- Bitcoin DeFi TVL soared 600% in Q1 2024 and could climb higher in 2025

- Babylon leads with $5.5B of locked BTC as demand for BTC yield increases

As a seasoned analyst with over two decades of experience in the financial industry, I have witnessed the evolution of digital assets from their infancy to the behemoth they are today. The explosive growth of Bitcoin DeFi TVL in Q1 2024 and the continued projection for further expansion in 2025 is a testament to the resilience and adaptability of this nascent sector.

Having closely followed the development of Ethereum‘s DeFi landscape, I must admit that I am intrigued by the rapid expansion of Bitcoin DeFi. The shift towards restaking platforms like Babylon, which now holds over 90% of BTC DeFi TVL, is a clear sign of investor trust and an indication of the increasing demand for yield in the Bitcoin ecosystem.

It’s fascinating to see how the popular narrative surrounding Ethereum DeFi has found its way into the Bitcoin ecosystem, with staking protocols like Babylon, Lombard, and SolvBTC leading the charge. The upcoming launch of Babylon’s L2 solution could potentially merge BTC and altcoins, opening up a world of opportunities for both retail and institutional investors.

However, as we move into 2025, it is essential to remain cautious and vigilant. While Bitcoin’s high liquidity and low counterparty risk make it an attractive collateral asset for DeFi systems, the industry must navigate regulatory hurdles and security risks to ensure sustainable growth.

In the spirit of transparency, I must admit that I’ve been known to make a few bold predictions in my time, but this one feels different. The potential merger of Bitcoin and altcoins through Babylon’s L2 launch could indeed mark a significant turning point for the DeFi industry as we know it.

To lighten the mood, let me share a joke: They say the best way to predict the future is to create it. Well, if that’s true, then maybe I should start building my own decentralized finance system in my backyard shed! After all, who needs walls when you have smart contracts?

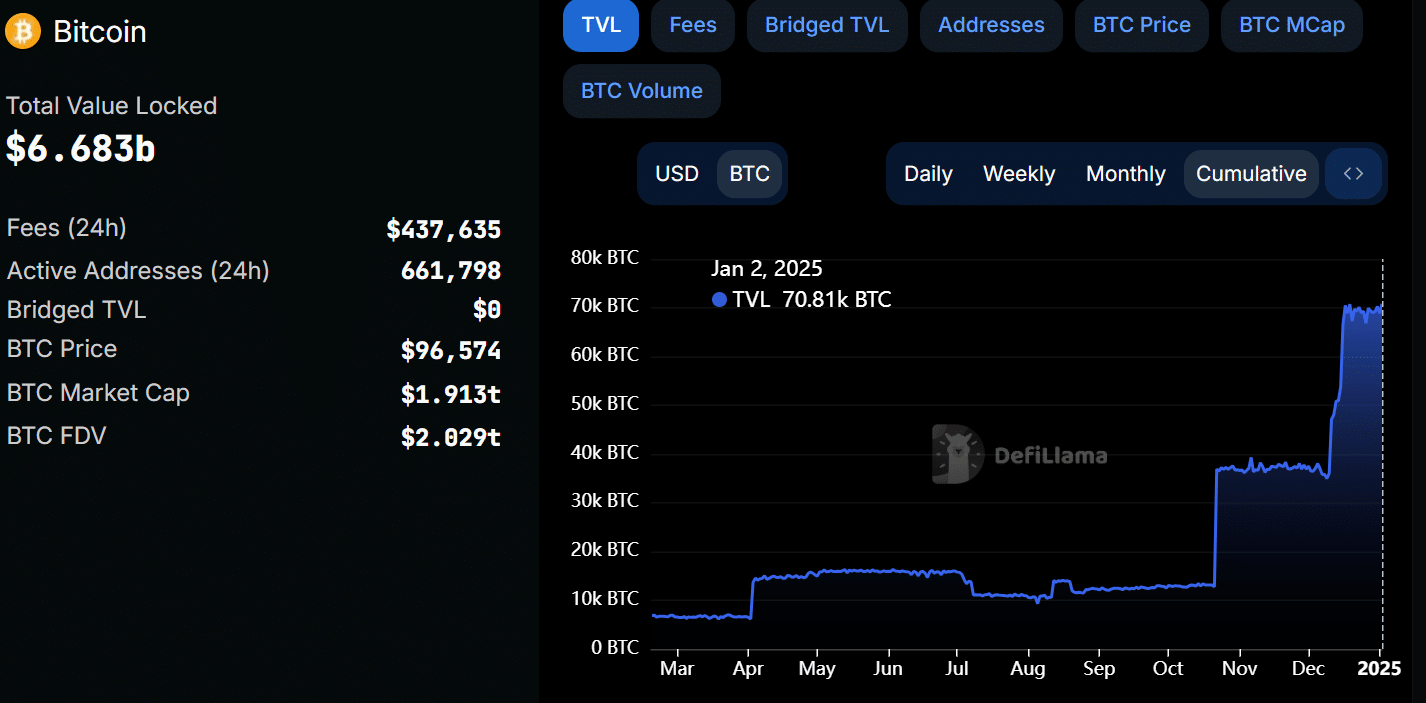

Bitcoin’s DeFi total value locked (TVL) experienced an approximately 600% increase in the first quarter of 2024, and experts anticipate further growth in 2025 as significant Layer 2 (L2) launches approach. Intriguingly, recent data from DeFiLlama shows that a remarkable amount of more than 70,000 Bitcoins, equivalent to around $6.68 billion, has been locked within its DeFi system.

This increase in Bitcoin (BTC) locked within DeFi from around 13k BTC as of October clearly illustrates a thriving Decentralized Finance (DeFi) ecosystem. This leads us to ponder – What factors are fueling the resurgence of BTC, and what can we expect for BTC in the year 2025?

Babylon leads BTC DeFi

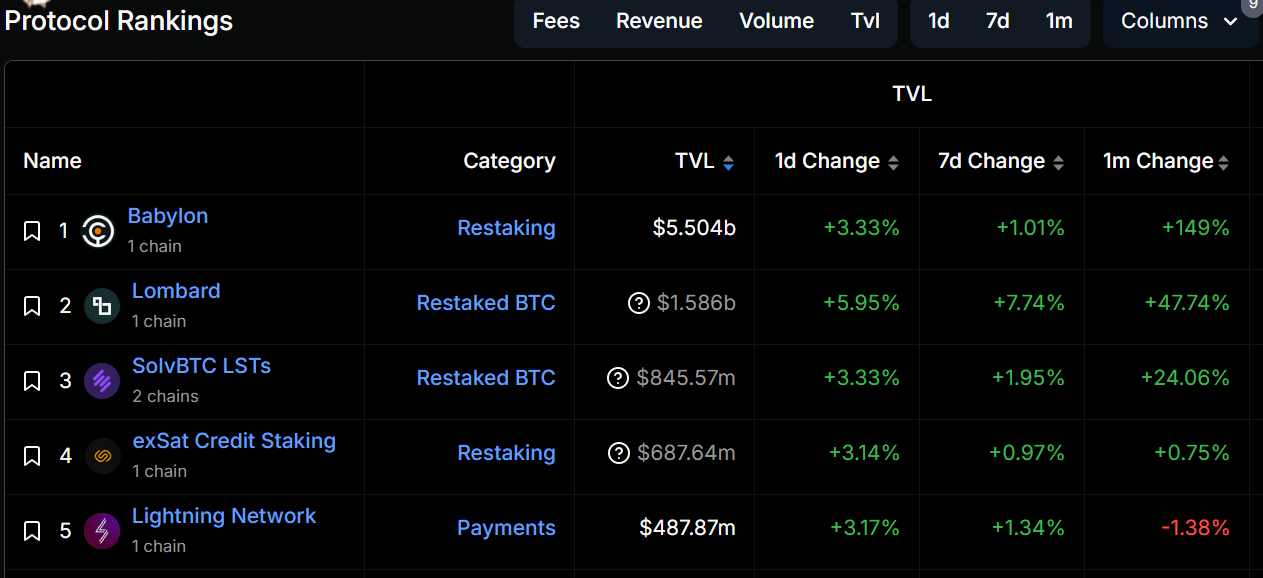

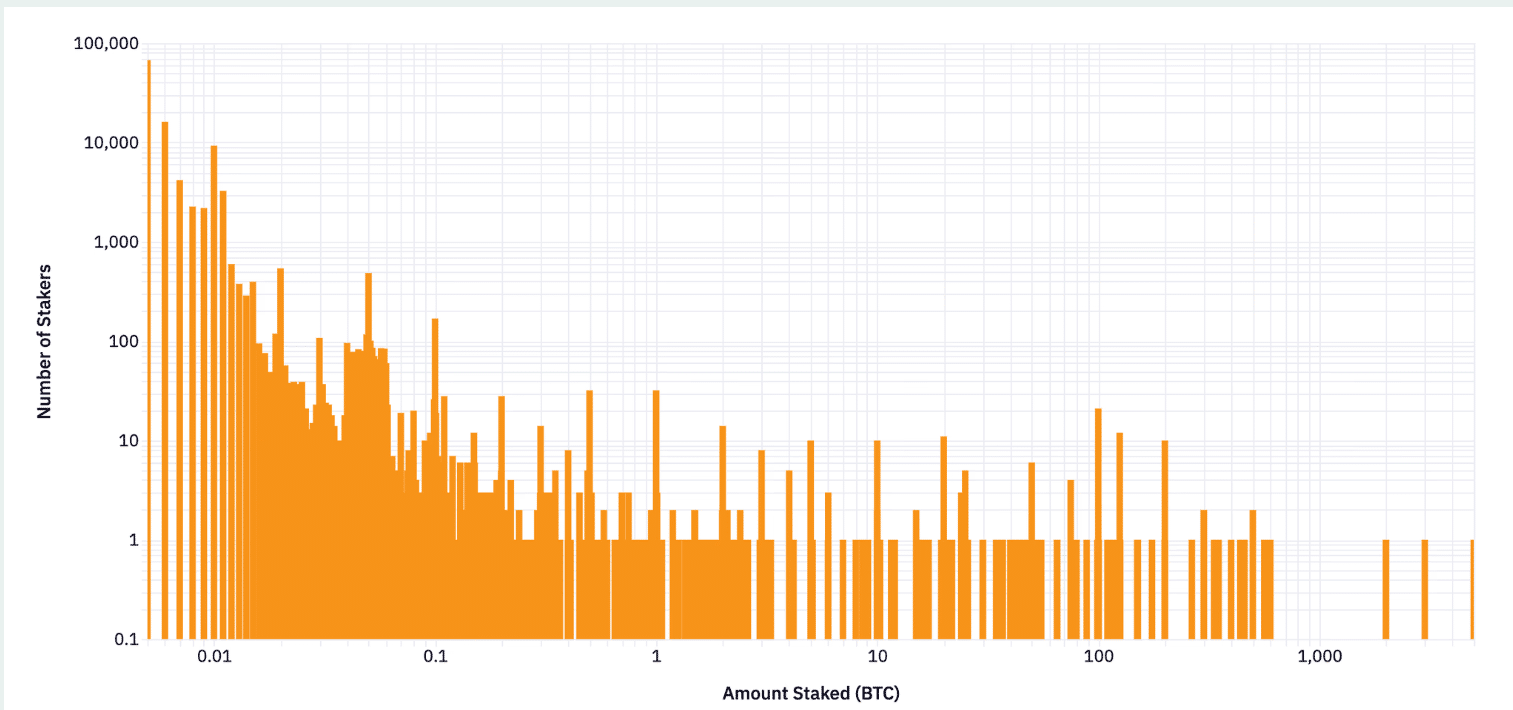

In terms of prominence among protocols, the newly introduced Babylon platform has been leading the pack on our network, accounting for more than 90% of Bitcoin DeFi’s Total Value Locked (TVL). With a staggering $5.5 billion TVL, this figure illustrates an extraordinary level of investor confidence in the protocol.

Indeed, the Total Value Locked (TVL) in Babylon increased by approximately 150% during the last month, due to a surge of investors eagerly staking their Bitcoin for returns.

In a recent ranking, Lombard and SolvBTC took the second and third spots. Interestingly, both of these are staking protocols, indicating that the idea of re-staking, which is popular in Ethereum, is now being embraced within the Bitcoin community as well.

However, top executives within the DeFi space expect more growth in 2025.

As a crypto investor, I’m eagerly anticipating the Babylon L2 launch, as it promises to bridge the gap between Bitcoin (BTC) and the broader altcoin universe. This strategic move is expected to provide us with the benefits of enhanced liquidity and security, according to Fisher Yu, the CTO of Babylon.

With our Phase-1 launch, it’s clear that both the Bitcoin world and the traditional market are prepared to welcome the realm of alternative coins (altcoins). This group encompasses both individual investors and large institutions, suggesting a possible agreement to explore the altcoin space.

Indeed, a growing number of institutional DeFi lending companies are preparing to accept Bitcoin derivatives as collateral for loans in the current year.

Sidney Powell, who heads up Maple Finance – a prominent DeFi lending company, shared with the press his belief that Bitcoin (BTC) may evolve into the primary asset used as collateral within decentralized finance (DeFi) platforms.

As Bitcoin becomes more prevalent in institutional Decentralized Finance (DeFi) lending, it’s on its way to becoming a leading form of security or asset in the world of decentralized finance.

At the time, Powell cited BTC’s high liquidity and low counterparty risk for his projections.

In other words, several expansion strategies like the Lightning Network and Stacks are preparing updates to fuel a revival of Bitcoin Decentralized Finance (DeFi).

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Masters Toronto 2025: Everything You Need to Know

- WCT PREDICTION. WCT cryptocurrency

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- LPT PREDICTION. LPT cryptocurrency

- Elden Ring Nightreign Recluse guide and abilities explained

- Solo Leveling Arise Tawata Kanae Guide

- Despite Bitcoin’s $64K surprise, some major concerns persist

2025-01-03 11:04