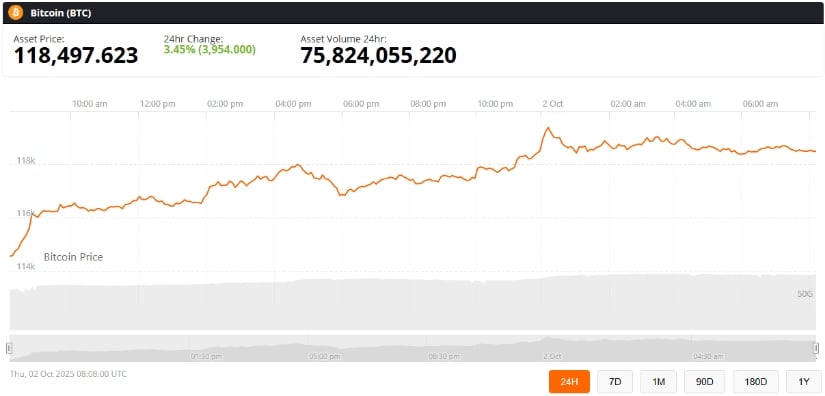

Ah, Bitcoin. The ever-volatile, mysterious mistress of the digital realm. With a certain flourish, it has glided past the once-daunting $118,000 resistance level, only to settle into the gentle embrace of the $114,000-$116,000 range. How utterly predictable. But do not despair, dear traders; all is not lost in this grand theater of finance.

Market data, of course, does what market data does best: it tells us what we already know. Bitcoin has strutted its way to a high of $119,453 and now graces us by trading just above the 100-hourly simple moving average. Analysts, in their infinite wisdom, have observed a “short-term bullish trend line” near $117,000, which-brace yourselves-remains a critical support level. If you can contain your excitement, read on.

Resistance Ahead: $119,500 and Beyond

Behold the immediate resistance. It sits upon us like a royal blockade at $119,000, with an even more formidable foe lurking at $119,500. Should Bitcoin somehow summon the strength to close above this zone, expect a swift and dramatic rise to $120,500, with a possibility of testing even grander heights-$122,500, $123,000, dare I say it? A dream, yes, but a possibility nonetheless.

But of course, the path to glory is not without its obstacles. Should Bitcoin fail to maintain its position above $117,000, despair not! There are support levels at $116,150 and $115,500, and if those falter, the great abyss of $114,000 awaits. The main support, dear reader, lies at $113,500. So many numbers, yet such little certainty. How charming!

Technical Signals: Momentum Stays Bullish

Ah, the technical indicators. They are our guiding stars in this murky financial galaxy. And what do they tell us? Why, that Bitcoin’s momentum is still bullish, of course! The hourly MACD dances merrily in the positive zone, while the RSI, that ever-so-trustworthy companion, remains above 50. Healthy demand, so they say. On the 4-hour chart, a bullish flag pattern has appeared, often a harbinger of accumulation before another glorious leg higher. How very exciting, don’t you think?

Jamie Redman, ever the optimist, muses in a recent Bitcoin price prediction that the series of higher lows since the $107,270 bottom may signal the momentum building for a breakout. Should volume increase, the sky’s the limit-perhaps a jump to $124,000, reminiscent of the glories of August. A return to the heights we so fondly remember!

Market Context: Uptober Energy

And what of “Uptober,” that beloved month of October when Bitcoin thrives like a pampered houseplant basking in autumn sunlight? Yes, this rally comes just as we’ve entered October, historically a month of strength for Bitcoin. With a market cap above $2.32 trillion and 24-hour trading volumes at $61 billion, the participation from both institutional and retail investors is almost as spectacular as the promises of untold riches that follow this cryptocurrency wherever it goes.

But lo, caution still lingers. Some analysts, those ever-skeptical souls, argue that without a convincing push above $119,500, this rally may very well fade into the ether, as all the greatest bubbles do. “Momentum is strong,” one trader notes, “but the $118,000-$120,000 zone is the velvet rope of this rally.” Beware, for there may be a bull trap lurking in the shadows, waiting to snap shut. But who am I to say?

Bitcoin Price Prediction: Eyes on $120K and Beyond

Ah, predictions. They are the lifeblood of this strange, intoxicating world of Bitcoin. While short-term fluctuations are, of course, inevitable (as they always are), the sentiment remains largely bullish. Should Bitcoin break past the $120K threshold, many will raise their glasses to the next major target-$124,000. In the far-off, perhaps fantastical future, some analysts foresee Bitcoin soaring even higher in 2025, depending on trends, adoption, and the whims of macroeconomics. Oh, the sweet possibilities!

For now, we wait with bated breath on the $119,500 resistance. A strong breakout could very well send the BTC price into new, unexplored territories. And as the old saying goes, “The upward momentum is far from over-unless it is, of course.”

Read More

- Best Controller Settings for ARC Raiders

- How to Get to Heaven from Belfast soundtrack: All songs featured

- 10 Most Memorable Batman Covers

- 10 Best Anime to Watch if You Miss Dragon Ball Super

- Best X-Men Movies (September 2025)

- How to Froggy Grind in Tony Hawk Pro Skater 3+4 | Foundry Pro Goals Guide

- Star Wars: Galactic Racer May Be 2026’s Best Substitute for WipEout on PS5

- Netflix’s Stranger Things Replacement Reveals First Trailer (It’s Scarier Than Anything in the Upside Down)

- The USDH Showdown: Who Will Claim the Crown of Hyperliquid’s Native Stablecoin? 🎉💰

- ‘Crime 101’ Ending, Explained

2025-10-02 17:49