- Bitcoin’s price continued to fall in the hour immediately following the pivotal event.

- The gap between Bitcoin’s supply and demand is expected to widen further

Excitedly, Bitcoin went through its fourth halving around 2:19 AM GMT on April 20th. Consequently, miners now earn only 3.12 BTC as rewards instead of the previous 6.25 BTC. This significant occurrence, happening every four years for Bitcoin [BTC], took place once our blockchain reached the 840,000th milestone.

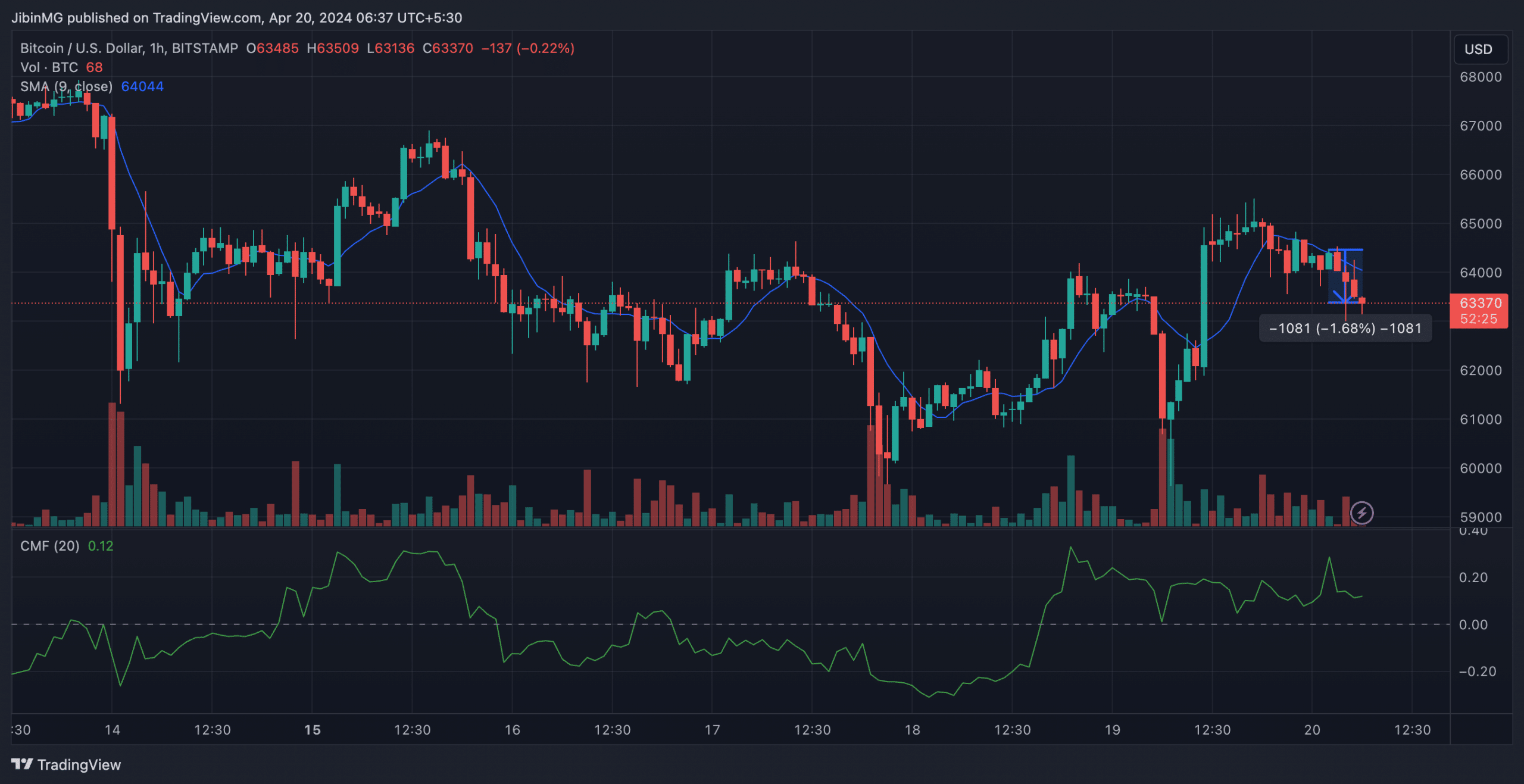

Over the past few weeks, Bitcoin’s price charts have shown considerable fluctuation, as anticipated due to the recent halving event. Currently, Bitcoin is priced at $63,370, representing a nearly 2% decrease in just the previous 6 hours. The technical indicators suggest bearish trends with the Moving Average sitting above the price candles. Conversely, the CMF indicates positive capital inflows as it hovers above zero.

Bitcoin becomes scarcer

Bitcoin was originally designed to function as a currency that resists inflation. In simpler terms, the number of bitcoins in circulation would decrease over time due to periodic halvings until the maximum limit of 21 million is reached. This gradual reduction in supply combined with increasing market demand could potentially enhance its value as a reliable store of wealth, similar to how gold is perceived in the broader economy.

Will the king coin rally?

In simpler terms, market observers believe that the reduction in Bitcoin’s supply, or “halving,” is a positive sign for the cryptocurrency because its price has generally risen following such events in the past.

After the decrease in BTC‘s reward rate in July 2016, its value increased threefold within the subsequent twelve months. Likewise, according to AMBCrypto’s assessment, the most recent halving in May 2020 was followed by a remarkable surge of 500% in BTC’s value over the following year.

A lot depends on ETF demand

In simpler terms, the recent reduction in supply, or halving, is important as we’re currently experiencing a prolonged uptrend in the market.

Bitcoins have seen a huge surge in popularity due to the introduction of Bitcoin ETFs for spot trading in the US market this year. These new investment vehicles have brought in over $12.23 billion collectively since their debut, which averages to around $120 million in Bitcoin inflow daily.

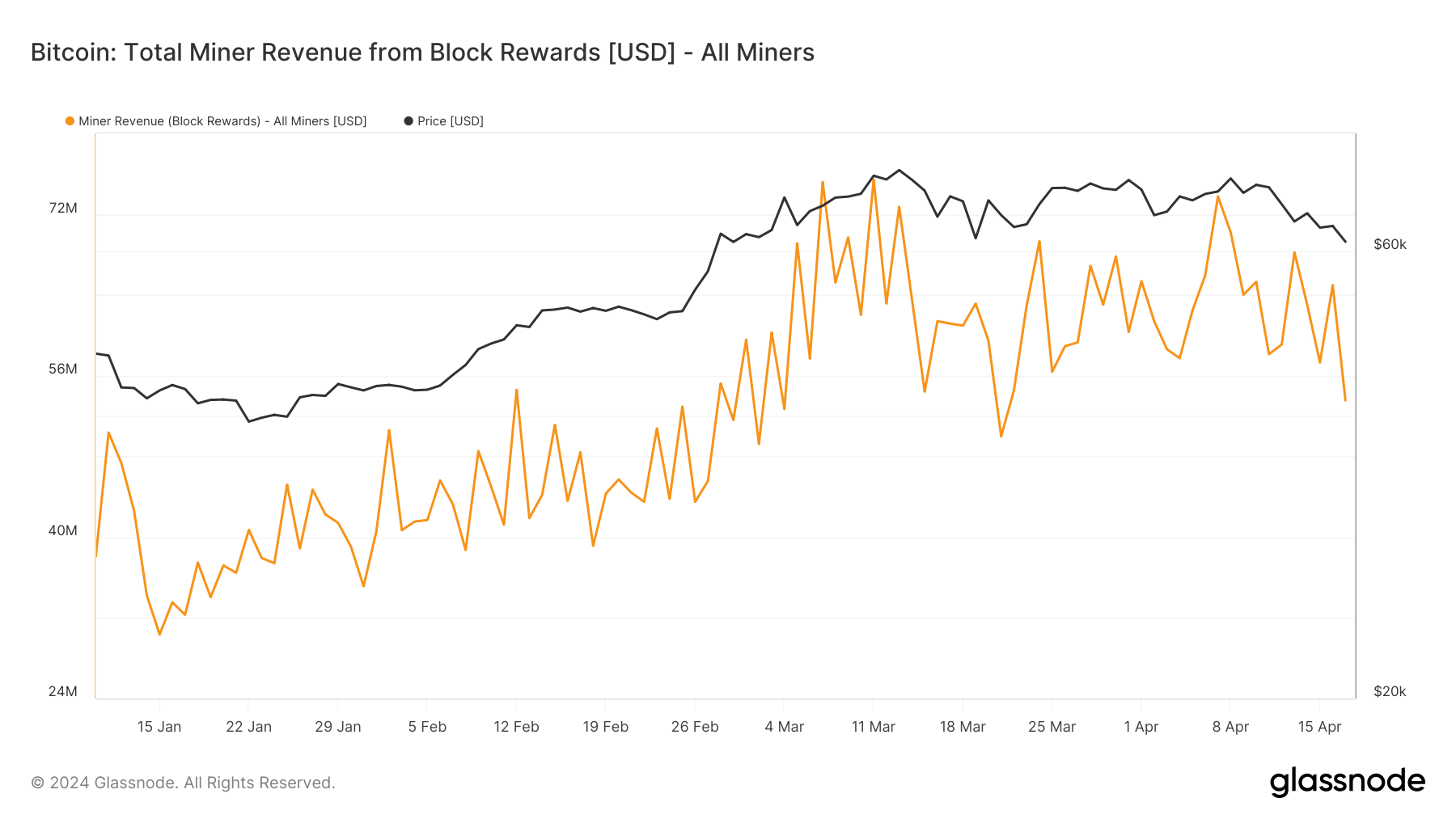

Alternatively, according to AMBCrypto’s findings based on Glassnode’s data, an average of $50 million in new Bitcoins were being mined each day.

At the current moment, the need for Bitcoins is over two times greater than the available supply. As the supply is projected to decrease even more, this gap is likely to expand, leading to a surge in Bitcoin prices.

Read More

- LDO PREDICTION. LDO cryptocurrency

- JASMY PREDICTION. JASMY cryptocurrency

- Can Ethereum ETFs outperform Bitcoin ETFs – Yes or No?

- Chainlink to $20, when? Why analysts are positive about LINK’s future

- Citi analysts upgrade Coinbase stock to ‘BUY’ after +30% rally projection

- Why iShares’ Bitcoin Trust stock surged 13% in 5 days, and what’s ahead

- Spot Solana ETF approvals – Closer than you think?

- Orca crypto price prediction: Buying opportunity ahead, or bull trap?

- Top 10 Stocks and Crypto Robinhood Alternatives & Competitors

- ‘China’s going to have it’ – Donald Trump crypto stance, finally explained

2024-04-20 04:23