So, you think Bitcoin’s finally making its move. Oh, you sweet summer cryptonaut, clutching your wallet and optimism. Enter Analyst Cristian Chifoi—a chap with charts, a YouTube channel, and an uncanny ability to spot traps like a medieval peasant in a field of bear snares. In his latest doom-scroll, “Bitcoin is breaking out! But why is it bad?” he tosses cold water on the wild party, suggesting this “breakout” is as genuine as an Ankh-Morpork solicitor’s promise.

Trust the Pump? Only If You Like Disappointment 🏋️♂️

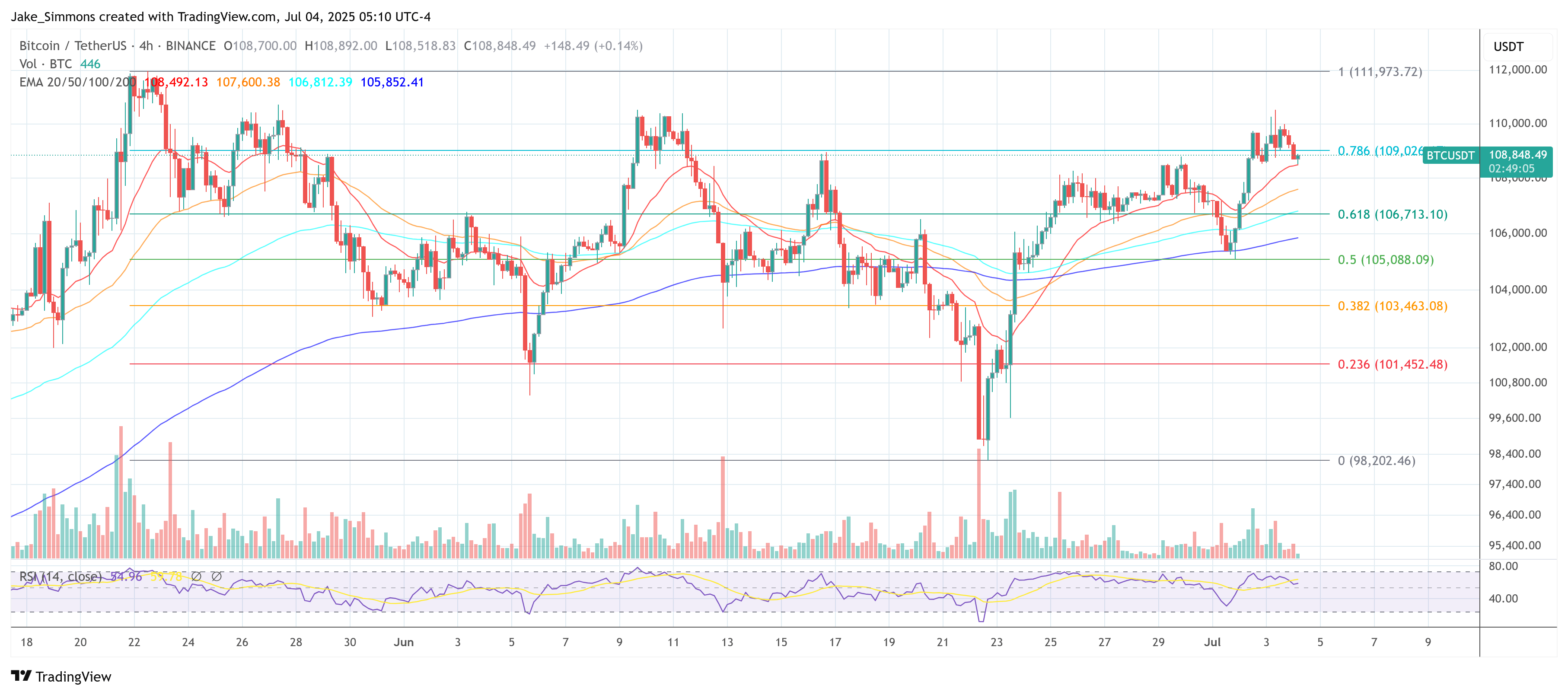

“From a technical angle,” Chifoi concedes, “this could mean an actual breakout, maybe even a polite retest, followed by some mathematical magic.” But he waves his warning lantern: what if it’s just the market’s way of luring in the over-excited, pushing Bitcoin past $113,000—possibly $120,000—only to have it tumble home with its tail between its legs right before July 20?

This, Chifoi asserts, is cyclical. Like Hogswatch or the Disc’s persistent rain, market patterns repeat, and it’s not just the price, but the calendar that deserves suspicion. “I’m more bullish after July 20, running toward September… unless the Patrician changes interest rate policy, then all bets are off (and possibly your shirt, too).”

His grand theory? Retail traders—those brave but frequently bamboozled saps—will leap in at the wrong moment, wallets primed for heartbreak, only for the shadowy market-makers to spirit away the cash. A quick dip to $97,000? Entirely possible. It’s all less a bull run, more a running of the bulls, sans escape route.

Yet it’s not just technical tea leaves at play. Our analyst points to the mighty Wizards of Macroeconomics: the Fed. Rate cuts, he proclaims, are a warning sign. “It’s only a rate cut if the financial wizards are waving their hands in frantic alarm,” he intones. The bond market, not Jerome “Great and Powerful Oz” Powell, truly decides when to pull the lever and shout “PANIC!” 📉

Stability is the name of the game; let rates simmer at 4.5% ‘til year’s end if you want anything to go up—except, perhaps, blood pressure among traders. “Do that, and the market will ascend like Nanny Ogg after a double gin.”

It’s not just Bitcoin on parade. Chifoi foretells a synchronized crypto waltz after July’s mysterious pivot, with Ethereum, XRP, DeFi whizz-bangs like CRV, and all those oddly acronymed wonders (ISO coins, ADA, Quant, IOTA) waiting in the wings, hoping for a turn in the limelight. Even old-schoolers like Filecoin and Polkadot might get a pity dance.

Into the “Stablecoin Super Cycle” 🌀

Now, gaze further into the future—where banks are run by cryptography, and people measure time in blocks. Here’s Chifoi’s vision: a stablecoin-laden orgy of yield, DeFi projects hoovering up Wall Street liquidity like a wizard downing banana daiquiris at the Drum. “In crypto, only DeFi projects get you yields,” he says, as if explaining gravitation to an orangutan. “Wall Street’s hungry, and crypto is the buffet.”

The financial system, having staggered about for a hundred years, might find itself replaced. Not so much a revolution as a very slow and confused shuffling of paper onto blockchain. Think of it as moving from the gold standard to “the magic internet money where the numbers go up.”

Panic not, faithful hodlers! Short-term shenanigans aside, Chifoi isn’t bearish. He’s eyeing $160,000 by September, with the wind of seasonality, late policy pivots, and the world’s growing addiction to blockchains propelling it along. It’s all a question of holding on long enough—preferably without being fleeced.

Best to keep your eye on the bigger picture. High time frame signals, he notes, are your friend. Bollinger Bands (not to be confused with marching bands) point to a fresh run. But beware: history suggests the party ends fast, and nobody wants to be left behind when the lights come back on.

“Next time there’s a rate cut, something’s on fire,” he finishes, with the air of someone who’s seen too many Discworld economy reboots. “For now, higher for longer. And possibly weirder.” 🎩🪙

At this very moment, as you nervously refresh the charts, BTC sits at $108,848—give or take an assassin’s fee.

Read More

- How to Get the Bloodfeather Set in Enshrouded

- Every Targaryen Death in Game of Thrones, House of the Dragon & AKOTSK, Ranked

- 4 TV Shows To Watch While You Wait for Wednesday Season 3

- The Pitt Season 2, Episode 7 Recap: Abbot’s Return To PTMC Shakes Things Up

- Felicia Day reveals The Guild movie update, as musical version lands in London

- Best Controller Settings for ARC Raiders

- 10 Movies That Were Secretly Sequels

- One of the Best EA Games Ever Is Now Less Than $2 for a Limited Time

- Goat 2 Release Date Estimate, News & Updates

- Best Thanos Comics (September 2025)

2025-07-04 19:24