- Bitcoin plunges below $53K, sparking a broad crypto market downturn.

- Crypto market turmoil extends to stocks, with notable reactions from former President Trump.

As a seasoned researcher with over two decades of experience in financial markets, I have witnessed numerous ups and downs – from the dot-com bubble burst to the global financial crisis of 2008. The recent plunge of Bitcoin below $53K and the subsequent crypto market downturn is yet another episode in this long-running drama.

Bitcoin (BTC) has taken a dip after reaching almost $70,000, falling below the $53,000 level as of now. As per CoinMarketCap, the cryptocurrency is currently being traded at around $52,591, representing a significant drop of approximately 13.42% within a day.

Due to this sudden drop, there was a mass sell-off of cryptocurrencies, resulting in substantial losses for numerous alternative coins.

Crypto bloodbath

In simple terms, Ethereum (ETH) saw a decrease of over 20%, while Solana (SOL) dropped by more than 16%. Other significant decreases were observed throughout the cryptocurrency market as well.

In spite of a recent drop in Bitcoin’s price, the cryptocurrency community continues to show strength and adaptability. This viewpoint was reinforced by Jameson Lopp, a Co-founder and CSO at CasaHODL, who emphasized this resilience in his statement.

“If you’re sad from looking at charts, just switch to the Bitcoin dominance chart.”

In alignment with this viewpoint, Samson Mow, CEO of JAN3 (a firm promoting Bitcoin usage), emphasized his optimistic stance towards Bitcoin, the front-runner in cryptocurrencies.

As a diligent analyst, I find myself often reflecting on potential uncertainties that may arise in the future. In such times of concern, whether it’s the stability of the financial system, global conflicts, or an uncertain tomorrow, my personal recommendation is to consider adding Bitcoin to your portfolio. Its decentralized nature and digital scarcity make it a compelling option for those seeking resilience amidst uncertainty.

He further emphasized the opportunity for investors not currently buying BTC, and added,

“If you don’t want #Bitcoin, then you either don’t understand Bitcoin or what is about to happen.”

Bitcoin falls further

As an analyst, I’ve noticed that despite the optimistic outlook towards Bitcoin, it has dipped even lower than $49K at the current moment. In response to this, Jason A. Williams, a co-founder of Morgan Creek Digital, shared his thoughts, stating: “Even in times of market turbulence, we see opportunities for long-term growth.”

“If you get more excited to buy Bitcoin the further it goes down, like and retweet this post.”

Further fueling criticism, Frank Chaparro, Host of The Scoop podcast and Director of Special Projects, added,

“Bitcoin can go to $20k before I feel anything.”

Significantly, the turbulence wasn’t limited to affecting only the cryptocurrency market; it also reached out to the stock market, causing a substantial drop in its value.

However, it was Trump’s latest remark on Truth Social, the former president, that left the community astonished.

On-chain metrics paint a different picture

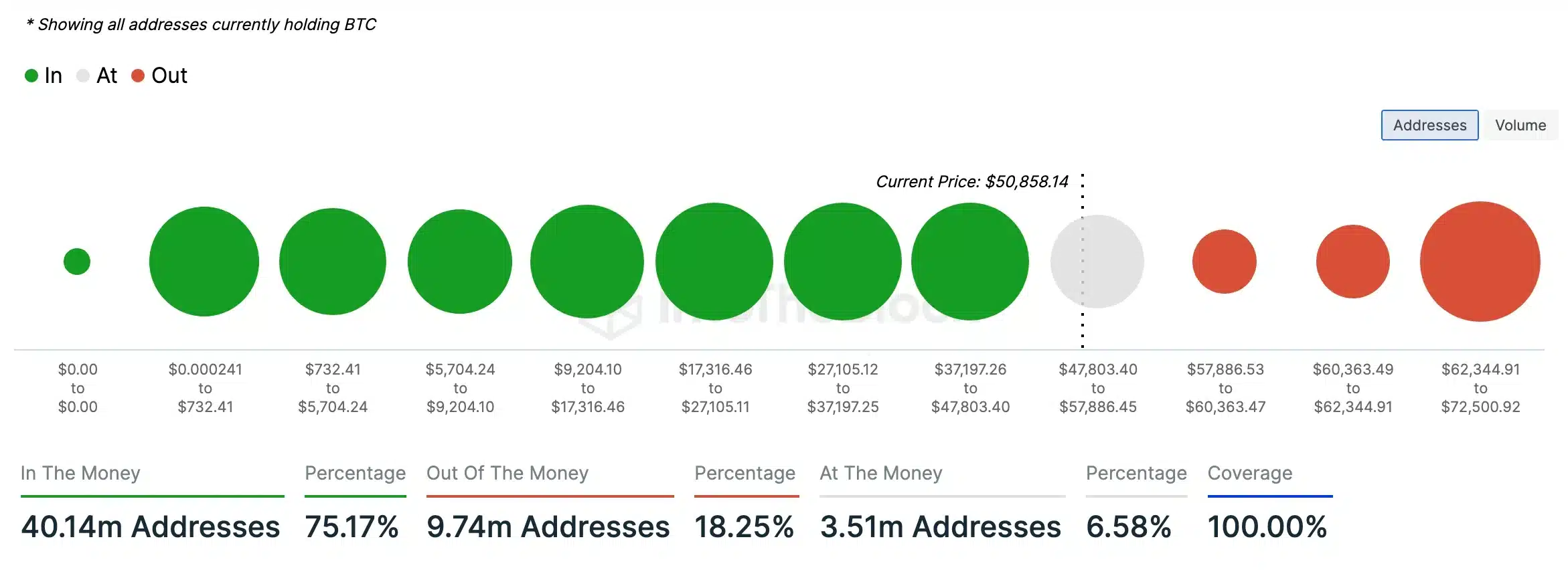

To grasp the fundamental movement of the market, AMBCrypto scrutinized IntoTheBlock data and found out that a substantial number (approximately 75.17%) of Bitcoin owners currently possess tokens that are worth more than what they initially paid for, suggesting that these owners are making a profit or “in the green” at the moment.

Conversely, about one fifth (18.25%) of the holders had BTC tokens that were valued lower than what they initially paid for them, which is referred to as being “underwater” or “out of the money.” This could imply a positive outlook or an imminent price rise for Bitcoin.

According to comments made by eToro market analyst Josh Gilbert in an interview, his perspective on the subject is particularly insightful.

“When you invest in crypto assets, you’re stepping into the ring of volatility. This is a small jab for crypto, not even a black eye. We’ve got more rounds left of this bull market before the bell rings.”

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- Rick and Morty Season 8: Release Date SHOCK!

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Masters Toronto 2025: Everything You Need to Know

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- Linkin Park Albums in Order: Full Tracklists and Secrets Revealed

2024-08-05 22:15