-

BTC has surged by 4.16% over the past week, with fundamentals indicating positive sentiments.

Despite the lows, RSI confirms a bullish trend with a bullish RSI divergence.

As a seasoned crypto investor with over a decade of experience under my belt, I must say that the current Bitcoin (BTC) market conditions are looking quite promising. After all, who would have thought that September, historically known for its bearish tendencies, would bring such an unexpected surge in BTC?

This month, Bitcoin (BTC) has shown a significant increase in value, exhibiting a robust uptrend. Typically, September is known for a downturn or bear market. But surprisingly, this year’s September has witnessed a notable change, as Bitcoin has been forming higher bottoms instead.

As I pen down these words, I’m observing that Bitcoin is currently being traded at approximately $65,530. This represents a significant growth of 10.52% on a monthly scale, with an additional 4.16% increase observed over the past seven days, further extending the uptrend.

However, the last 24 hours have seen a minor correction with Bitcoin declining by 0.46%.

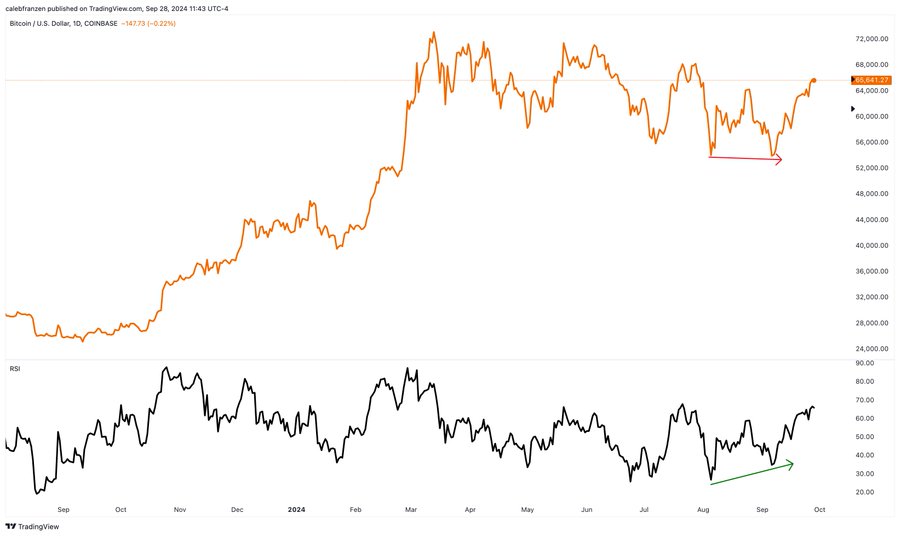

Consequently, the present market scenario has sparked discussions among analysts about Bitcoin’s future path. Specifically, well-known cryptocurrency analyst Caleb Franzen proposes that an upward trend might persist due to a bullish Relative Strength Index (RSI) divergence.

What market sentiment says

According to Franzen’s examination, he pointed out a positive RSI divergence to suggest that the bulls have control over the market.

Based on the analysis, the Relative Strength Index (RSI) hasn’t shown a bearish RSI divergence on daily graphs. Instead, it continues to support the bullish trend that began at the price lows. In other words, the RSI has been indicating a bullish RSI divergence.

In this situation, the absence of a bullish divergence suggests that the current price rise is backed by strong momentum and there’s currently no substantial indication of a price reversal occurring.

When there’s a bearish Relative Strength Index (RSI) divergence, it signifies a potential decrease in the trend’s strength upwards, hinting that a possible price adjustment might be approaching.

In other words, even though Bitcoin (BTC) has seen lower price levels recently, the Relative Strength Index (RSI) is forming higher bottoms. This suggests that the underlying momentum could be increasing, despite the drop in price.

As a researcher, I often observe that when Bullish Relative Strength Index (RSI) divergence occurs, it indicates a shift in market dynamics where the selling pressure lessens and the buying interest intensifies. This suggests a potential continuation of the upward trend.

What BTC charts say

According to Frazen’s observations, Bitcoin seems to be thriving in beneficial market situations. These advantageous conditions might pave the way for additional price increases as depicted on the charts.

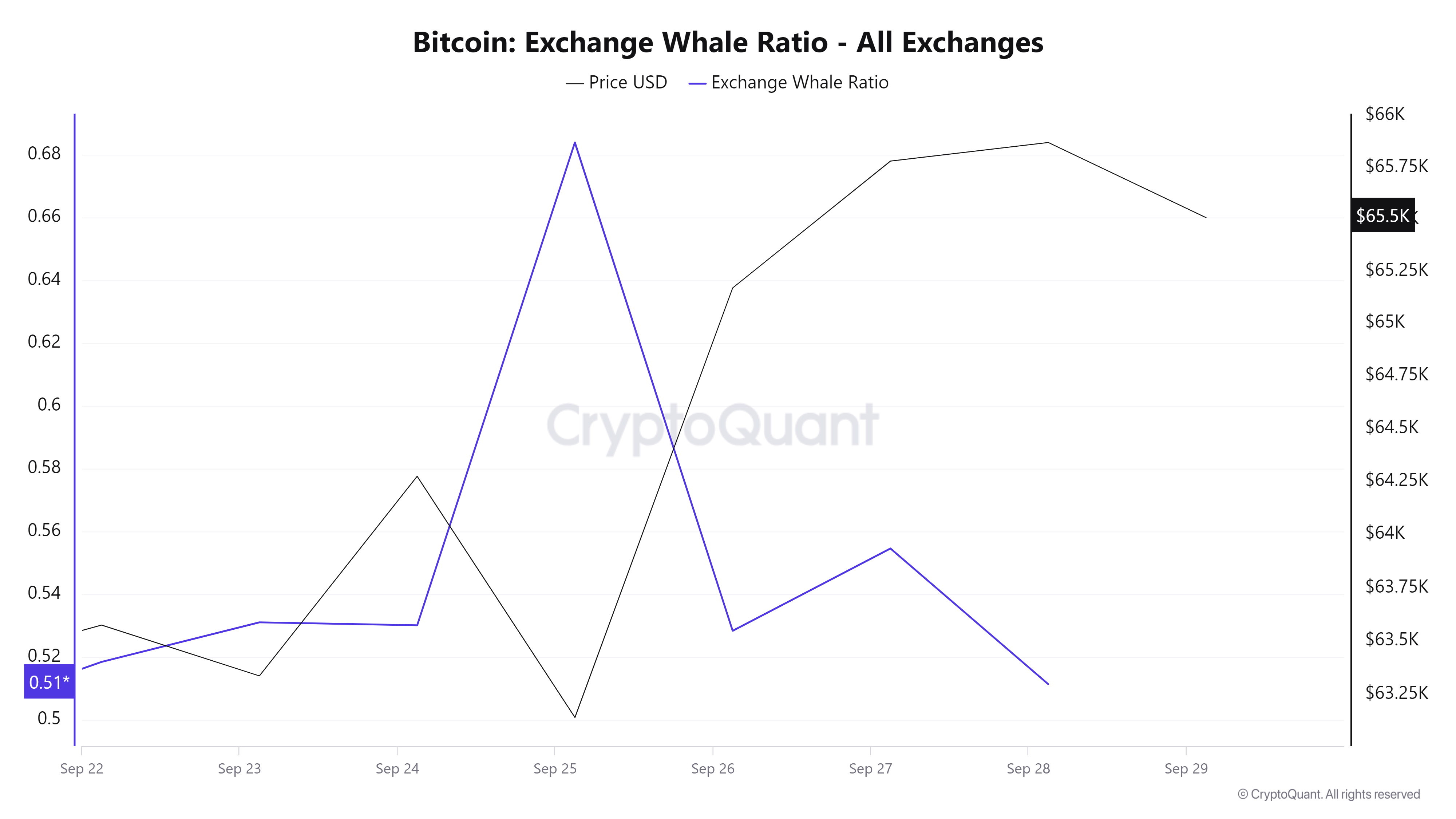

At this moment, the whale-to-Exchange ratio has dropped from its peak of 0.68 to 0.511. This decrease indicates a possible trend where large investors (whales) might be transferring their Bitcoin (BT) from exchanges into personal wallets for safekeeping.

As an analyst, I can say that this market’s behavior suggests a bullish outlook, which means that major investors seem to be holding onto their assets for now, implying they don’t intend to offload them in the near future.

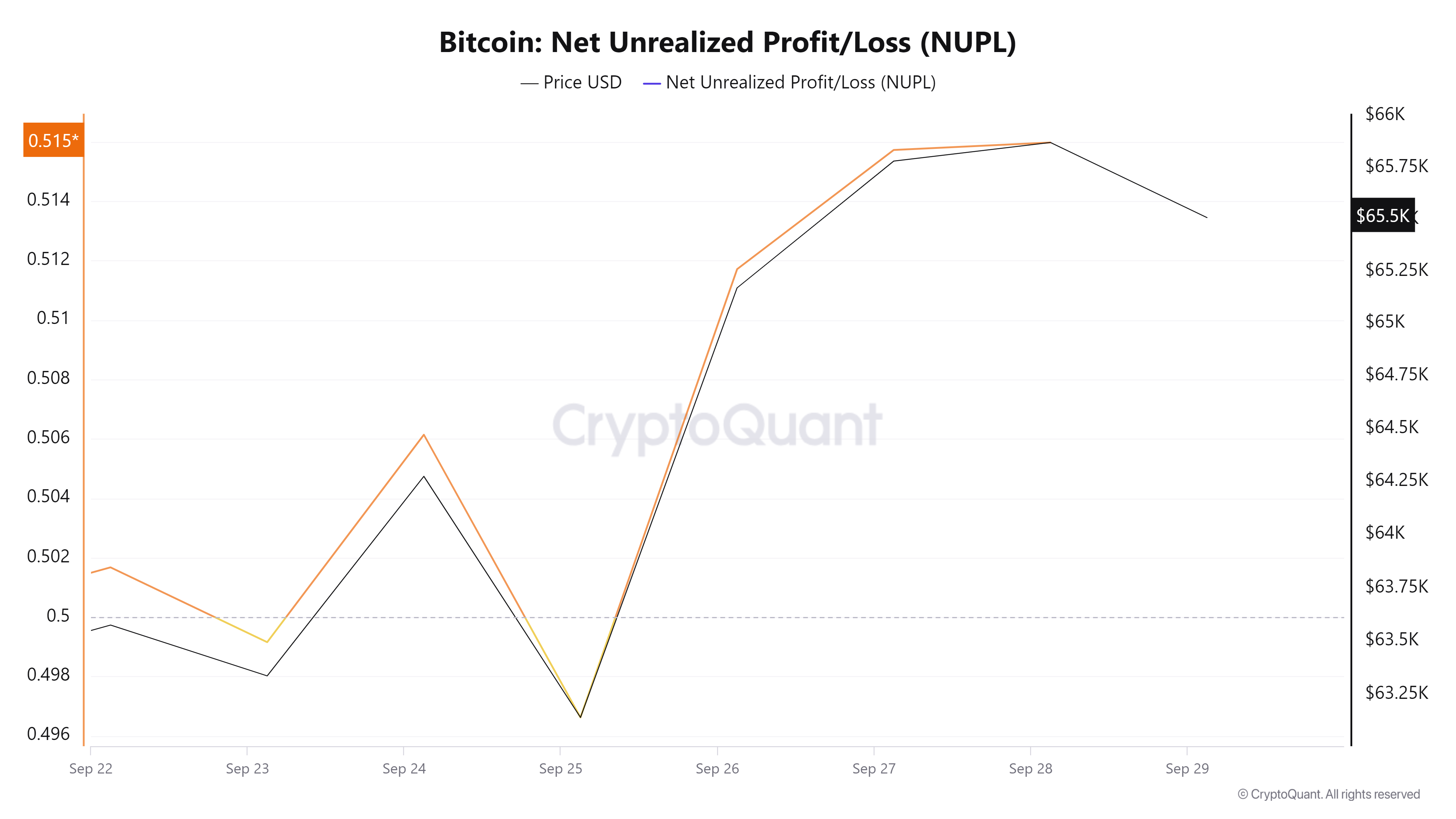

Furthermore, Bitcoin’s Net Unrealized Profit/Loss (NUPL) has climbed from a minimum of 0.4 to 0.51 during the last week. An increase in NUPL suggests that investors are realizing gains, meaning they are experiencing profit.

Typically, this happens when the market is experiencing a bull run, with prices climbing higher than their original purchase values. This situation fosters greater optimism among investors, as they become more assured about the market’s growth prospects and anticipate additional price rises.

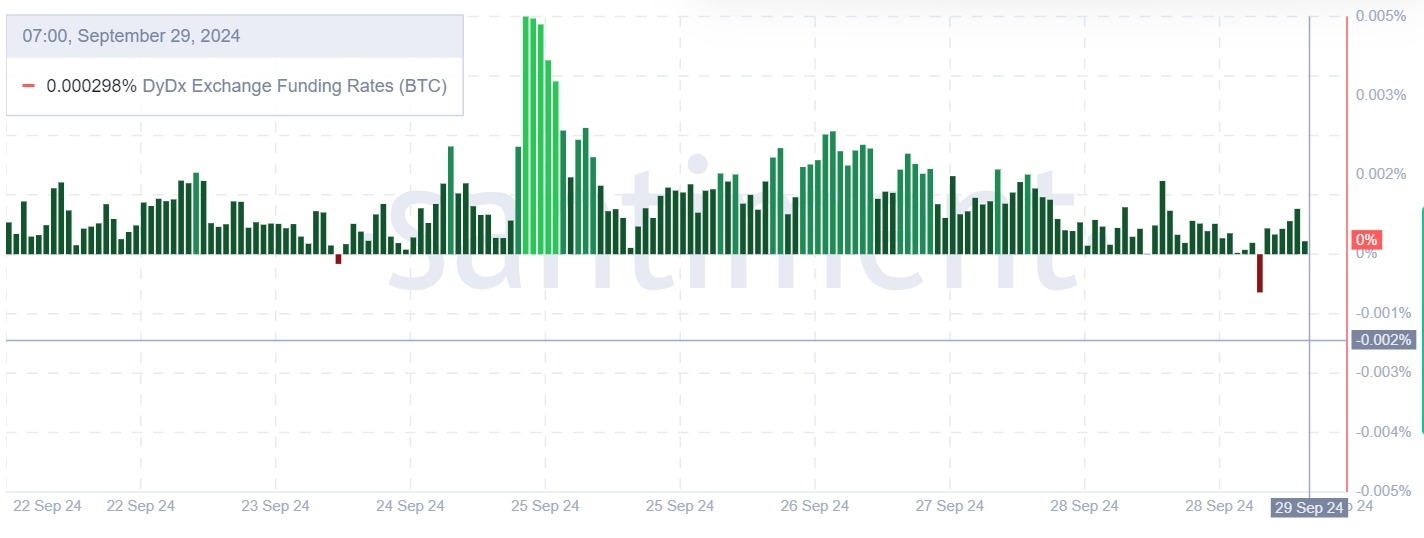

To wrap up, the funding rate for trades on Dydx’s Bitcoin exchange has consistently been favorable during the last seven days. A positive funding rate indicates that individuals holding long positions are compensating those who have taken short positions to maintain their stance.

Given the current market conditions, many investors tend to prefer holding long positions, as they expect the prices to go up instead.

Essentially, Bitcoin appears to be surging robustly with bulls holding sway over the market. Given this situation, it’s likely that Bitcoin will continue to rise and potentially overcome the $66,500 resistance level on price graphs within the near future.

Read More

- Forza Horizon 5 Update Available Now, Includes Several PS5-Specific Fixes

- ‘The budget card to beat right now’ — Radeon RX 9060 XT reviews are in, and it looks like a win for AMD

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Gold Rate Forecast

- Valorant Champions 2025: Paris Set to Host Esports’ Premier Event Across Two Iconic Venues

- Street Fighter 6 Game-Key Card on Switch 2 is Considered to be a Digital Copy by Capcom

- The Lowdown on Labubu: What to Know About the Viral Toy

- Karate Kid: Legends Hits Important Global Box Office Milestone, Showing Promise Despite 59% RT Score

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

2024-09-29 20:08