- Gox FUD threatens to push Bitcoin prices lower despite the latest recovery attempts.

- A look at the next potential price bottom based on Fibonacci, if BTC bears extend their dominance.

As a seasoned crypto investor with a fair share of battle scars from past market turmoils, I can’t help but feel a sense of deja vu as the Mt. Gox FUD re-emerges and threatens to push Bitcoin prices lower. The last time we saw such a spectacle was during the infamous Mt. Gox hack back in 2014, which sent shockwaves through the crypto community and led to a significant market downturn.

For the past six days, Bitcoin [BTC] has shown a continuous drop in value. This trend appears to be driven by a general sense of caution related to the upcoming U.S. elections. However, a fresh wave of uncertainty or negative news (FUD) could potentially deepen this downturn in the near future.

It appears that the Bitcoin stored in the wallet connected to Mt. Gox has moved to a different, unidentified wallet. This transfer equated to approximately 32,371 Bitcoins, which is valued around $2.9 billion based on current estimates.

Many analysts have been expecting a bearish outcome when the Mt. Gox payout eventually takes place.

The predominant pessimism stems from investors who’ve been patiently waiting for payments over several years, already enjoying substantial profits.

Consequently, they could find themselves motivated to cash out, possibly leading to a significant drop in the price of Bitcoin again.

Will Mt. Gox FUD add more fuel to the Bitcoin bears?

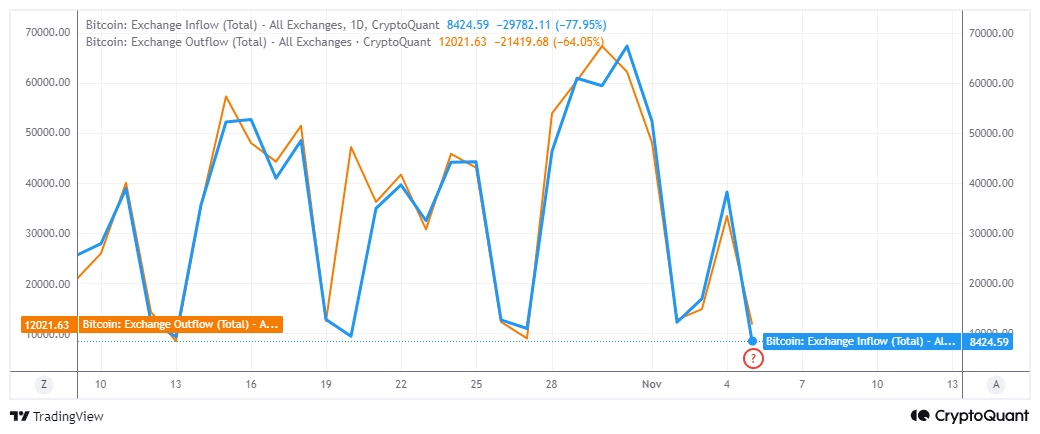

Since the end of October, exchange flows have been steadily decreasing and have now reached a significantly low level that is notable in historical context.

It’s possible that we may witness a significant shift, implying the conflict between Bitcoin bulls and bears might become more intense.

However, the odds of a strong bullish recovery are lower, especially now that Mt. Gox FUD is adding to the selling pressure previously fueled by U.S. election concerns.

In the past day, the inflow of Bitcoins into exchanges has decreased to approximately 8,424 coins, as I write this.

The outgoing Bitcoin transfers amounted to a significant 12,021 BTC, implying that the selling frenzy seemed to subside, thereby creating opportunities for buyers to capitalize on reduced prices.

In simpler terms, there has been a slight improvement over the past day due to more money going out of the country than coming in.

Currently, Bitcoin (BTC) has rebounded to $68,778 following a dip to $66,813 the day prior. This recovery took place before the Mt. Gox announcement, suggesting that the news could potentially undo the slight regained trust within the market.

But what should traders expect in case the bears resume dominance?

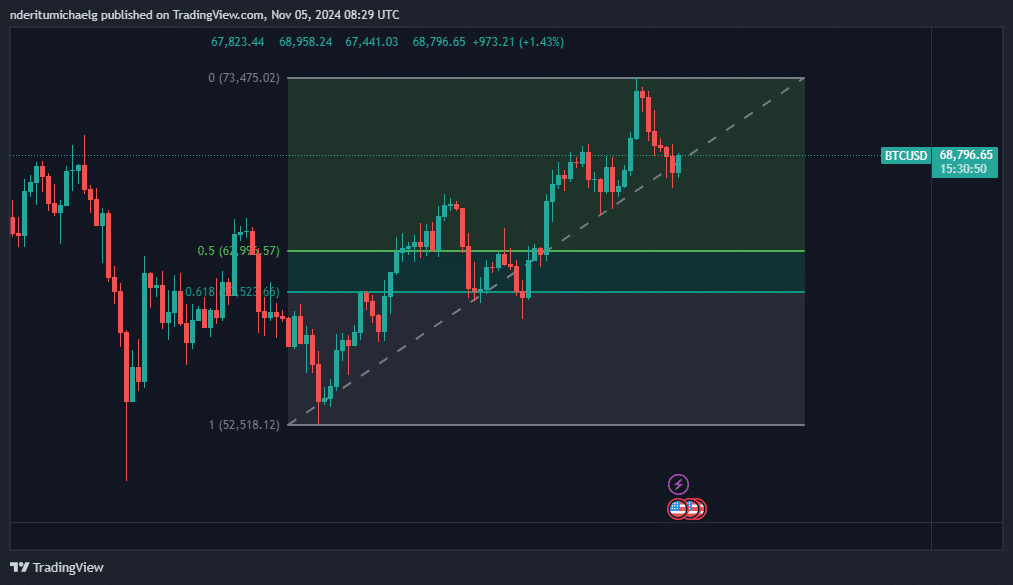

According to Fibonacci retracement analysis, Bitcoin’s next significant support level might be situated between $60,000 and $63,000. This prediction is derived from the upward trend that began at the September lows and peaked during the October high points.

Read Bitcoin (BTC) Price Prediction 2024-25

As an analyst, I am considering the possibility of Bitcoin potentially dipping back towards the $60,000 region. However, the outcome of the U.S. election could help protect the price from further declines.

A favorable outcome may send BTC back above the $70,000 range, but that remains to be seen.

Read More

- Gold Rate Forecast

- Rick and Morty Season 8: Release Date SHOCK!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- PI PREDICTION. PI cryptocurrency

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

2024-11-05 22:15