- Buying pressure on Bitcoin remained high.

- Market indicators suggested a price correction in the coming days.

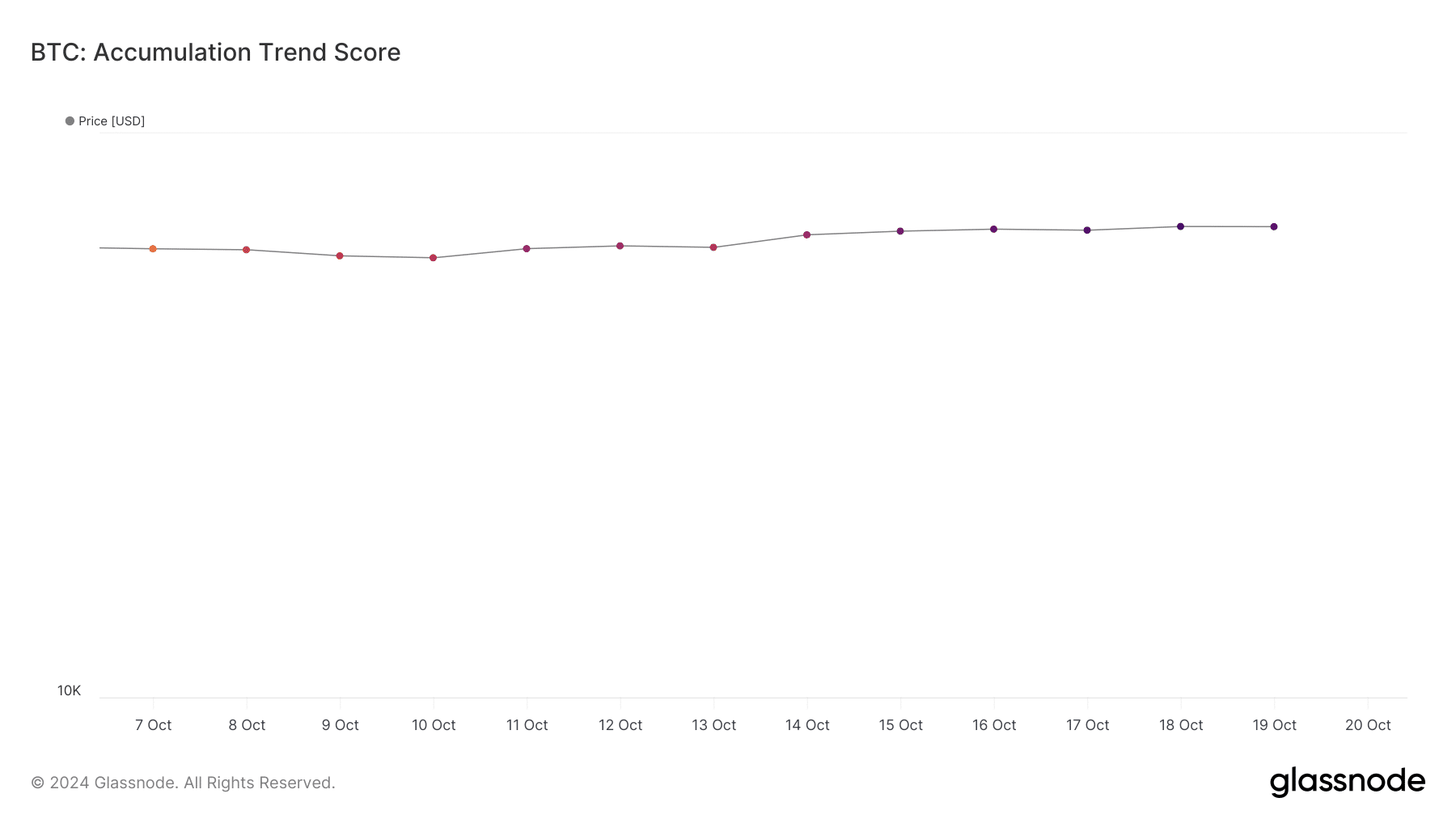

As a seasoned crypto investor who has weathered multiple market cycles, I find myself at a crossroads with Bitcoin (BTC) right now. On one hand, the buying pressure remains high, and the coin’s accumulation trend score is increasing, suggesting that investors are still accumulating BTC. On the other hand, technical indicators such as the TD sequential flagging a sell signal and the NVT ratio hinting at overvaluation, suggest that a price correction might be imminent.

Following a cruise, there’s been a recent adjustment in the value of Bitcoin (BTC). Moreover, a recent update suggests a trend that seems to indicate a decrease in its price.

AMBCrypto intends to analyze Bitcoin’s on-chain data to determine if this downtrend is temporary or if an uptrend may reemerge.

How is Bitcoin doing?

Over the past week, Bitcoin’s upward trend appears to have slowed down noticeably. As per CoinMarketCap, there was a significant jump of over 8% in its value during this period.

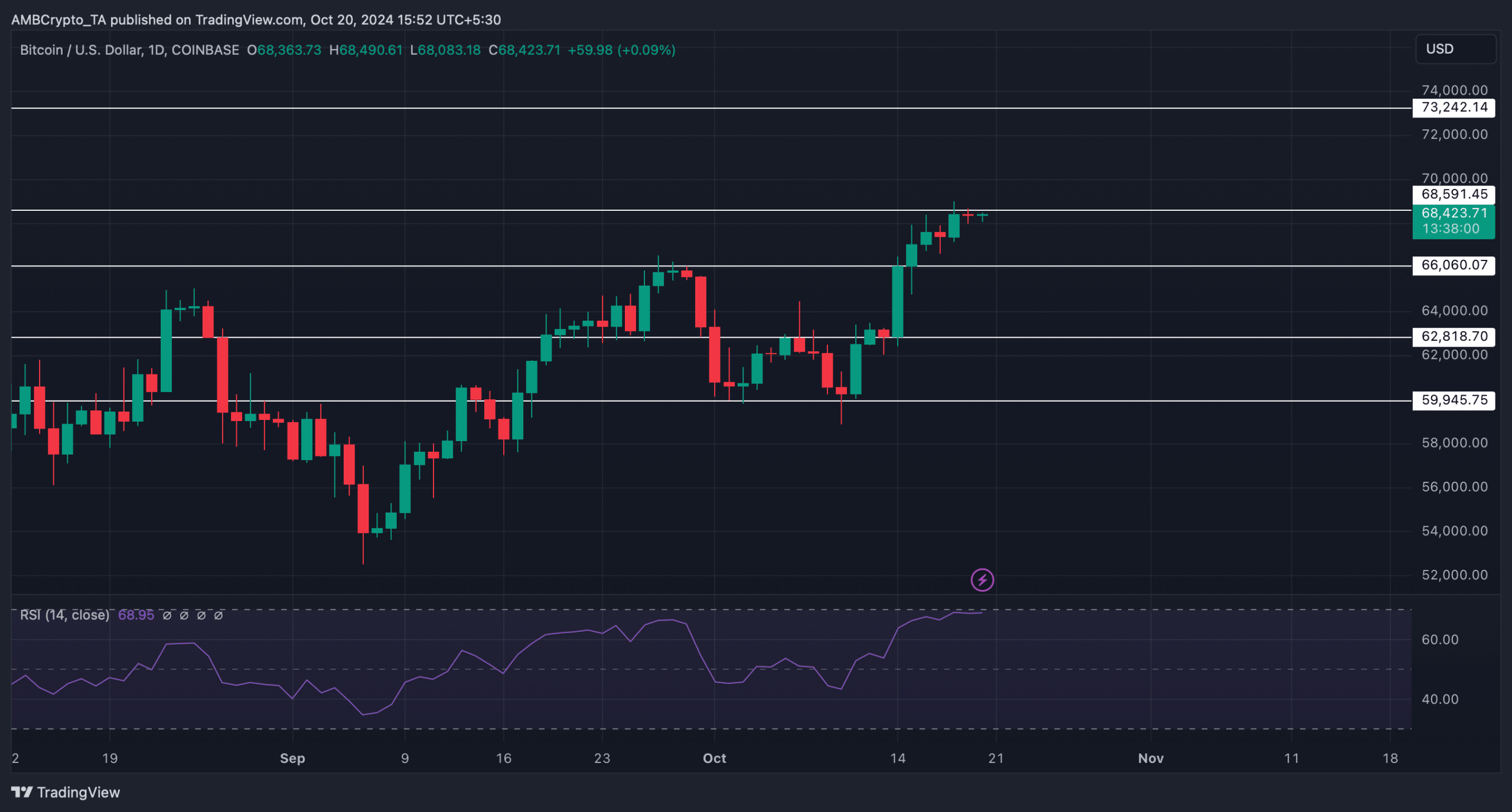

Over the past 24 hours, there’s been a shift in the coin’s trend – it hasn’t seen much price fluctuation. Currently, the coin is being traded at $68,423.71, and its market cap exceeds an impressive $1.35 trillion.

Currently, renowned crypto expert Ali has shared a significant update on Twitter. According to his post, Bitcoin’s crucial predictor, the TD Sequential, has signaled a potential sell opportunity.

This suggests that investors could begin offloading the digital currency. When there’s more demand to sell an asset, it often signals a drop in its value.

In contrast to the previous week, our examination of Glassnode’s data shows a rise in Bitcoin purchases by investors. This increase was indicated by a boost in the Bitcoin Accumulation Trend Score, which climbed from 0.5 to 0.7 last week.

Initially, the Accumulation Trend Score functions as a tool to measure the proportion of entities that are currently increasing their Bitcoin holdings by acquiring more coins on the blockchain compared to others.

A number closer to 1 represents a rise in buying pressure.

Is BTC poised for a correction?.

AMBCrypto conducted a thorough investigation to predict Bitcoin’s future performance. Based on our examination, the Network Value to Transactions (NVT) ratio of Bitcoin has risen significantly over the past few days.

When the value of a metric increases, it suggests that the asset might be too expensive, potentially signaling a decrease in its price within the near future.

However, BTC’s exchange reserve was dropping, meaning that selling pressure was dripping. The fact that investors were still buying BTC was further proven by its net deposit on exchanges.

In simpler terms, the amount of Bitcoin going into exchange platforms recently has been lower than usual over the past week. However, this could be a good sign because it suggests strong buying interest, which often leads to an increase in price.

Read Bitcoin (BTC) Price Prediction 2024-25

After examining Bitcoin’s daily chart, it appears that its upward momentum is being halted at a significant resistance level. Importantly, the Relative Strength Index (RSI) is nearing the overbought territory, suggesting potential price correction may be imminent.

If that happens, then Bitcoin might witness a price correction, causing BTC to drop to $66k again. In case of a continued bull run, BTC might touch $73k.

Read More

- Best Race Tier List In Elder Scrolls Oblivion

- Elder Scrolls Oblivion: Best Pilgrim Build

- Becky G Shares Game-Changing Tips for Tyla’s Coachella Debut!

- Elder Scrolls Oblivion: Best Sorcerer Build

- Yvette Nicole Brown Confirms She’s Returning For the Community Movie

- Gold Rate Forecast

- Elder Scrolls Oblivion: Best Thief Build

- Justin Baldoni Opens Up About Turmoil Before Blake Lively’s Shocking Legal Claims

- Ludicrous

- Meet Tayme Thapthimthong: The Rising Star of The White Lotus!

2024-10-21 06:15