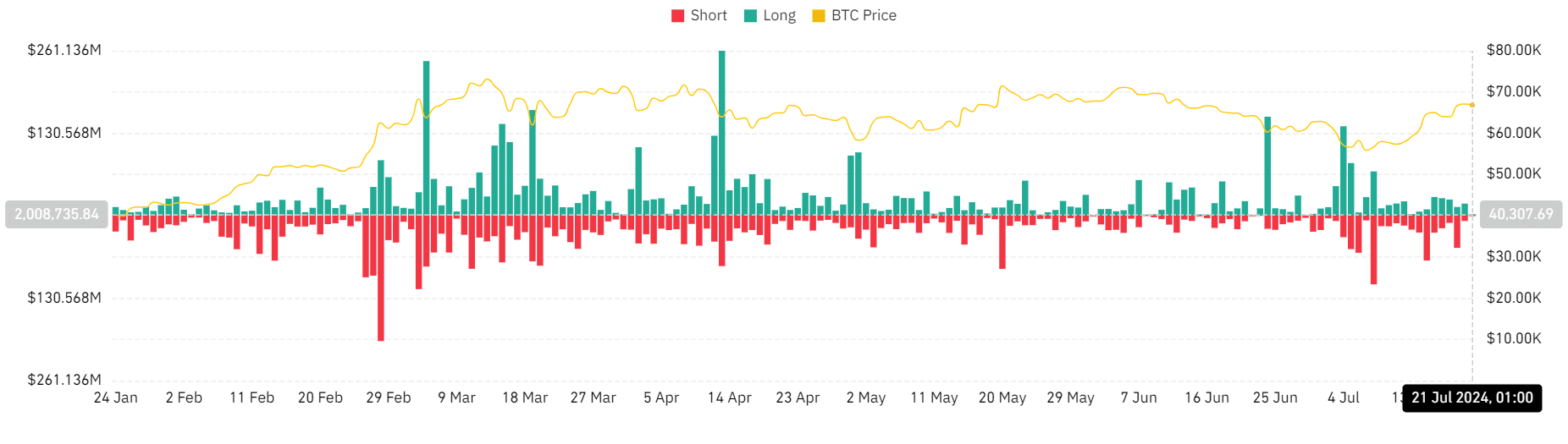

Approximately $51 million worth of short positions were liquidated, representing the larger share of the total liquidation volume of roughly $64.3 million. Long positions accounted for about $13.7 million in liquidations.

The comparatively smaller amount of assets being sold off is quite striking when set against past occurrences.

On the eighth of July, when Bitcoin’s price approximated $56,000, the overall liquidation volume noticeably increased to more than $170 million. Short sellers accounted for approximately $100 million of this amount.

Similarly, a rise to about $64,000 on 15th July resulted in around $80 million in liquidations.

Possible reasons for lower Bitcoin liquidation

The pattern indicates that the Bitcoin market may have been less geared up or more resilient to price swings when it surpassed the $66,000 mark.

Traders could have modified their tactics or holdings in preparation for predicted price shifts, resulting in a decrease in forced sales amidst substantial price fluctuations.

An alternate interpretation could be that this situation signifies a change in investor attitudes or a varied group of investors involved in the market contrasting the initial phase of the month.

Analyzing Bitcoin’s weighted funding rate and open interest provides important perspectives on the present market conditions.

The funding rate, which takes into account the fees paid by longer-term position holders to shorter-term traders, has been on an upward trend. This rise usually signifies robust demand for long positions. It suggests that traders are prepared to pay higher premiums to sustain their positions, anticipating further price growth.

At the same time, the surge in open interest serves as evidence of growing market participation. With an open interest of over $36 billion, this signifies a significant influx of capital into the market, potentially fueling or maintaining the ongoing price rise.

BTC sees a slight knock-back

As of this writing, Bitcoin was trading at approximately $66,900.

Based on AMBCrypto’s assessment, I noticed a minimal decrease of roughly 1% in value, which somewhat countered the progress achieved during the preceding trading day.

In that particular session, there was a rise of approximately 0.6%. This temporary surge propelled the price past the $67,000 mark.

Although it experienced a slight dip, the RSI of this trend suggested that its robustness remained intact.

Read More

- Gold Rate Forecast

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- PI PREDICTION. PI cryptocurrency

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

- Rick and Morty Season 8: Release Date SHOCK!

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

- Linkin Park Albums in Order: Full Tracklists and Secrets Revealed

2024-07-21 18:15