For most of my life, numbers like 100,000 felt reserved for things that seemed almost intentionally unobtainable: jelly beans in jars at the county fair, or the amount of unread emails in my father’s inbox. Yet, here we are, staring at Bitcoin tiptoeing toward $100,000, and nobody’s calling it a prank. Give it a week, and your Uber driver will be insisting Bitcoin is a “safe, sensible savings account.”

The real drama isn’t just in the price, but in the sagely whisperings of one Robert Breedlove, who, if Twitter/X bios are to be believed, is basically the Obi-Wan Kenobi of crypto maxis. He’s watching indicators—the kind that apparently sent telegrams to markets before rallies past, which I assume is why my retirement account still looks like a before picture.

Miners: The Unsung, Sweaty Heroes 🛠️

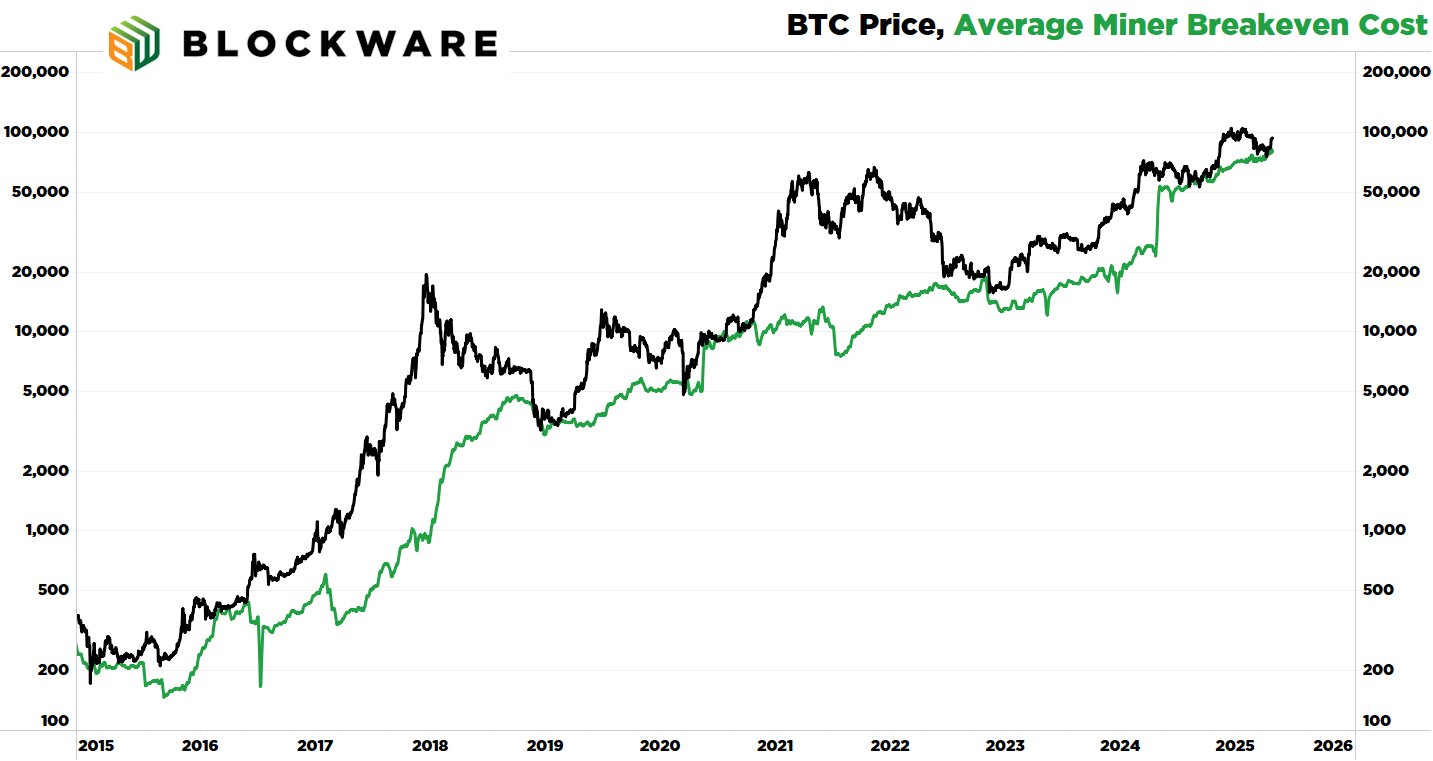

Before you picture an army of sooty-faced men in hard hats, let’s clarify: these miners are more “tech goblin with air conditioner” than “canary-in-a-coalmine.” Breedlove’s using data from Blockware, who gather stats that sound very adult: electricity, hardware, costs. All you need to know is that Bitcoin bottoms out at the miner’s average cost. If you like playing the slots, this is as close to the dealer whispering “now” as you’re likely to get.

It’s happened six times already. You’d think we’d learn by now, but the thrill of possibly guessing wrong is apparently too much for humans to resist. Right now, that indicator is flashing “bottom,” like a neon sign for crypto masochists who missed out three rallies ago.

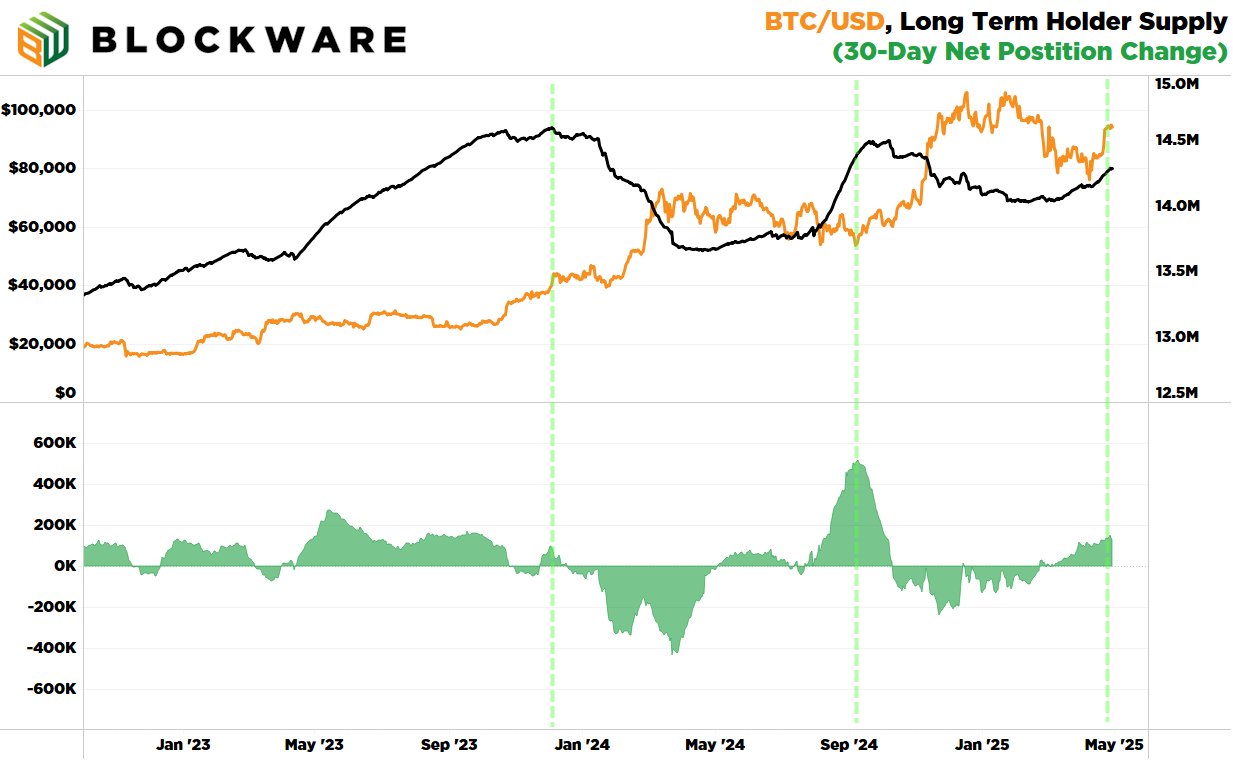

He’s also tracking long-term holder behavior, which works like this: if you haven’t touched your Bitcoin in 155 days, you are officially “convicted.” (My apartment lease doesn’t last that long, and I’m in no way committed to either.)

Fun fact: In the last thirty days, these “convicts” have hoarded 150,000 more Bitcoin. If selling pressure goes down any further, you’ll need to physically wrestle a Bitcoin out of someone’s cold, diamond hands.

So if $80,000 – $100,000 sounds like a scary range, congratulations! The smart money is apparently digging in for the long haul, while the rest of us are scraping couch cushions for more fiat to FOMO in.

Liquidity: Because Who Doesn’t Love Free Money? 💸

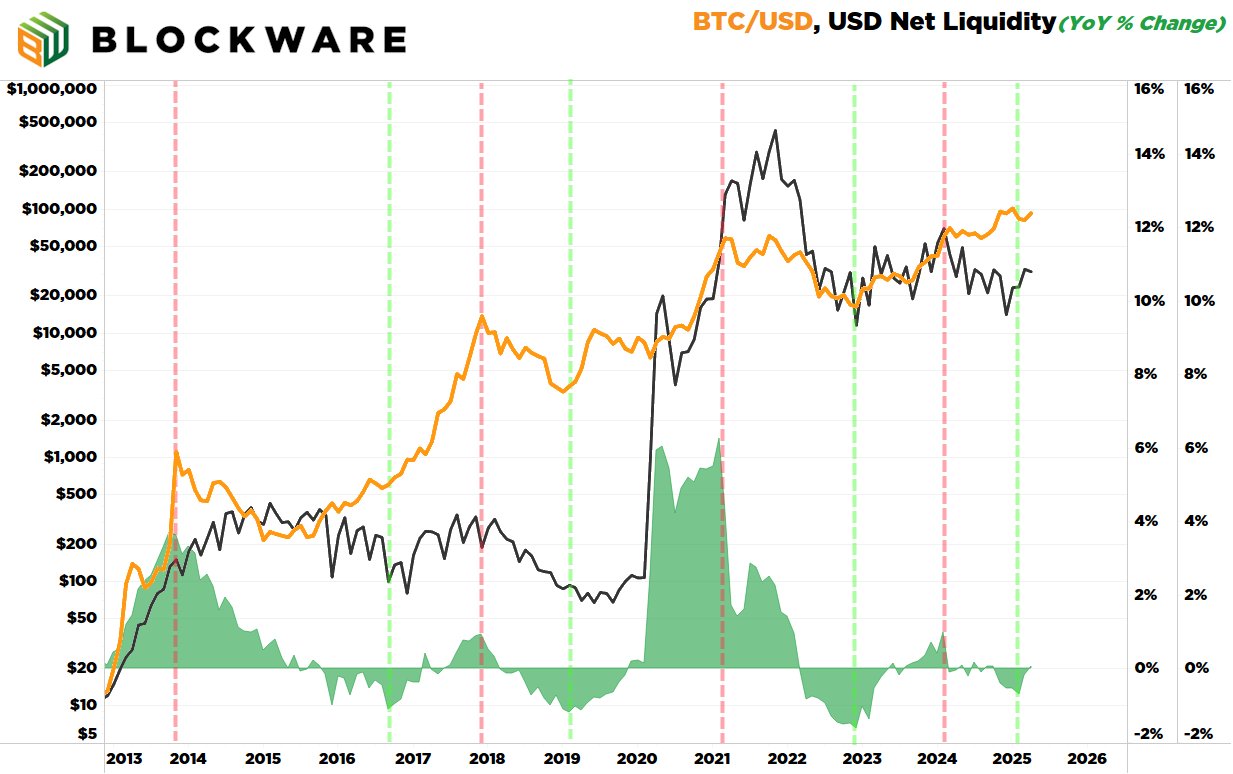

Breedlove’s got a point: as long as governments print money like they’re playing Monopoly, more dollars slosh into markets, looking for a little harmless speculation. With Bitcoin now flaunting ETFs, you can lose your savings faster and more conveniently than ever before.

This extra liquidity is like the world’s most aggressive leaf blower, sending everything sky-high until someone in regulation remembers to read the manual.

He wraps up by muttering soothing things about Bitcoin’s “unchanged fundamentals”: limited supply, ten-minute blocks, halving events—basically, the comfort blanket for the terminally optimistic. But the real show’s off-stage, with liquidity flows, ETFs, and one boardroom after another selling grandma’s savings for the promise of blockchain glory.

Breedlove’s final “a-ha”: more dollars sloshing around means more bidders for Bitcoin. In other news, water is wet, and I still don’t have a yacht.

Bitcoin’s tight with fiat liquidity these days—so if you spot an ETF brochure at your dentist’s office, don’t say I didn’t warn you.

— Robert ₿reedlove (@Breedlove22) May 1, 2025

Read More

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- ‘The budget card to beat right now’ — Radeon RX 9060 XT reviews are in, and it looks like a win for AMD

- Valorant Champions 2025: Paris Set to Host Esports’ Premier Event Across Two Iconic Venues

- Forza Horizon 5 Update Available Now, Includes Several PS5-Specific Fixes

- Gold Rate Forecast

- Street Fighter 6 Game-Key Card on Switch 2 is Considered to be a Digital Copy by Capcom

- The Lowdown on Labubu: What to Know About the Viral Toy

- Karate Kid: Legends Hits Important Global Box Office Milestone, Showing Promise Despite 59% RT Score

- Mario Kart World Sold More Than 780,000 Physical Copies in Japan in First Three Days

2025-05-03 15:08