- Bitcoin capital outflows prompt market reassessment, signaling potential price shifts

- Bitcoin’s key support zones could determine future bullish or bearish momentum

The recent decrease in Bitcoin’s [BTC] capital inflows has sparked worries about potential price changes ahead. Historically, these types of shifts have often signaled upcoming market adjustments, leading investors to reconsider their tactics. As market players might be on the hunt for fresh investment opportunities, the question arises: What direction will Bitcoin take next?

Bitcoin capital outflows

The movement of funds away from Bitcoin is essentially a reallocation process, frequently mirroring adjustments in investor sentiment. When investors withdraw their resources from BTC, this might suggest they’re taking profits, selling due to fear, or shifting to alternative investment options. Market makers, who function as liquidity providers, then examine potential price points, either lower or higher, to find the best spots for re-entering the market.

These outflows don’t necessarily indicate bearishness; instead, they often function as a period of adjustment or readjustment. Keeping tabs on these shifts is essential for market participants.

Bullish trend continuation?

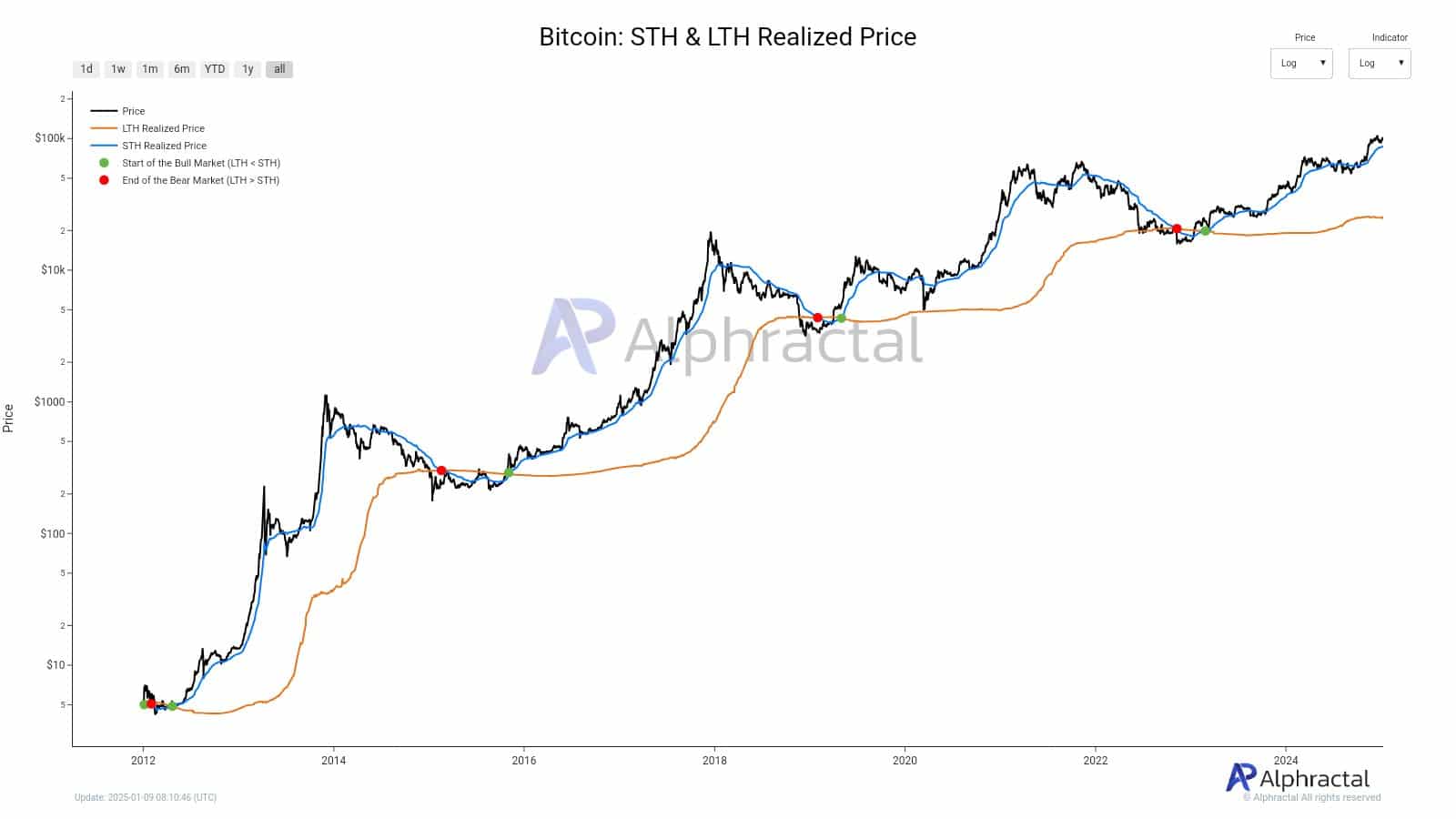

One optimistic outlook is based on Bitcoin surpassing its Short-Term Holder Realized Price, which stands at around $86,200 currently. This figure symbolizes the average price that short-term investors paid for their coins, and it typically acts as a psychological and technical foundation during bullish market periods. Historically, this metric’s recovery has been associated with increased investor confidence and renewed bullish sentiment.

The data showed that during previous bull markets, the STH Realized Price served as a launchpad for even greater increases in value. If Bitcoin exceeds this price point, it may suggest a renewed wave of buying interest, implying that both market makers and individual investors are poised to drive the price up further.

This situation seems to imply a possible further rise, where the price of Bitcoin could surpass $86.2k, serving as an initial milestone in its upward trend.

Sentiment-based price action

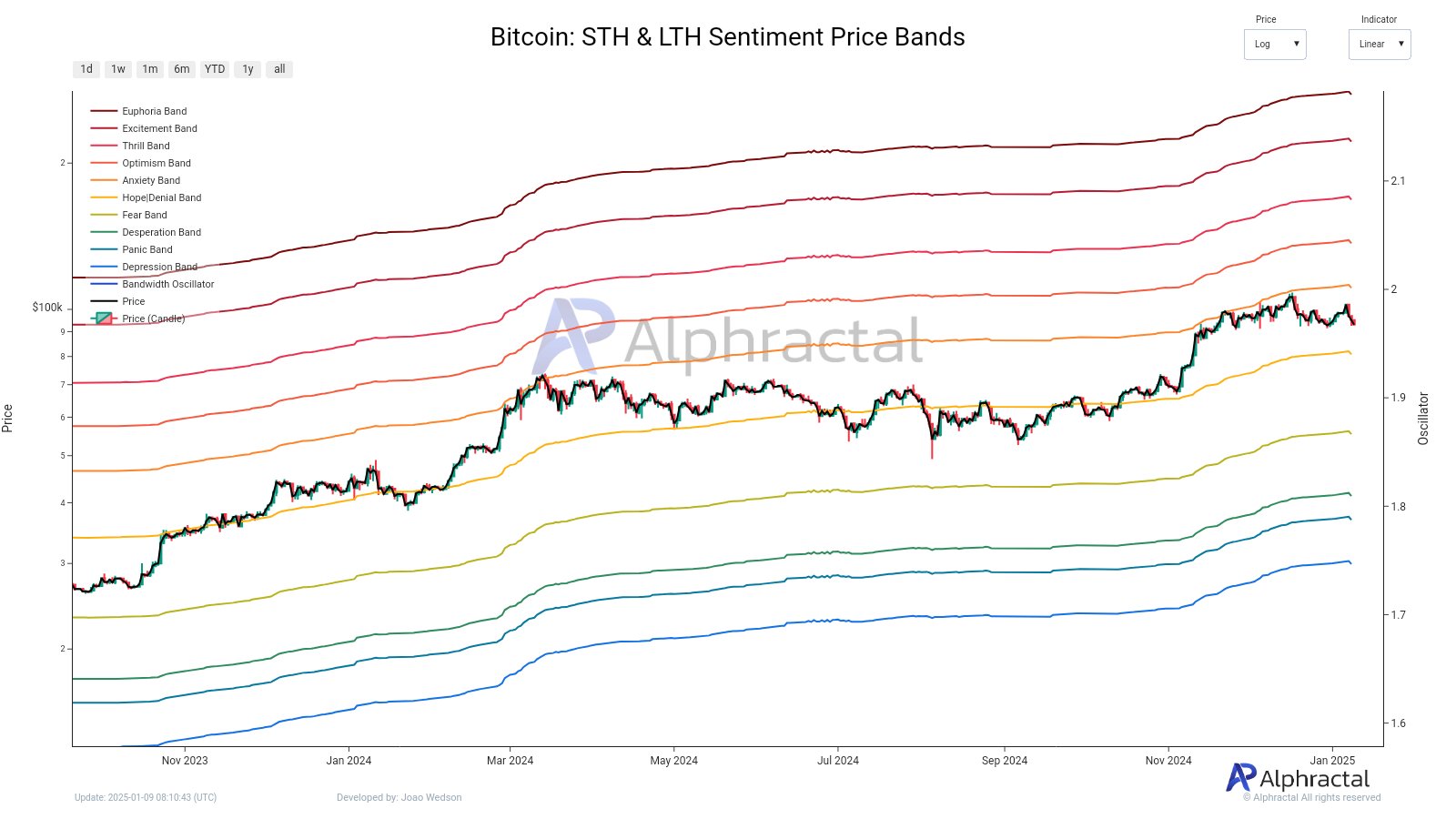

The Hope/Denial Band, located at $80.7k, is a crucial indicator that mirrors the overall emotion balance between short-term investors and long-term investors. This band tracks market mood swings, moving between optimism and caution, and frequently functions as a balancing element during bullish periods.

Previously, the value of Bitcoin tends to stay within a specific price range, often sparking prolonged trends that originate from these points. This range signifies assurance for long-term holders (STHs), while it represents a possible confirmation of long-term investment plans for large-time holders (LTHs).

According to the graph, past instances where the price touched the Hope/Denial Zone were followed by price increases, suggesting it serves as a crucial benchmark. A robust hold at approximately $80,700 might indicate strength and boost optimistic sentiment.

Read Bitcoin’s [BTC] Price Prediction 2025-26

A potential downturn

It appears that the recent fall in Bitcoin’s price seems to echo events from May 2021, where a sudden market correction occurred due to excessive optimism and investors cashing out their profits. This led to a significant withdrawal of funds, causing Bitcoin to reach lower support points and adjusting the market’s predictions for the future.

At present, comparable trends are unfolding. Should bearish forces persist, Bitcoin may dip to approximately $66,000 – $60,000. These levels correspond with significant indicators like the Active Realized Price and True Market Mean Price, which take into account the network’s intrinsic value excluding freshly mined coins.

As a crypto investor, I can’t deny that periods of market downturns certainly test my confidence and push both short-term and long-term strategies to their limits. However, these challenging times also present opportunities for me to reassess potential re-entry points into the market. In other words, when the market seems uncertain, it offers a chance for savvy investors like myself to seek out sustainable entry options that could potentially yield profitable returns in the future.

Read More

- PI PREDICTION. PI cryptocurrency

- Gold Rate Forecast

- WCT PREDICTION. WCT cryptocurrency

- LPT PREDICTION. LPT cryptocurrency

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- Shrek Fans Have Mixed Feelings About New Shrek 5 Character Designs (And There’s A Good Reason)

- SOL PREDICTION. SOL cryptocurrency

- FANTASY LIFE i: The Girl Who Steals Time digital pre-orders now available for PS5, PS4, Xbox Series, and PC

- Playmates’ Power Rangers Toyline Teaser Reveals First Lineup of Figures

- Despite Bitcoin’s $64K surprise, some major concerns persist

2025-01-10 16:07