- After the recent drop to $56.8k, Bitcoin seemed to have a short-term bearish bias.

- Signs of accumulation and demand were present, but the consolidation period might not end soon.

As a seasoned crypto investor with several market cycles under my belt, I’ve learned to read between the lines when it comes to Bitcoin’s price movements. After the recent drop to $56.8k, Bitcoin seemed to have a short-term bearish bias. However, signs of accumulation and demand were present, but the consolidation period might not end soon.

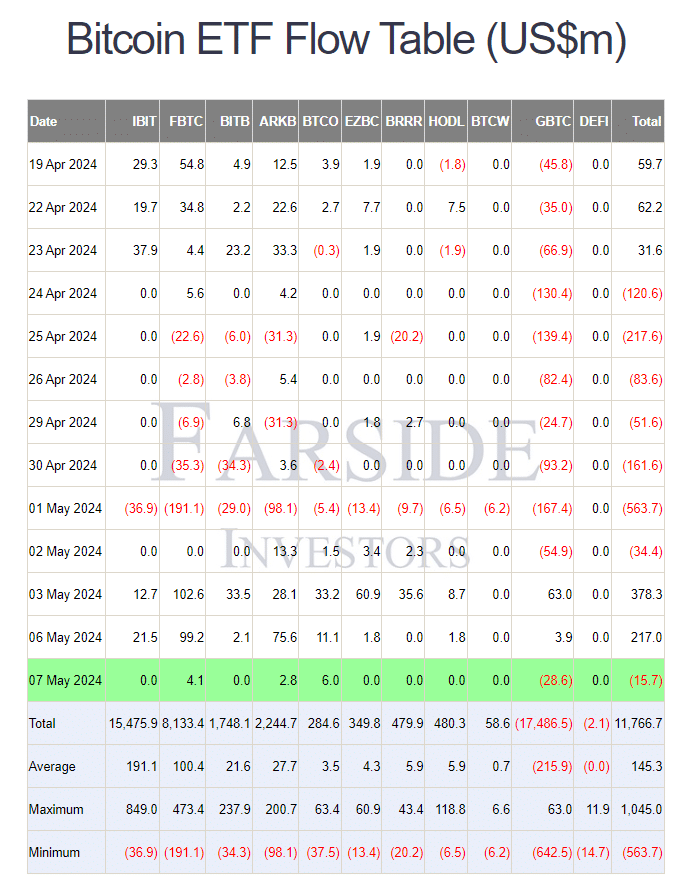

In the last seven days, Bitcoin (BTC) experienced a 4.6% price increase. Moreover, data from Bitcoin ETF inflows indicated a growing influence of buyers in the market.

As a crypto investor, I’ve noticed that the Grayscale Bitcoin Trust (GBTC) had been experiencing consistent outflows for quite some time. However, something shifted in early May – the situation took a turn for the better.

Its short-term bias hasn’t changed to become bullish, despite this. The technical setup still indicates a bearish trend. A closer look at the on-chain data can provide insights into potential future price movements.

Resolving the long and short-term outlook

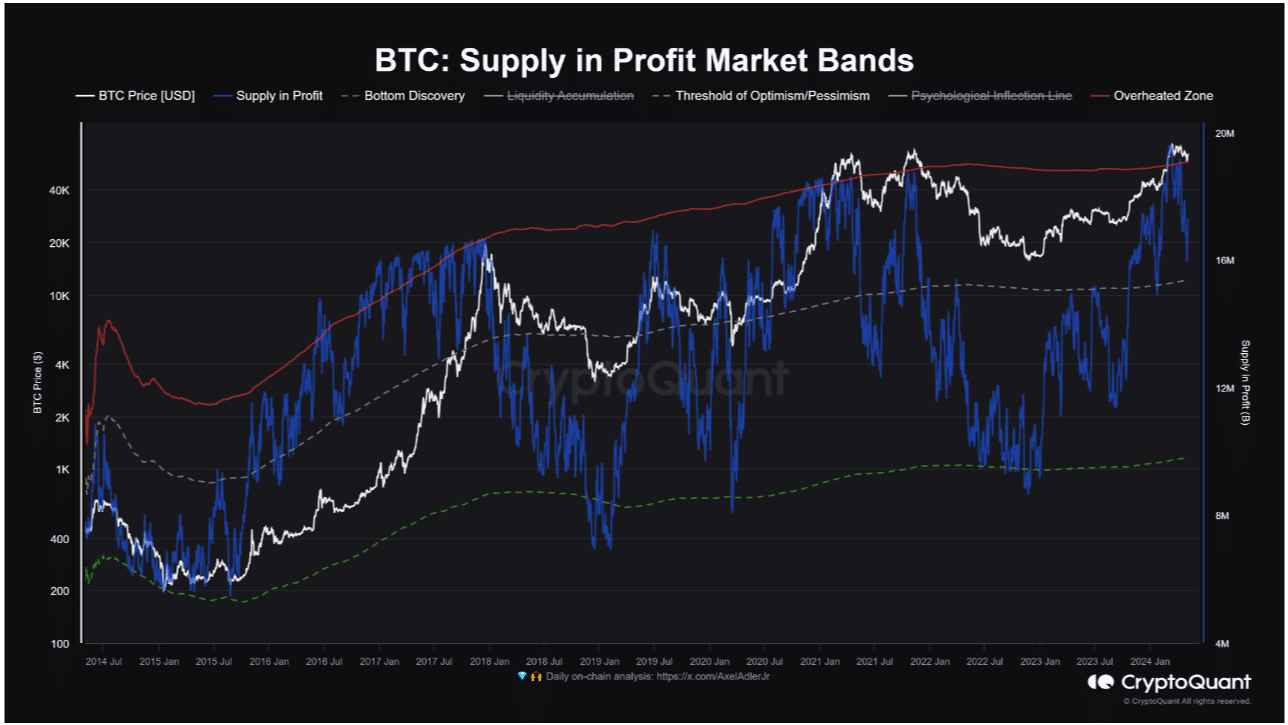

As a crypto investor, I’ve noticed an insightful observation made by analyst Kripto Mevsimi in a recent post on CryptoQuant. He highlighted that due to the recent market correction, the amount of Bitcoin in profit has decreased.

A collection of bands served to mark the overheated area, the point of discovery below, and the boundaries distinguishing optimism from pessimism.

As of now, the metric is trending towards reaching this threshold. If it drops beneath it, there’s a possibility of a more significant correction as Bitcoin approaches its bottom level.

As a researcher studying market trends, I would interprete this as follows: If the metric surpasses this threshold, there is a strong probability that investors’ attitudes will remain optimistic on the whole, providing potential grounds for a market rebound.

During the 2016 market cycle, the profit supply indicator remained excessively high for extended periods without experiencing a significant downturn.

During the July 2020 to January 2021 period, the overheated zone was frequently encountered. However, we have not reached that phase of the cycle just yet.

In an ideal scenario, Bitcoin supporters hope that the gray line will hold firm and prices will bounce back, rising steadily and mirroring past bull market trends over the upcoming months.

Is it a good time to buy Bitcoin, or should you wait?

As a long-term Bitcoin investor, I’ve generally held a bullish outlook for the cryptocurrency market. However, in the short term, there have been bearish signs that I couldn’t ignore. Although the overall trend remains upward, it’s essential to acknowledge the potential for a more significant correction. Keeping an eye on market indicators and staying adaptable is crucial in crypto investing.

As an analyst at AMBCrypto, I delved into exploring certain data points provided by Santiment to assess whether a potential buying opportunity lies ahead.

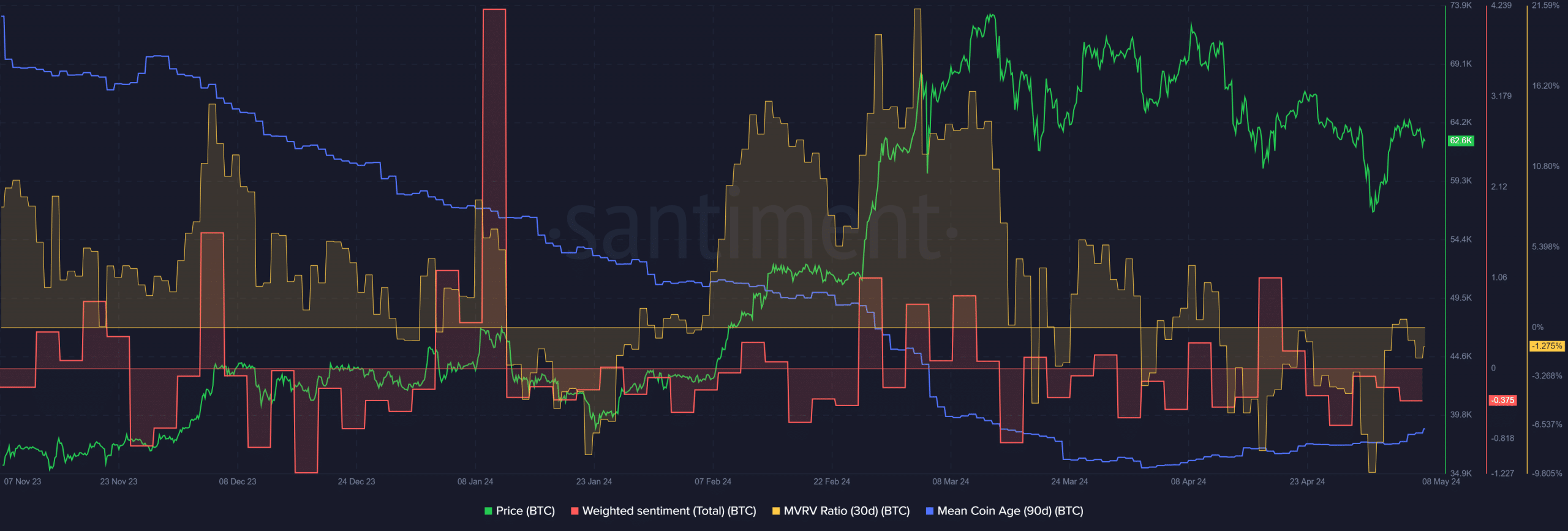

As an analyst, I’ve noticed that the 30-day MVRV (Moving Average of Realized Value) has been displaying a negative trend for most of the previous month. This indicates that the asset was possibly undervalued during that period. Nevertheless, the sentiment analysis, specifically the 3-day weighted sentiment, remained consistently negative over the last two weeks.

Read Bitcoin’s [BTC] Price Prediction 2024-25

Over the past month, the mean coin age metric, which had been trending downward, appeared to have paused and even started to incrementally rise. Alongside the MVRV indicator, this development suggested a potential buying opportunity for Bitcoin.

Based on current market trends, it appears that the bears are in control, potentially driving the price down to around $55k during the summer months.

Read More

- PI PREDICTION. PI cryptocurrency

- WCT PREDICTION. WCT cryptocurrency

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- LPT PREDICTION. LPT cryptocurrency

- Gold Rate Forecast

- Shrek Fans Have Mixed Feelings About New Shrek 5 Character Designs (And There’s A Good Reason)

- SOL PREDICTION. SOL cryptocurrency

- FANTASY LIFE i: The Girl Who Steals Time digital pre-orders now available for PS5, PS4, Xbox Series, and PC

- Playmates’ Power Rangers Toyline Teaser Reveals First Lineup of Figures

- Solo Leveling Arise Tawata Kanae Guide

2024-05-09 00:07