-

BTC appreciated by 10.38% on the monthly charts

Analysts are eyeing a further rally citing the historical relationship between MVRV and SMA 365

As a seasoned crypto investor with years of experience navigating the wild west that is the cryptocurrency market, I have seen my fair share of bull runs and bear markets. The recent surge in Bitcoin’s price has caught my attention, particularly given the historical relationship between MVRV and SMA 365 highlighted by analyst Burak Kesmeci.

Over the past month, Bitcoin [BTC] has shown a notable recovery in its price trends following two months of intense price fluctuations. Interestingly, since reaching a peak of $70,016 in July, BTC has experienced a substantial drop and even dipped to a nearby minimum of around $49,000.

Following last week’s Federal Reserve rate cuts, Bitcoin has experienced significant growth. Currently, it is being traded at $65,839. This represents a 10.38% increase over the past month, and an additional 4.47% rise in the last 24 hours, further extending its bullish trend.

Will the king coin continue its rally?

The sudden increase in activity within the cryptocurrency world has sparked intrigue and sparked discussions among analysts, with one such expert being Cryptoquant analyst Burak Kesmeci. He proposed that this upward trend could potentially persist over the long term, based on his evaluation of the MVRV metric.

As per Kesmeci’s analysis, the Bitcoin MVRV Signal is showing a positive trend once more, as the MVRV value exceeds its 365-day Simple Moving Average (SMA). Historically, when the MVRV surpasses the SMA 365, Bitcoin tends to experience an upward surge.

Currently, the MVRV stands at 2.04, which is higher than its Simple Moving Average (SMA) of 365 days at 2.02. This discrepancy suggests a robust bullish trend, implying that the momentum may favor the bulls in the market.

When you configure the MVRV (Moving Average of Venture Value) and SMA 365 (Simple Moving Average for 365 days) in this specific way, it indicates that the long-term direction is becoming more robust. This is particularly significant since Bitcoin’s current market worth exceeds its average realized value from the past year. This price increase suggests a growing level of trust among long-term investors and holders.

Consequently, it appears there’s a growing interest in Bitcoin, potentially leading to its rising costs.

What do the charts say?

Although Kesmeci’s metric suggests a promising perspective, it’s important to consider what other fundamental factors indicate.

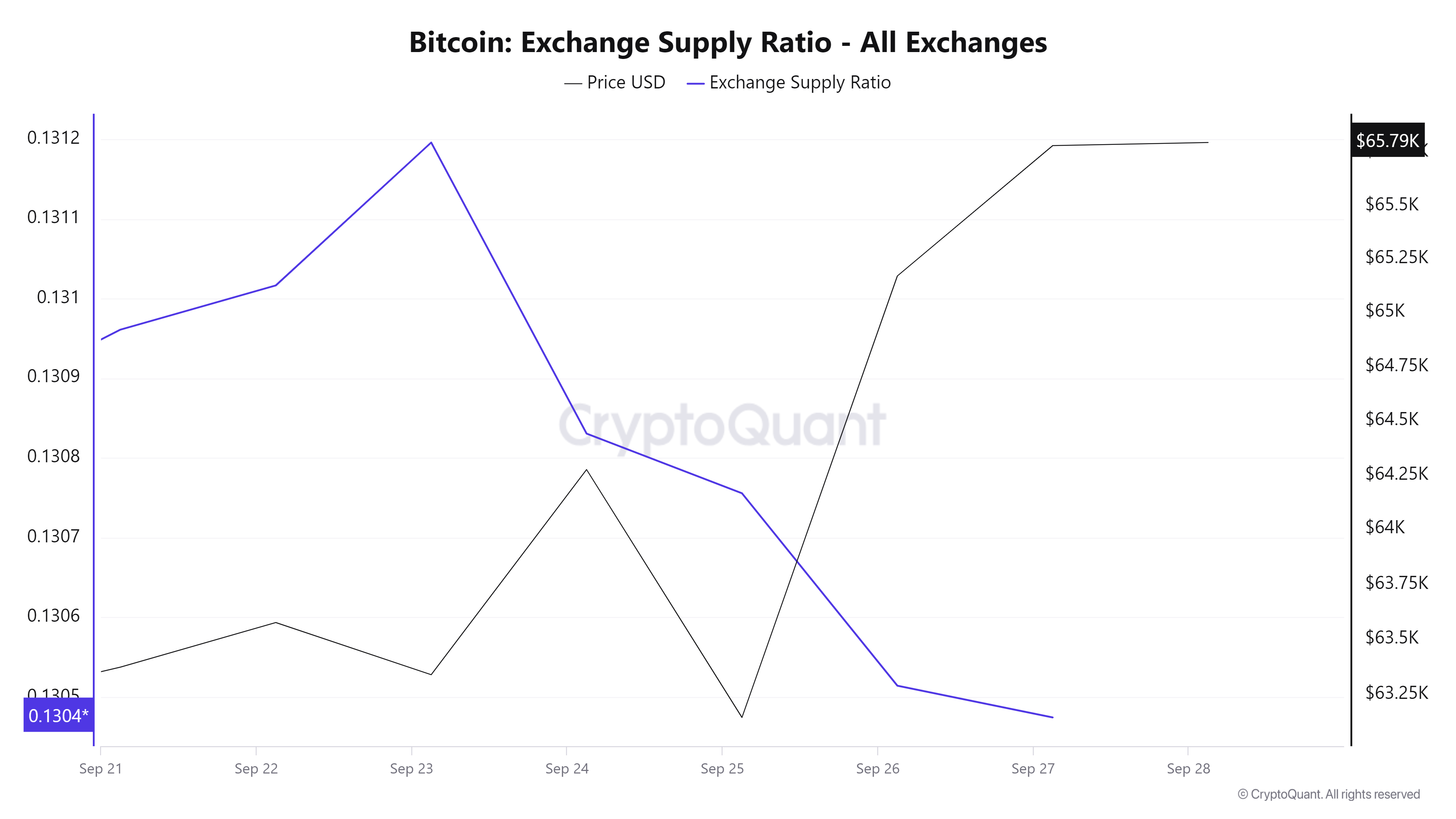

Initially, the ratio of Bitcoin’s available supply on exchanges has been consistently decreasing during the last week. Specifically, this ratio dropped from 0.1311 to 0.1304 over that time frame.

Based on my personal experience and observations in the cryptocurrency market, I believe that when investors choose to store their assets in cold wallets rather than keeping them on exchanges, it indicates a bullish signal. As someone who has been actively investing in crypto for several years now, I’ve learned that long-term holders are often more confident in the future value of their investments and anticipate an increase in the price. This behavior suggests that they believe the market is stable enough to warrant moving assets out of exchanges and into secure cold storage. In my opinion, this trend is a positive development for the crypto market as it shows that investors are taking steps to safeguard their assets while maintaining faith in the long-term growth potential of digital currencies.

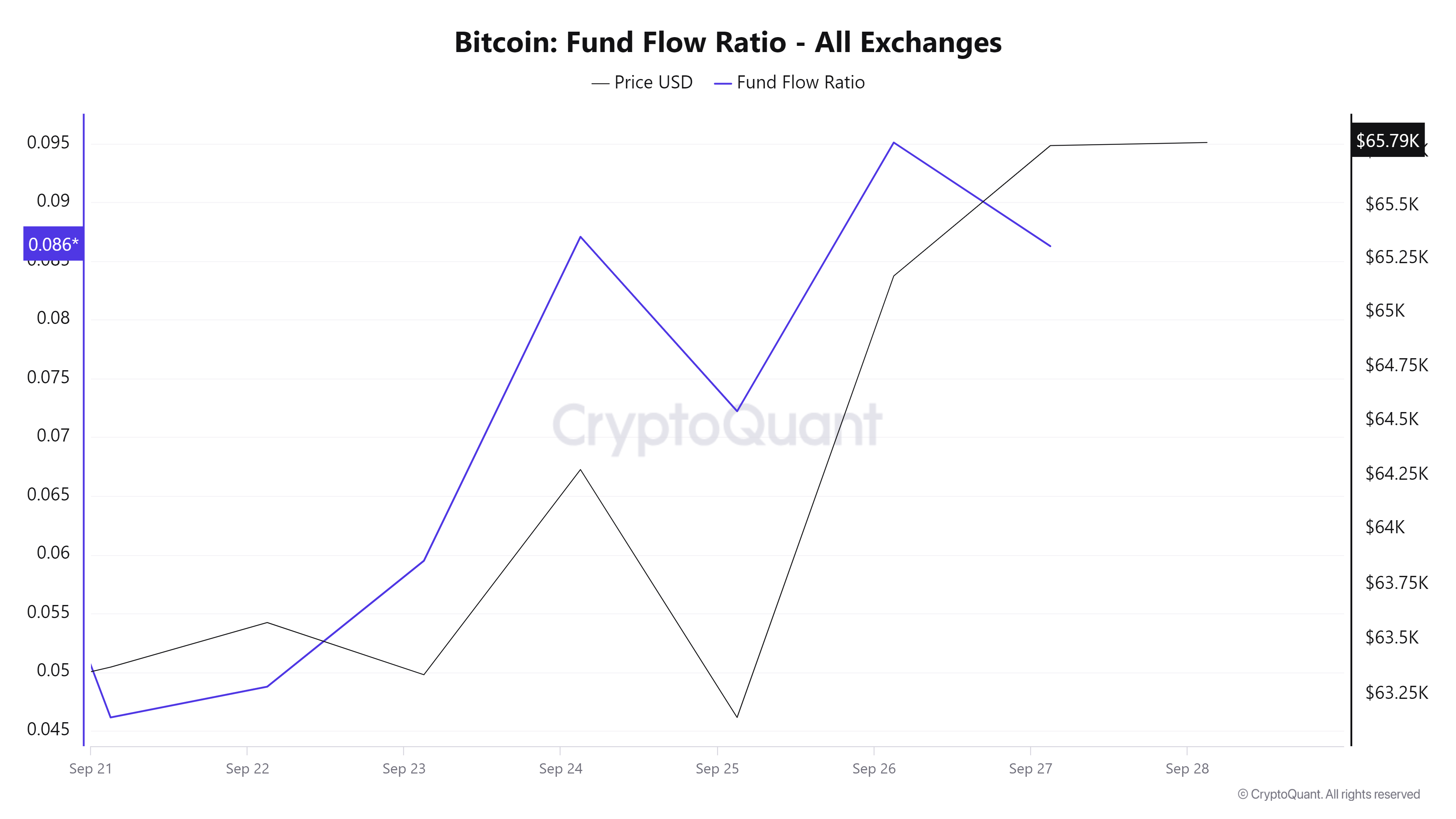

Furthermore, the Flow of Funds Ratio associated with Bitcoin has been climbing steadily during the past week. Specifically, this ratio rose from 0.04 to 0.086 within the last seven days.

In simpler terms, an increase in Bitcoin (BTC) investments indicates a rise in the amount of money flowing into it. This trend suggests that investors have growing trust and faith in BTC. With such market conditions, investors might be inclined to purchase BTC, expecting potential profits in the future.

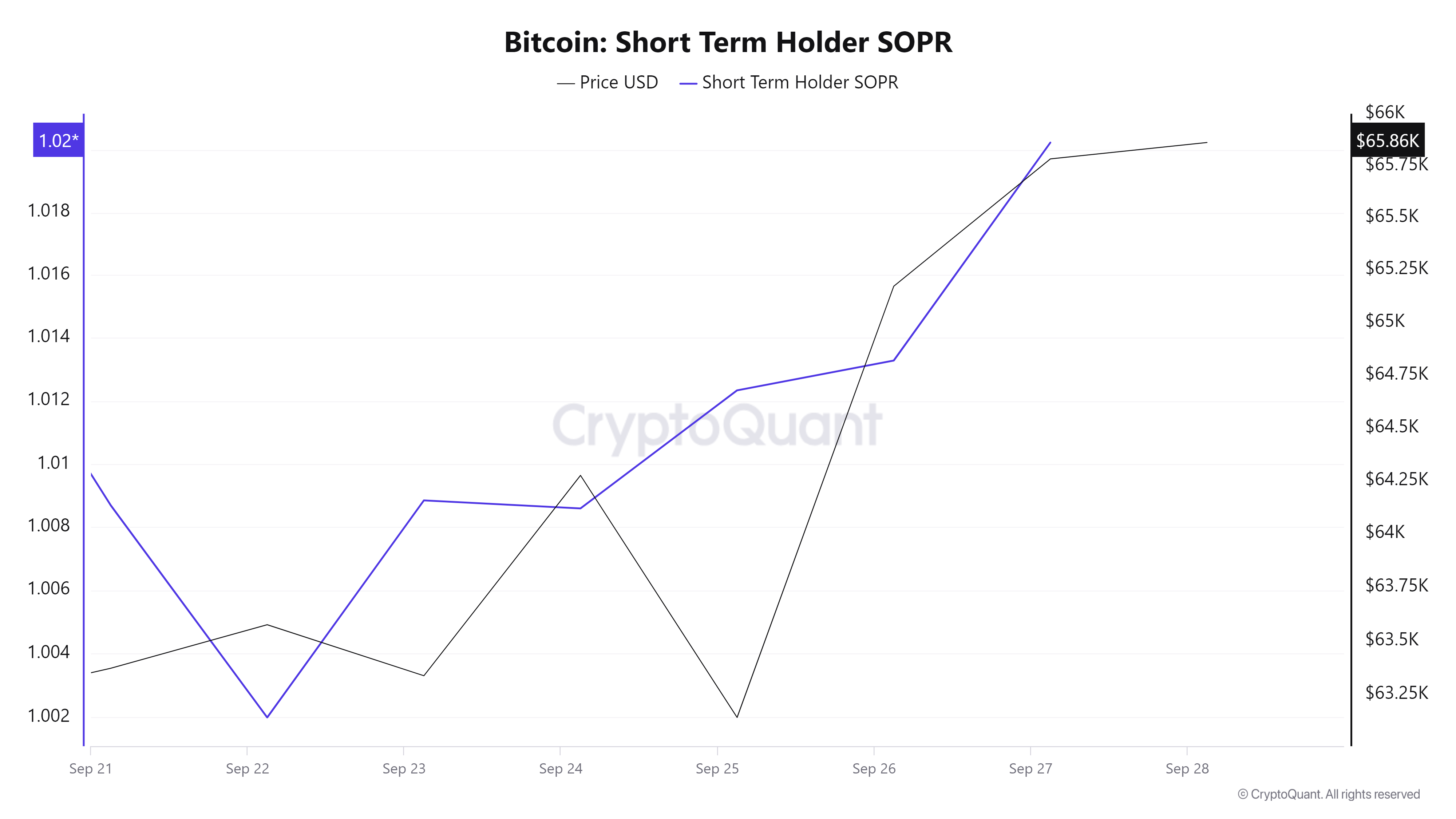

In simpler terms, the Short-Term SOPR (Spent Output Profit Ratio) of Bitcoin has been climbing over the last week. An increase in short-term SOPR during an upward trend suggests a robust market. Even though short-term holders are cashing out at a profit, there’s enough demand to counteract their selling pressure and prevent a downturn. This indicates that the current uptrend might persist.

Essentially, Bitcoin is currently being viewed favorably by investors and showing a positive trend in the market. If this momentum continues, Bitcoin may try to break through the resistance level of $68,240.

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- Rick and Morty Season 8: Release Date SHOCK!

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Linkin Park Albums in Order: Full Tracklists and Secrets Revealed

2024-09-29 05:12