-

Bitcoin whales have been accumulating for six weeks.

BTC has continued to meander around the $60,000 price level.

As a seasoned crypto investor with a knack for spotting market trends, I find the recent accumulation of Bitcoin by mid-sized whales intriguing. Having witnessed several market cycles, I can sense the growing confidence in the price prospects of BTC, as these holders are strategically positioning themselves for potential gains.

In the past 48 hours, Bitcoin (BTC) has made a strong advancement, managing to surpass the significant $60,000 mark at the current reporting.

As an analyst, I’ve noticed that this particular level, historically acting as a substantial psychological hurdle, has been a point of fluctuation for Bitcoin as the market responds to the resurgence in bullish sentiments.

With Bitcoin’s price finding it difficult to sustain levels above $60,000, some large-scale investors (whales) capitalized on this situation by purchasing additional Bitcoins.

Weeks of whale accumulation

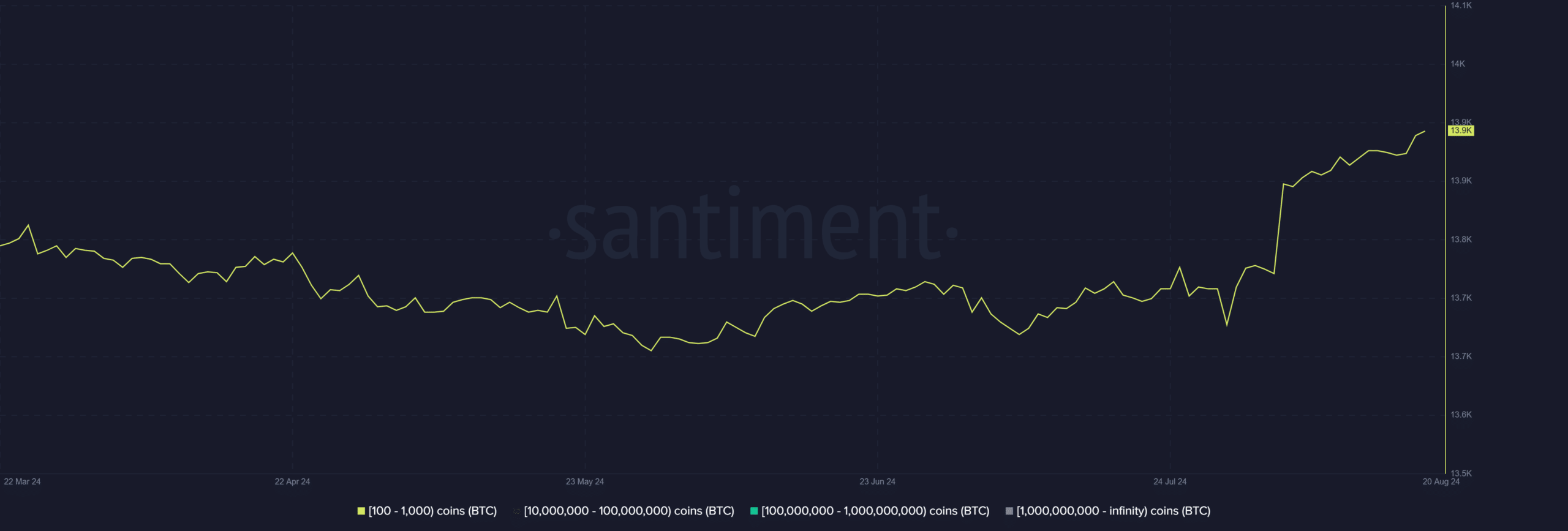

An examination of Bitcoin wallets classified as ‘whales’ (holding between 100 and 1,000 Bitcoins) has shown a marked increase in these larger investors buying more Bitcoin.

Earlier, we noticed a small drop in the count of these Bitcoin addresses, implying that some owners may have been disposing or transferring their BTC assets during that timeframe.

On the other hand, there’s been a change in direction, showing a noticeable rise in the quantity of wallets that own between 100 and 1,000 Bitcoins.

Based on my years of observing and participating in the cryptocurrency market, it appears that middle-sized investors, who often hold significant sway, have resumed buying Bitcoin once more. This trend seems to indicate a renewed confidence in the digital currency’s potential for growth and stability, which aligns with my own positive outlook on its future prospects.

Over the past six weeks, these addresses have collectively accumulated approximately 94,700 more BTC, representing a 2.44% increase in their holdings.

An uptick in Bitcoin stored in these accounts might lend stability to Bitcoin’s value, especially as it endeavors to sustain and strengthen its latest milestone at $60,000.

Possible implications of these accumulations

As a crypto investor, I’ve noticed an increase in the amount of Bitcoin (BTC) being amassed by mid-tier whales – those with between 100 to 1,000 BTC. This accumulation suggests that these investors are becoming more confident about Bitcoin’s potential price growth, signaling a positive outlook for the digital currency.

It’s plausible that these holders are preparing for additional profits by tactfully stockpiling more Bitcoin.

If this increasing stacking pattern continues, there might be less urge to sell Bitcoin among these medium-scale investors, as they’ve boosted their holdings and could choose to keep them for now instead of selling right away.

Engaging in this holding pattern might help maintain stability in Bitcoin’s value, particularly when demand stays consistent or grows further.

As a crypto investor, I’ve noticed that accumulation seems to be the prevailing strategy right now, but I can’t help but anticipate a potential massive price increase. Such an uptick might trigger some investors to cash in their profits, which could impact the market dynamics.

Medium-sized whales, holding a significant amount of shares at lower price points, might decide to sell when prices rise, potentially increasing the supply in the market and causing a drop in prices.

On the other hand, it’s probable that this event will take place following the accumulation stage, and at present, the general feeling seems to support keeping rather than instant selling off.

Bitcoin sees a slight recovery

Over the past day, Bitcoin’s price has shown a favorable upward movement, mirroring increasing market energy.

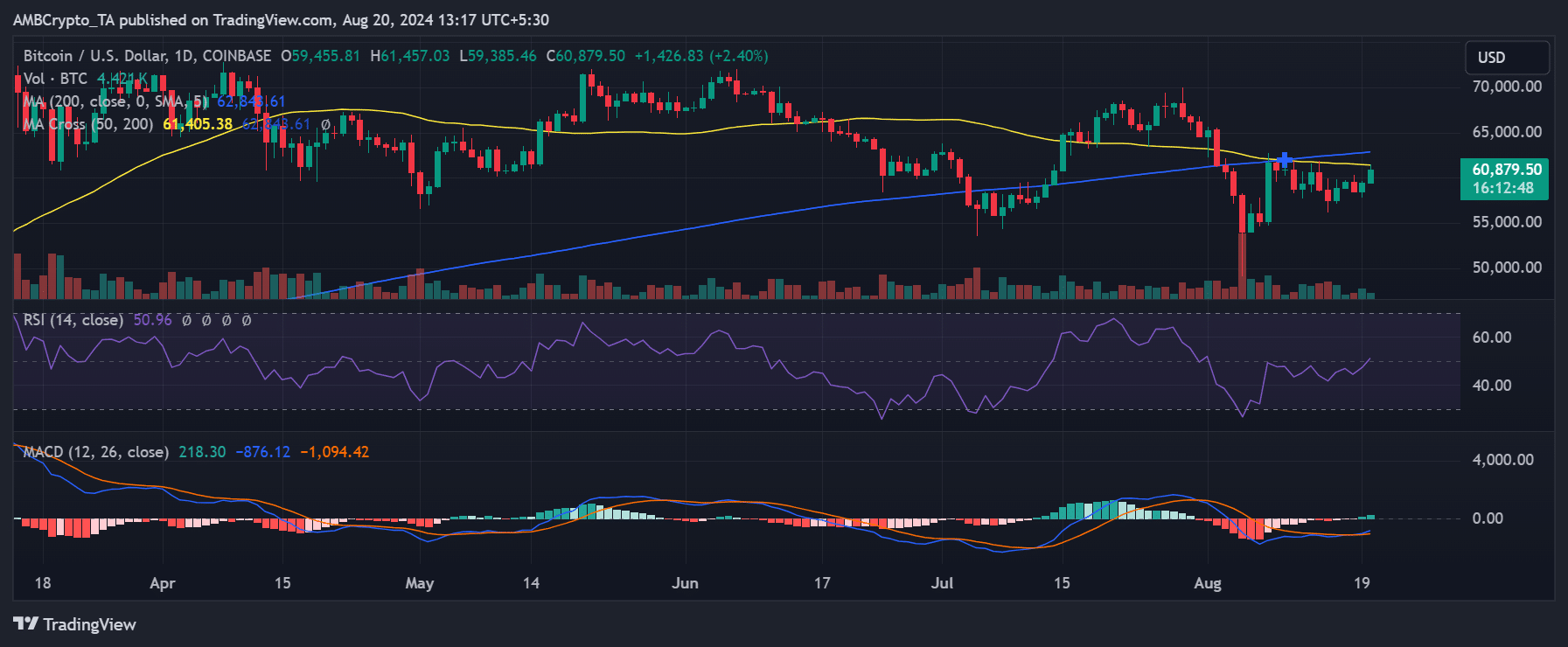

Based on an assessment by AMBCrypto, Bitcoin experienced a rise of approximately 1.74% during the last trading day, causing its value to approximate $59,400.

Currently, Bitcoin is surging, having climbed to around $60,800 following a 2% boost in value.

Lately, the price fluctuations have nudged Bitcoin’s Relative Strength Index (RSI) marginally over the neutral threshold, hinting at a transition towards a more optimistic outlook among investors.

As the Relative Strength Index (RSI) moved beyond its neutral point, it implied an increasing dominance of buying forces over selling forces. This might be a sign that the asset’s value could continue to rise if the current trend persists.

Despite the rise in price, large investors holding between 100 and 1,000 Bitcoin have yet to show substantial reaction towards this uptrend.

Read Bitcoin’s [BTC] Price Prediction 2024-25

These locations could currently be in a monitoring stage, watching closely as the market evolves, ready to act significantly once they have a clearer picture of its direction.

In the coming days, I’ll be closely monitoring the ongoing buildup of assets or potential sale actions triggered by future price hikes, as these factors could significantly impact my research findings.

Read More

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- ‘The budget card to beat right now’ — Radeon RX 9060 XT reviews are in, and it looks like a win for AMD

- Forza Horizon 5 Update Available Now, Includes Several PS5-Specific Fixes

- Gold Rate Forecast

- Valorant Champions 2025: Paris Set to Host Esports’ Premier Event Across Two Iconic Venues

- The Lowdown on Labubu: What to Know About the Viral Toy

- Karate Kid: Legends Hits Important Global Box Office Milestone, Showing Promise Despite 59% RT Score

- Street Fighter 6 Game-Key Card on Switch 2 is Considered to be a Digital Copy by Capcom

- Mario Kart World Sold More Than 780,000 Physical Copies in Japan in First Three Days

2024-08-20 13:28