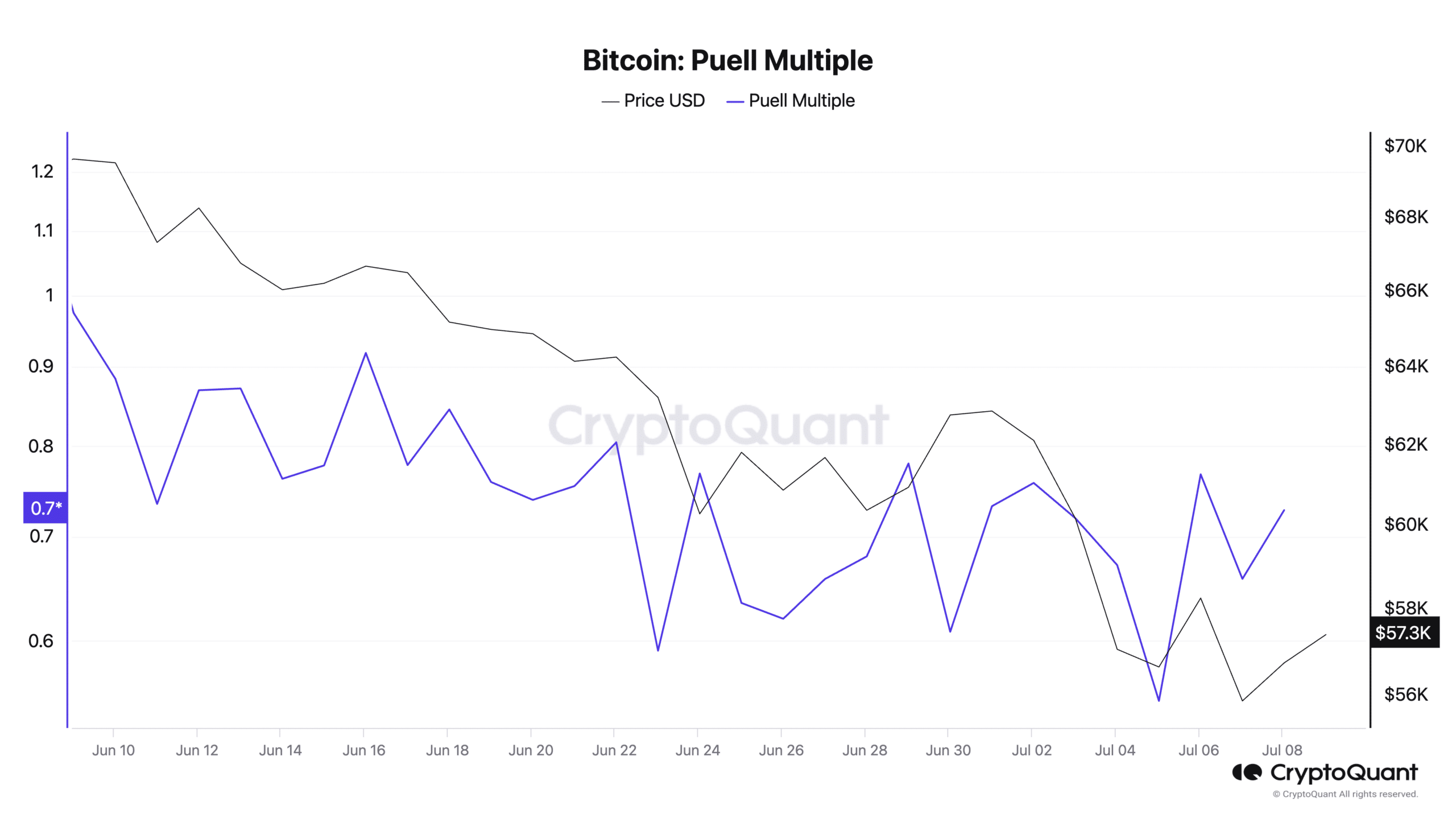

- Bitcoin’s Puell Multiple has been on a decline in the last month.

- This provided a buying opportunity for market participants.

As a seasoned analyst with extensive experience in the crypto market, I believe that Bitcoin’s (BTC) recent decline in Puell Multiple could signal the beginning of a new bull cycle. Based on historical data, this metric has often indicated undervaluation and has been followed by significant price spikes.

In a recent analysis, Crypto Quant’s anonymous expert, Crypto Dan, pointed out that Bitcoin’s (BTC) decreasing Puell Multiple could be indicative of an upcoming bull market.

As a researcher studying Bitcoin’s (BTC) market dynamics, I would describe the Puell Multiple as a valuable metric that helps me gauge the profitability of Bitcoin miners. This metric is calculated by comparing the daily issuance value of new Bitcoins to its 365-day moving average. In simpler terms, it shows me how profitable it is for miners to mine and sell their newly minted coins based on historical averages.

As a researcher studying Bitcoin’s (BTC) market trends, I have observed that when the Puell Multiple experiences a notable surge, it signifies that the daily issuance of coins is well above the annual average. Historically, such occurrences have frequently preceded market peaks. This phenomenon suggests that BTC might be overvalued and could be due for a correction or decline in value.

In simpler terms, when the metric goes down, it means that the daily creation of new Bitcoids is lower than the annual average. This could potentially indicate that Bitcoin is being undervalued in the market.

It is often followed by a BTC price spike as market participants “buy the dip.”

From my perspective as a researcher studying Bitcoin’s market trends, the Puell Multiple stood at 0.80 when I last checked. This downward cycle began on the 6th of June and has resulted in a decrease of approximately 54% since then.

Dan analyzed Bitcoin’s past trends and noticed that when the Puell Multiple took a dip during the bull markets in 2016 and 2020, this was indicative of an impending price surge for Bitcoin.

According to Dan, this can happen in the current market cycle.

“Dan pointed out that by 2024, there have been indications of similar trends emerging. The precise timeline for the conclusion of this transition phase is uncertain, but it’s reasonable to assume it’s not too far off. It’s likely that we will witness the commencement of a bull market rally during the third quarter of 2024.”

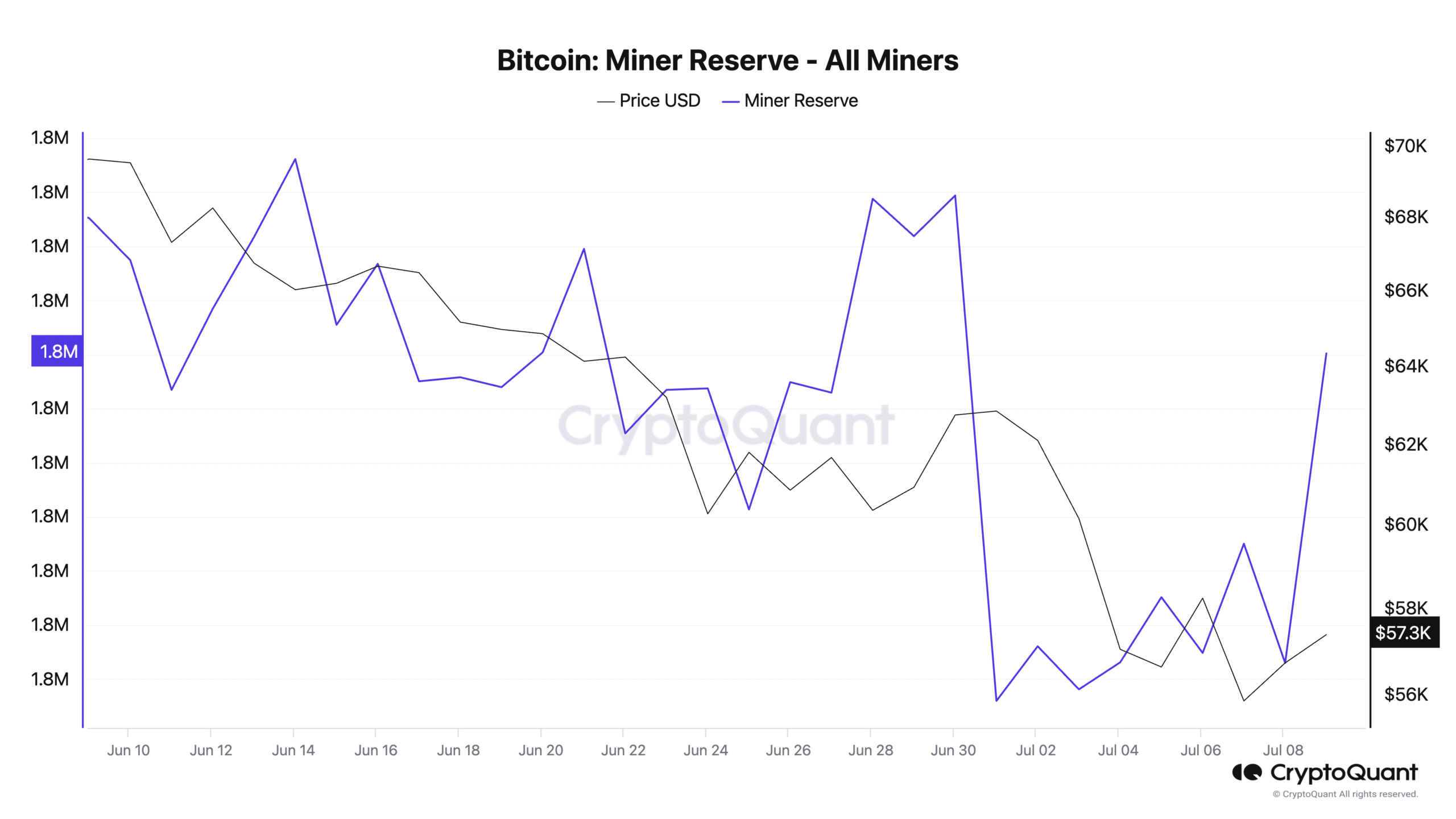

What are BTC miners up to?

Over the last day, there has been a significant increase in the quantity of Bitcoins stored in the wallets of associated miners. This figure reflects the coins that these miners have not yet chosen to put up for sale.

As of the current moment, approximately 1.82 million Bitcoins, equivalent to around $104 billion based on market prices, are stored in the wallets of miners.

Read Bitcoin’s [BTC] Price Prediction 2024-2025

Over the past day, the Bitcoin mining community has seen a 1% rise in their reserves. This signifies that miners have chosen to keep their coins rather than offloading them into the market.

It may be due to the anticipation that the coin’s price will rise in the short/mid-term.

Read More

- Solo Leveling Season 3: What You NEED to Know!

- OM PREDICTION. OM cryptocurrency

- Oshi no Ko Season 3: Release Date, Cast, and What to Expect!

- Serena Williams’ Husband’s Jaw-Dropping Reaction to Her Halftime Show!

- Oblivion Remastered: The Ultimate Race Guide & Tier List

- Why Tina Fey’s Netflix Show The Four Seasons Is a Must-Watch Remake of a Classic Romcom

- Fantastic Four: First Steps Cast’s Surprising Best Roles and Streaming Guides!

- Rachel Zegler Claps Back at Critics While Ignoring Snow White Controversies!

- Oblivion Remastered – Ring of Namira Quest Guide

- Sophia Grace’s Baby Name Reveal: Meet Her Adorable Daughter Athena Rose!

2024-07-09 23:03