- Long-term Bitcoin holders exhibited confidence, selling less despite market fluctuations and nearing all-time highs.

- Bitcoin’s strong support at $63,440-$65,470 and growing liquidity suggested potential for upward momentum.

As a seasoned researcher with extensive experience in the cryptocurrency market, I have closely observed Bitcoin’s [BTC] price movements and investor behavior over the years. Based on my analysis of recent developments, long-term Bitcoin holders, those who have held their investments for six months to two years, have exhibited remarkable confidence and resilience in the face of market fluctuations.

Ki Young Ju, the Founder and CEO of CryptoQuant, recently shared his insights on the actions of Bitcoin (BTC) investors.

People who had owned Bitcoin for a half year to two years have mainly disposed of their investments as the cryptocurrency approached its prior peak price.

The founder noted,

“If you’re currently trading Bitcoin, it’s probable that you haven’t owned it for more than three years, since long-term investors are typically unwilling to part with their holdings.”

Based on this action, it can be inferred that long-term investors continue to trust in Bitcoin’s worthiness as a long-term investment.

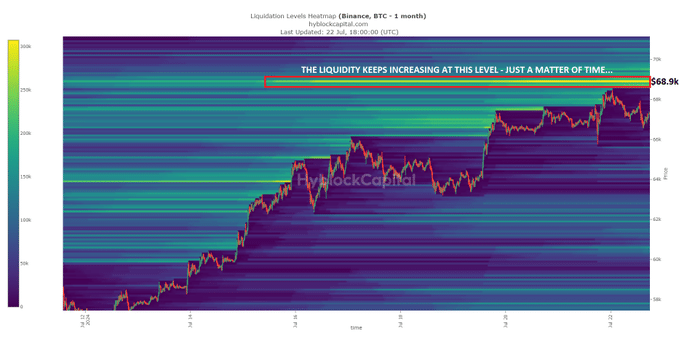

At the $68.9k mark, Bitcoin’s liquidity was noticeably on the rise according to CrypNuevo during their discourse on Bitcoin’s potential future trend.

Based on CrypNuevo’s perspective, it appears that Bitcoin is likely to hit this mark. However, it’s unclear if the price will experience a decline prior to reaching this level or if it will steadily climb upward without interruption.

According to analyst Ali Martinez, Bitcoin is currently.

“Breaking through multiple trend lines in the hourly chart.”

Additionally, he highlighted an essential resistance zone for Bitcoin, encompassing the price range from $63,440 to $65,470, which represents approximately 1.89 million wallets holding around 1.23 million Bitcoins.

At these levels, the support zone plays a crucial role by indicating significant buying activity. This could potentially prevent price declines and maintain market stability.

Current market conditions

At the moment of publication, the cost of a single Bitcoin was $66,680.44, and the total value of Bitcoin transactions conducted within the past 24 hours reached an astounding $43,180,179,849. However, there has been a slight decrease in Bitcoin’s price by approximately 0.85% over the previous 24 hours.

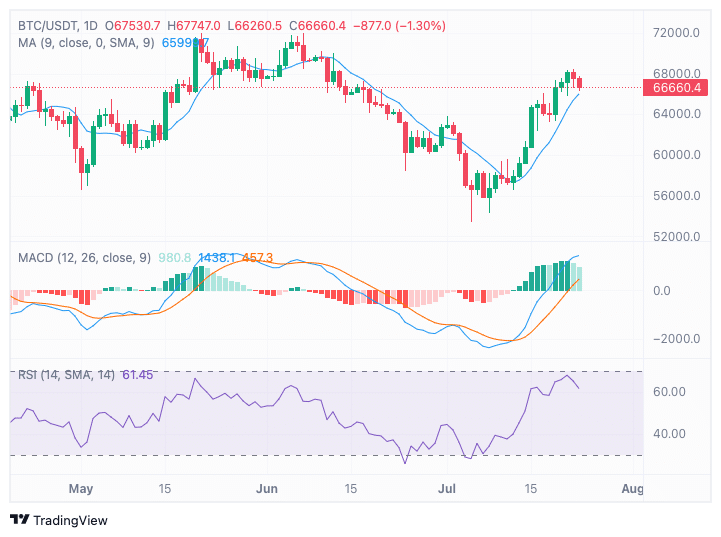

The 9-day moving average stood at 6599, implying that the current price was slightly higher than this mark, signaling a brief uptrend in the market.

The MACD indicator signaled a bullish trend around mid-year when its line intersected above the signal line according to the Moving Average Convergence Divergence (MACD) analysis.

The rising green histogram bars indicated a bullish trend, signifying escalating momentum.

It’s important to exercise caution as the MACD indicator moves toward overbought territory, potentially signaling a possible reversal or correction.

As a market analyst, I’d observe that at the present moment, the Relative Strength Index (RSI) stands at 61.45. This figure indicates that the market is currently in a bullish phase, but it hasn’t reached the level of being overbought yet.

In simpler terms, the Relative Strength Index (RSI) has rebounded since its oversold reading in late June, indicating a pickup in bullish force.

As a crypto investor, I keep a close eye on market trends and indicators. While the overall sentiment remains bullish, it’s important not to ignore potential warning signs. The Relative Strength Index (RSI) is approaching 70, which could indicate emerging overbought conditions. This means that the price of crypto may have risen too quickly in a short period of time and could be due for a correction. I remain cautious and attentive to any bearish divergence or trend reversal that might follow.

On-chain activity

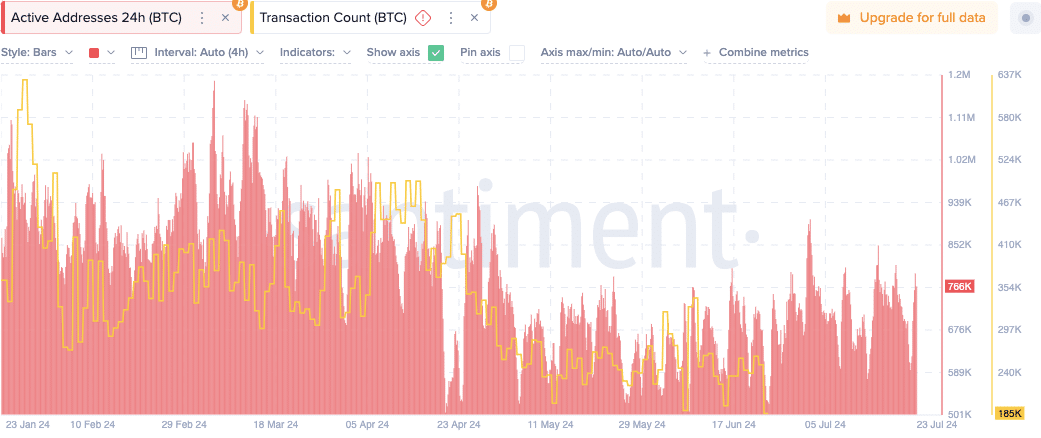

According to on-chain analysis, there has been a noticeable variation in the number of active cryptocurrency addresses. This figure saw a substantial rise in late February and early April, reaching over 766,000. However, it has been trending downward since then, with the most recent count being approximately 766,000.

Read Bitcoin’s [BTC] Price Prediction 2024-25

The number of transactions has followed a similar pattern, exhibiting significant increases during those specific timeframes and reaching a current total of 185,000 transactions.

The decrease in on-chain transactions indicates a drop in user interaction and trading volume over the past few months, which is consistent with the broader market patterns.

Read More

- Gold Rate Forecast

- Rick and Morty Season 8: Release Date SHOCK!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- PI PREDICTION. PI cryptocurrency

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

2024-07-24 01:12