-

Bitcoin’s value dropped by more than 4% in the last seven days.

Market indicators continued to remain bearish on BTC.

As a researcher with experience in analyzing cryptocurrency markets, I find the recent trend of Bitcoin (BTC) disconcerting. In just the last seven days, BTC’s value dropped by over 4%, reaching as low as $63,931.44. Market indicators continued to remain bearish on BTC, with fear and uncertainty dominating investor sentiment.

As a researcher studying Bitcoin’s [BTC] price movements, I’ve observed that the past week didn’t bring good news to investors as the cryptocurrency dipped below the $65k mark. This downturn caused some apprehension among the market participants. Nevertheless, historical trends may indicate that we are approaching a potential market bottom, providing hope for a turnaround in Bitcoin’s performance.

Bitcoin hits a market bottom

As a researcher examining the latest market trends, I’ve discovered that Bitcoin (BTC) experienced a significant decrease in value over the past week. Specifically, BTC’s price dipped nearly 4.5% during this period. Furthermore, within the last 24 hours, Bitcoin underwent an additional decline of more than 2%.

As I pen down these words, Bitcoin is currently transacting at an astounding price of $63,931.44 in the cryptocurrency market. Its market value has surpassed the impressive milestone of $1.26 trillion.

Lately, Santiment shared on Twitter an intriguing update regarding Bitcoin’s market sentiment. According to their post, investors were predominantly fearful or indifferent towards Bitcoin, with its price fluctuating between $65,000 and $66,000.

As a researcher studying cryptocurrency markets, I’ve noticed an unusual increase in fear, uncertainty, and doubt (FUD) among traders, leading to widespread capitulation. However, this extended period of market anxiety is not common, and it seems to be creating opportunities for those with the patience to wait it out. BTC traders, in particular, appear to be growing weary, but their exhaustion could be just what the whales are counting on. Accumulating large amounts of Bitcoin during times of market turmoil, whales often profit handsomely when the market bounces back. So, if you’re a trader considering jumping into the market right now, remember that history suggests there may be rewards for those who stay the course.

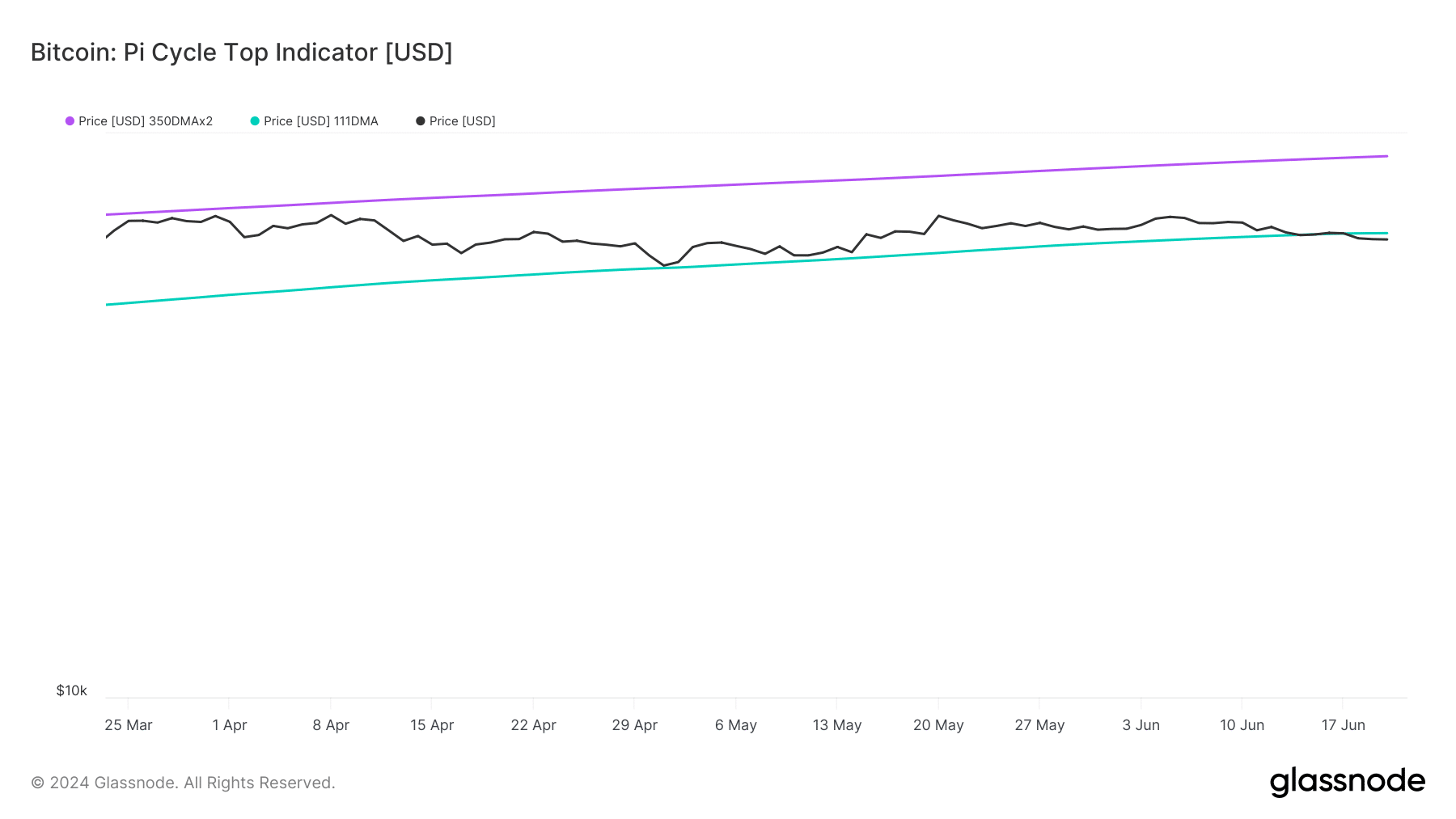

To see whether Bitcoin was actually near its market bottom, AMBCrypto analyzed Glassnode’s data.

The Pi Cycle Top indicator signaled that Bitcoin’s price had dipped from its apparent market low of $66,500. This suggested that a price rise was likely in the near future.

As a researcher studying the intricacies of Bitcoin’s price movements, I would describe the Pi Cycle indicator as follows: This technical analysis tool is constructed using two essential components. The first component is the 111-day moving average of Bitcoin’s price. The second part is twice the value of the 350-day moving average. In simpler terms, we calculate the average price of Bitcoin over the past 111 days and then add two times the average price from the previous 350 days to determine the Pi Cycle indicator’s value.

Moving forward, if the markets become particularly bullish, Bitcoin could potentially hit its peak price of $91,000 within the next few weeks or months.

Looking ahead

Similar to the mentioned data, some additional key performance indicators showed promising signs. For instance, the Bitcoin Fear and Greed Index stood at 37% during the press check, indicating a “fear” state for the market.

Whenever the metric hits this level, it indicates that the chances of a bull rally are high.

According to AMBCrypto’s analysis of CryptoQuant’s data, some bearish indicators were identified. For example, the amount of Bitcoin held in exchanges was on the rise.

The amount of new deposits into cryptocurrency exchanges for Bitcoin was greater than the typical volume over the past week, indicating a significant influx of sellers in the market.

Read Bitcoin’s [BTC] Price Prediction 2024-25

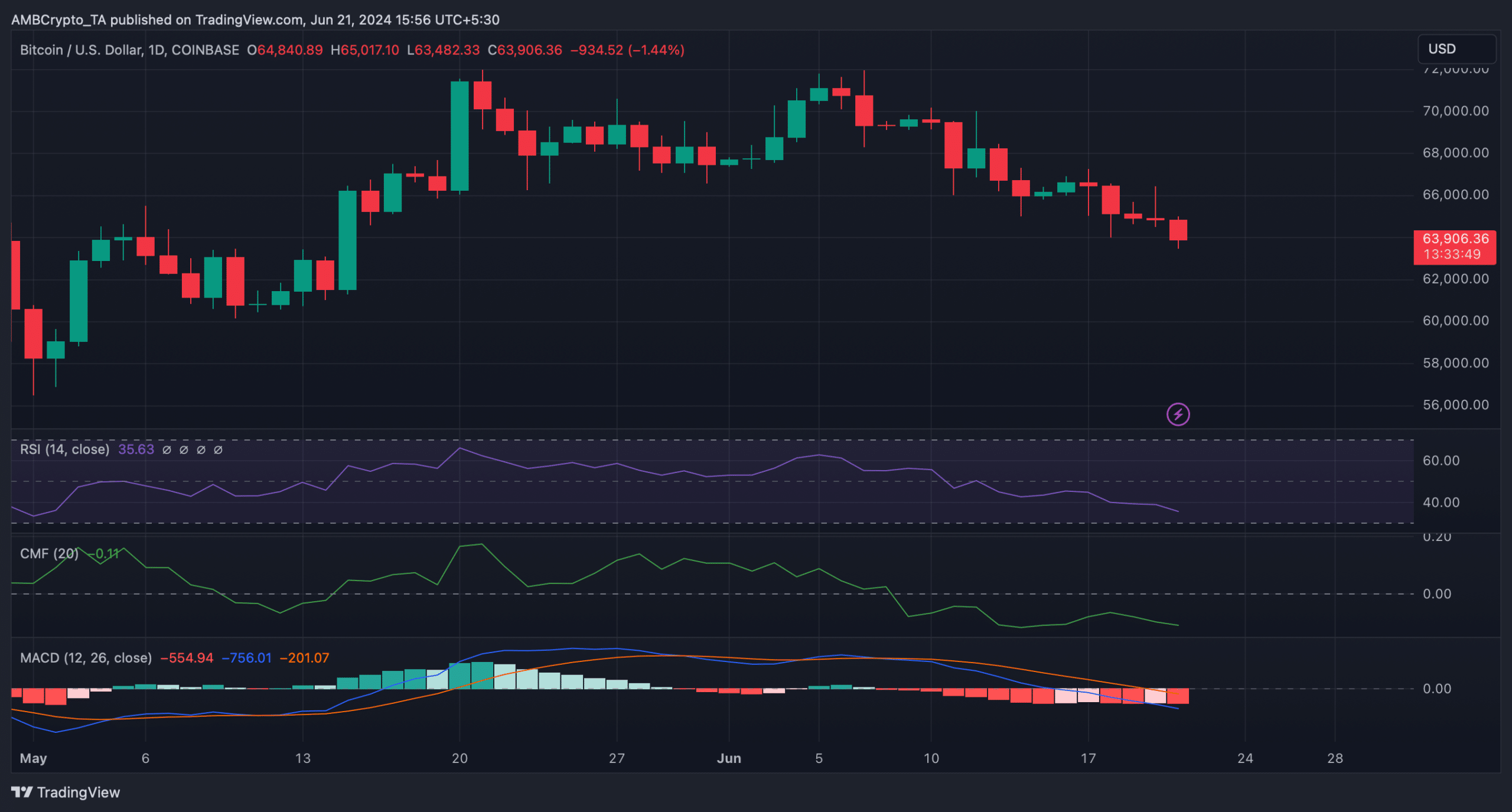

To gain a clearer perspective on Bitcoin’s price trend, we decided to examine its daily chart next. However, the majority of the technical indicators suggested bearish signs at the time.

In simpler terms, the MACD indicator showed that bears were in control of the Bitcoin market. The RSI reading decreased, while Bitcoin’s Chaikin Money Flow likewise indicated a downward trend, implying further price decline.

Read More

- PI PREDICTION. PI cryptocurrency

- Gold Rate Forecast

- WCT PREDICTION. WCT cryptocurrency

- LPT PREDICTION. LPT cryptocurrency

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- Solo Leveling Arise Tawata Kanae Guide

- Despite Bitcoin’s $64K surprise, some major concerns persist

- Clarkson’s Farm Season 5: What We Know About the Release Date and More!

- Planet Coaster 2 Interview – Water Parks, Coaster Customization, PS5 Pro Enhancements, and More

- Chrishell Stause’s Dig at Ex-Husband Justin Hartley Sparks Backlash

2024-06-22 07:03