- Data reveals that BTC “shrimps”—wallets holding over one Bitcoin—have consistently accumulated the asset over time, now controlling a notable portion of its supply.

- BTC’s price trajectory also mirrors the 2017 rally cycle, which saw the asset experience significant upward momentum.

In the last day, the market has displayed indications of recuperation. The market cap of Bitcoin (BTC) has grown by 1.44%, reaching an impressive $1.88 trillion, while its trading volume experienced a significant spike of approximately 144.37%.

Over the last week and month, this latest development has kept Bitcoin’s decline to less than 6%.

Based on historical trends, it appears that Bitcoin may be poised for an increase, given that investors are consistently adding the cryptocurrency to their portfolios.

BTC investors pave the way for further growth

Based on Glassnode’s information, after a phase where Bitcoin was heavily distributed, marked by considerable selling as the price neared its peak of $108,353, small-scale Bitcoin investors (referred to as “shrimps”) have started buying again.

In this context, “shrimps” refer to wallet addresses holding more than one BTC.

It appears that the group in question has noticeably boosted their Bitcoin assets, amassing approximately 17,600 BTC each month on average. This growth now represents around 6.9% of the entire circulating Bitcoin supply.

Building positions over time suggests that investors remain optimistic about the market’s future direction, even amidst current market fluctuations, which could be a sign of a positive or bullish forecast.

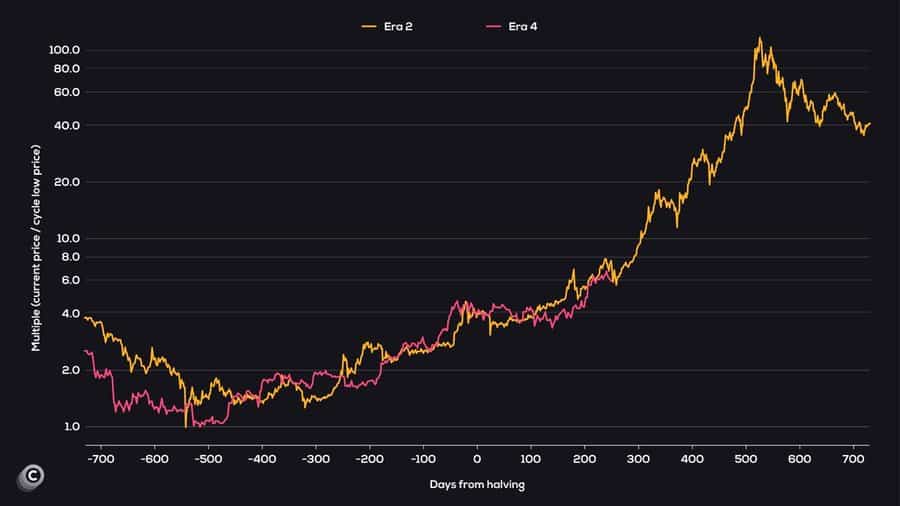

A more detailed examination indicates that the current market turbulence might be a precursor to a future bull market surge, bearing similarities to the 2017 market boom.

BTC mirrors 2017 rally with similar market moves

The latest findings indicate that Bitcoin’s present market trend appears strikingly similar to the upward surge it experienced during its 2017 bullish phase.

The examination follows Bitcoin’s price fluctuations during times following halvings, which is a period characterized by a decrease in miner rewards.

As a crypto investor, I’ve noticed an intriguing pattern in Bitcoin’s (BTC) performance. If this pattern persists, it seems plausible that BTC could potentially shatter its previous All-Time High (ATH), reaching unprecedented heights.

Yet, although the general trend seems similar to that of 2017, there have been some instances where the price fluctuations have deviated from it.

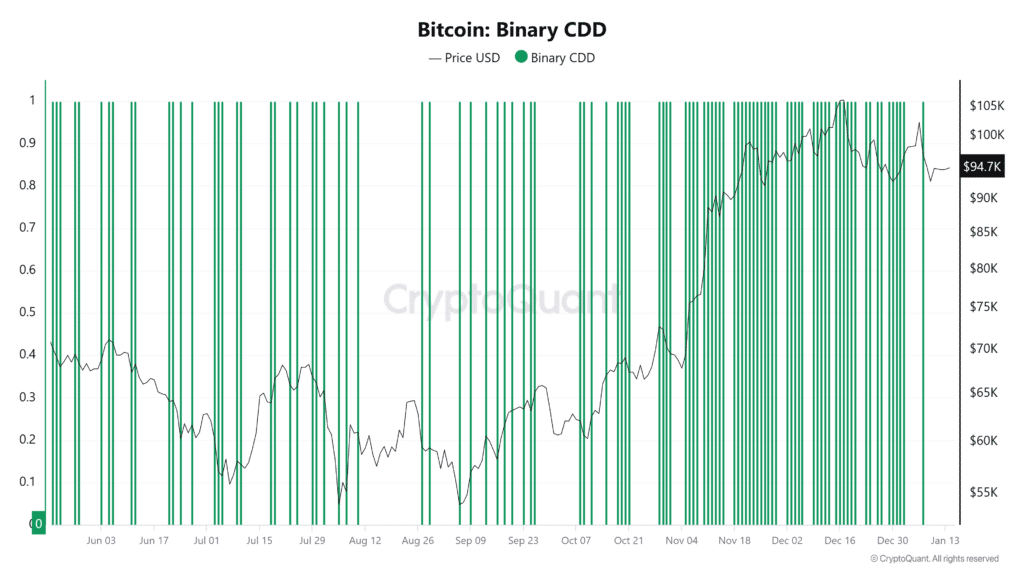

Ongoing buying activity signals bullish momentum for BTC

Based on the Binary Coin Days Destroyed (Binary CDD) metric by CryptoQuant, which follows Long-Term Holder (LTH) behavior using a system of ones and zeros, it appears that Bitcoin holders are displaying increased trust in the asset again.

Reading a score of 1 suggests that Long-Term Holders (LTHs) may be shifting their Bitcoin (BTC), possibly in preparation for selling, whereas a score of 0 signifies confidence and the decision by these holders to keep their Bitcoin.

At the moment of reporting, the Long-Term Holder Confirmation Deposit (CDD) for Bitcoin was at zero, indicating that these investors are buying more instead of offloading their BTC.

In simpler terms, the feeling among investors that prices will rise (bullish sentiment) is also being seen in the derivatives market. The funding rate, which recently became positive, has reached its highest point in four days. It increased from around 0.00393 on January 10th to 0.0124 at the time of this report.

This is the highest rate since the 2nd of January.

Read Bitcoin (BTC) Price Prediction 2025-26

As more people continue to purchase Bitcoin in the continuous market, long-term investors holding onto their assets, and a steady increase in buyers over the past few months, Bitcoin seems ready for an uptrend or significant price increase.

Read More

- Forza Horizon 5 Update Available Now, Includes Several PS5-Specific Fixes

- Gold Rate Forecast

- ‘The budget card to beat right now’ — Radeon RX 9060 XT reviews are in, and it looks like a win for AMD

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Valorant Champions 2025: Paris Set to Host Esports’ Premier Event Across Two Iconic Venues

- Karate Kid: Legends Hits Important Global Box Office Milestone, Showing Promise Despite 59% RT Score

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Street Fighter 6 Game-Key Card on Switch 2 is Considered to be a Digital Copy by Capcom

2025-01-15 04:08