- Bitcoin surged to over $64K after the Fed’s rate cut, showing a 2.8% increase in 24 hours.

- Analysts caution that despite bullish signs, certain indicators suggest a possible price reversal ahead.

As a seasoned analyst with over two decades of experience in various financial markets, I’ve witnessed countless bull and bear cycles, and have learned to appreciate the unpredictable nature of markets. The recent surge in Bitcoin’s price to over $64K following the Fed’s rate cut is indeed an exciting development, but as always, it’s essential to remain cautious and scrutinize the underlying fundamentals.

Bitcoin’s trend has transitioned from a period of gathering and falling, to a clear stage of rebound or regrowth.

In the last day, the value of the asset peaked at around $64,000, but then dipped a bit, currently trading at $63,786 as I’m speaking to you. This represents a 2.8% rise.

This rally comes in the wake of the U.S. Federal Reserve’s announcement of a rate cut, which has triggered positive market sentiment across risk assets, including Bitcoin.

Is a reversal ahead?

Although the price hike has brought about a wave of optimism, experts are carefully assessing Bitcoin’s underlying factors to ascertain whether this surge is sustainable.

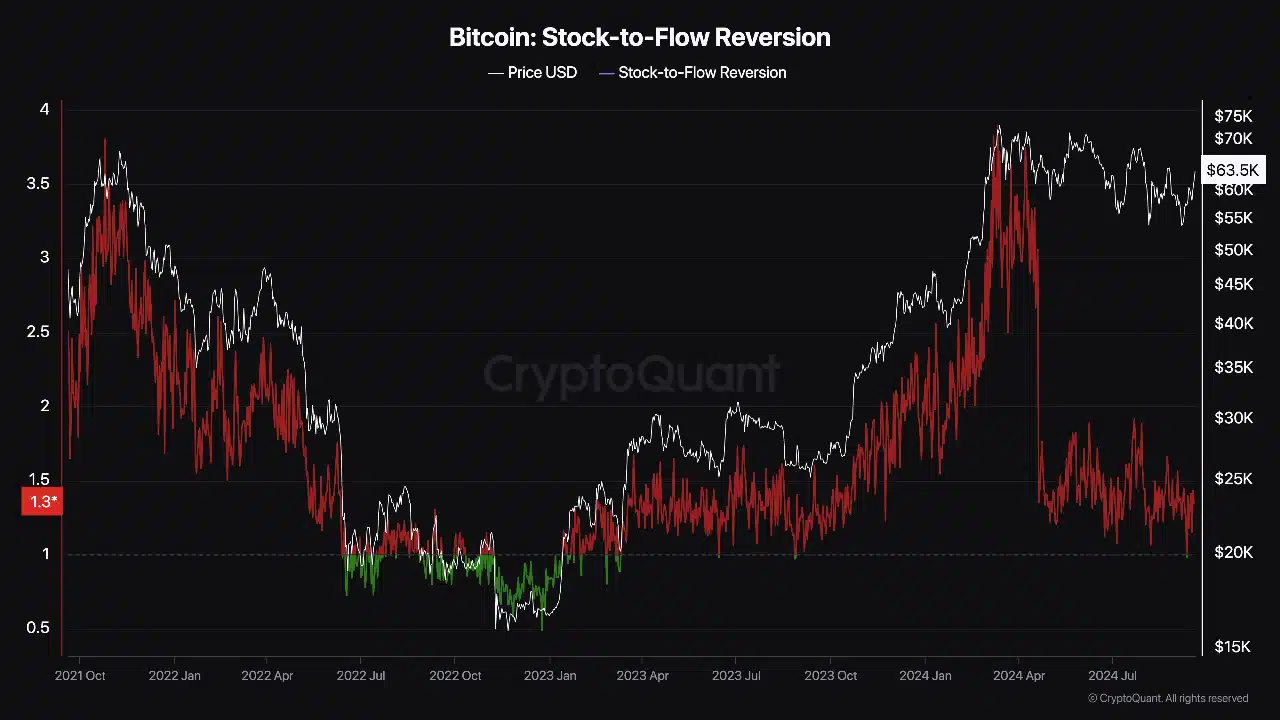

As a researcher delving into the intricacies of cryptocurrency, I recently drew attention to a potential concern based on my analysis using the moniker ‘Darkfost.’ Specifically, I referred to the Stock-to-Flow (S2F) reversion chart, suggesting it might indicate an imminent shift or reversal in the current trend.

As a researcher, I frequently employ the Stock-to-Flow (S2F) model to predict fluctuations in the Bitcoin market. This model compares the inflow of newly minted Bitcoins into circulation against the overall stock or total existing supply.

Based on Darkfost’s analysis, the S2F ratio is presently within the “green zone,” suggesting an advantageous time for purchasing Bitcoins since it has reached this level and commenced its rebound.

Nevertheless, the analyst issued a caution that when similar events happened in September and June of 2023, there was a substantial decline in the value of the asset.

This brings up the question of whether the present upward trend has enough power to continue, or if a new downturn might be approaching instead.

Bitcoin fundamentals show strength

Although there are worries about a possible reversal, Bitcoin’s underlying factors seem robust enough to potentially drive further price increases.

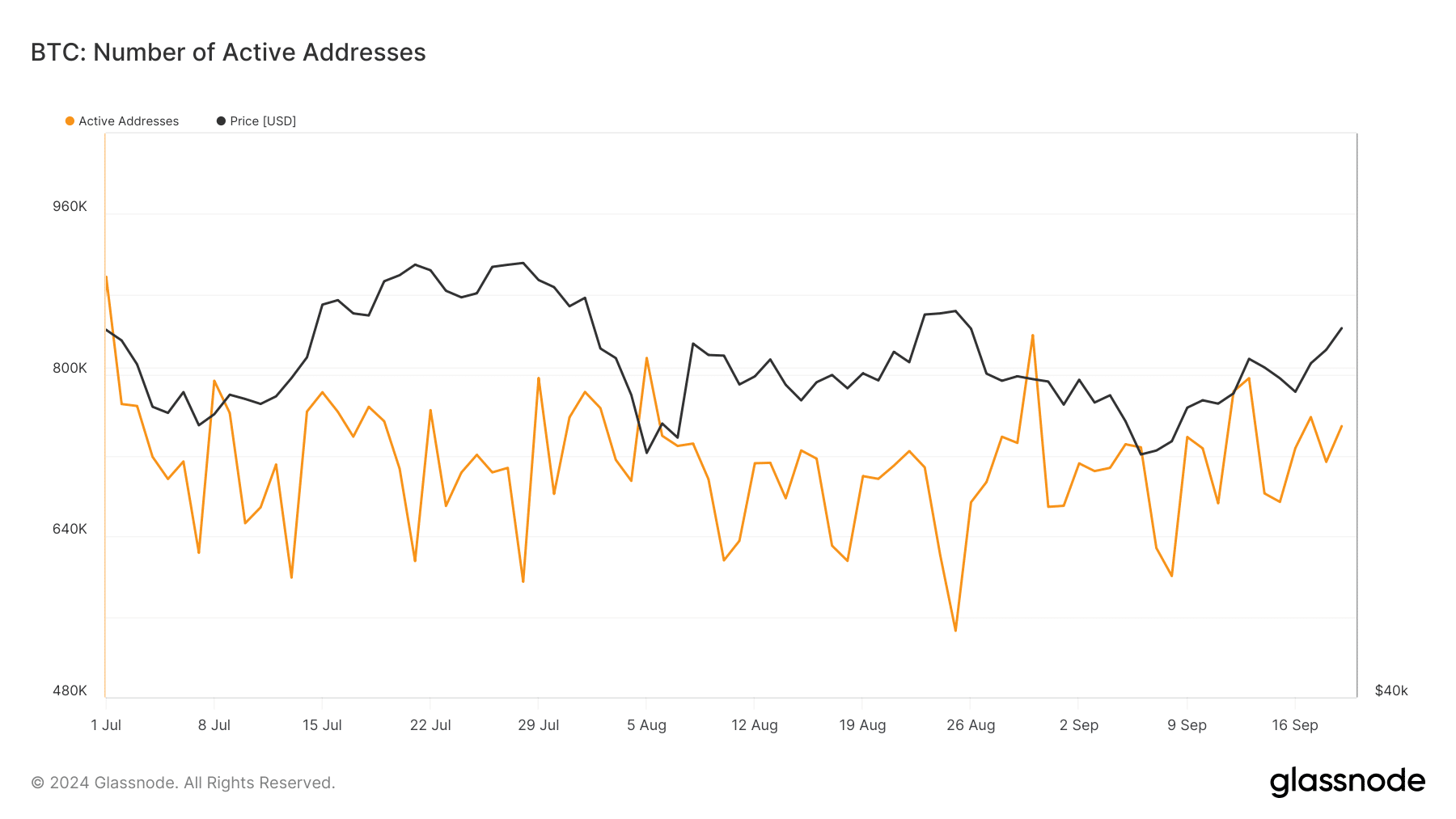

One key metric is the recovery of Bitcoin’s active addresses, which serves as an indicator of retail interest in the asset.

This past month, the count of active Bitcoin wallets dropped approximately to 600,000, as per data from Glassnode.

Consequently, the number of active addresses on the network now exceeds 700,000, indicating an uptick in user interaction – a promising indicator of growing demand.

As a researcher, I often observe that surging retail interest in Bitcoin is typically a sign of growing investor confidence. This increased trust can fuel the price’s upward momentum, suggesting a bullish trend for the digital currency.

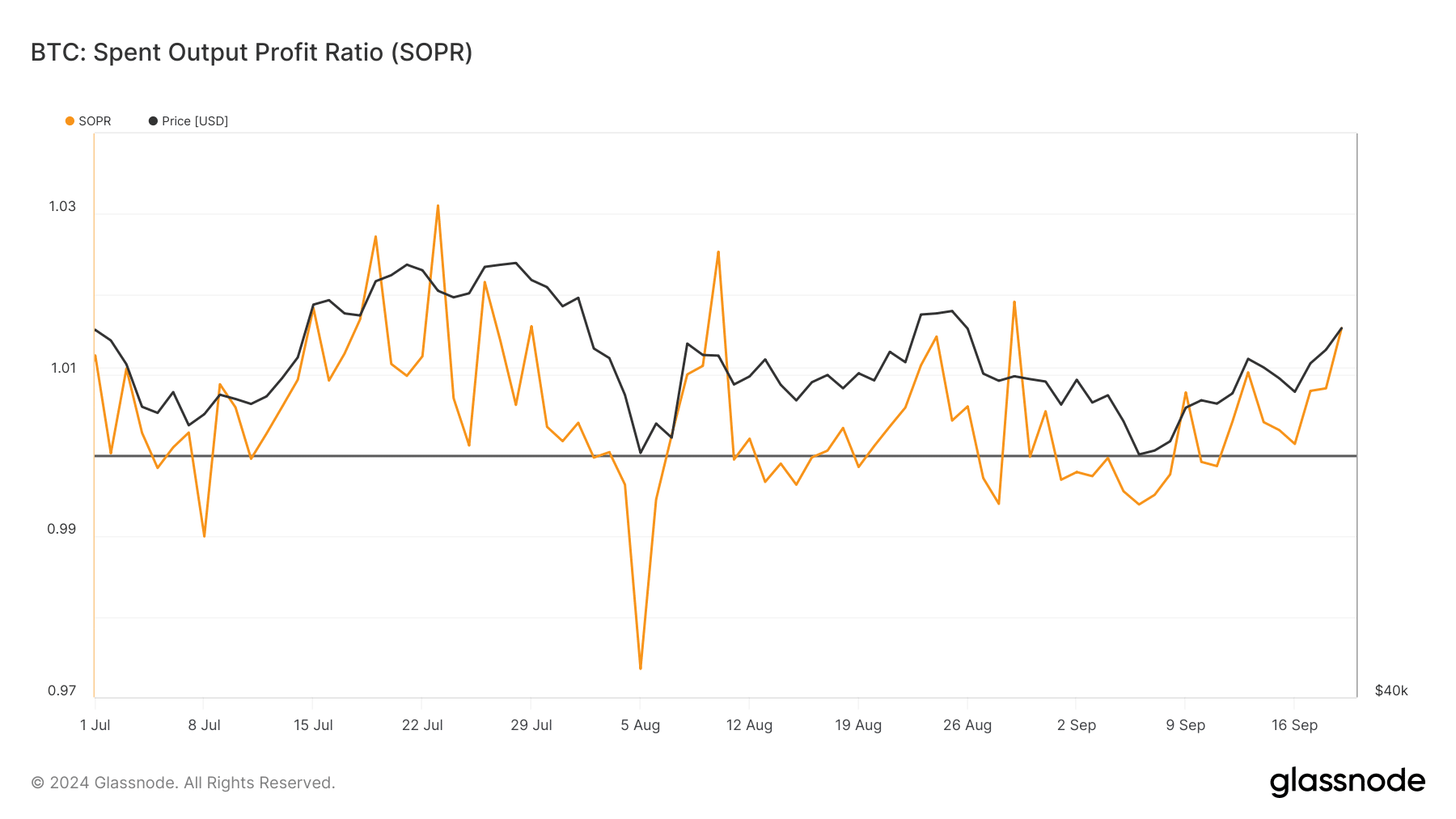

Another important metric to consider is Bitcoin’s Spent Output Profit Ratio (SOPR), which measures whether investors are selling their Bitcoin at a profit or a loss.

A SOPR value above 1 indicates that holders are selling at a profit, while a value below 1 suggests they are selling at a loss. As of today, Bitcoin’s SOPR sits at 1.01, up from 0.994 in late August.

Read Bitcoin’s [BTC] Price Prediction 2024–2025

As I delve into the data, it appears there’s a subtle uptick, suggesting that an increasing number of Bitcoin investors are cashing out their profits. This trend points towards a more optimistic market mood.

As investor confidence grows and they become less worried about a sudden drop, they may be more likely to sell their holdings for profit during times when the market is on an uptrend, which can lead to an increase in the SOPR (Spent Output Profit Ratio).

Read More

- PI PREDICTION. PI cryptocurrency

- Gold Rate Forecast

- WCT PREDICTION. WCT cryptocurrency

- LPT PREDICTION. LPT cryptocurrency

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- Solo Leveling Arise Tawata Kanae Guide

- Despite Bitcoin’s $64K surprise, some major concerns persist

- Clarkson’s Farm Season 5: What We Know About the Release Date and More!

- Planet Coaster 2 Interview – Water Parks, Coaster Customization, PS5 Pro Enhancements, and More

- Chrishell Stause’s Dig at Ex-Husband Justin Hartley Sparks Backlash

2024-09-20 14:16