- Price outlook of Bitcoin is looking good despite liquidity squeeze.

- Bitcoin’s key liquidity level is at $65K.

As a seasoned researcher with over a decade of experience in the financial markets, I have witnessed numerous liquidity squeezes and market turbulences. Yet, this current scenario presents a unique blend of challenges and opportunities that I find intriguing. Despite the Federal Reserve’s ongoing liquidity squeeze, Bitcoin has managed to hold its ground, even showing signs of resilience and potential growth.

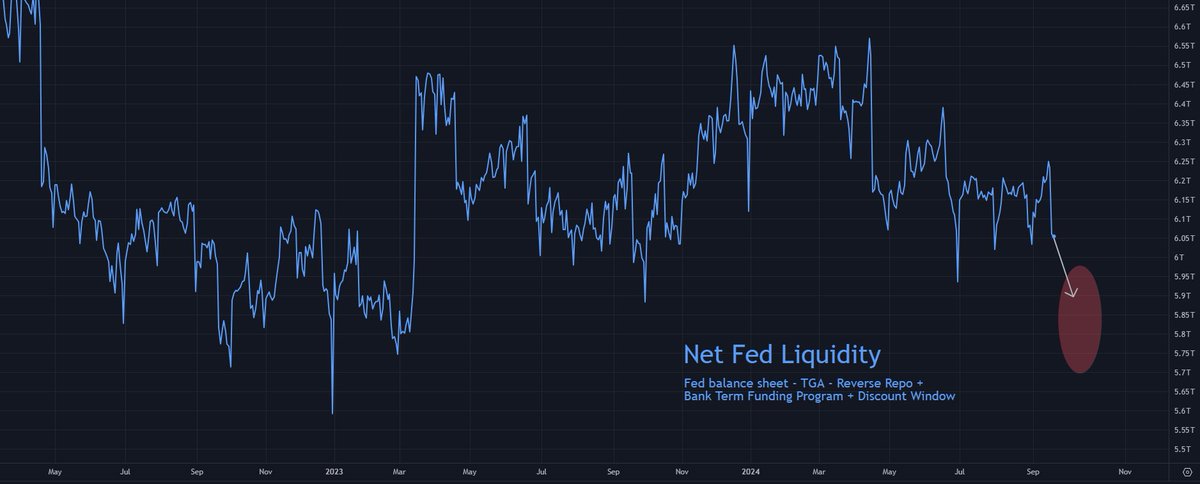

The tightening of liquidity by the Federal Reserve has been actively progressing, as net liquidity has decreased approximately $200 billion since Monday.

The decrease is attributed to an upward trend in corporate tax payments enlarging the Treasury General Account, which might lead to an increase in the use of Reverse Repurchase Agreements as we approach the end of the month.

Currently, the market is roughly two-thirds of the way into a period of reduced liquidity, with expectations that it will last for approximately another week in terms of trading days.

Approximately $100 billion to $300 billion of liquidity might be withdrawn from the market by October 1st. Yet, despite this squeeze, significant risk assets like US stock markets, gold, and Bitcoin have experienced a surge, thanks in part to the Federal Reserve’s recent 50 basis point interest rate reduction.

In simpler terms, although the temporary issue with Bitcoin market’s liquidity seems to be less impactful, it’s important to stay cautious and vigilant until we weather this liquidity turbulence.

Can Bitcoin continue its rally despite the Fed’s liquidity drop?

Over $2B in Bitcoin future contracts opened

Regardless of any decrease in available funds, various signs point towards Bitcoin potentially maintaining its upward trend. One notable indicator is the significant increase in open interest related to future contracts.

Approximately $2 billion worth of Bitcoin future contracts were initiated in a span of only 48 hours. This sudden surge might trigger a possible ‘long squeeze’, yet it underscores the confidence among traders regarding Bitcoin’s anticipated price growth in the near future.

It appears that the Federal Reserve’s reduction in interest rates has alleviated worries about cash flow, prompting investors to wager on Bitcoin potentially climbing to greater heights.

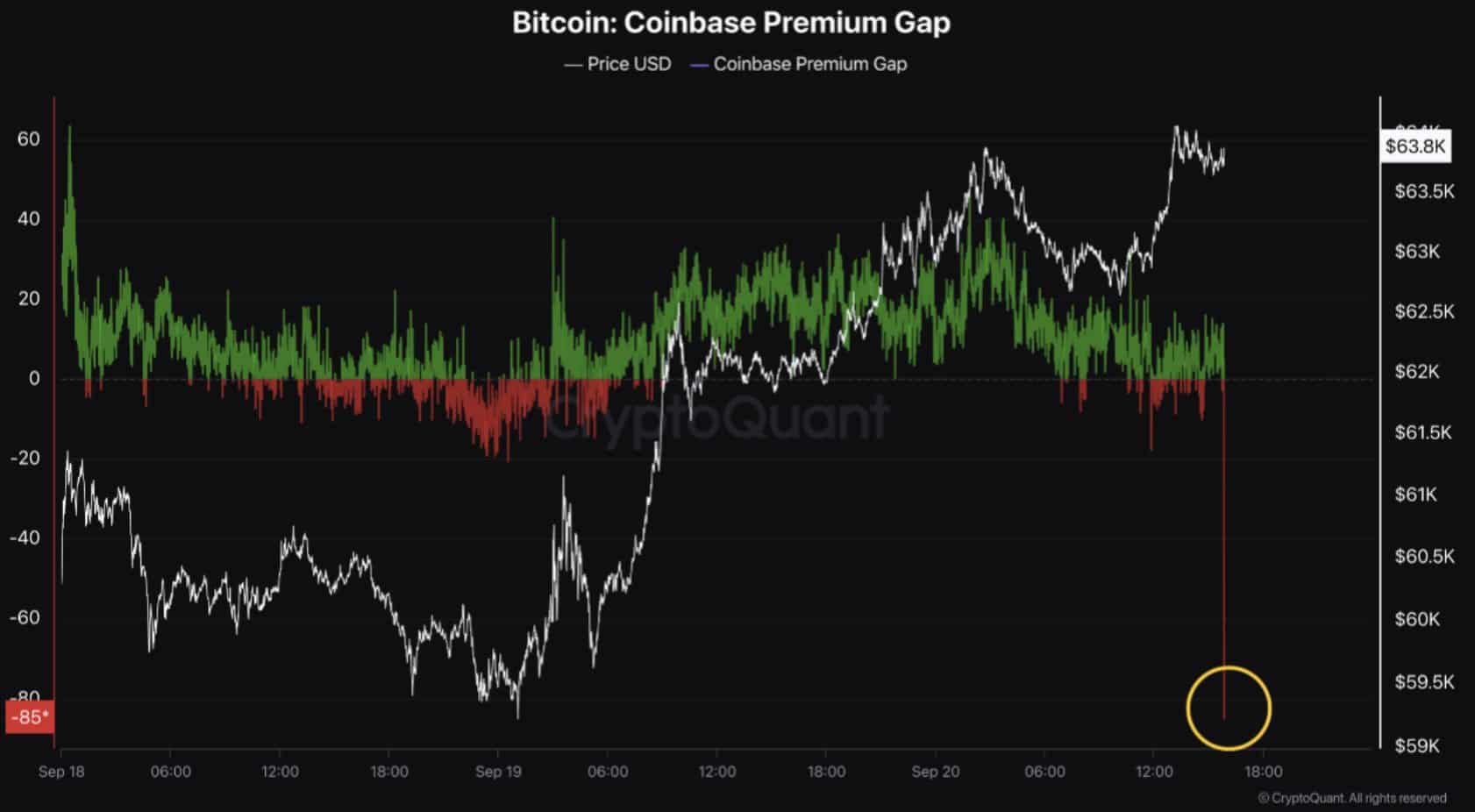

An encouraging indication arises from the Coinbase Premium Index, a tool that compares the Bitcoin price on Coinbase with that on Binance, showing us any discrepancy in pricing.

As a market analyst, I’m observing a unique situation where the Coinbase Premium is currently in the negative, implying that Bitcoin is being traded at a lower price on Coinbase compared to Binance. This phenomenon, often referred to as divergence, typically indicates robust buying pressure, particularly on Binance, suggesting that investors are actively purchasing Bitcoins there.

When two interconnected indicators show contrasting movements, it frequently implies a shift or reversal, hinting that Bitcoin’s recent decline might have reached its lowest point.

Despite Bitcoin’s current price remaining steady, the strong buying interest suggests that an upward price trend may be imminent.

Key levels and liquidation zones for the next move

For traders, understanding liquidation levels is crucial because they indicate potential areas where the price might shift to find more trading activity (liquidity). At present, a significant liquidity point for Bitcoin stands around $65,000.

Should Bitcoin surpass the current threshold, it’s plausible that its price could be headed towards approximately $75K, a point with substantial buying potential.

If Bitcoin surpasses $65K, it wouldn’t just move us nearer to the next goal, but it would also reinforce a bullish market pattern. This increase would represent a new peak (higher high), following the recent recovery (higher low) that Bitcoin experienced after its price drop in August.

Regardless of the current tightening of funds by the Federal Reserve, Bitcoin appears to be robust, as various signs suggest it could continue its upward trend.

Read Bitcoin’s [BTC] Price Prediction 2024–2025

Based on increased open interest, robust purchasing activity on Binance, and crucial liquidity thresholds, it seems likely that Bitcoin’s value may trend upward over the next few weeks.

Keep an eye out for a jump over the $65,000 mark, as this might indicate a substantial price increase towards $75,000. But remember to stay vigilant, as it’s crucial to ensure that the market turbulence subsides completely before making any significant moves.

Read More

- The Bachelor’s Ben Higgins and Jessica Clarke Welcome Baby Girl with Heartfelt Instagram Post

- WCT PREDICTION. WCT cryptocurrency

- Royal Baby Alert: Princess Beatrice Welcomes Second Child!

- New Mickey 17 Trailer Highlights Robert Pattinson in the Sci-Fi “Masterpiece”

- AMD’s RDNA 4 GPUs Reinvigorate the Mid-Range Market

- Chrishell Stause’s Dig at Ex-Husband Justin Hartley Sparks Backlash

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- The Elder Scrolls IV: Oblivion Remastered – How to Complete Canvas the Castle Quest

- Studio Ghibli Creates Live-Action Anime Adaptation For Theme Park’s Anniversary: Watch

- Sea of Thieves Season 15: New Megalodons, Wildlife, and More!

2024-09-21 19:04