- Bitcoin’s price faced a bearish downturn after surpassing $66,000, raising market uncertainty.

- Technical indicators suggested bullish sentiment, but potential trend reversal looms with rising volatility.

As a seasoned crypto investor who has weathered multiple market cycles, I find myself treading cautiously amidst Bitcoin’s recent bearish downturn. While the technical indicators still suggest bullish sentiment, the rising volatility and potential trend reversal loom large, making it a tricky time to make predictions.

Following its breakthrough above the $66,000 threshold, which ignited enthusiasm within the cryptocurrency market and boosted expectations of an immediate uptrend, Bitcoin [BTC] encountered a gloomy outlook marked by bearish tendencies.

Based on the most recent figures from CoinMarketCap, Bitcoin’s current price stands at approximately $64,519 following a minor decrease of around 1.65% over the past day.

This unexpected drop in value has dampened the enthusiasm of numerous investors, creating a sense of uncertainty about the future direction of the foremost cryptocurrency within the market.

Bitcoin turns bearish

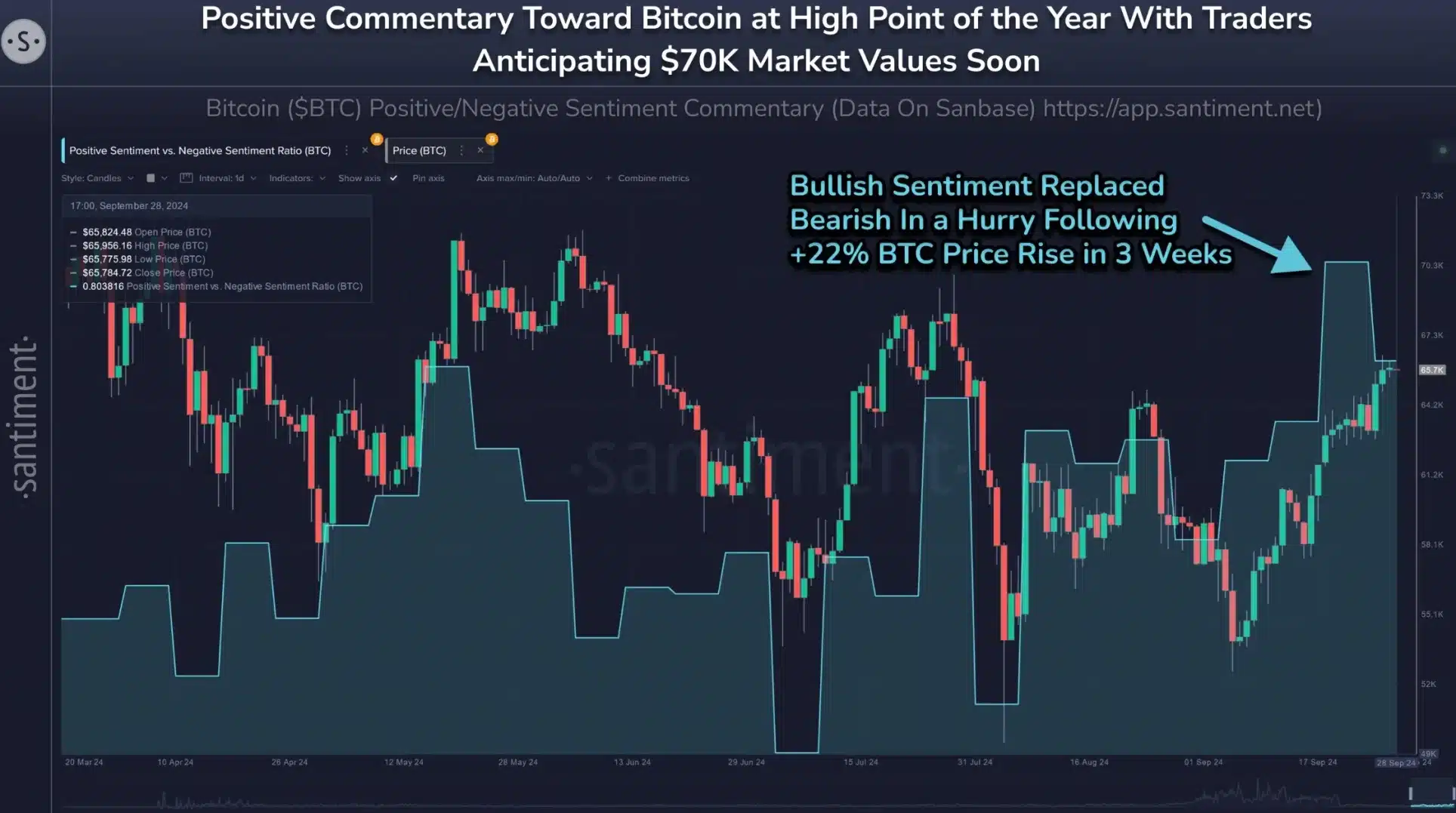

Upon observing the bearish divergence, the on-chain analysis platform Santiment recently discussed its findings about X (previously known as Twitter), on the 29th of September.

To reach a fresh record for Bitcoin’s highest price, you might have to be patient until the public’s excitement calms down and their predictions become less enthusiastic.

In its latest post, Santiment emphasized that there are now approximately “1.8 bullish posts toward BTC for every 1 bearish post”, reflecting the ongoing optimism despite recent market downturns.

This was further confirmed by Jameson Lopp, Chief Security Officer at Casa, who said,

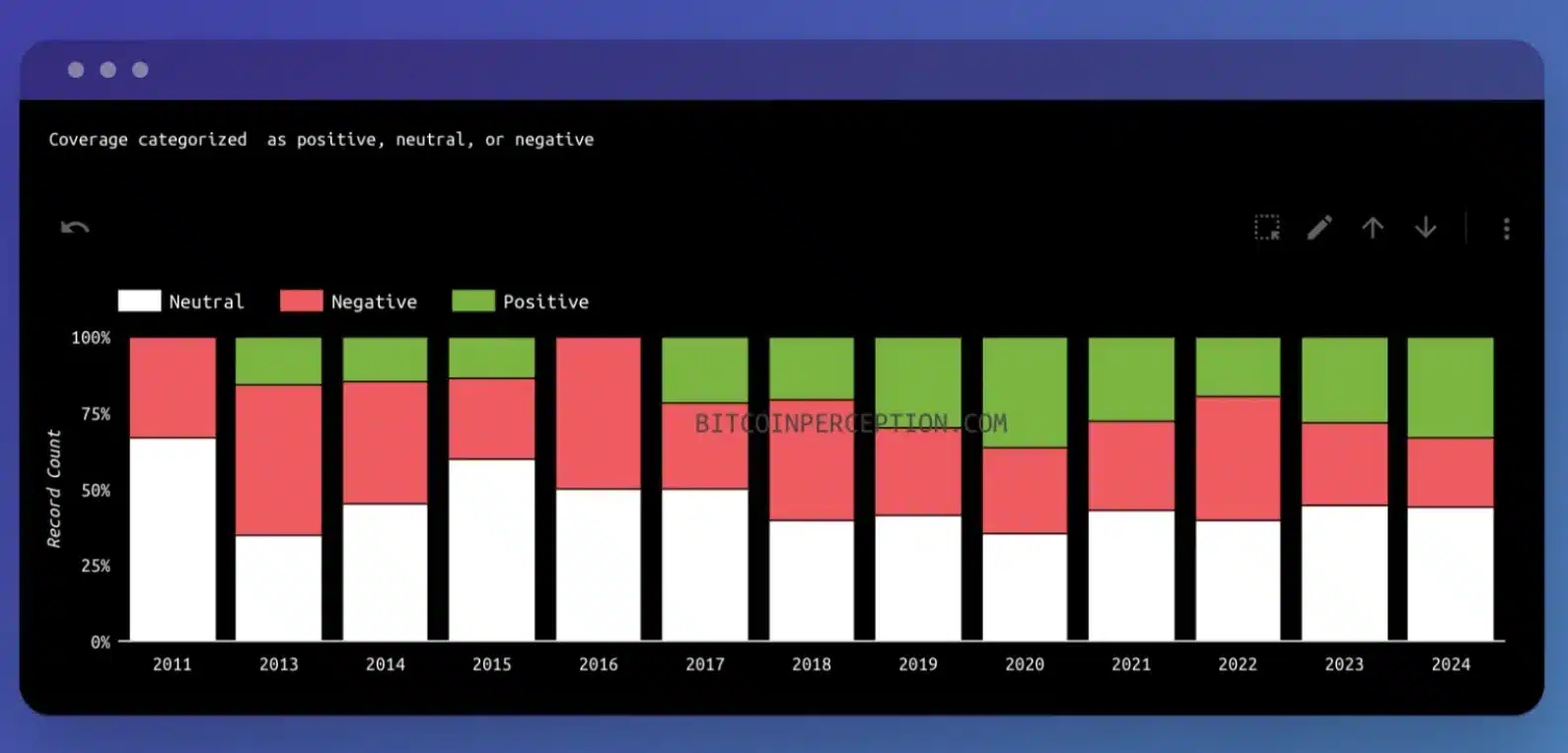

The general public’s perception towards Bitcoin is becoming more favorable in popular news outlets, as the fear, uncertainty, and doubt (FUD) surrounding it seems to be proving unfounded over time.

However, drawing a parallel to past performance, Santiment added,

“Markets historically always move the opposite direction of crowd’s expectations.”

Are technical indicators painting a different picture?

Although some debates imply that Bitcoin might need some time to attain a fresh record peak, the technical signs present a subtler outlook instead.

As a crypto investor, I’m observing that the Relative Strength Index (RSI) is hovering above the neutral zone, specifically at 59, which typically indicates a positive or bullish outlook in the market.

It’s important to point out that the Relative Strength Index (RSI) has been declining steadily since September 29th, which could suggest a possible change in the current trend direction.

This cautious perspective gains strength from the Bollinger Bands, as they’ve expanded, signaling heightened volatility and potential changes in market opinion. In simpler terms, it means that the range within which prices usually move (the Bollinger Bands) has grown wider, suggesting that there may be significant fluctuations or shifts in the market’s attitude.

However, the community still looks positive as noted by an X user — Crypto Rover who said,

“The #Bitcoin bull market starts here!”

Read More

- Gold Rate Forecast

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- Rick and Morty Season 8: Release Date SHOCK!

- PI PREDICTION. PI cryptocurrency

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Masters Toronto 2025: Everything You Need to Know

2024-09-30 14:16