- Bitcoin faced significant resistance between $98K and $100K.

- Shrinking exchange reserves and inflows signaled reduced selling pressure, leaning in favor of long-term bullish sentiment.

The attempt by Bitcoin (BTC) to reach the significant $100,000 mark has faced strong opposition. Currently, its value remains close to an essential resistance area, which lies between approximately $98,000 and $100,000 – a region where there’s been increased supply of the cryptocurrency.

In this particular area, bulls have found it tough going due to strong defensive efforts by those holding short positions.

As a researcher delving into the dynamics of Bitcoin, overcoming this key resistance point is crucial to maintain the coin’s bullish trend and prevent a possible bearish correction.

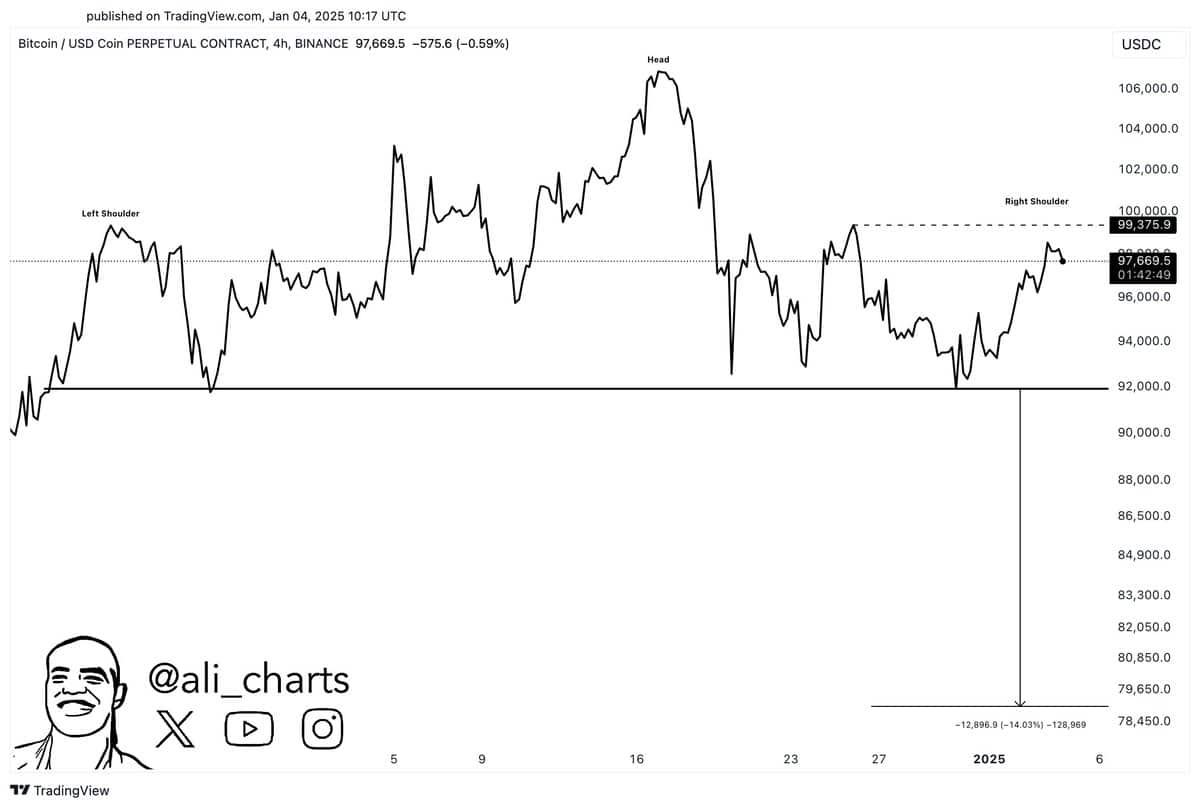

Head-and-shoulders pattern looms

As per an esteemed expert in the field of X, there appears to be a potential head-and-shoulders pattern emerging on Bitcoin’s price chart. If verified, this bearish configuration might lead to a drop in its value towards the $78,000 range.

This adjustment matches the technical standards, considering the pattern’s past reliability.

However, the pattern remains invalidated until a decisive break below the neckline.

It’s crucial for bulls that the closing price of either day or week surpasses $100K significantly. Doing so would contradict the current bearish perspective, paving the way for Bitcoin to reach even higher prices.

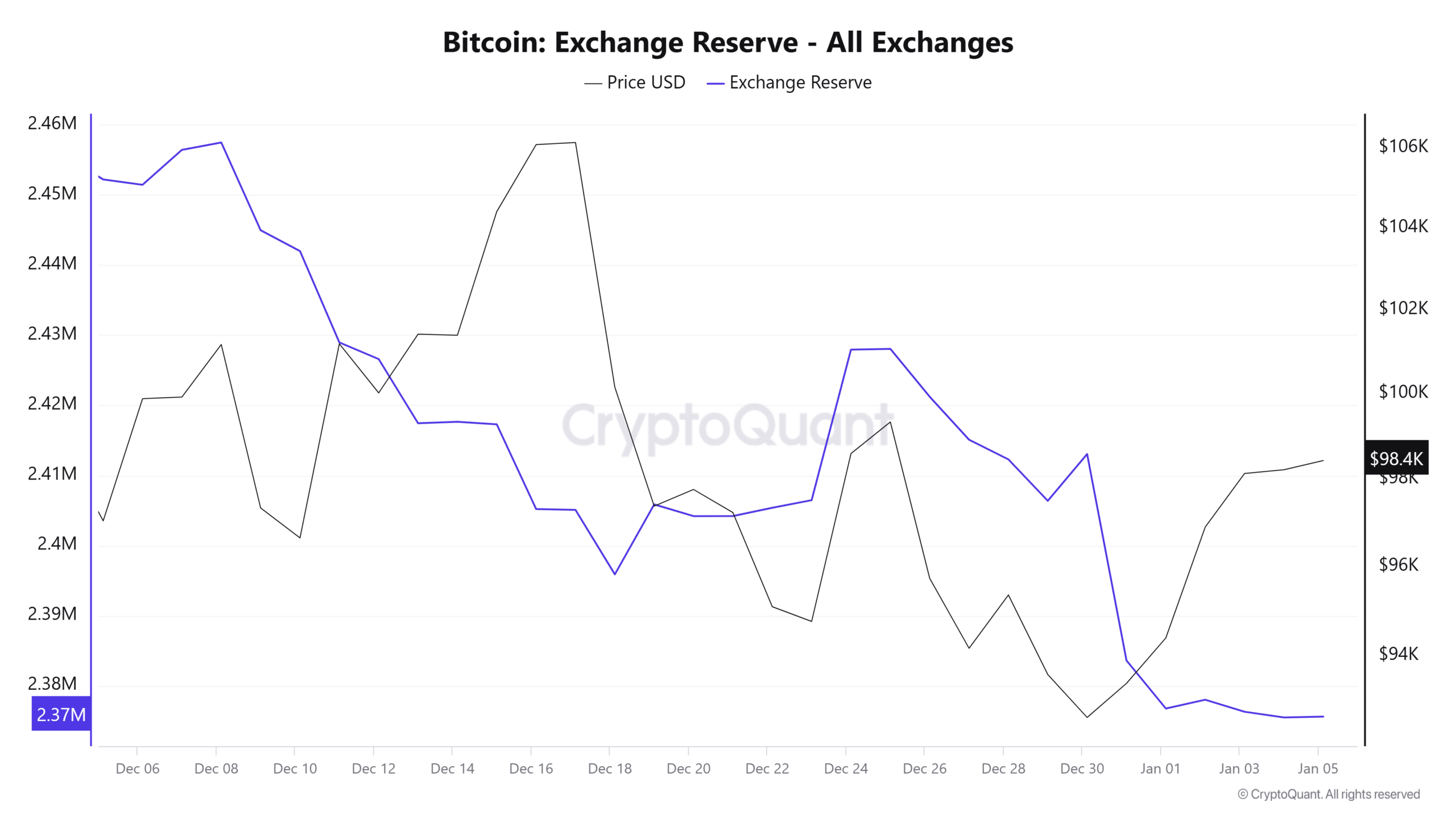

Decreasing exchange reserves point to a bullish potential

The on-chain data presents a more hopeful outlook. It appears that the amount of Bitcoin held on exchanges has been steadily decreasing, suggesting that less Bitcoin is currently being offered for trade.

As a researcher examining the Bitcoin market, I’ve noticed an emerging trend: Market participants appear to be preferentially holding onto their Bitcoins rather than selling them. This shift in behavior seems to be decreasing the selling pressure on Bitcoin.

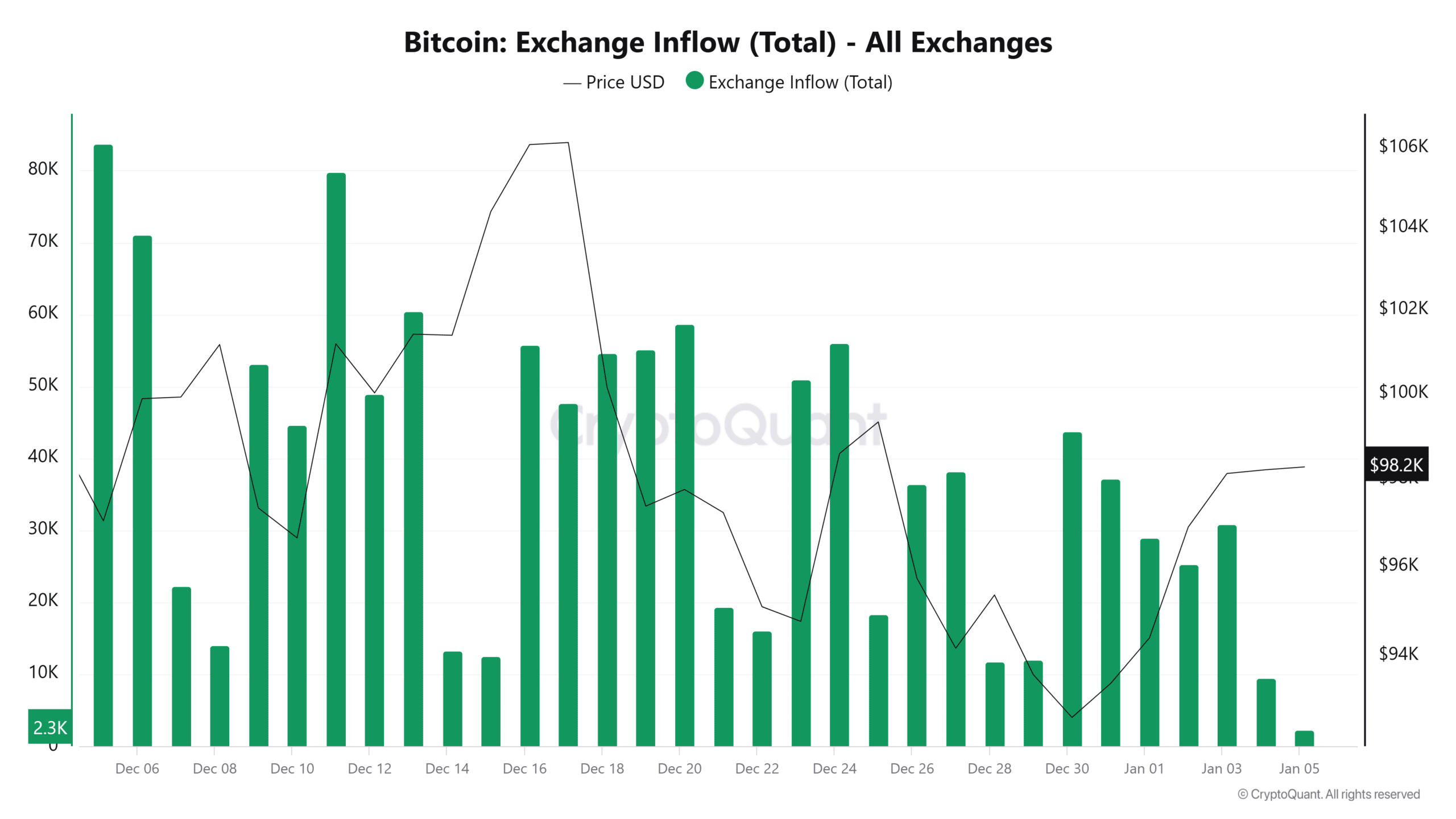

Furthermore, it’s worth noting that the rate at which money is coming into the system, a crucial indicator for predicting possible selling actions, has been gradually falling since the 30th of December.

According to CryptoQuant’s reports, lower amounts of Bitcoin are moving to exchanges, a trend that lends strength to the optimistic perspective about its market direction.

What lies ahead for Bitcoin?

The struggle between those who support Bitcoin’s price increase (Bitcoin bulls) and those expecting a decline (Bitcoin bears) continues, with the leading cryptocurrency still unable to break through the barrier of $100,000.

If we surpass this significant resistance point, it may signal more increases ahead. But if we don’t, it could confirm a pessimistic head-and-shoulders chart pattern instead.

Despite this technical uncertainty, on-chain data paints a bullish picture.

Read Bitcoin’s [BTC] Price Prediction 2025–2026

Decreases in Bitcoin’s exchange reserves and incoming funds indicate a change in attitude among holders, who seem to be increasingly optimistic about the digital currency’s future rather than taking a bearish stance by selling off their current investments.

Bitcoin’s next move will majorly rely on its ability to overcome the $100K resistance.

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- Masters Toronto 2025: Everything You Need to Know

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- WCT PREDICTION. WCT cryptocurrency

- LPT PREDICTION. LPT cryptocurrency

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- Elden Ring Nightreign Recluse guide and abilities explained

2025-01-06 01:11