-

Bitcoin and Ethereum have risen to become one of the most valuable assets globally.

There has been a pause in the uptrends that BTC and ETH saw in the previous week.

As a researcher with experience in the cryptocurrency market, I have witnessed firsthand how Bitcoin and Ethereum have risen to become two of the most valuable assets globally. Their dominance is not just within the crypto market but also in the broader financial landscape.

As a researcher studying the trends in digital currencies, I’ve come across some intriguing findings. The data indicates that Bitcoin (BTC) and Ethereum (ETH) have gained significant influence not just within the cryptocurrency sphere but also in the larger financial world.

As a researcher, I’ve noticed that the market capitalizations of certain entities have experienced substantial growth, placing them on par with the valuations of established, traditional businesses.

Bitcoin and Ethereum features among top assets

According to a analysis of data conducted by Crypto Rank, Bitcoin and Ethereum were among the leading assets in terms of market value.

The data revealed that Bitcoin held the ninth position in terms of market capitalization, amounting to $1.33 trillion. Notably, its market value lagged slightly behind Silver’s, which boasted a larger market cap of $1.8 trillion.

Furthermore, the largest asset by market capitalization was Gold, at $15.7 trillion.

As a cryptocurrency investor, I can share that Ethereum held the 24th spot among all assets with a market capitalization of approximately $455 billion. That’s quite an impressive figure, surpassing the market cap of Mastercard, which stood at around $413 billion.

Bitcoin and Ethereum continue dominance

An examination of cryptocurrency figures from CoinMarketCap revealed that the combined worth of all cryptocurrencies surpassed an astounding $2.5 trillion. Among them, Bitcoin held the largest share with approximately $1.3 trillion, representing nearly 53% of the overall market.

Additionally, Ethereum’s market value exceeded $453 billion, accounting for approximately 18% of the entire market’s worth.

The combined value of Bitcoin and Ethereum represents more than two-thirds of the total cryptocurrency marketcap, implying that their individual price fluctuations carry substantial influence on the broader market trend.

Despite the fact that the overall value of the cryptocurrency market is significantly less than that of gold, it nonetheless carries a considerable worth.

BTC and ETH sees pause in uptrends

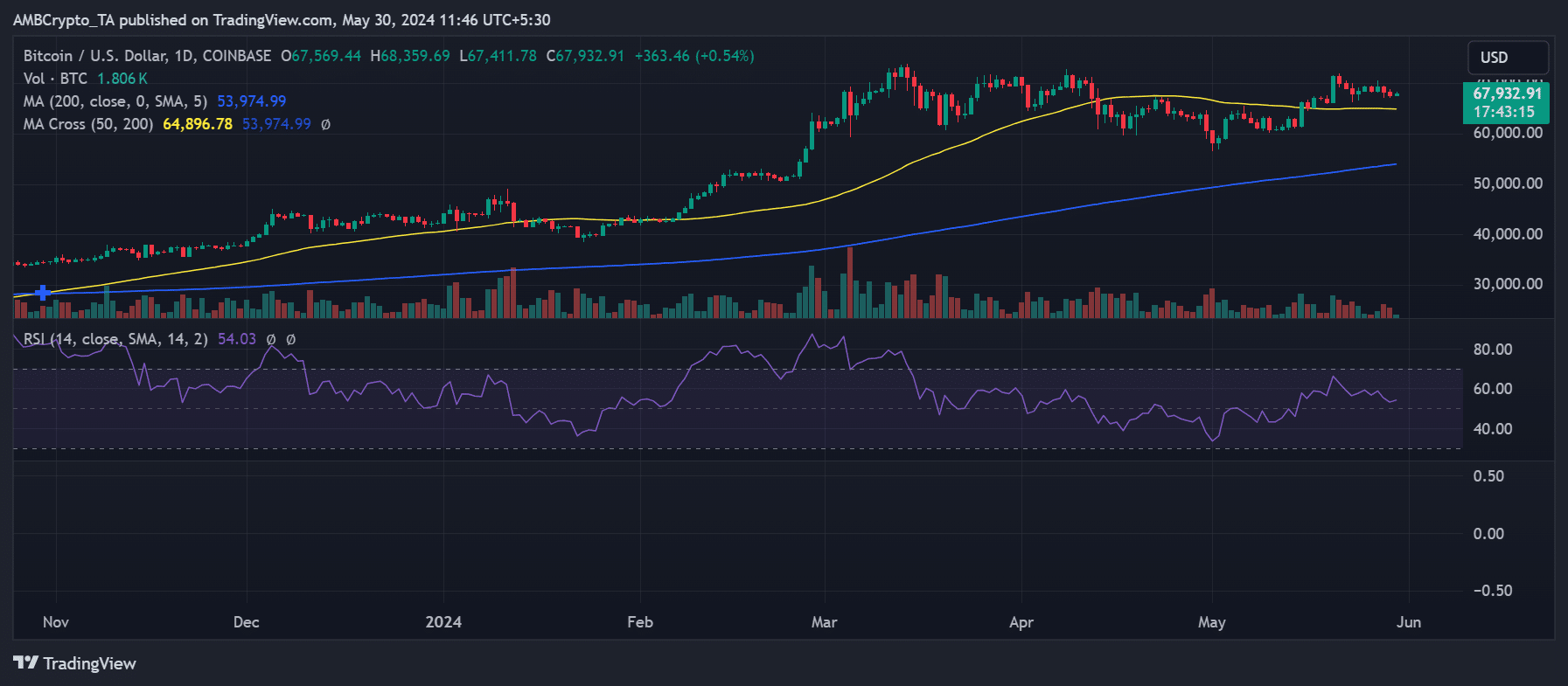

Bitcoin’s value has dipped below the $70,000 threshold in the past few days, causing a decrease in its total market worth. An examination of the daily chart revealed that the cryptocurrency had been oscillating between $68,000 and $69,000 for some time before dropping to approximately $67,000.

By the close of business on May 29th, Bitcoin’s value had dropped more than 1% to roughly $67,500. Currently, its price hovers around $67,900, representing a minimal rise of almost 1%.

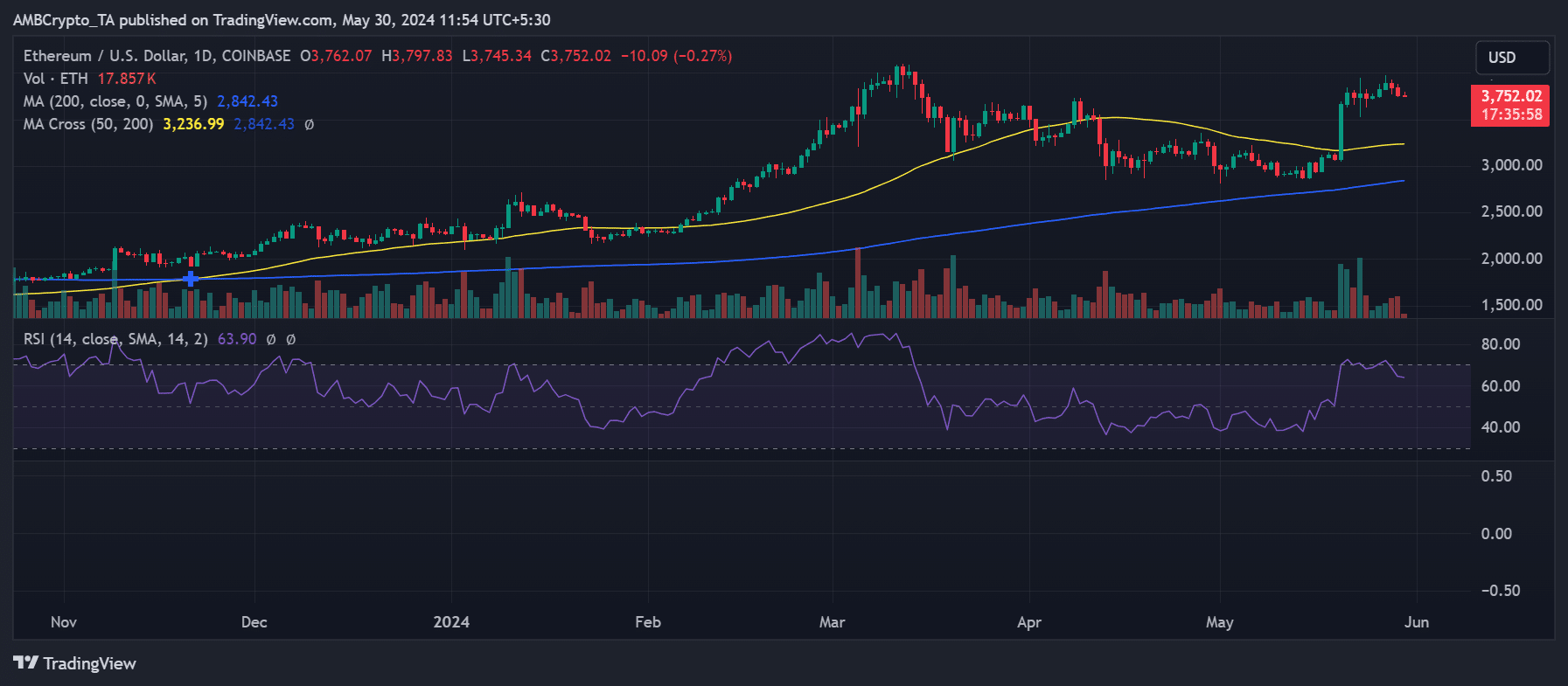

Furthermore, Ethereum has recently experienced a pause in its upward trend.

Realistic or not, here’s ETH market cap in BTC’s terms

As a researcher studying market trends, I’ve observed that the price peaked at approximately $3,890 on May 27th – a level not seen since the surge to around $4,000 in March. However, this upward momentum was short-lived as subsequent declines put a halt to this price increase.

At the close of business on the 29th of May, Ethereum experienced a drop greater than 2% and was valued near $3,762. Currently, its price hovers around $3,750 following a minor decrease.

Read More

- Why Tina Fey’s Netflix Show The Four Seasons Is a Must-Watch Remake of a Classic Romcom

- OM PREDICTION. OM cryptocurrency

- Disney’s Animal Kingdom Says Goodbye to ‘It’s Tough to Be a Bug’ for Zootopia Show

- Jujutsu Kaisen Reveals New Gojo and Geto Image That Will Break Your Heart Before the Movie!

- The Weeknd Shocks Fans with Unforgettable Grammy Stage Comeback!

- Gaming News: Why Kingdom Come Deliverance II is Winning Hearts – A Reader’s Review

- Oblivion Remastered: The Ultimate Race Guide & Tier List

- The Elder Scrolls IV: Oblivion Remastered – How to Complete Canvas the Castle Quest

- WWE’s Braun Strowman Suffers Bloody Beatdown on Saturday Night’s Main Event

- Jay-Z and Diddy Celebrate as Rape Lawsuit is Shockingly Dismissed!

2024-05-30 16:08