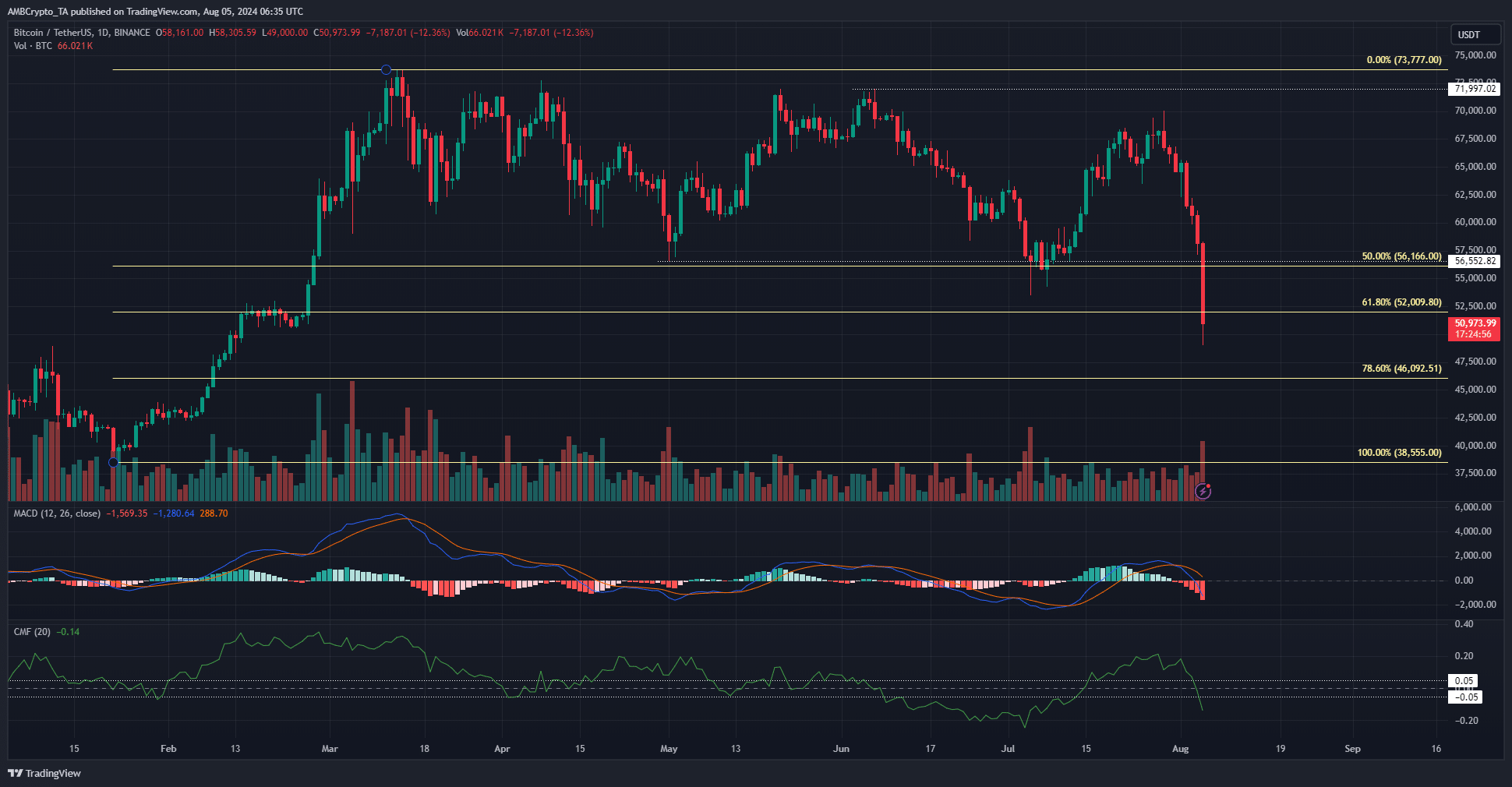

- Bitcoin plummeted past the $60k and $56k levels, which had been faithful support zones in recent months

- Sentiment was extremely bearish, and long-term investors can wait for a few days before looking to “buy the blood.”

As a seasoned researcher with over a decade of market observation under my belt, I’ve seen my fair share of market turbulence, and this latest Bitcoin plunge is no exception. The current price drop below $50k is reminiscent of the rollercoaster ride we witnessed in 2017-2018. However, the difference now is that we’re not just dealing with inexperienced retail investors but a mature market with institutional players.

In the past seven days, Bitcoin (BTC) dropped by approximately 24%, decreasing from around $70,000 to $53,100, since July 29th. This decline occurred as the bulls failed to maintain the price above the Fibonacci retracement level of $56,000.

The past 24 hours saw $880 million in crypto liquidations.

In simpler terms, the largest trade among them was worth approximately 27 million USD, investing in Bitcoin (BTC) through Huobi. The market was filled with fear due to this significant investment, and it may be wise for investors to hold off on purchasing until the situation becomes clearer.

Sub $50k Bitcoin prices are here

The increase in interest rates by Japan sparked concerns that it might lead to another financial crisis like the one seen in 2008. While this development may have contributed to the recent stock market declines, it is not solely to blame.

At press time, the Monday New York open in traditional markets was not yet in.

During the New York trading period, there might be an increase in downward price momentum due to heightened selling activity. The Cold Movers Indicator (CMF) stands at -0.14, indicating a substantial movement of funds away from the market.

The MACD formed a bearish crossover on the daily chart and dived below zero.

In simpler terms, if you’re following Fibonacci levels in Bitcoin trading, the price might aim for approximately $46.1k which represents a significant retracement level of about 78.6%. The trading activity has been robust, and there’s been considerable volatility in shorter timeframes. Given these conditions, it could be wise for traders to hold back and observe the market trends more closely.

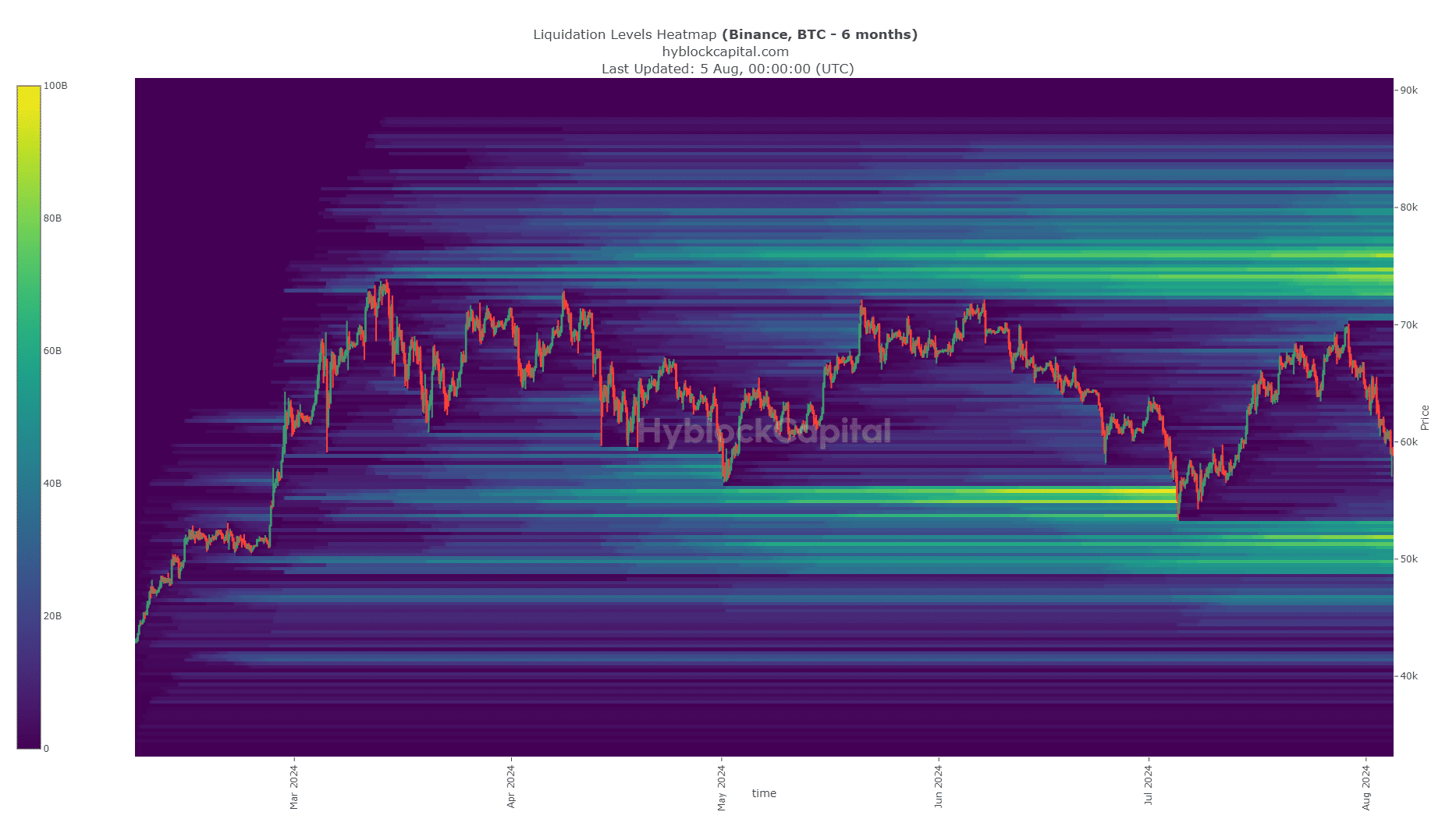

Exploring the next liquidation cluster

During the past six months, there was a notable cluster of potential selling points around the $50,000 mark. These areas have been gradually accumulating since June, with a significant increase in strength observed in July.

At the beginning of July, the $54,000 area experienced Bitcoin sweeping through it before initiating a bullish turnaround. Now, investors are crossing their fingers, hoping for another such occurrence around the $50,000 mark.

To the north, the notable liquidation target was at $73k, near the all-time high.

Read Bitcoin’s [BTC] Price Prediction 2024-25

The general mood towards investing appears to have significantly deteriorated, as indicated by the Intel CEO sharing religious texts on social platforms. It seems like record highs (ATHs) are a distant dream at this point.

In previous instances, Bitcoin has weathered more challenging times and bounced back; therefore, it’s hoped that it will do so again for investors.

Read More

- The Lowdown on Labubu: What to Know About the Viral Toy

- Street Fighter 6 Game-Key Card on Switch 2 is Considered to be a Digital Copy by Capcom

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Karate Kid: Legends Hits Important Global Box Office Milestone, Showing Promise Despite 59% RT Score

- Valorant Champions 2025: Paris Set to Host Esports’ Premier Event Across Two Iconic Venues

- Masters Toronto 2025: Everything You Need to Know

- There is no Forza Horizon 6 this year, but Phil Spencer did tease it for the Xbox 25th anniversary in 2026

- Mario Kart World Sold More Than 780,000 Physical Copies in Japan in First Three Days

- ‘The budget card to beat right now’ — Radeon RX 9060 XT reviews are in, and it looks like a win for AMD

- Microsoft Has Essentially Cancelled Development of its Own Xbox Handheld – Rumour

2024-08-05 13:11