- Bitcoin’s DeFi activity has surged after the TVL hit an ATH and flipped that of BNB Chain.

- This rise co mes amid demand for restaking on the Babylon Bitcoin staking protocol.

As a seasoned analyst with over two decades of experience in the crypto market, I’ve witnessed many ups and downs, but the recent surge in Bitcoin’s DeFi activity is truly remarkable. The TVL surpassing that of BNB Chain is a significant milestone, indicating a shift in the crypto landscape.

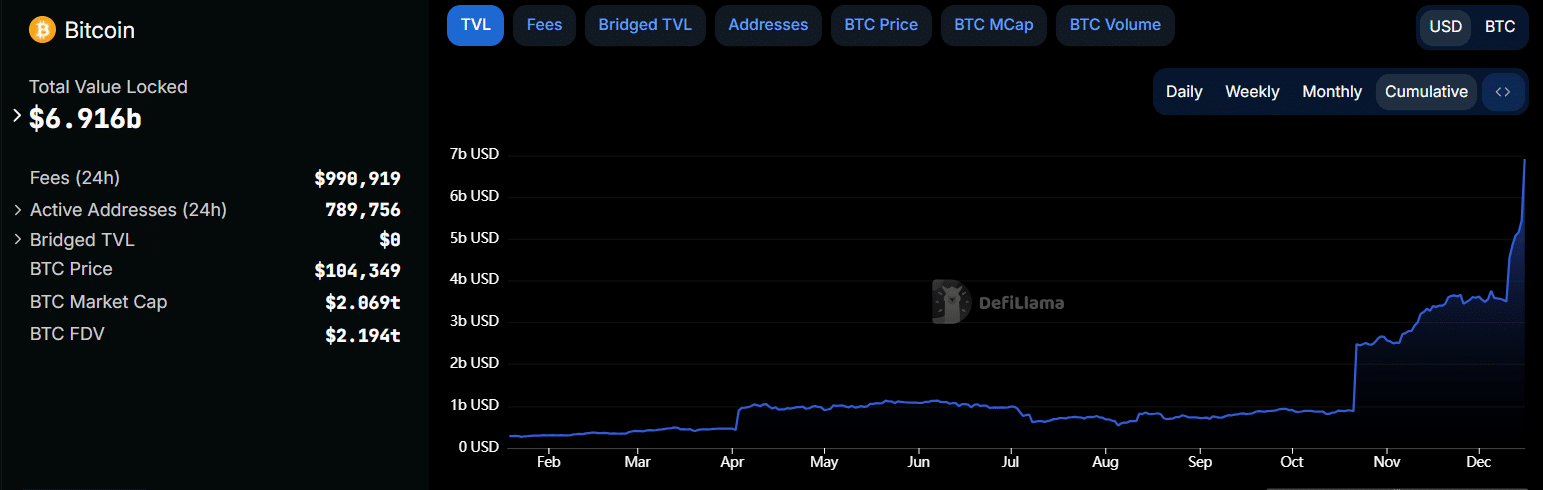

The value locked in Bitcoin’s decentralized finance sector has skyrocketed, reaching a record $6.9 billion as per DeFiLlama, pushing Bitcoin ahead of BNB Chain to rank fourth among blockchains in terms of this measurement.

The activity of Decentralized Finance (DeFi) related to Bitcoin began to increase significantly towards late October, driven by an increasing demand for Bitcoin yields. As per DeFiLlama, the Total Value Locked (TVL) was less than $1 billion on October 21st, suggesting that it has increased more than sixfold in less than two months since then.

The rising TVL is not only because of BTC’s price appreciation but also an increase in the coins locked on the network. These assets have increased from 34,980 BTC to 66,040 BTC at press time.

So, what is driving the boom in DeFi activity on the blockchain?

Rising demand for restaking

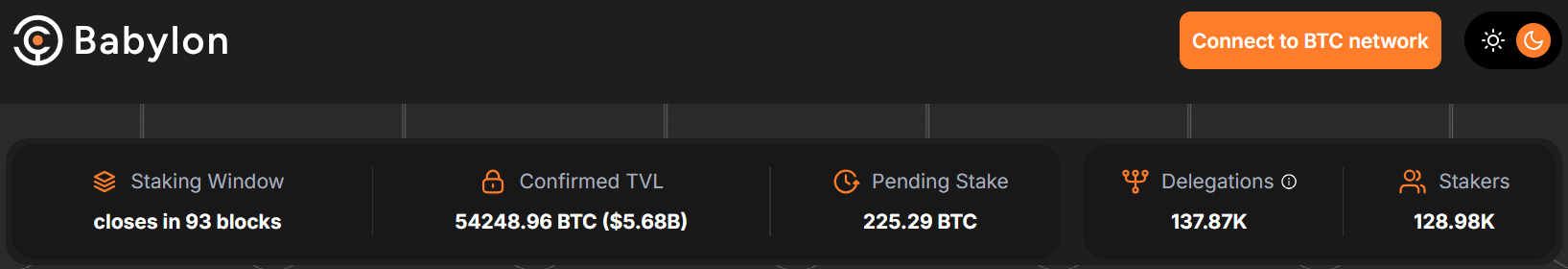

The primary reason for the increase in this metric is attributed to the Babylon staking platform, which makes up approximately $5.6 billion of the entire TVL (Total Value Locked) within the Bitcoin ecosystem.

As indicated by the Babylon staking dashboard, a total of 128,000 users have deposited over 54,000 Bitcoins within the platform, signifying an increasing appetite for Bitcoin returns.

Per DeFiLlama, the amount of BTC staked on this platform has also increased by 151% in seven days.

This sudden increase has propelled Babylon to the first place on the leaderboard as the biggest Decentralized Finance (DeFi) Bitcoin project. Moreover, its expansion rate surpasses that of the Lightning Network, currently ranked fifth with a TVL (Total Value Locked) of $530 million, showcasing a transition in Bitcoin’s purpose from transactions to DeFi, indicating a growing interest in DeFi applications.

Even though Bitcoin’s Total Value Locked (TVL) is increasing, it’s significantly smaller than Ethereum‘s TVL of $88 billion. In fact, the largest staking protocol on Ethereum, Lido, boasts a TVL of $38 billion.

Following the switch to BNB Chain, Bitcoin’s total value locked (TVL) is approaching that of Tron (TRX), which was previously at $8.08 billion.

Impact on Bitcoin price?

Currently, Bitcoin is transacting at approximately $104,240, representing a 1.67% increase in the past day. On December 16th, it reached a new peak of $106,488. This surge occurred due to increasing institutional interest, following the inflow of $2.17 billion into US-listed spot Bitcoin exchange-traded funds (ETFs) last week.

Increased Decentralized Finance (DeFi) usage might spark new interest in Bitcoin, potentially leading to price increases. Additionally, staking Bitcoin could decrease supply sold on the market since traders are interested in earning returns instead.

DeFi activity soars to 2022 highs

It’s important to note that Bitcoin isn’t the only blockchain experiencing an increase in DeFi activity. In fact, the total value locked (TVL) across various platforms has soared to a record high of $154 billion, which is its highest since May 2022.

Read Bitcoin’s [BTC] Price Prediction 2024-25

In the past month, Ethereum’s Total Value Locked (TVL) has soared by more than $24 billion, while Solana’s TVL has seen a growth of over $1 billion. Simultaneously, DeFi tokens like AAVE have surpassed many altcoins in terms of performance.

The increase might boost Bitcoin’s Total Value Locked (TVL) even further and potentially spark a substantial surge for the leading cryptocurrency.

Read More

- Forza Horizon 5 Update Available Now, Includes Several PS5-Specific Fixes

- Gold Rate Forecast

- ‘The budget card to beat right now’ — Radeon RX 9060 XT reviews are in, and it looks like a win for AMD

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Valorant Champions 2025: Paris Set to Host Esports’ Premier Event Across Two Iconic Venues

- Karate Kid: Legends Hits Important Global Box Office Milestone, Showing Promise Despite 59% RT Score

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Street Fighter 6 Game-Key Card on Switch 2 is Considered to be a Digital Copy by Capcom

2024-12-16 21:11