- Bitcoin bulls have defended the short-term mid-range support.

- There has been increased spot selling over the past couple of days, but it might not be enough to pull prices lower.

As a seasoned crypto investor with a knack for navigating the volatile Bitcoin market, I find myself cautiously optimistic about the current situation. The bulls have defended the mid-range support effectively, despite the increased spot selling over the past couple of days. This resilience suggests a rebound could be on the horizon, but we must remain vigilant as volatility might still pull prices to the short-term lows at $94.5k due to a liquidity hunt.

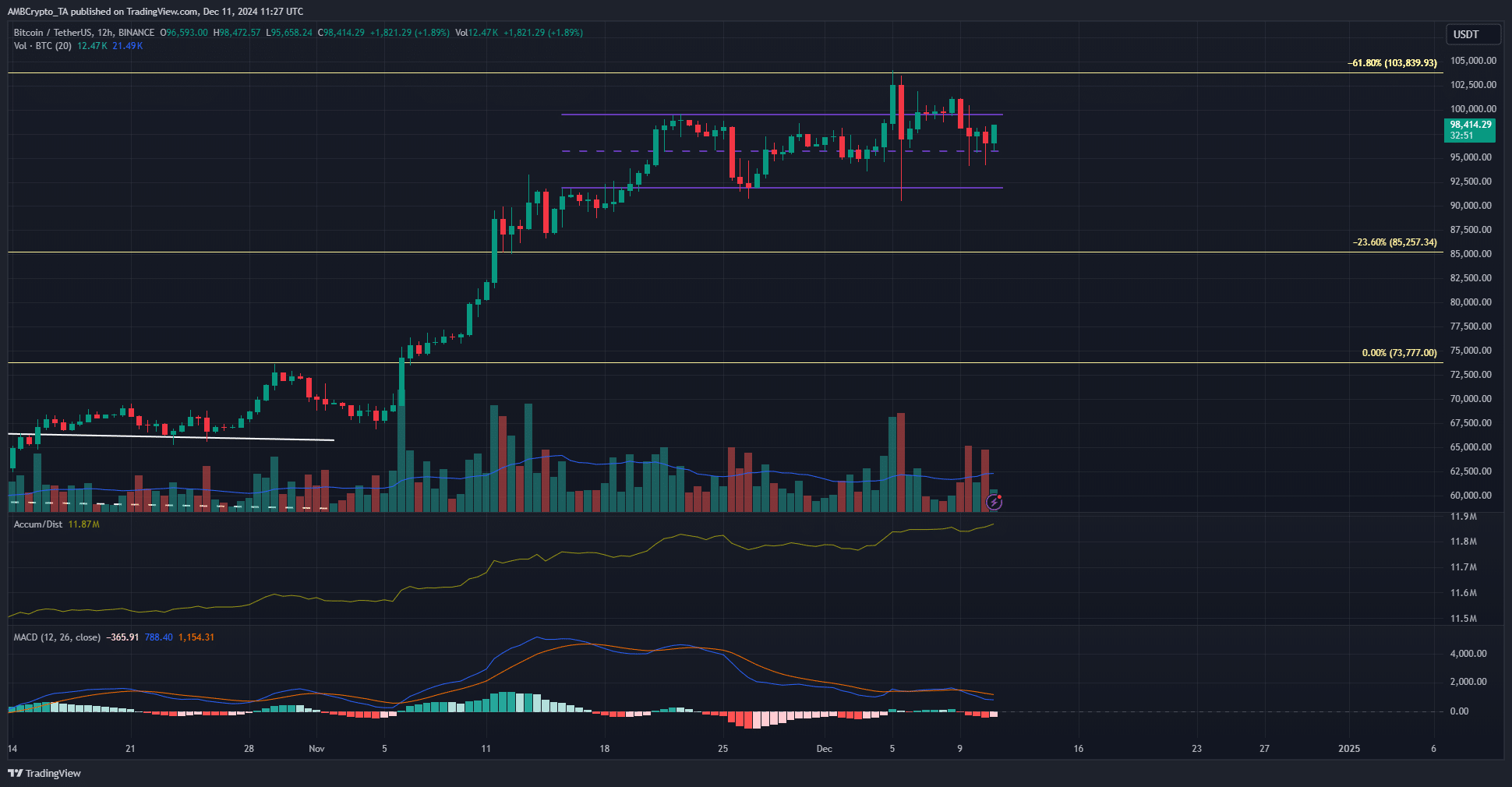

Bitcoin’s price has been contained within a band around $100,000 and has found it challenging to surpass the significant psychological barrier. This price range spans from approximately $92,100 to $99,500.

Over the last three days, the middle-level support for Bitcoin has remained strong, withstanding numerous attempts, suggesting that it may bounce back soon.

Bitcoin bulls push prices above $95.8k support

Over the last three days, Bitcoin managed to hold its ground near the $95,800 support level, avoiding closing any 12-hour sessions beneath it. Additionally, the Accumulation/Distribution (A/D) indicator has shown an upward trend throughout this week.

This suggested that investors were keen on purchasing Bitcoin around its mid-level support, potentially indicating a surge. There’s a possibility that the price fluctuations might push Bitcoin down temporarily to approximately $94.5k, which might be caused by a search for liquidity.

On a 12-hour basis, the MACD indicated a bearish stance, despite being above zero. This suggests that the initial bullish energy was starting to fade. Furthermore, as Bitcoin consolidated within its three-week price range, the trading volume has been gradually decreasing.

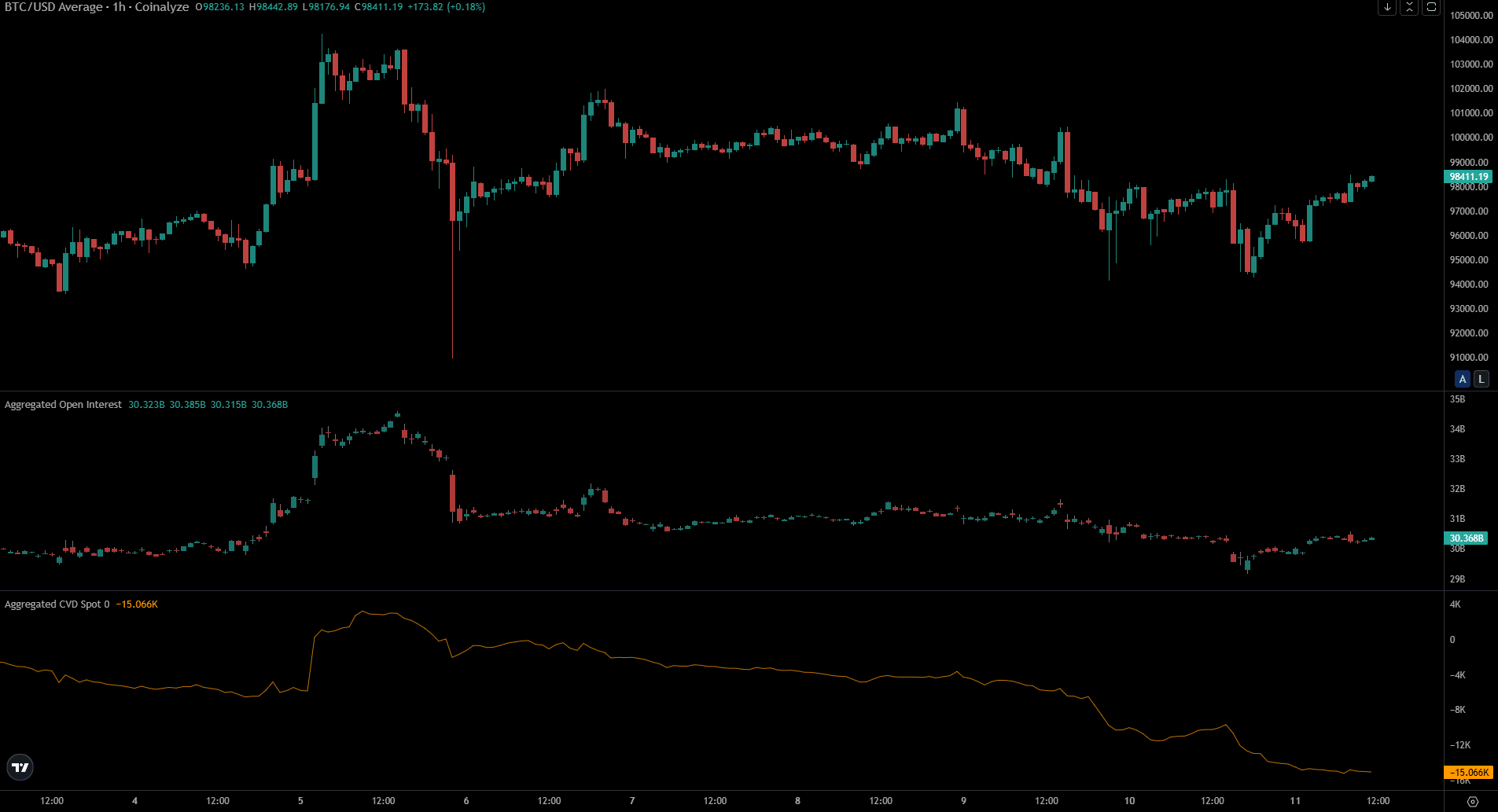

Falling Open Interest showed sentiment was lukewarm

Despite the downward trend in the CVD spot, the bulls managed to hold onto the mid-range support. However, this contradicted the signals from the A/D indicator as the timeframes involved were distinct. Lately, there’s been more selling activity, but over the past week, the buyers have shown greater strength.

As the temporary need for the asset decreases, Open Interest (OI) is also decreasing. This typically occurs when an asset experiences a break in its dominant trend, such as Bitcoin’s formation of a price range.

The drop in the OI suggested that speculators were holding back, anticipating the market to decide which direction it would break from its current range.

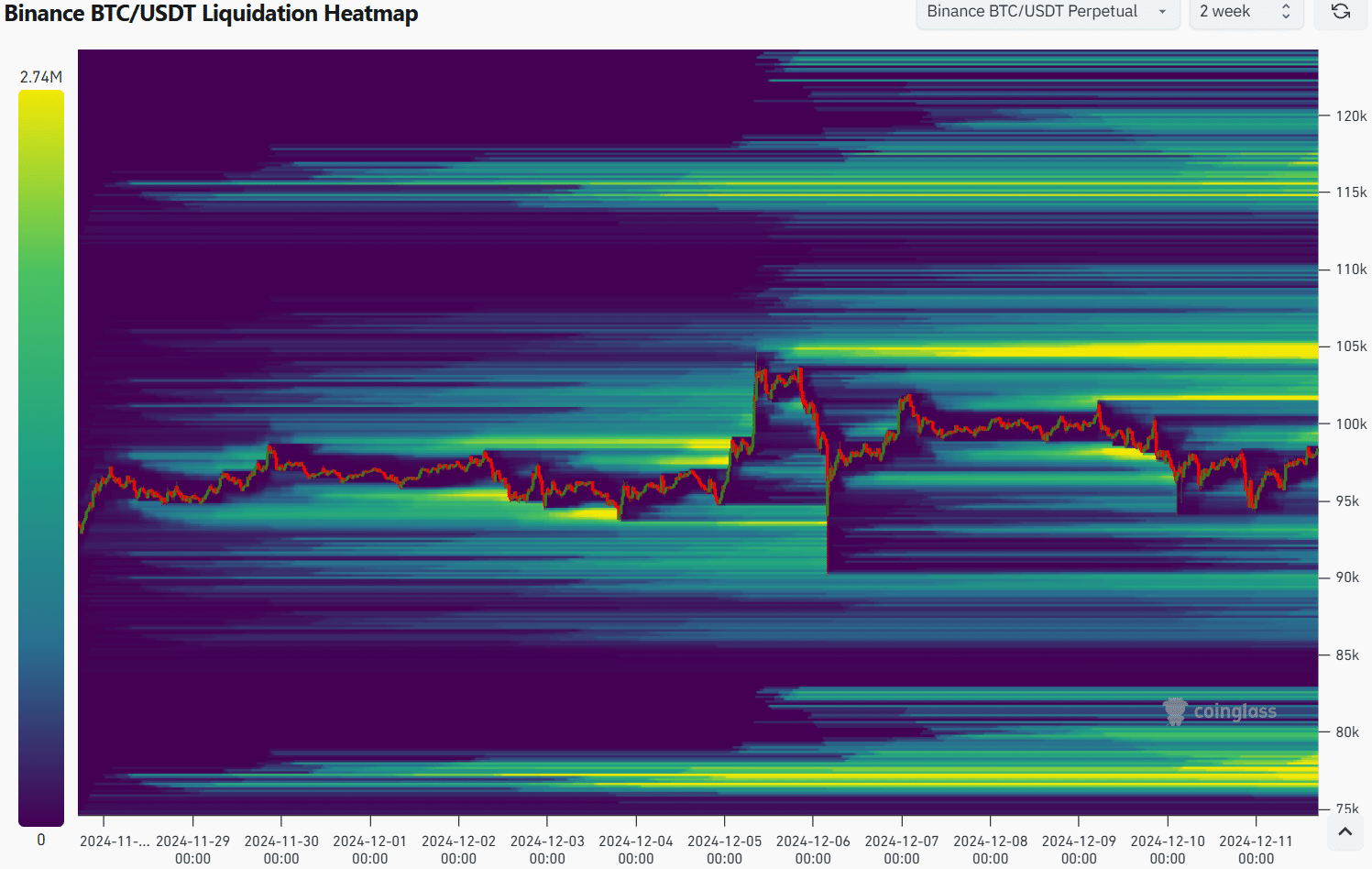

Previously, we discussed a scenario where a ‘liquidity chase’ might push Bitcoin down towards the $94.5k support level. However, based on the liquidation chart, it appears that a surge towards a $105k price point is statistically more probable than the suggested drop.

Read Bitcoin’s [BTC] Price Prediction 2024-25

The concentration of liquidity at $105,000 was significant, and the consolidation of Bitcoin around $100,000 contributed to this liquidity. There’s a strong possibility that Bitcoin could revisit these highs in the near future, and even surpass them.

Read More

- PI PREDICTION. PI cryptocurrency

- Gold Rate Forecast

- WCT PREDICTION. WCT cryptocurrency

- LPT PREDICTION. LPT cryptocurrency

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- Shrek Fans Have Mixed Feelings About New Shrek 5 Character Designs (And There’s A Good Reason)

- SOL PREDICTION. SOL cryptocurrency

- Playmates’ Power Rangers Toyline Teaser Reveals First Lineup of Figures

- FANTASY LIFE i: The Girl Who Steals Time digital pre-orders now available for PS5, PS4, Xbox Series, and PC

- Solo Leveling Arise Tawata Kanae Guide

2024-12-12 04:07