-

Bitcoin’s attempt at recovery in the last 24 hours saw a minor setback with the current decline.

A lot of BTC has now piled up with no buyers in sight.

As a researcher with extensive experience in the cryptocurrency market, I’ve observed with concern the recent setback in Bitcoin’s [BTC] recovery attempt. The minor decline we saw in the last 24 hours was disheartening, especially after a brief effort to narrow the gap.

As a researcher studying the cryptocurrency market, I’ve observed that Bitcoin’s [BTC] price has taken a hit lately. However, during the last trading session, there were attempts made to reduce the price difference between buyers and sellers.

As an analyst, I’ve observed a significant decrease in the price of the so-called “king coin” over the past few days. Moreover, its market dominance has waned concurrently. Notably, during this price decline, Over the Counter (OTC) balances have continued to accumulate.

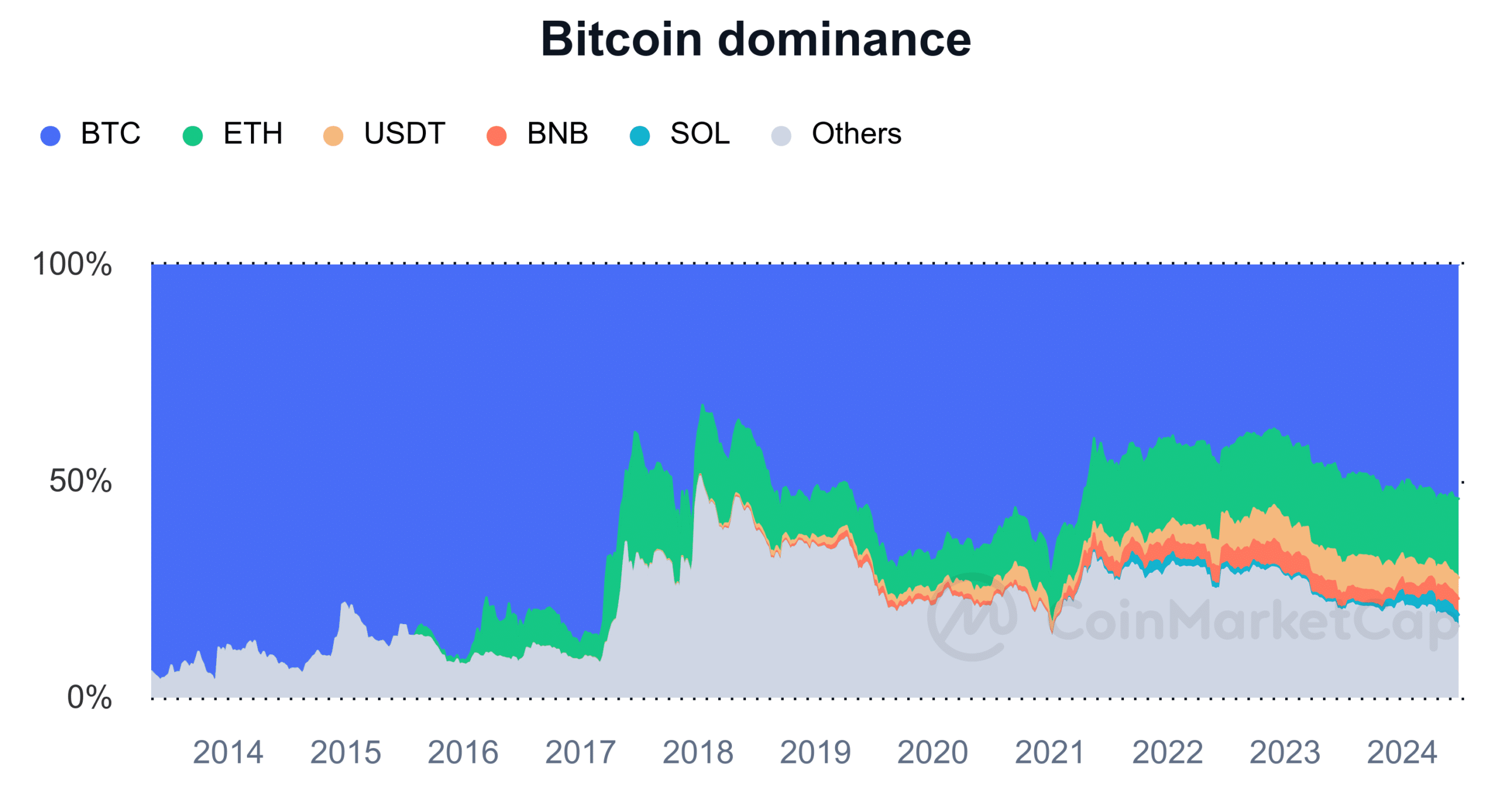

BTC Dominance drops

I’ve observed a significant decline in Bitcoin’s market dominance recently, with its value facing challenges that made it hard to hold onto its leading position within the cryptocurrency sphere.

At the close of trading on the 24th of June, Bitcoin’s market dominance, as reported by AMBCrypto, surpassed the 54% mark.

However, by the end of the next day, the 25th of June, it had fallen to around 52.28%.

Within just 24 hours, Bitcoin experienced a significant drop in value, whereas certain altcoins managed to hold their ground or even increased in value, indicating they were making gains in the market share.

At present, Bitcoin’s market dominance has undergone a minor reduction, yet it continues to remain roughly at the 53% threshold.

As a market analyst, I can observe that Bitcoin’s significant market dominance is reflected in its accounting for more than half of the entire cryptocurrency market capitalization.

Bitcoin dominance vs. other assets

As a market analyst, I can tell you that the value of Bitcoin’s market capitalization surpassed one trillion dollars at the current moment in time. In addition, the overall market capitalization of all cryptocurrencies reached an impressive figure of around two trillion dollars.

Ethereum [ETH] holds a significant position in the cryptocurrency market, accounting for approximately 18% of the overall market capitalization.

As a researcher studying the cryptocurrency market, I discovered that fluctuations in Bitcoin’s (BTC) price and performance have a substantial influence on the market share distribution among different digital currencies.

More Bitcoin hits reserves

I’ve noticed an intriguing trend based on the latest figures from CryptoQuant. The amount of Bitcoin stored in Over-the-Counter (OTC) reserves has seen a significant uptick.

In the past six weeks, over 103,000 Bitcoins, equivalent to more than $6 billion using current market values, have been amassed in these reserves. This substantial increase suggests a notable growth in the Over-the-Counter (OTC) reserve holdings.

The rising OTC Bitcoin reserves indicate a current surplus of sellers, potentially due to Bitcoin’s recent price drop.

This fall in price may be deterring potential buyers, leading to the accumulation of the reserves.

Read Bitcoin’s [BTC] Price Prediction 2024-25

During times of price instability, larger market players exhibit caution by accumulating Over-the-Counter (OTC) reserves as the price declines.

From my perspective as a crypto investor, Bitcoin was currently hovering around the $61,680 mark on the daily chart at this moment in time. The coin exhibited a minimal decrease, amounting to less than 1%.

Read More

- PI PREDICTION. PI cryptocurrency

- Gold Rate Forecast

- Rick and Morty Season 8: Release Date SHOCK!

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Linkin Park Albums in Order: Full Tracklists and Secrets Revealed

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

2024-06-26 15:03