-

Metrics revealed that Bitcoin was overvalued.

A continued price drop might push BTC down to $53k again.

As a seasoned analyst with years of experience in the volatile world of cryptocurrencies, I can’t help but feel a sense of deja vu when observing Bitcoin’s recent price action. The red candles on the daily chart and the selling pressure from whales have become all too familiar.

Last week, Bitcoin [BTC] bulls successfully increased its price by a significant margin, indicating a positive trend. However, within the past few hours, the daily chart for the leading coin has turned red once more. It’s worth mentioning that just prior to the price decrease, a large Bitcoin investor (whale) sold off a considerable amount of BTC.

Are Bitcoin whales selling?

A post on Lookonchain’s Twitter account disclosed a transaction where a large investor (whale) unloaded 500 Bitcoins, equivalent to approximately $30.07 million, shortly before the BTC price started falling. Interestingly, this whale has executed three trading moves related to Bitcoin, but managed to profit only from the initial one; the subsequent two trades resulted in losses for them.

Given that the whale had significantly unloaded a large quantity of Bitcoin, AMBCrypto looked into additional data sources to determine if the total selling pressure from whales was unusually high.

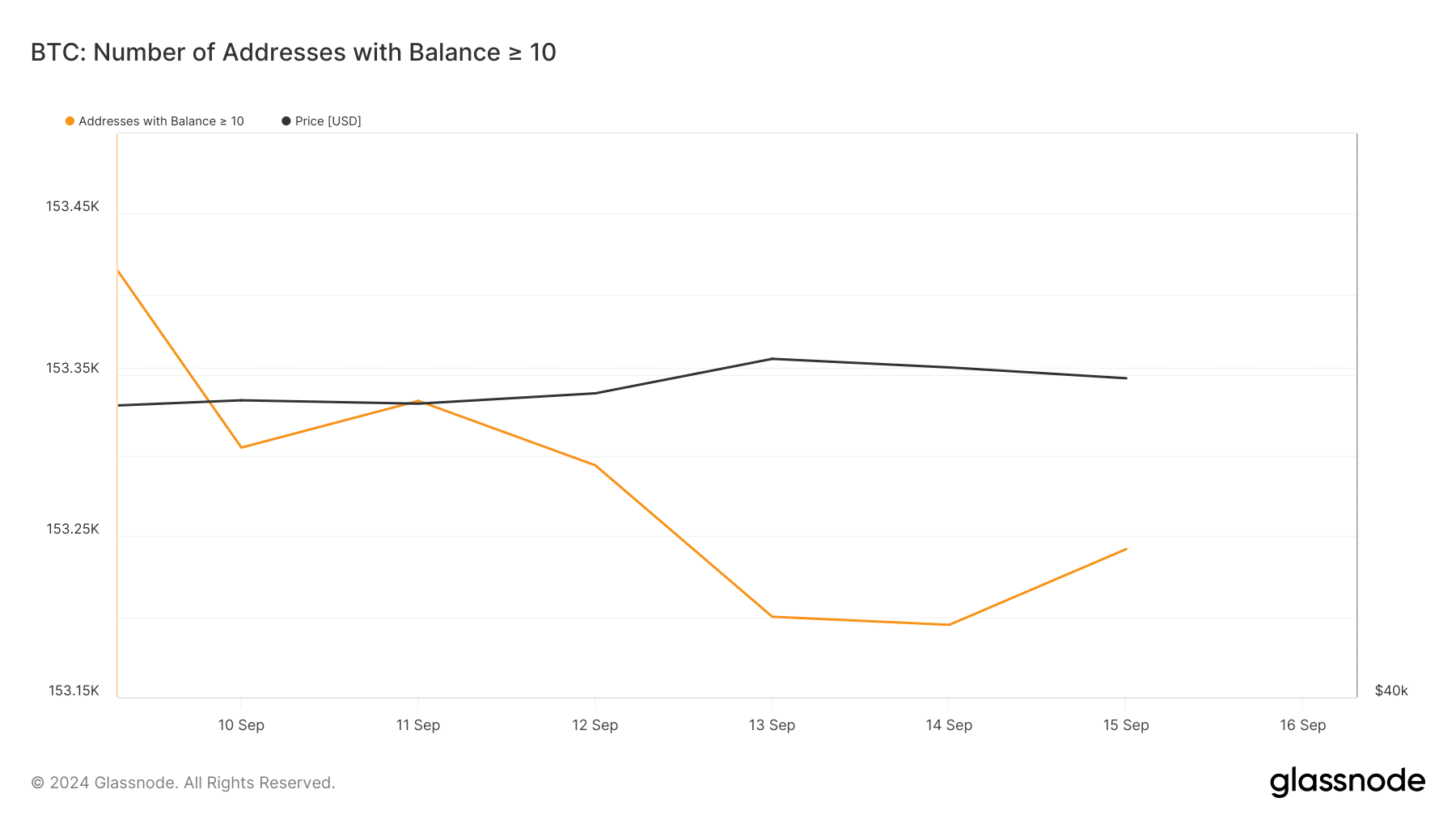

According to our review of data from Glassnode, there was a decrease in the number of Bitcoin wallets containing 10 or more Bitcoins during the past week. This downward trend suggests that major players in the cryptocurrency market may have been offloading their BTC holdings, potentially leading to a drop in Bitcoin’s price over the last 24 hours.

In the past day, Bitcoin saw a decline of over 2%, with its current price standing at approximately $58,789.75 as we speak. Additionally, information from Hyblock Capital indicates a decrease in whale involvement within the market during the same timeframe.

In my investigation, I observed a significant shift when the disparity between Bitcoin’s whale and retail investor exposure lessened from 64 to 0. This indicates an interesting turn of events where both large-scale whale investors and retail investors now hold approximately equal stakes in the market.

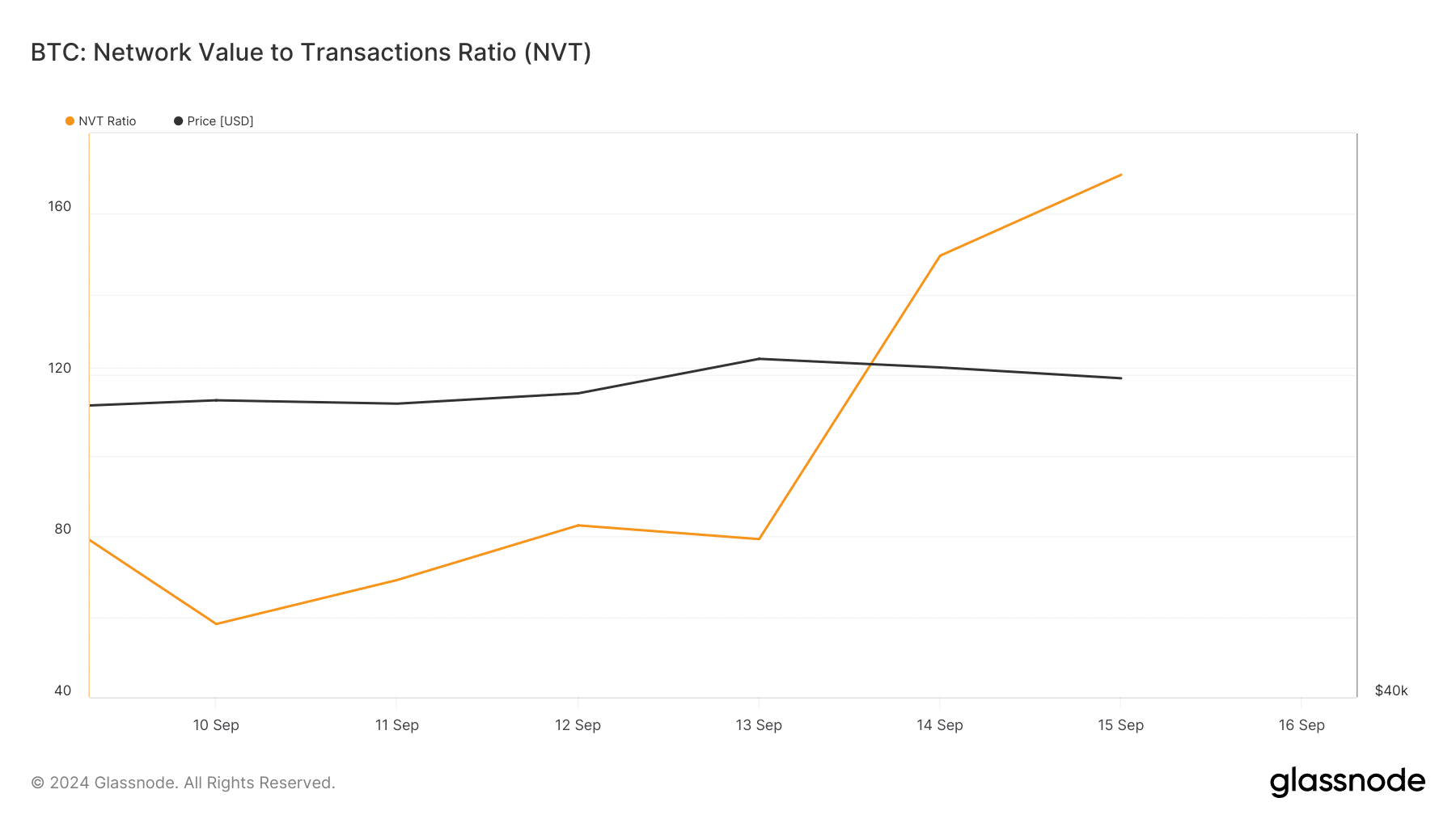

Furthermore, it wasn’t just whale activities that caused the price drop. Additionally, AMBCrypto reported an increase in Bitcoin’s NVT ratio, suggesting that the asset might be overvalued. Typically, such a rise indicates that a correction in price may follow.

What to expect from Bitcoin

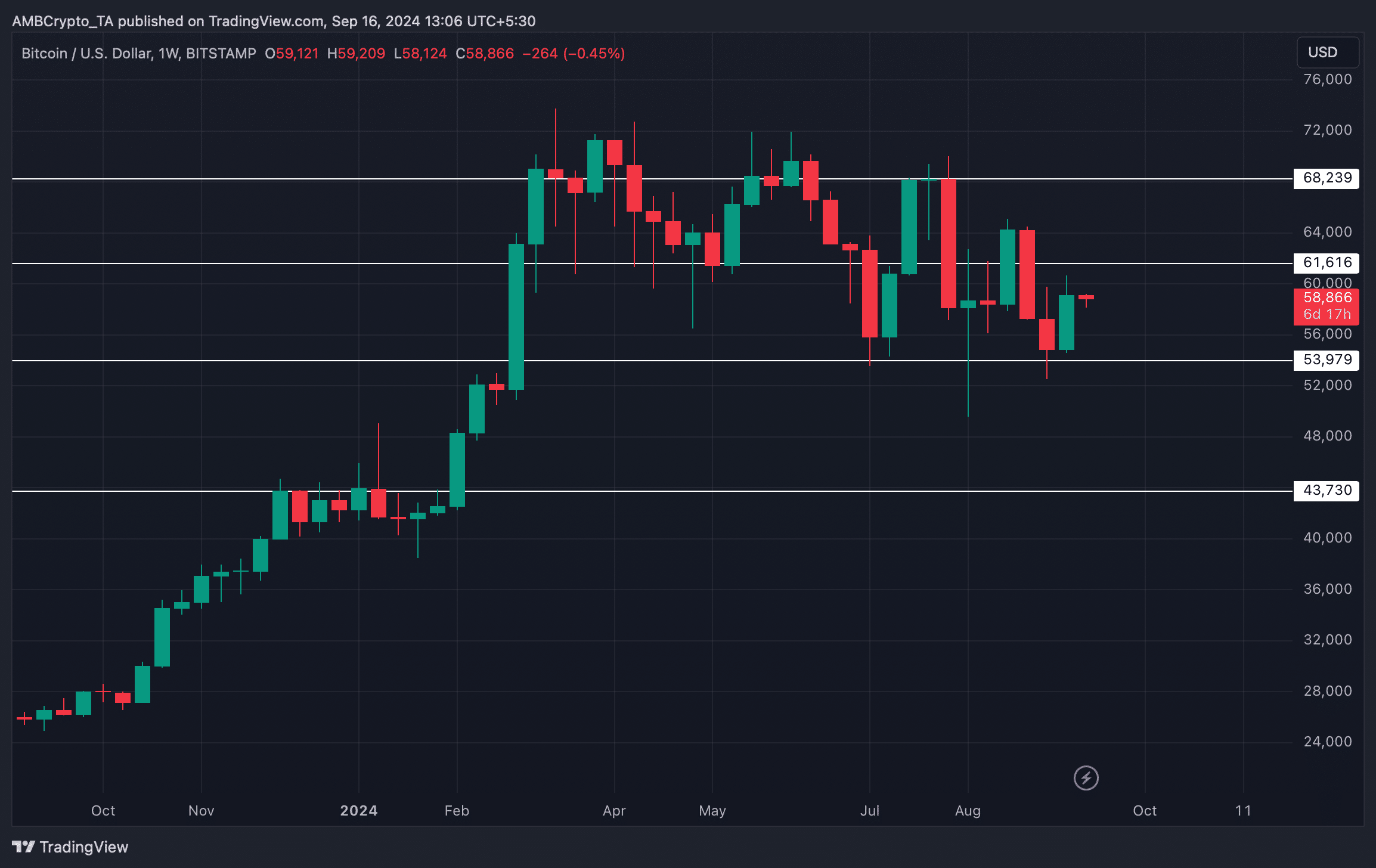

After examining Bitcoin’s weekly chart, AMBCrypto sought to predict potential outcomes if the bearish trend persists. According to their analysis, further price declines could potentially drive Bitcoin back towards the $53,000 support level.

Read Bitcoin’s [BTC] Price Prediction 2024–2025

If Bitcoin slips from its current support, it might fall to around $43k. Contrarily, as previously mentioned by AMBCrypto, there’s a high probability that Bitcoin’s price could increase. One significant factor pointed out is the decrease in Bitcoin’s NVM ratio.

If Bitcoin bulls gain control, it may initially move towards its potential resistance around $61,000. A convincing breakthrough could lead Bitcoin to target $68,000 over the next few weeks.

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- Masters Toronto 2025: Everything You Need to Know

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- WCT PREDICTION. WCT cryptocurrency

- LPT PREDICTION. LPT cryptocurrency

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- Elden Ring Nightreign Recluse guide and abilities explained

2024-09-16 14:15