- Bitcoin price action flips bullish.

- Bitcoin pulling institutions due to its yearly gains.

As a seasoned crypto investor with a decade of experience under my belt, I can confidently say that the current bullish trend of Bitcoin [BTC] is nothing short of exhilarating. The price action flipping bullish and institutions pulling towards BTC due to its yearly gains is reminiscent of the dot-com boom in the late 90s.

Bitcoin (BTC) has moved above the crucial support zone on higher timeframes, which is known as the Bull Market Support band, following three successive weeks where it remained below this level.

The current upward trend in Bitcoin’s recovery indicates a possibility of its price increasing further. Although there may be temporary fluctuations, the current pattern points towards a bullish market. The area near $67k is currently serving as a significant zone for liquidity.

When Bitcoin surpasses its high-volume resistance level and maintains its position above it, many traders and investors gain confidence to buy more (going long), with some even choosing to increase their holdings further.

Bitcoin’s pull is unstoppable

The increasing fascination towards Bitcoin among institutions is becoming more pronounced, fueling its ascent even further. Notably, Semler Scientific has just added another 83 Bitcoins, valued at approximately $5 million, to their existing stash, now totalling 1,012 Bitcoin.

This purchase makes them the fourth-biggest U.S. firm holding Bitcoins (not including mining operations).

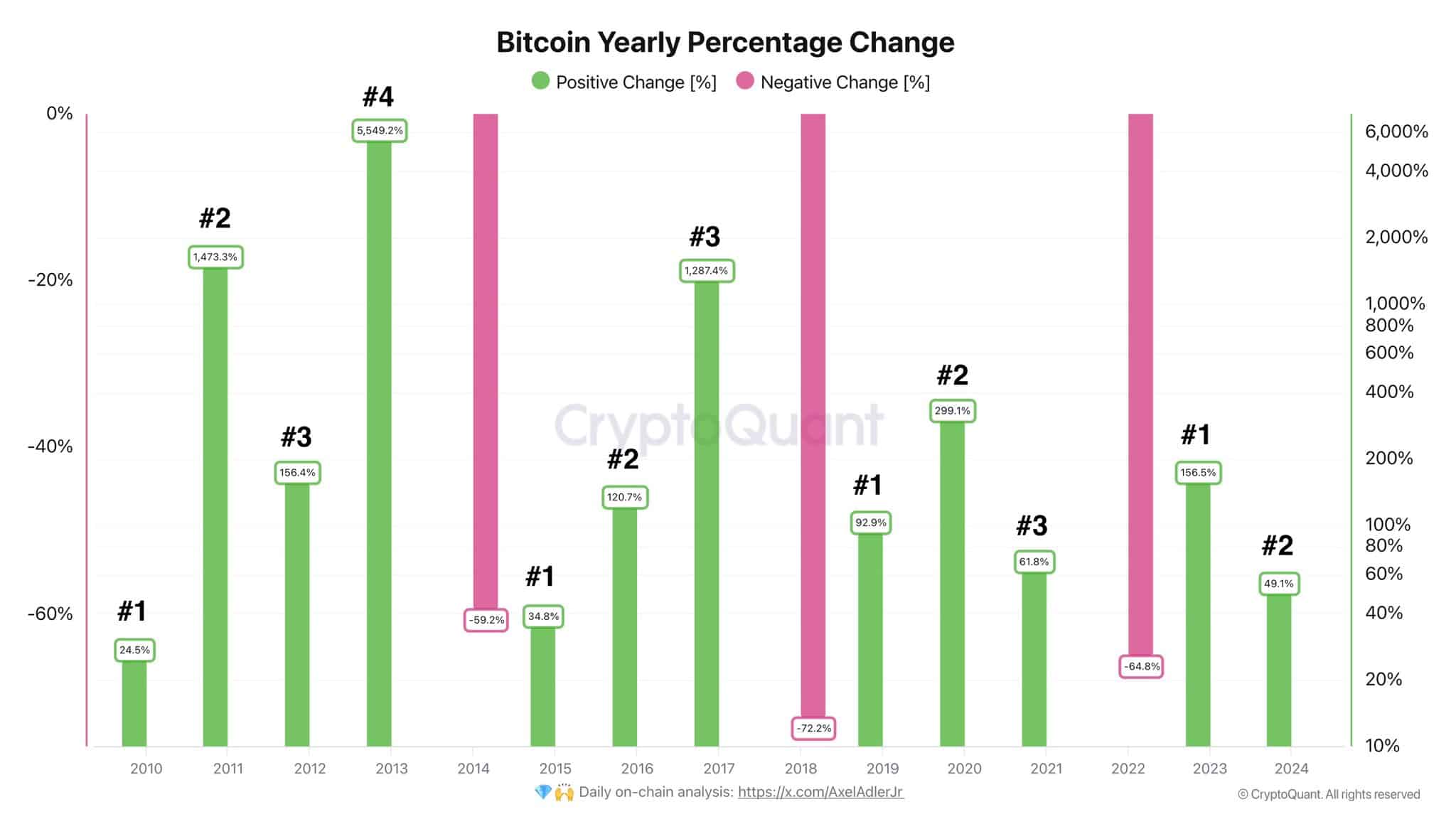

Historically speaking, Bitcoin (BTC) has demonstrated a remarkable ability to bounce back. It’s only experienced three years out of its total 15 where it posted negative returns since its creation, while the remaining twelve years have seen positive growth.

Semler’s decision to invest $150M in Bitcoin through their fundraising campaign underscores the growing acceptance of Bitcoin among institutions, contributing to the upward trend in the market.

Regardless of obstacles, Bitcoin persistently showcases its capacity to attain greater peaks. This year, in particular, has seen encouraging growth, leading many to anticipate a robust conclusion, further fueling optimistic feelings.

BTC and S&P 500 divergence

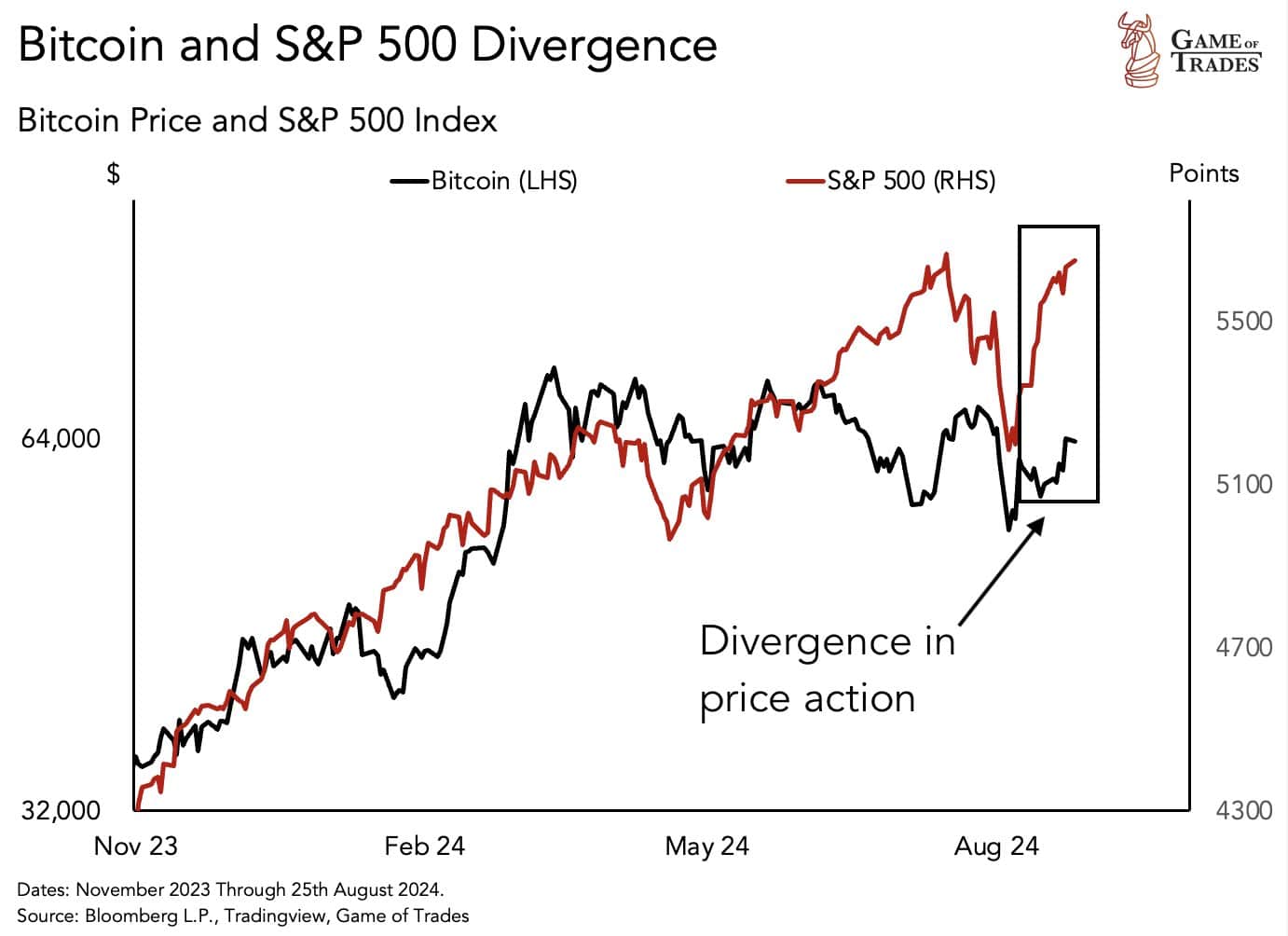

The fluctuations in Bitcoin’s price frequently correspond with changes in the U.S. stock market, notably the S&P 500. Typically, when the S&P 500 increases, so does Bitcoin, and when the S&P 500 decreases, Bitcoin tends to as well.

In August, as apprehensions about a potential economic downturn caused the market to plummet by 6%, I observed a corresponding steep decrease of approximately 30% in the value of Bitcoin.

Despite the market now being close to record highs following its recovery, Bitcoin is still about 20% lower than it was in July and around 30% lower compared to its predicted peak in March 2024.

This discrepancy offers an attractive chance to invest in Bitcoin, as it’s anticipated that its growth may align with the stock market’s recuperation.

Read Bitcoin’s [BTC] Price Prediction 2024-25

Stablecoin supply increases

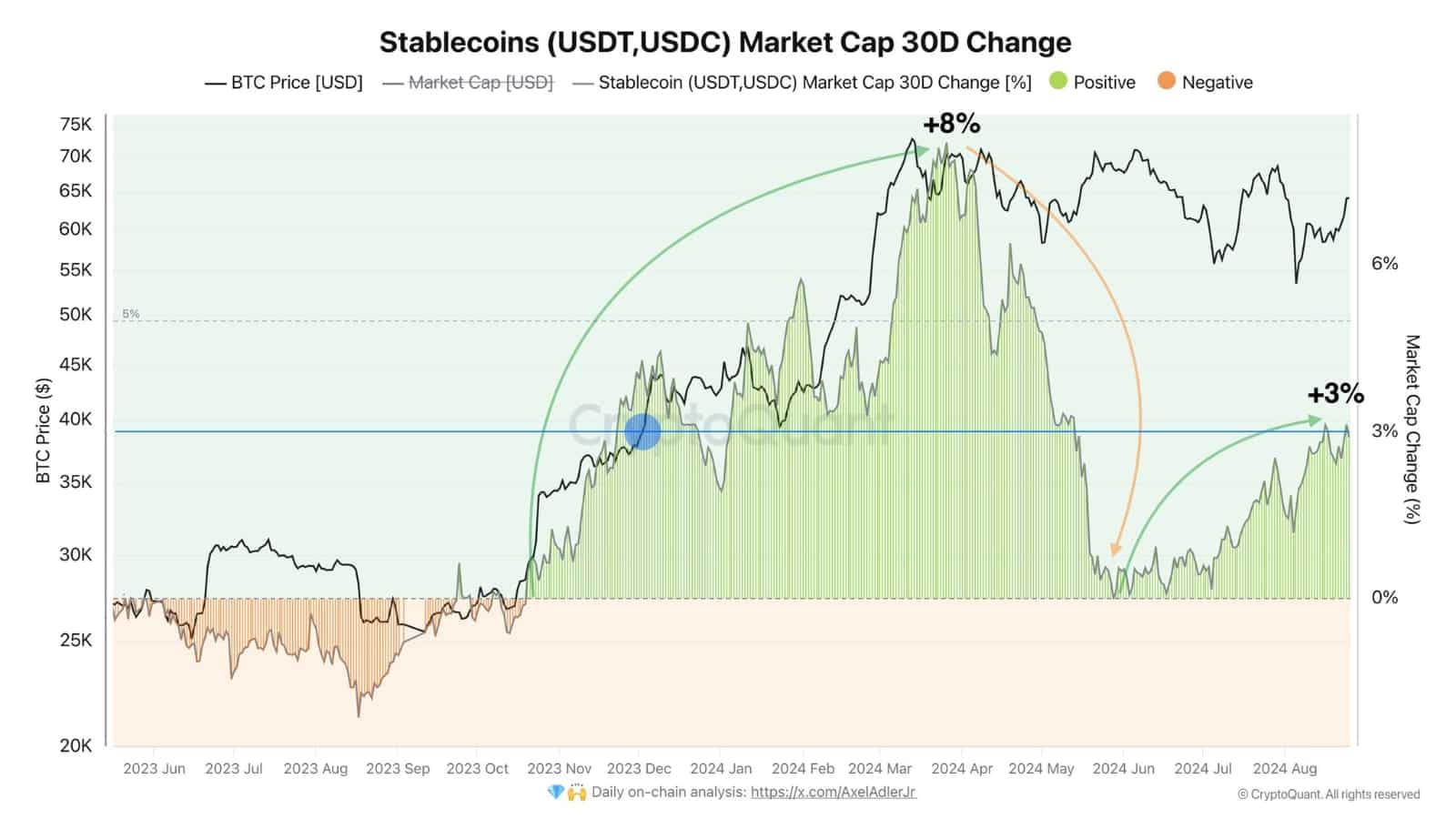

To conclude, the expanding availability of stablecoins such as USDT and USDC is contributing to a rise in Bitcoin’s value. Over the last three months, there has been a 3% increase in their total market value, suggesting that demand for these digital assets is on the upswing.

As the rate at which Bitcoin is produced decreases following the halving event, the escalating desire for it indicates that its value may keep escalating further.

Read More

- WCT PREDICTION. WCT cryptocurrency

- LPT PREDICTION. LPT cryptocurrency

- Chrishell Stause’s Dig at Ex-Husband Justin Hartley Sparks Backlash

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- The Bachelor’s Ben Higgins and Jessica Clarke Welcome Baby Girl with Heartfelt Instagram Post

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- SOL PREDICTION. SOL cryptocurrency

- Grammys Pay Emotional Tribute to Liam Payne in First Honorary Performance

- Has Unforgotten Season 6 Lost Sight of What Fans Loved Most?

2024-08-27 21:12