-

Is China waiting for US FED’s rates decision before pumping the liquidity machine?

Liquidity to drive market rallies for BTC and altcoins

As a seasoned researcher with over a decade of experience in financial markets, I’ve learned to keep a keen eye on patterns and trends that may hint at future market movements. With my finger firmly on the pulse of global economic developments, I can confidently say that China seems to be gearing up for another liquidity injection, possibly following the Federal Reserve’s rate decision on September 18th.

China is prepared to introduce a large amount of money into its economy, potentially causing an increase in Bitcoin [BTC] and various cryptocurrencies, as suggested by user X and market analyst Quinten.

It’s common for the People’s Bank of China to boost liquidity during the month of August. For instance, they injected funds on August 11th in 2020, August 31st in 2021, and August 28th in both 2022 and 2023.

Although there was a brief liquidity boost in June, there has been little activity since.

It’s possible that China is holding off on increasing its liquidity until the U.S. Federal Reserve reduces interest rates (potentially on September 18th). If this occurs, it could lead to a boost in global liquidity levels.

Historic post-halving BTC consolidation in play

Despite recent downturns, the cryptocurrency market continues to show positive momentum, disproving those who forecasted a bearish trend.

Right now, Bitcoin is going through its usual period of consolidation following a halving, which typically comes before a major price surge. Add to that China’s anticipated increase in liquidity, and it seems the cryptocurrency market might be on the verge of experiencing a significant growth spurt.

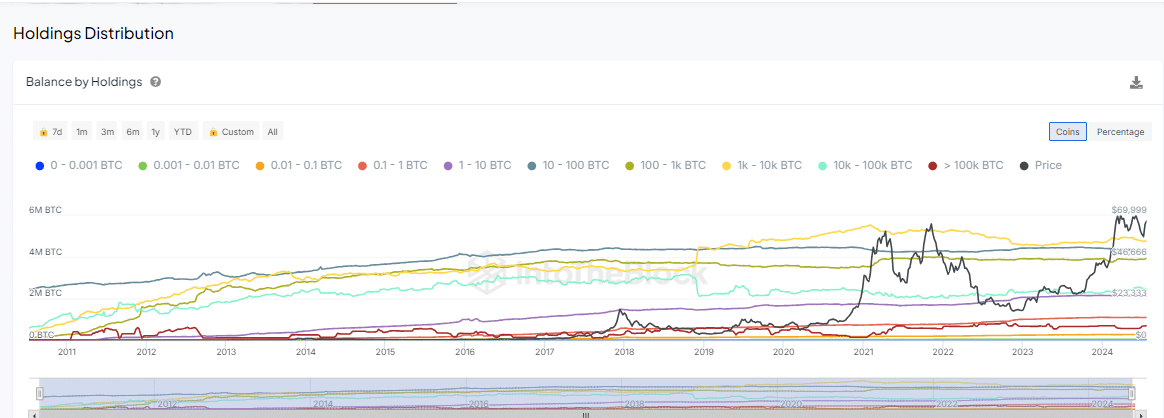

Examining BTC address holdings on IntoTheBlock shows little movement, suggesting accumulation.

During this stage, we often see it precede substantial market growth. It signifies a time when both traders and investors are actively making transactions.

Based on the existing buildup, there’s a strong indication that Bitcoin (BTC) and other cryptocurrencies’ prices could surge. This prediction is largely due to an expected boost in liquidity in the market.

BTC’s double bottom forms below the daily 200 EMA

The graph indicating Bitcoin’s price demonstrates a double bottom that lies beneath its 200-day Exponential Moving Average (EMA). This specific pattern is typically interpreted as a precursor to an upward trend in the market.

Based on my extensive experience as a trader, I find that the convergence of a retest on the lower band of the Gaussian channel and the daily 200 EMA can be a significant indicator for potential trading opportunities. This combination has proven to be a reliable signal in my personal journey, providing insights into market trends and helping me make informed decisions. It’s essential to remember that every trade carries risk, but when these two factors align, it could potentially indicate a profitable opportunity if approached with caution and proper analysis.

As a crypto investor, I’m observing some robust signs that hint at an imminent surge in Bitcoin prices. Particularly noteworthy is the positive impact expected from China’s recent liquidity injections, which could potentially accelerate its growth trajectory.

Massive weekly candle for the entire market

As an analyst, I’ve noticed a compelling bullish signal emerging. The expected liquidity influx is reflected in a robust, long weekly candle. Moreover, the market’s resistance to a significant downward movement during this period, represented by the rejection wick, underscores the strength of the bullish trend.

Indications point toward a possible increase in the value of Bitcoin, Ethereum, and other altcoins within the next few weeks. Significant buying interest is evident at support levels across various time frames, which strengthens the belief that the market will trend upward.

Read More

2024-08-12 06:16