- The Fed injected $400B liquidity into the U.S. market on the 1st of January.

- But long-term holders’ relentless sell-off has been absorbed by STH (short-term holders).

As a seasoned analyst with over two decades of experience in financial markets, I have seen my fair share of liquidity injections and their effects on various assets. The recent $400B injection by the Fed into the U.S. market could potentially fuel the rise of risk-on assets like Bitcoin [BTC].

Historically, similar moves by the Fed have correlated with strong BTC uptrends, as we witnessed in 2021. If this trend repeats and the Fed continues its liquidity injection, we could see BTC experiencing upside momentum. However, it’s important to note that history doesn’t always repeat itself, but it often rhymes.

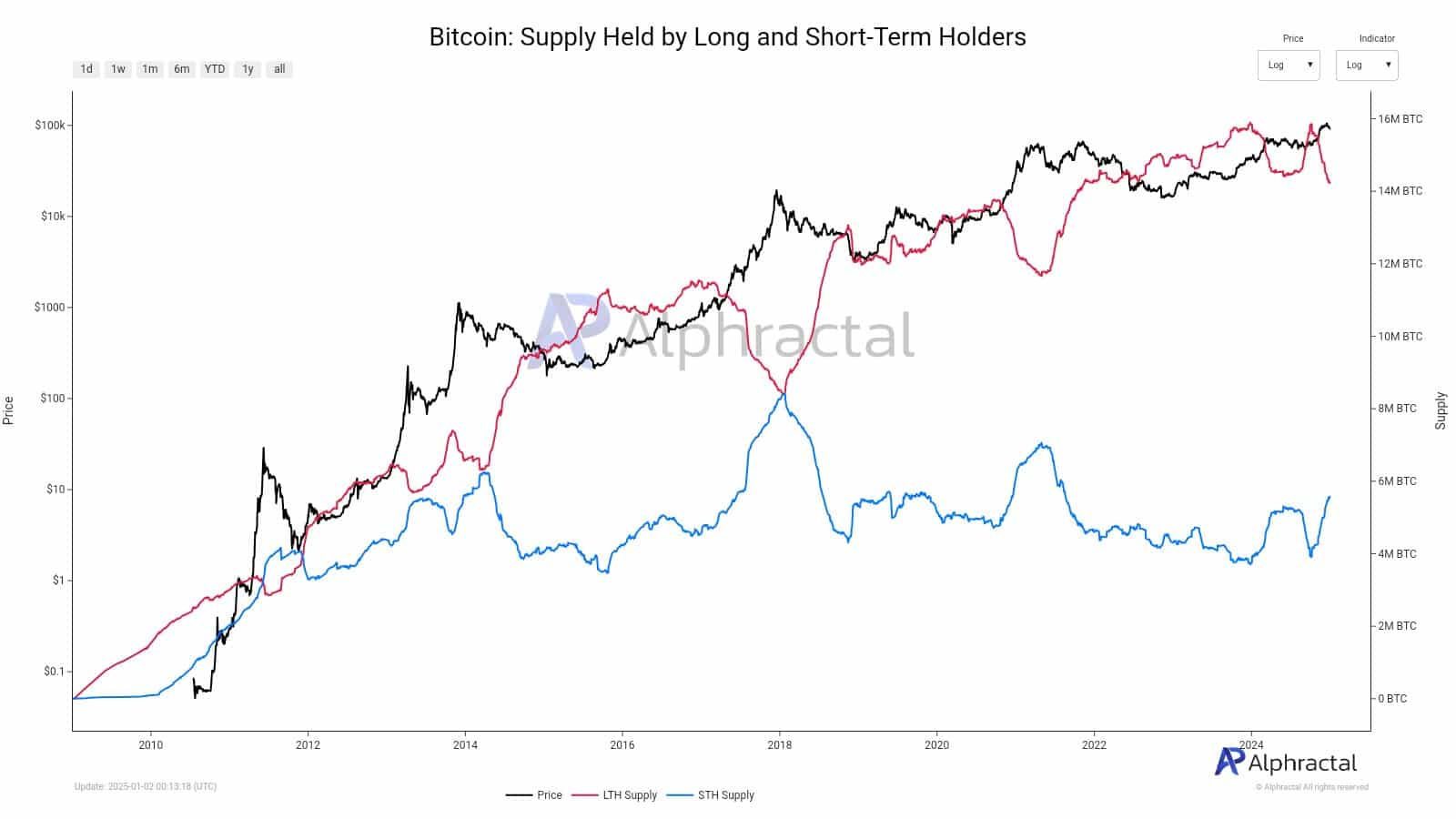

On the flip side, the relentless sell-off by long-term holders (LTH) poses a challenge. Over 1M BTC coins have been sold by LTH in just three months, with the supply shrinking from 14.2M to nearly 13.1M. Yet, this selling has been absorbed by short-term holders (STH), as their supply has increased from 2.5M to 3.8M BTC.

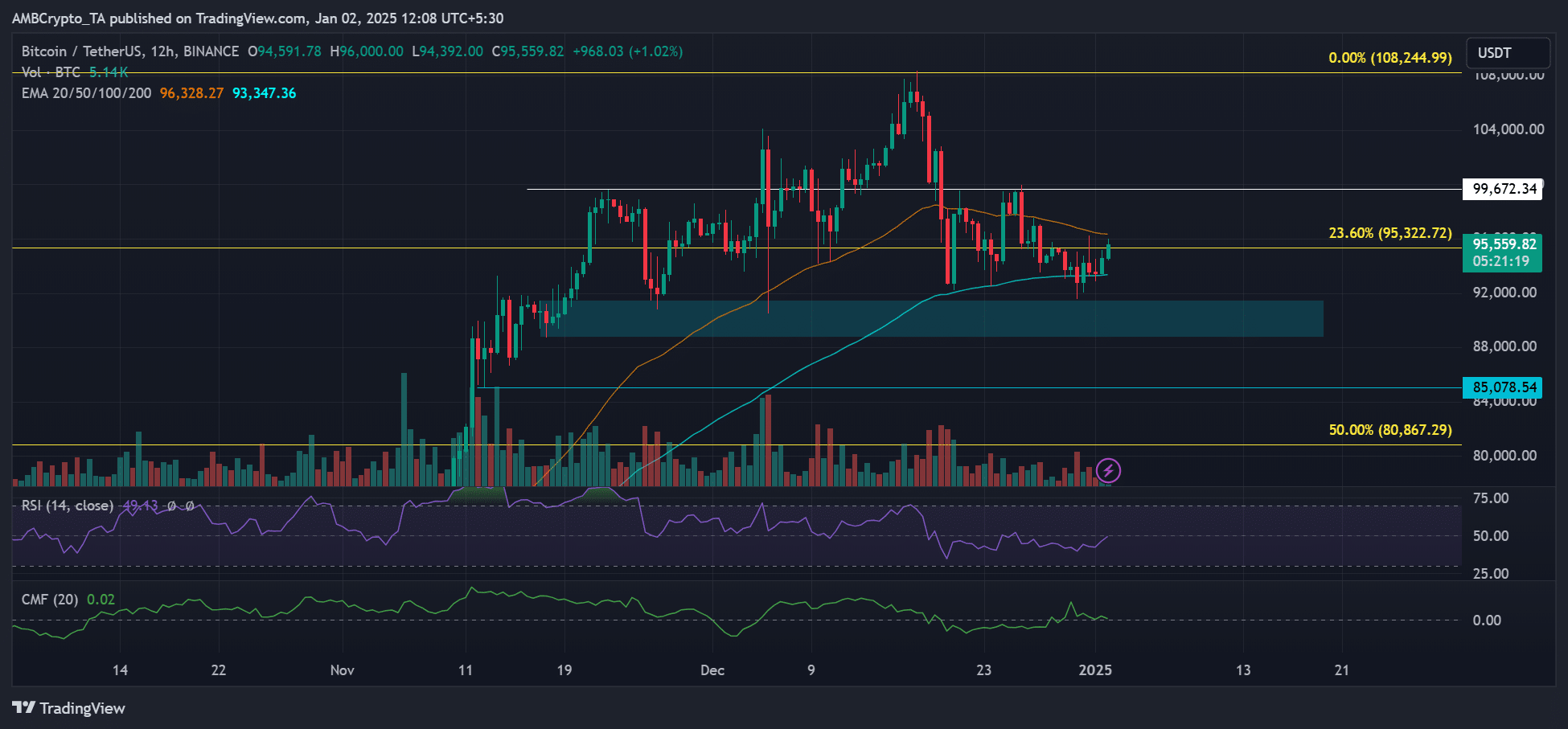

At press time, BTC is attempting to reclaim $95K, a significant psychological level. If it can decisively close above $97K and key moving averages, the higher timeframe market structure could flip bullish. However, another price rejection at $97K could pull it lower to the 100-day EMA of $93K or the demand support at $90K.

In a lighter note, I’ve been in this game long enough to remember when Bitcoin was worth less than a single cup of coffee. So, while we analyze the markets, always remember to keep a sense of humor and enjoy the ride!

It’s possible that the U.S. Federal Reserve (Fed) is shifting its approach, potentially moving towards less restrictive monetary policies. This change could lead to an increase in available funds within financial markets, which might stimulate growth for assets considered risky, such as Bitcoin [BTC].

Starting from the 1st of January, one key indicator for assessing the Federal Reserve’s Quantitative Tightening (QT) process – the Reverse Repo Facility – infused a significant amount of $400 billion into the U.S. economy. This influx served to enhance market liquidity, bolstering the overall financial system.

(In other words: As an analyst, on January 1st, I observed that one important measurement for determining the Fed’s QT – the Reverse Repo Facility – pumped $400 billion into the U.S. economy, thereby increasing market liquidity.)

Will U.S. liquidity injection pump BTC?

Historically, an increase in the Repo Facility has coincided with a significant surge in Bitcoin’s price in 2021. If this pattern repeats and the Fed continues to inject liquidity, it’s possible that Bitcoin could experience another upward trend.

Previously, an anonymous financial expert known as Chicken Genius predicted that the Federal Reserve’s Quantitative Tightening (QT) would conclude by the first quarter of 2025. He made this statement…

“Prediction: Quantitative tightening (QT) ends this quarter.”

Long-term holders dump Bitcoin

Despite an optimistic outlook on a broader scale, long-term Bitcoin investors (LTH) have persistently been offloading their holdings.

From mid-September 2024 to early January 2025, the LTH supply (Long-Term Holder supply) of Bitcoin decreased from approximately 14.2 million to around 13.1 million. This means that they have sold over a million BTC coins within a span of three months.

On the other hand, it appears that most of the large holder sell-offs have been taken up by short-term investors. Simultaneously, the amount of Bitcoin held by short-term holders has significantly increased over time, rising from 2.5 million to 3.8 million coins during this period.

Read Bitcoin [BTC] Price Prediction 2025-2026

At the current moment, the digital currency was trying to regain its value near $95,000. If it successfully ended the day above $97,000 and crucial moving averages, the larger market trend could potentially shift bullish.

Based on my years of trading experience, I believe that a further price rejection at $97K could potentially push the market down towards the 100-day Exponential Moving Average (EMA) at $93K or the demand support level around $90K. This is a common pattern in markets and I’ve seen similar situations play out before. It’s important to keep an eye on these levels for potential entry or exit points, as they can provide valuable insights into market sentiment and direction.

Read More

- PI PREDICTION. PI cryptocurrency

- WCT PREDICTION. WCT cryptocurrency

- Gold Rate Forecast

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- LPT PREDICTION. LPT cryptocurrency

- Solo Leveling Arise Tawata Kanae Guide

- Despite Bitcoin’s $64K surprise, some major concerns persist

- SOL PREDICTION. SOL cryptocurrency

- Gayle King, Katy Perry & More Embark on Historic All-Women Space Mission

- Jack Dorsey’s Block to use 10% of Bitcoin profit to buy BTC every month

2025-01-02 18:15