- BTC was trading in a symmetrical triangle pattern that could trigger a major breakout to the upside.

- Market sentiment also suggests room for Bitcoin to climb even higher, potentially reaching $71,000.

As a seasoned researcher with a penchant for understanding market trends and patterns, I find the current state of Bitcoin (BTC) quite intriguing. The symmetrical triangle pattern suggests a potential major breakout to the upside, which aligns with my personal experience of navigating through various market cycles over the years.

For approximately four weeks now, Bitcoin [BTC] has experienced a steady rise of around 7.87%. On a weekly scale, it’s climbed by approximately 8.97%, while day-to-day increases amount to roughly 0.18%. These figures suggest a gradual yet persistent upward trajectory, strengthening the prevailing optimistic forecast.

In simpler terms, AMBCrypto has examined the possibility of a rise in Bitcoin’s price and the elements that could impact its direction of travel.

BTC is bullish, but must overcome resistance

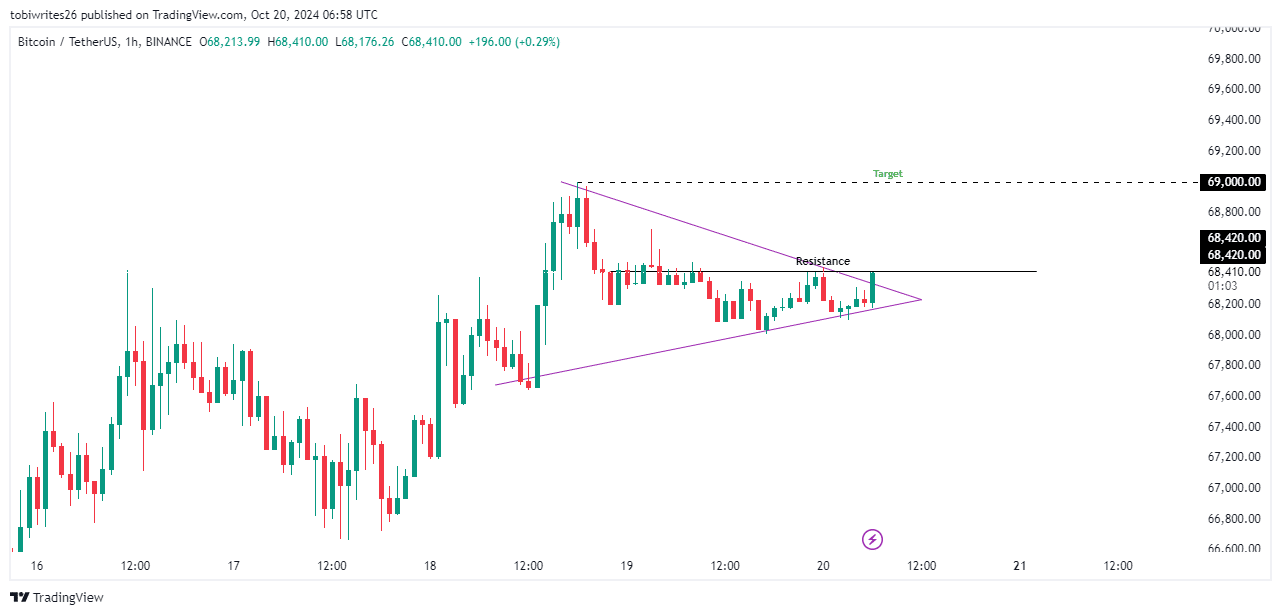

At the current moment, Bitcoin was moving inside an ascending and descending symmetrical channel over the course of an hour, alternating between strengthening support and resistance levels. This pattern often signals a period of bullish consolidation, hinting at possible price increase in the future.

To bring about this upcoming rally, Bitcoin needs to surpass the current resistance at approximately $68,420. Once it does, this level could then serve as a new base or foundation, which would be crucial in maintaining further price growth.

Should Bitcoin manage to break through the current resistance, a significant future goal could be around $69,000 – that’s where the top of the channel is located.

If this breakthrough doesn’t happen, Bitcoin (BTC) might keep showing positive signs (bullish tendencies), but it could be stuck in the accumulation stage until there’s a surge in demand (stronger buying momentum).

BTC accumulation phase is confirmed

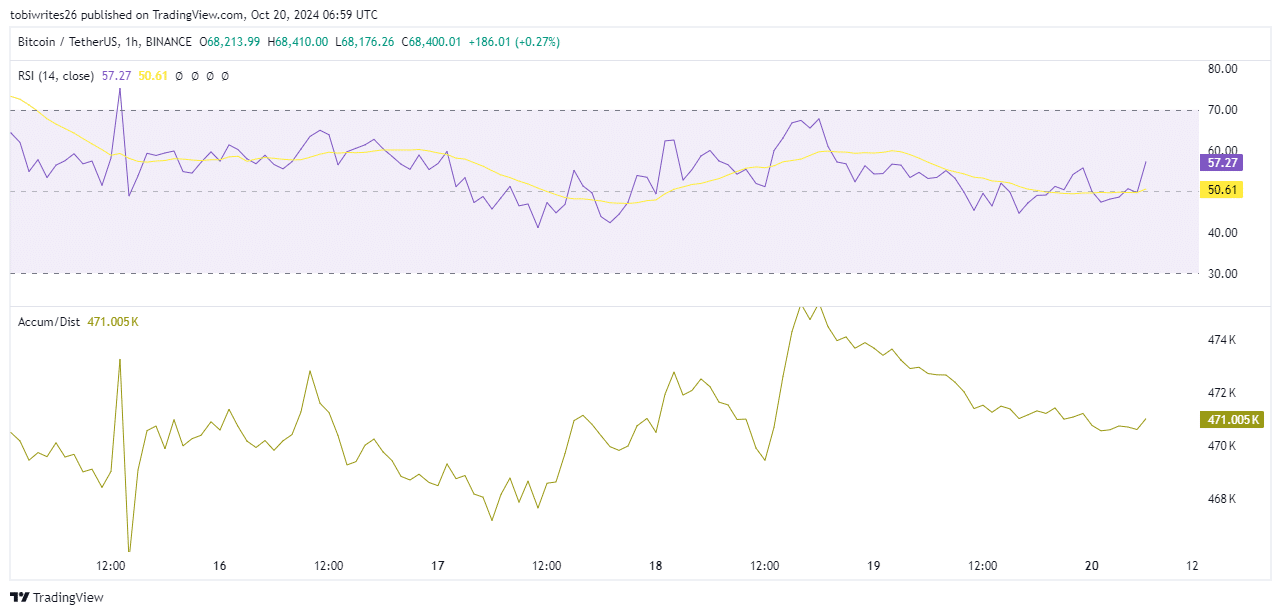

The increased fascination towards Bitcoin is apparent, with the Accumulation/Distribution (A/D) indicator and the Relative Strength Index (RSI) both indicating a rise in interest.

Based on its readings, the A/D (Accumulation-Distribution) indicator reveals that investors are presently amassing Bitcoin, suggesting they anticipate a substantial price rise. This suggests a robust buying enthusiasm among market players.

In a similar vein, the Relative Strength Index (RSI) has been climbing, surging above the non-directional zone at 57.27. This pattern implies that Bitcoin’s price may continue to ascend, offering promising prospects for long-term investors and holders who might reap higher rewards.

The current positive trend is likely to continue, aiming for a near-term goal around $69,000. After reaching this level, a reassessment of potential future targets will be made based on the ongoing market movement.

Long-term bullish outlook

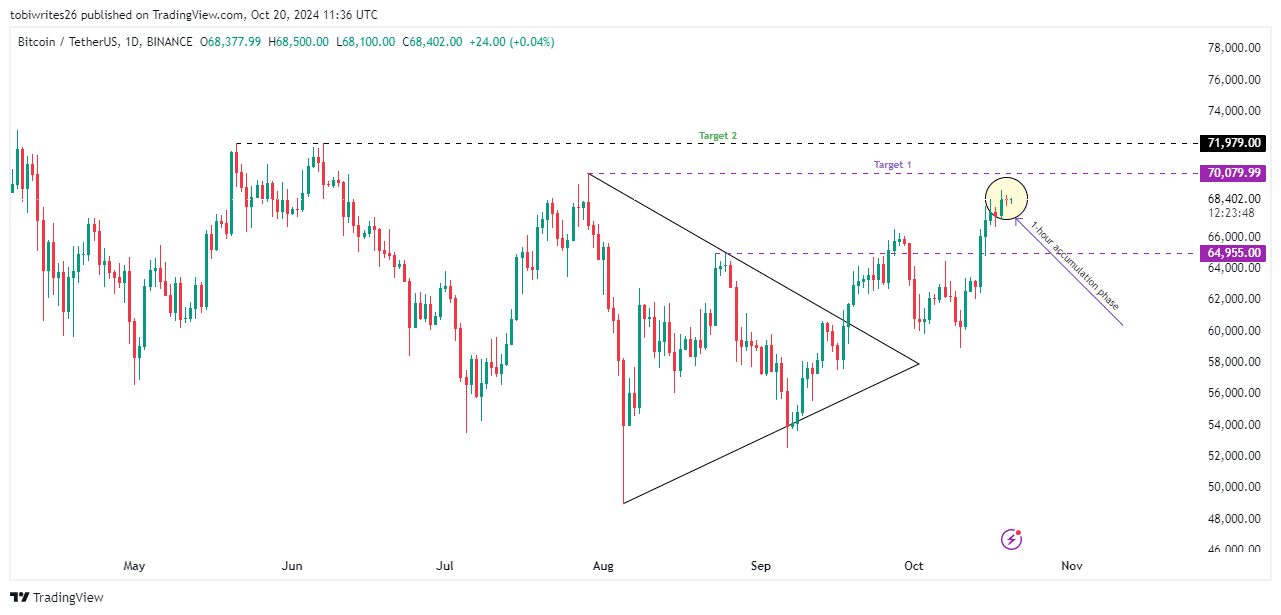

On a day-by-day basis, Bitcoin continues to exhibit bullish trends, drawing closer to the top of the symmetrical trading range it’s been moving within.

Read Bitcoin (BTC) Price Prediction 2024-25

As an analyst, I foresee two significant milestones for Bitcoin (BTC) from its current price point. The first target lies around $70,079.99, which represents the peak of the identified channel. The second objective is situated at approximately $71,979.00, a location marked by a substantial liquidity grouping.

If the current trends keep supporting the buyers, it’s just a question of when Bitcoin will hit those newly set goals.

Read More

- Solo Leveling Season 3: What You NEED to Know!

- OM PREDICTION. OM cryptocurrency

- Oshi no Ko Season 3: Release Date, Cast, and What to Expect!

- Serena Williams’ Husband’s Jaw-Dropping Reaction to Her Halftime Show!

- Lisa Rinna’s Jaw-Dropping Blonde Bombshell Takeover at Paris Fashion Week!

- Rachel Zegler Claps Back at Critics While Ignoring Snow White Controversies!

- Oblivion Remastered – Ring of Namira Quest Guide

- Oblivion Remastered: The Ultimate Race Guide & Tier List

- Captain America: Brave New World’s Shocking Leader Design Change Explained!

- Why Tina Fey’s Netflix Show The Four Seasons Is a Must-Watch Remake of a Classic Romcom

2024-10-21 12:07