-

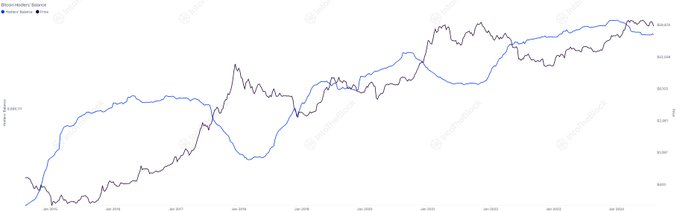

Bitcoin HODLers controlled 12.87M BTC at press time, shaping market cycles and signaling potential trends.

Miners’ influence on Bitcoin price weakened as their volume share dropped to 7.4%, reducing market volatility.

As a seasoned analyst with over two decades of experience in financial markets, I have witnessed countless bull and bear cycles. Observing Bitcoin’s current trajectory, it appears we are in the midst of another fascinating chapter.

On Wednesday morning in Asia, Bitcoin (BTC) spiked over $61,000, bouncing back after a substantial decline in its value earlier in the month.

Bitcoin, being the front-runner in the cryptocurrency market, is frequently viewed as a gauge for wider financial market fluctuations.

At this moment, the value of Bitcoin was reported as $60,892, marking a 3.1% rise over the previous 24-hour period, according to information from CoinGecko.

As per the data from IntoTheBlock, a significant number of 12.87 million Bitcoins were being held by long-term investors, or HODLers, who maintain their investment even during market ups and downs, at the current moment.

As a researcher studying this particular group, I’ve observed a pattern where they amass Bitcoin during market downturns, or bear markets, and then tactically offload their holdings during uptrends, or bull markets.

Their significant holdings of Bitcoin suggested they still held sway over influencing the direction of market movements.

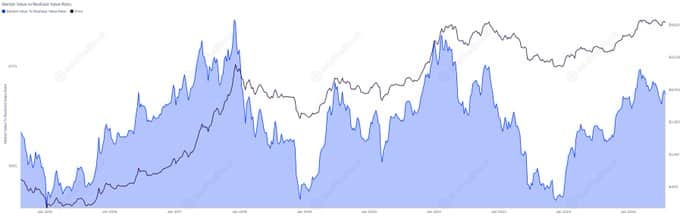

At the moment, the Market Value to Realized Value (MVRV) ratio stood at 1.86, meaning Bitcoin’s current market value was 186% more than what it was originally realized (or sold). In simpler terms, for every dollar of realized value, Bitcoin’s market value was approximately $1.86.

While this suggested that Bitcoin might be slightly overvalued, it does not point to an extreme overvaluation.

Previous trends suggest that high MVRV levels (comparable to those in 2017 and 2021) often correspond with market peaks, whereas lower MVRV ratios (like those seen in 2018 and 2022) typically accompany market bottoms.

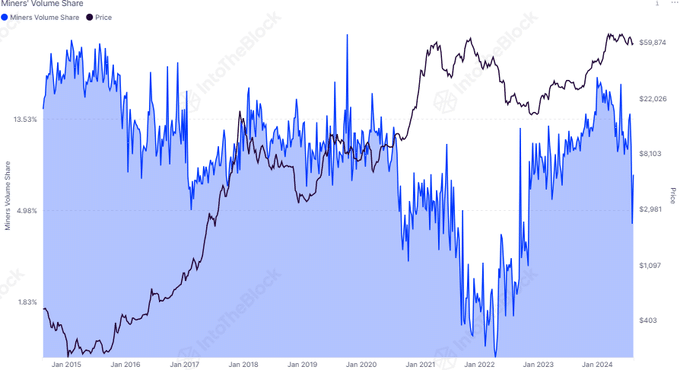

Miners’ diminishing market influence

By August 2024, the proportion of transactions handled by Bitcoin miners dropped to 7.4%. This is a decrease from earlier in the year, suggesting that their impact on market prices may be waning.

In the past, miners typically exchange some of the Bitcoins they’ve mined to meet their operating expenses. Lower sales volumes could potentially help maintain market balance or stability.

The decrease in selling pressure from Bitcoin miners might indicate a possible relaxation of the supply restrictions affecting its price.

Reducing miner sales could lead to a calmer market, offering a more consistent trading and investing atmosphere due to decreased price fluctuations.

Market sentiment and network activity

Furthermore, about 81% of Bitcoin wallets showed a profit at that moment, indicating a positive market mood. Yet, it’s important to remember that this figure can fluctuate, highlighting the market’s tendency to go through cycles.

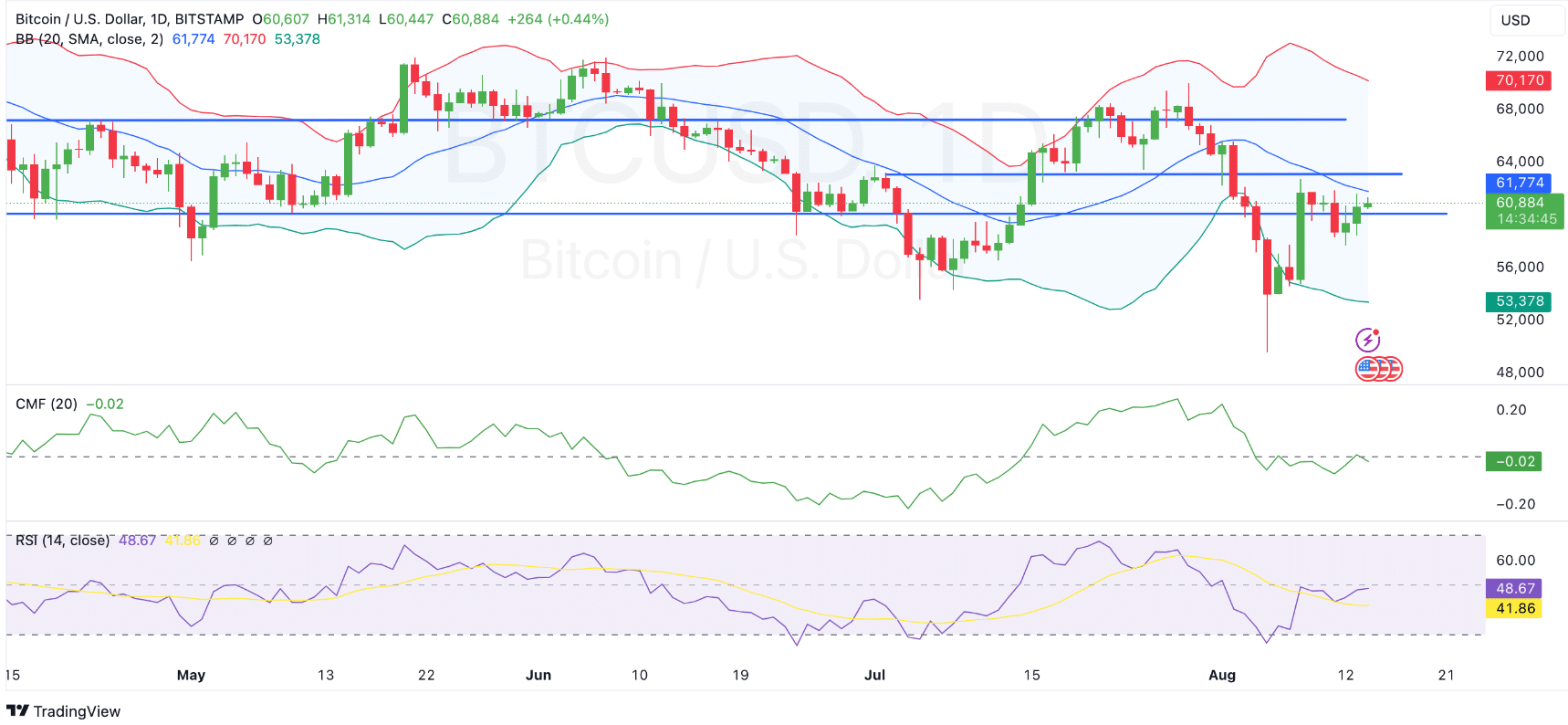

In simpler terms, the Bollinger Bands – a tool that helps gauge market turbulence – are becoming more compact, which could mean less market instability and possibly a period where prices stabilize or hold steady.

The Chaikin Money Flow (CMF) indicator, used for gauging market pressure from buying and selling activities, currently stands at a slight negative value of -0.02.

From my years of trading experience, I have learned that when selling pressure slightly surpasses buying pressure, it often signals a tentative market mood. This has been a lesson hard-earned through numerous market cycles and trends. It reminds me of a time when I made an investment decision based on overly optimistic sentiments, only to see the market turn against me. Since then, I have always taken caution when such situations arise, as they can quickly shift the balance in favor of the sellers.

As I analyze the market at this moment, the Relative Strength Index (RSI) stands at 48.66, slightly dipping below the neutral threshold of 50. This suggests that the market is neither exhibiting signs of overbuying nor overselling, providing a potentially stable condition for further analysis.

The RSI’s recent trends hint at a potential recovery if positive momentum builds.

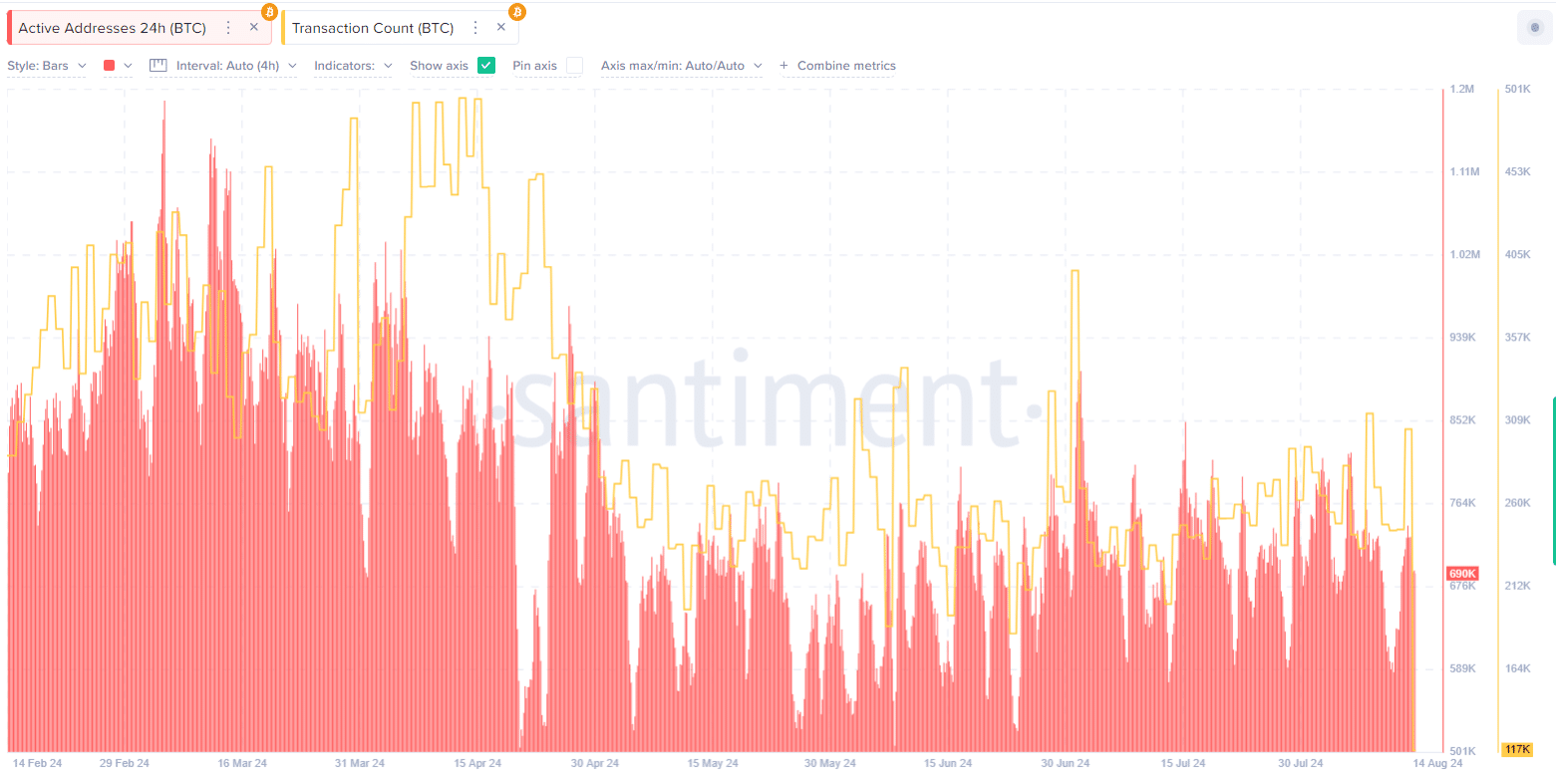

Bitcoin’s network pace continued at a consistent level, albeit slightly lower than its heightened points seen earlier this year.

Approximately 690,410 active addresses were in use, demonstrating continuous user interaction, and a total of around 117,890 transactions took place.

Even though it’s lower than its previous peaks, the number of transactions seems to have leveled off, suggesting that while activity on the network has decreased, it’s still happening at a steady rate.

Maintaining a consistent level of activity within this system is vital for preserving its general well-being and effectiveness.

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Masters Toronto 2025: Everything You Need to Know

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

- LPT PREDICTION. LPT cryptocurrency

- WCT PREDICTION. WCT cryptocurrency

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Elden Ring Nightreign Recluse guide and abilities explained

2024-08-15 07:06