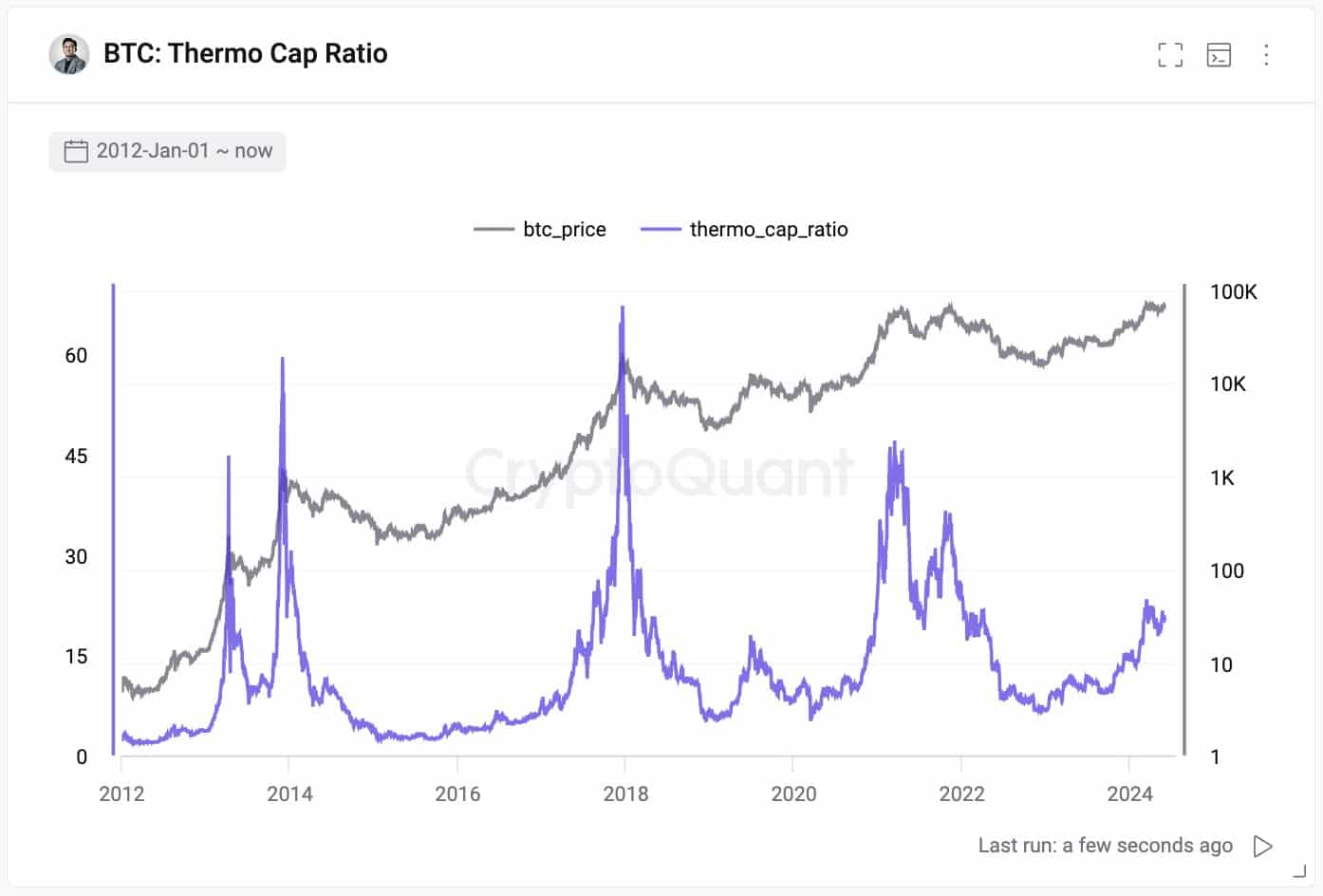

- Bitcoin has a strong thermo cap ratio that underlined strong investments into the network.

- The transaction volume and unrealized profits metrics suggested Bitcoin’s overvaluation and potential correction, respectively.

As an experienced analyst, I believe that Bitcoin’s strong thermo cap ratio is a positive sign for the network and underlines the significant investments made into it. However, I also recognize that the high transaction volume and unrealized profits metrics suggest potential overvaluation and the possibility of a correction.

As a researcher studying the cryptocurrency market, I’ve observed significant growth in Bitcoin [BTC] leading up to this moment. In just the previous 24 hours, its price surged by 3%. Currently, Bitcoin is valued at approximately $71,100. However, it encounters resistance at around $71,400, a potential barrier for further growth. The thin trading volume over the past period raises concerns of another price range formation.

Although the shorter-term Bitcoin price movements appeared devoid of significant bullish momentum, the longer-term trends remained positively inclined. Indicators suggested that Bitcoin’s network foundations were robust, yet concerns persisted regarding its potential valuation.

Investment in the Bitcoin network has remained strong

As a crypto investor, I’ve noticed an intriguing perspective shared by Ki Young Ju, the CEO of CryptoQuant, in a recent post on X (formerly Twitter). He expressed that Bitcoin’s current valuation did not appear overinflated when considering its network fundamentals. The Thermo Cap metric, which Ki Young Ju emphasized, was at a high point. This suggests that the network is robust and strong, adding to my confidence in the digital asset’s value.

As a crypto investor, I would describe the Thermo Cap metric as the total value of all Bitcoins mined up to now. Essentially, it reflects the overall investment that has been made into the Bitcoin network. Regarding the Thermo Cap ratio, I would say that we calculate this figure by dividing the current market capitalization of Bitcoin by its Thermo Cap. This ratio provides us with an insight into the relationship between the market value and the total historical investment in Bitcoin.

Over the last eight months, its value has gradually risen, yet it hasn’t approached the peak levels seen in previous cycles. As a result, there’s a strong possibility that current Bitcoin prices are not the final surge in this bull market.

Is it time for you to book profits on your holdings?

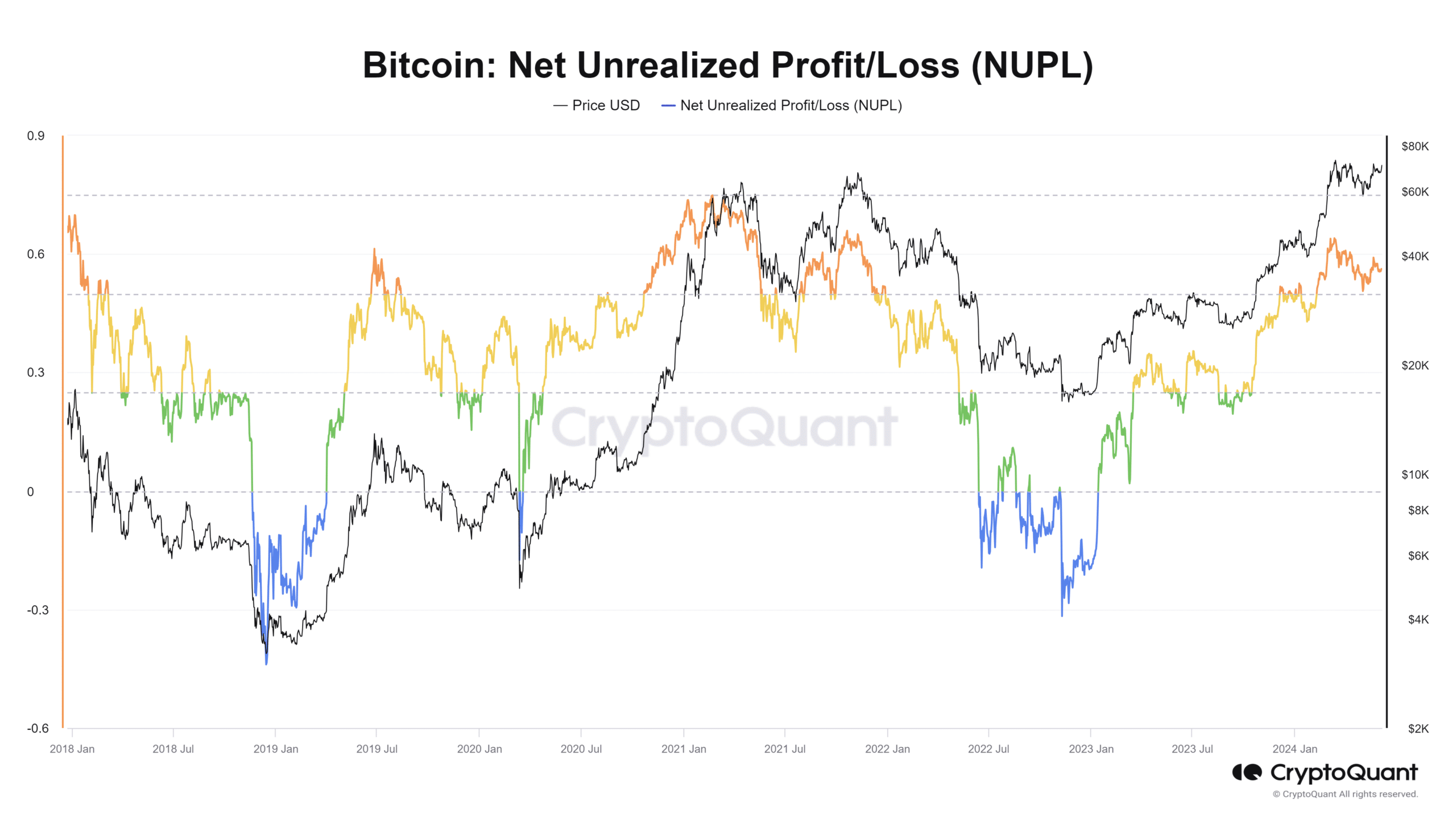

During a bull market, the Net Unrealized Profit/Loss metric often surpasses 0.5. This metric signifies the proportion of investors who are currently making a profit on their investments. With such a large number of profitable holders, it indicates that it may be a good time for them to consider realizing their gains.

As a seasoned crypto investor, I’ve noticed that when Bitcoin’s price surges above +0.7, it often signals the approach of a market top. However, we haven’t hit that level just yet. But keep in mind, history shows us that every bull run has seen significant corrections of 20% or more. These downturns are usually sharp and swift, but they pave the way for a quick recovery, leading us back to new growth.

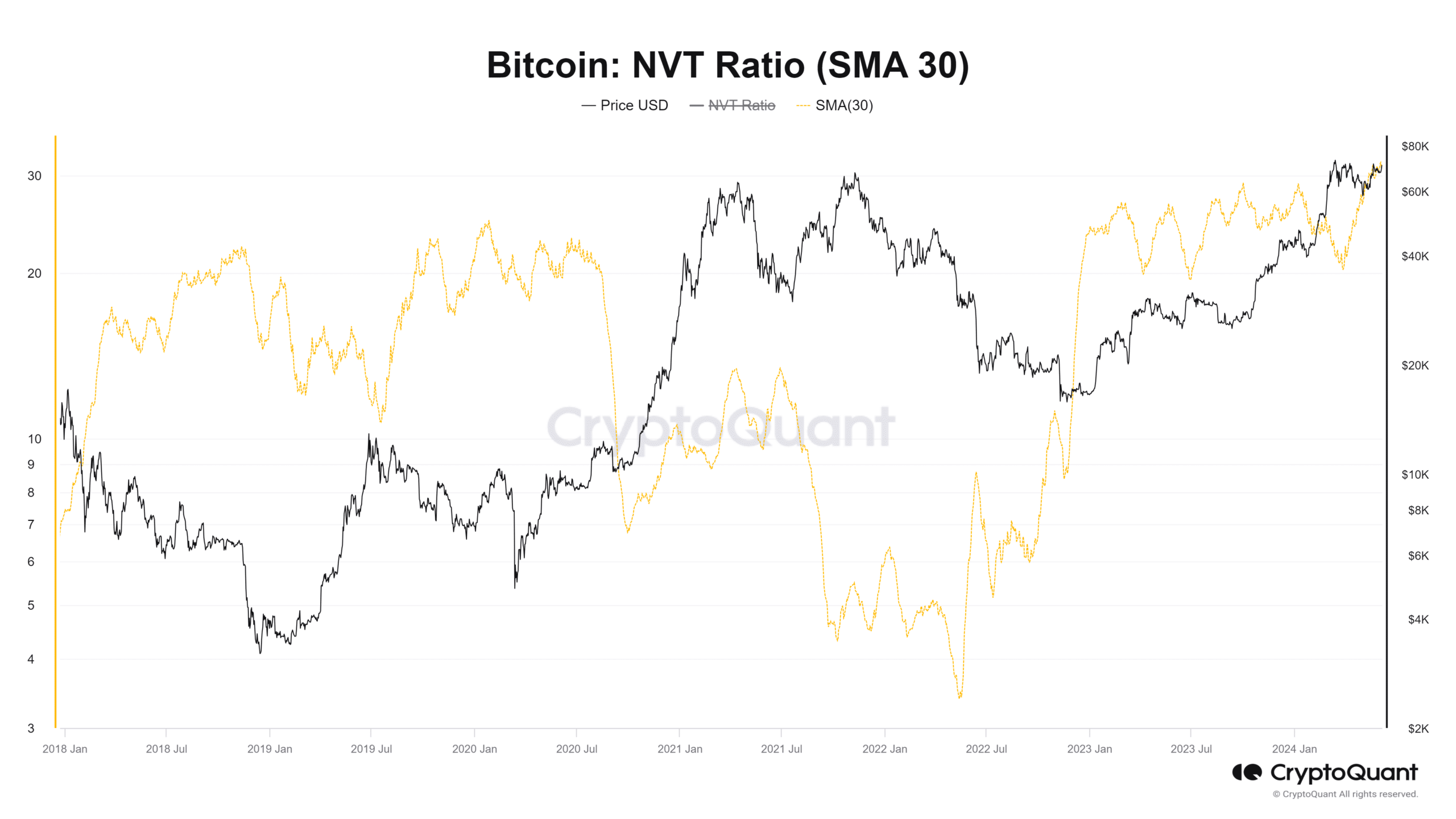

One way to rephrase this in a more conversational tone could be: The ratio of a network’s market value to its transaction volume is an important metric, calculated as the market capitalization divided by the number of transactions over a 30-day period. Lately, this ratio has been trending upwards.

As a crypto investor, I’ve noticed that the current market price of Bitcoin seems to be overvalued when considering its transaction capabilities on the network. However, this observation doesn’t automatically signal an impending correction in the market.

Read Bitcoin’s [BTC] Price Prediction 2024-25

As a crypto investor, I’ve observed an increasing trend towards viewing Bitcoin not just as a digital currency for transactions, but also as a valuable hedge against inflation. A prominent figure in this shift is Michael Saylor and his company MicroStrategy, who have made significant investments in Bitcoin as a means to protect their assets from potential inflationary pressures.

“The increasing NVT ratio may be lending credence to this notion rather than signaling that Bitcoin is excessively priced.”

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- Rick and Morty Season 8: Release Date SHOCK!

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Linkin Park Albums in Order: Full Tracklists and Secrets Revealed

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

2024-06-05 09:11