Market analyst Ali Martinez has revealed data suggesting that Bitcoin could be worth $130,000, but under one specific condition. This optimistic forecast was made after a minor 2.6% increase in price over the last two days, moving Bitcoin’s value into the vicinity of $118,000.

$110K Emerges As Crucial Bitcoin Support Zone – Here’s Why

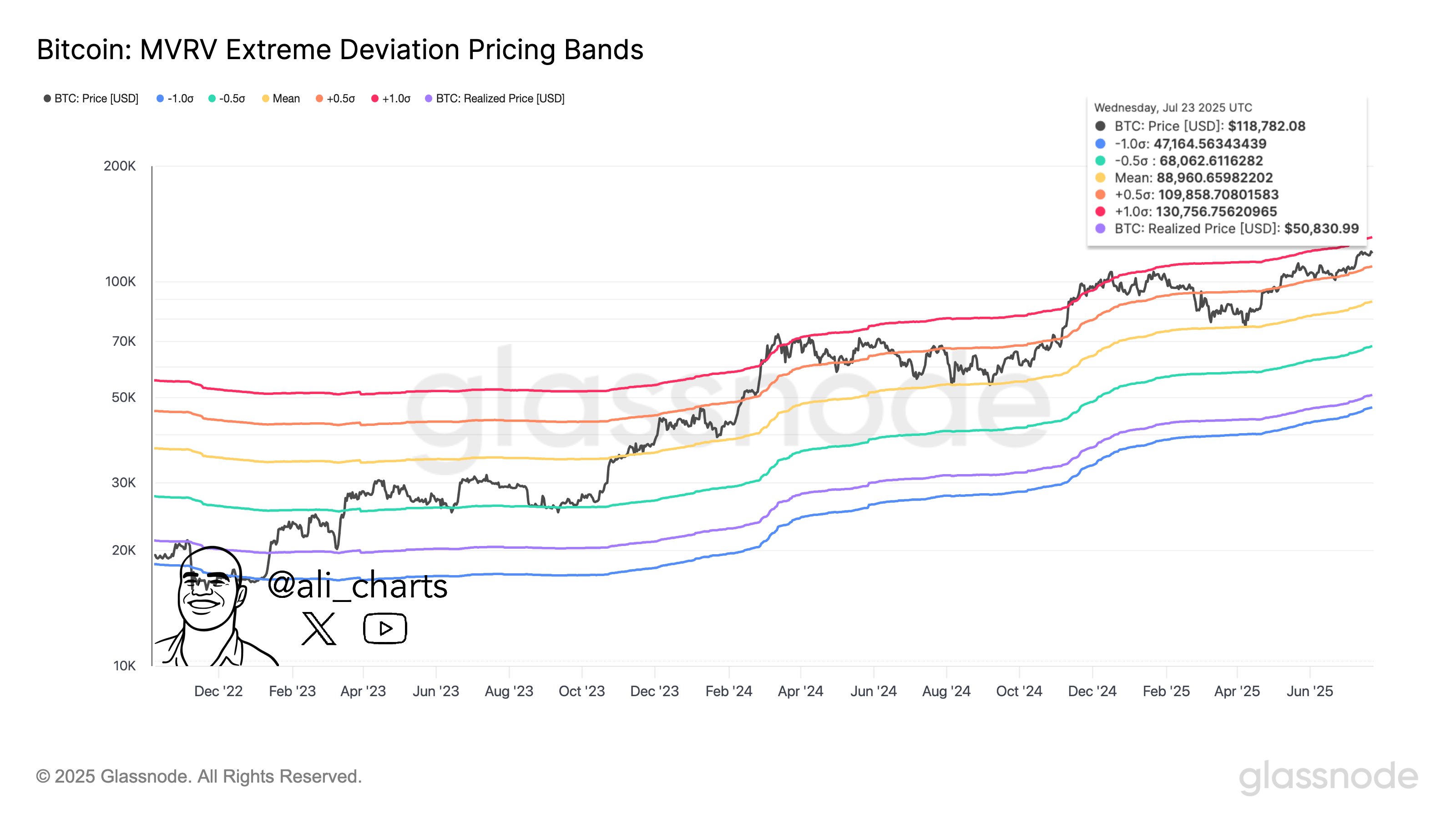

According to a post on July 26 by Ali Martinez, it’s possible that Bitcoin could experience a substantial increase in value according to data from MVRV pricing bands provided by Glassnode. However, for this bullish prediction to remain valid, Bitcoin needs to steer clear of a specific support level to prevent a potential contradiction of this theory.

The MVRV bands, calculated using Market Value to Realized Value (MVRV) ratios, offer a way to visually determine if Bitcoin is currently overpriced or underpriced compared to its historical average market price. These bands operate similar to Bollinger Bands but are rooted in the fundamentals of the blockchain, measuring fluctuations around the average MVRV value by examining statistical deviations.

By July 23, 2025, Bitcoin was being traded around $118,782, having risen steadily in recent weeks. Using the MVRV pricing model, Bitcoin was close to the +1.0σ deviation band, which stood at $130,756. This price level is considered a significant resistance and potential target for future prices. Interestingly, the +1.0σ band is also seen as a critical zone of intense market optimism, frequently preceding local peaks (+2.0σ).

Instead, it’s worth noting that the model’s safety zone, located 0.5 standard deviations below the current market prices, was found at roughly $109,858 less than the current values. This level is crucial as it provides significant support. According to analyst Ali Marinez, Bitcoin needs to keep its price above this level for a strong likelihood of continuing towards the 1-standard deviation target based on past trends. However, if the price drops below $110,000, it might indicate a more substantial correction, possibly reaching as low as the mean band at approximately $88,960 or even lower to around $68,062 (-0.5 standard deviations).

Bitcoin Investors Take Profits With Rising Market Confidence

As an analyst, I’ve been closely examining the MVRV model data, and it appears that the gap between Bitcoin’s current market price and its realized price of approximately $50,831 is expanding. This discrepancy suggests a growing conviction among investors about the potential value of Bitcoin. To put it in simpler terms, the realized price signifies the average cost at which all circulating Bitcoins were bought, so a larger gap means more Bitcoin holders are currently profitable.

As an analyst, I’m reporting that at the moment of my analysis, Bitcoin is trading at approximately $118,178. Over the past day, there has been a slight increase of 0.73%. However, it’s important to note that the daily trading volume has significantly decreased by around 53.39%, currently valued at roughly $47.98 billion. Looking ahead, according to Coincodex, the Bitcoin market sentiment remains predominantly bullish, with the Fear & Greed Index inching towards extreme greed, standing at 72. This suggests that investor enthusiasm is high, but caution should be exercised as such levels can sometimes indicate overoptimism.

According to the predictions made by the analysts at Coincodex, it is anticipated that the top cryptocurrency will continue its current uptrend, potentially reaching a value of $122,019 within the next five days. Over the course of a month, this figure could further increase to approximately $141,075.

Read More

- How to Get the Bloodfeather Set in Enshrouded

- Gold Rate Forecast

- 10 Movies That Were Secretly Sequels

- USD JPY PREDICTION

- 4 TV Shows To Watch While You Wait for Wednesday Season 3

- 32 Kids Movies From The ’90s I Still Like Despite Being Kind Of Terrible

- One of the Best EA Games Ever Is Now Less Than $2 for a Limited Time

- Best Werewolf Movies (October 2025)

- Auto 9 Upgrade Guide RoboCop Unfinished Business Chips & Boards Guide

- Uncovering Hidden Order: AI Spots Phase Transitions in Complex Systems

2025-07-28 00:00